The Perfect Storm

Colliding Global Cycles

If you stand still long enough, you can almost hear it: the low rumble of overlapping cycles, grinding against each other like tectonic plates.

Debt, demographics, geopolitics, technology…each on its own schedule, each manageable in isolation. But now? They’ve synchronized.

This isn’t chaos. It’s choreography. A dance of collapse and opportunity. The bubbles aren’t popping one by one…they’re colliding. And when cycles collide, they don’t whisper. They roar.

But before the thunder breaks, let’s step into the eye of the storm.

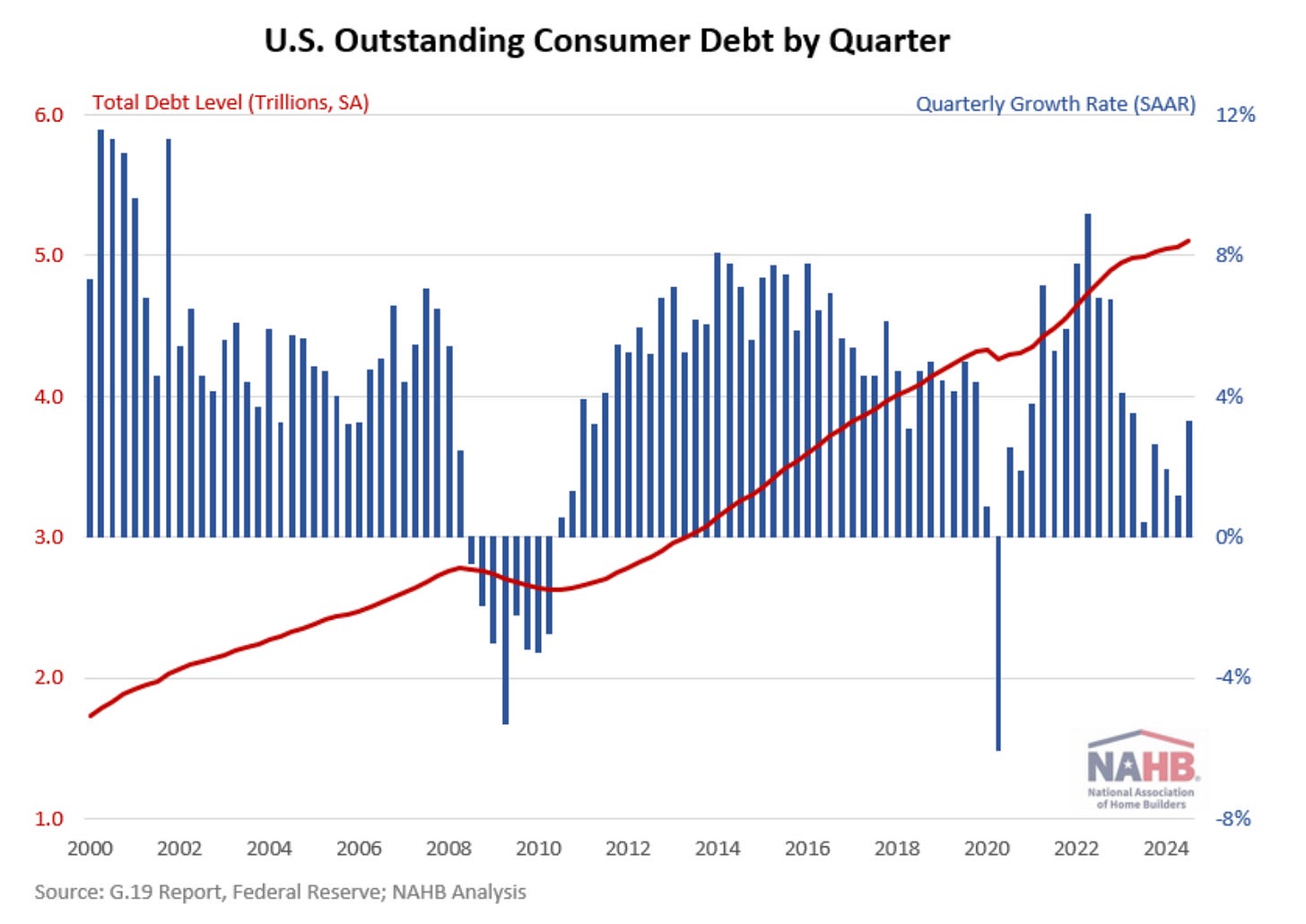

The Debt Trap: Nations on the Edge

Picture a family that keeps refinancing the mortgage to pay for groceries. That’s modern government finance.

Western nations, in particular, promised the moon…pensions, healthcare, free education…all funded by borrowing from tomorrow.

Tomorrow has arrived.

Balance sheets groan under liabilities that can’t be met with today’s dollars.

Sovereign debt crises aren’t just accounting curiosities; they are accelerants for political firestorms.

When governments run out of rope, their options are painfully familiar:

Raise taxes—sell it as “fairness,” but it’s theft by another name.

Seize assets—freeze accounts, skim pensions, “windfall” levies.

Slash spending—political suicide dressed up as “austerity.”

Light the fuse of war—the oldest escape hatch in history.

Each option ricochets through society, turning disagreements into deadlocks, neighbors into enemies. Europe argues over fiscal transfers while its streets simmer. The U.S. lurches between red and blue standoffs with no middle ground.

When politics fractures beyond repair, leaders look outward. A common enemy unites the mob. But who gets cast in the role of villain this time?

From Boardrooms to Battlefields

Domestic tensions don’t stay home. They spill onto the global stage, where rising powers smell blood.

The cycle is old: a fading empire clashing with a rising one.

Enter China. Patient, methodical, unwilling to play by Western rules. The U.S. and its allies defend the “status quo.” Beijing demands a rewrite. History says such standoffs rarely end in polite diplomacy.

Meanwhile, Russia laughs in the face of sanctions.

Cut off from SWIFT, locked out of Western finance, it still grows faster than many European economies.

How? By hacking the system with parallel networks, alternative currencies, and…most provocatively…blockchain rails.

What was supposed to isolate Russia instead accelerated de-dollarization, tightening bonds between the sanctioned and the sidelined.

Europe’s leaders, drowning in debt, see no easy exits. But a well-timed narrative of invasion…They’re coming for us!…can still rally the frightened.

The chessboard resets. But this time, pawns don’t behave the way kings expect.

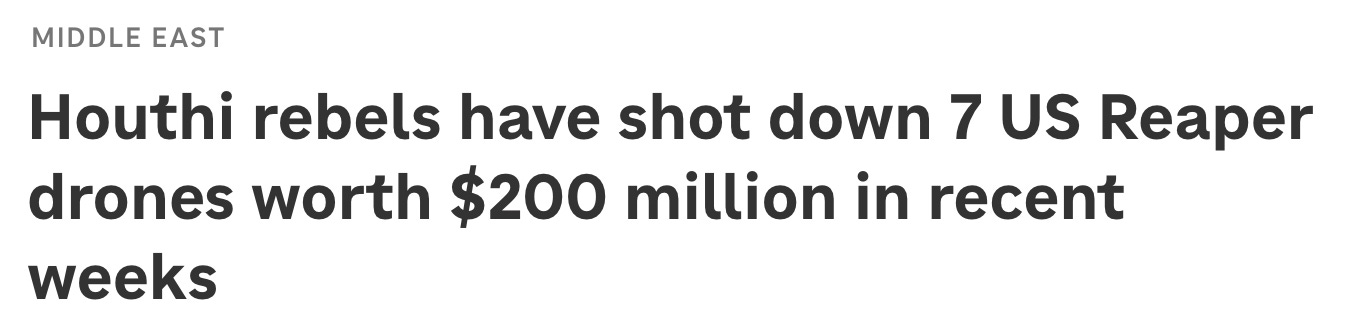

Tech Revolutions: The $2,000 Drone vs. the $2 Million Missile

Here’s the twist no one saw coming: technology is making David’s sling sharper than Goliath’s sword.

Take the Houthis in Yemen. With drones that cost less than a used car, they shut down shipping lanes and force superpowers to fire missiles worth a thousand times more. Asymmetry has gone mainstream.

And it isn’t just warfare. Blockchain is re-wiring the arteries of global finance, slipping around sanctions and cutting middlemen out of capital flows. Capital has become as mobile as code—and governments hate it.

Even banks, once trusted vaults, quietly rewrite the rules. Deposits? They’re not really yours anymore. You’re a creditor, not a customer. Try moving money abroad and watch how quickly you learn what “capital controls” really means.

Technology was supposed to free us. Instead, it’s arming both rebels and rulers. Which side wins?

Betting on the Underdogs

Cycles destroy the overvalued and reward the ignored. Today’s ignored assets are hiding in plain sight.

Coal—vilified as the villain, yet consumption rises. China and Indonesia are building coal plants by the hundreds while Western markets chant “net zero.” Coal equities yield fat dividends at fire-sale multiples.

Created with TradingView Mining—now around 3-4% of global equities (down from roughly 10% in the 1970s), miners generated record free cash flows in 2024, with many like Barrick and Kinross doubling prior years' levels, though valuations have rallied sharply in 2025 (up over 50% YTD for gold miners) from multi-decade lows earlier in the cycle. Gold miners, in particular, remain undervalued relative to surging earnings, serving as cheap insurance against monetary folly.

Created with TradingView Shipping—tanker fleets choke on underinvestment. Wall Street won’t fund “dirty” vessels, leaving incumbents with moats as wide as oceans. No debt, tight supply, soaring margins.

Source: Capitalist Exploits Insider Argentina—a $30 billion market cap for an entire country. One-thousandth the size of Apple. Political chaos is already priced in; upside isn’t.

Source: Capitalist Exploits Insider Russia—equities at single-digit P/Es, dividends north of 10%, currency-hedged bonds yielding 15–16%. Five years to double your money—if you can stomach the politics.

Cheap assets in a pricey world. But governments see them too…and they want their cut.

The Iron Curtain of Finance

When the tax base runs dry, capital controls arrive.

Australia leads the charge: taxing unrealized gains over $3 million, forcing sales to pay taxes on phantom profits.

Leave the country? Expect to keep paying income tax for years.

Europe’s already perfecting the art. Transfers inside the EU are seamless, but try sending money to Asia or Latin America, and alarms go off.

The UK plays with “non-dom” rules. Central bank digital currencies hover on the horizon—programmable chains for your savings.

It’s not a bug; it’s the design. Trap the money, then milk it.

So where does capital flee? To hard assets. To emerging markets. To any jurisdiction still willing to say, “Your money is welcome here.”

But what happens when even that escape route narrows?

War Drums in Europe

Europe is a pressure cooker: debts ballooning, politics fragmenting, and populations restless. Leaders know the formula. When domestic legitimacy fails, war unifies.

Cue the Russian menace. NATO’s slow eastward creep since 1945 fuels Moscow’s paranoia, but Western narratives cast it as simple expansionism.

Either way, the outcome rhymes with history: escalation.

Wars aren’t deflationary. They inflate hard assets, destroy growth stocks, and redraw financial maps.

Just ask the “Magnificent Seven,” bloated to the largest share of indices in history. When war funding collides with bubble valuations, the math is merciless.

But if war is inevitable, does that mean peace is uninvestable?

Navigating the Chaos

Here’s the paradox: in madness lies method.

The playbook is simple, but not easy:

Bet against false narratives.

Own what’s cheap, not what’s popular.

Diversify across geographies, even passports.

Size positions with humility…3–5 year horizons, asymmetric bets.

Commodities, shipping, mining, energy…these aren’t speculative side shows. They’re the backbone of civilization, priced today like afterthoughts.

Governments will tax, seize, and spin fairy tales. Central banks will digitize control. Wars will inflate the price of reality. Through it all, hard assets endure.

Because here’s the ultimate cycle: we are all terminal, but markets never are. The storm won’t pass—it will simply morph into the next one.

The only question is: will you be a spectator of the thunder…or a navigator of the lightning?

"Mining—shrunk to 1% of global equities (down from 11% in the 1970s), miners gush record free cash flows yet trade at 45-year lows"

Say what?

Need a proof reader?