Insider Newsletter: Issue #316

"If we don’t end up in a global catastrophe here, what is absolutely clear as day is that this course of action will cement the bifurcation of East and West."

Greetings, friends!

Not a sunset, but gorgeous nevertheless.

And Tavira, Portugal from my partner in crime Andrew over at Subvertere Capital, our venture capital business.

In This Week’s Issue

New Opportunities?

Cementing the East vs West Divide

Out of Kilter

Is This the Greatest Example of Patience Ever?

BP: A Lesson in “Greed Is Good”

Five Big Macro Themes

The Big

FiveSix:

New Opportunities?

I don’t know if you saw it, but the Russkies are courting capital.

Here’s what uncle Vlad did:

On July 1, 2025, the President of the Russian Federation V.V. Putin signed

Decree No. 436 “On additional guarantees of the rights of foreign investors”The decree opens up opportunities for foreign investors of any jurisdiction to acquire securities of Russian issuers, subject to a number of conditions being met:

– funds for the purchase of securities are credited to type “In” accounts from accounts opened in foreign banks or from the account of a foreign broker representing the interests of the client;

– the purchase (and sale) of securities is carried out on the stock exchange.The concept of “foreign investor” within the framework of the Decree is interpreted as broadly as possible and includes both persons from “friendly” states and persons from unfriendly states.

The decree extends guarantees to both categories of investors, indicating the intention to create a universal and transparent channel for all new investments, regardless of the investor’s “jurisdiction of origin”.

Accounts of type “In”

The central element of the new mechanism is special accounts – accounts of type “In”.

“In” accounts (both bank and depository accounts) are intended for crediting funds for investments and accounting of acquired Russian securities.

Foreign investments may be made exclusively through funds credited to “In” type accounts from accounts opened in foreign banks.

Strictly prohibited to make investments within the framework of this regime using funds from other accounts in the Russian Federation that are not “In” type accounts.

Guarantee of repatriation

The Decree directly guarantees foreign investors the right to transfer, including outside the Russian Federation, funds in rubles and foreign currency received from investments made through “In” type accounts.

Permitted operations and provided guarantees

The guarantees of the Decree apply to a strictly defined range of transactions, primarily related to portfolio investments on the organized market:

– purchase of Russian securities (shares, bonds, units) during their initial placement or on the organized market based on public bids (stock exchange);

– sale of these same securities on the stock exchange;

– fulfillment of obligations to pay (dividends, coupons) on these securities;

– placement of funds in deposits in Russian banks and their return.

– conclusion and execution of contracts that are derivative financial instruments in organized trading.One of the most important innovations is the direct exemption from the application of Decree No. 138.

In particular, it is established that the requirement for separate accounting of “toxic” assets does not apply to the acquisition and disposal of Russian securities under the new regime.

🧐 Invest in the same asymmetric opportunities we are:

Conclusions and Practical Significance

The decree does not cancel the current restrictions. Instead, it creates a parallel system for “new investments.”

The list of permitted operations clearly indicates the focus on attracting capital to the stock market and the banking system.

The main guarantee provided by the decree is the possibility of unhindered withdrawal of capital and profits received from new investments.

Critics will say uncle Vlad is on his knees and desperate for some spare change. Others will say he’s opening his capital markets to investment.

Being a capitalist, I am of the opinion that a government should not be interfering in or with private individuals and who they can trade with.

However, I understand that there is a gaping chasm between what I hope for and what the world actually operates like, and so we play the cards we’re dealt.

This looks like it could be a really interesting card. We will be watching very closely.

Cementing the East vs West Divide

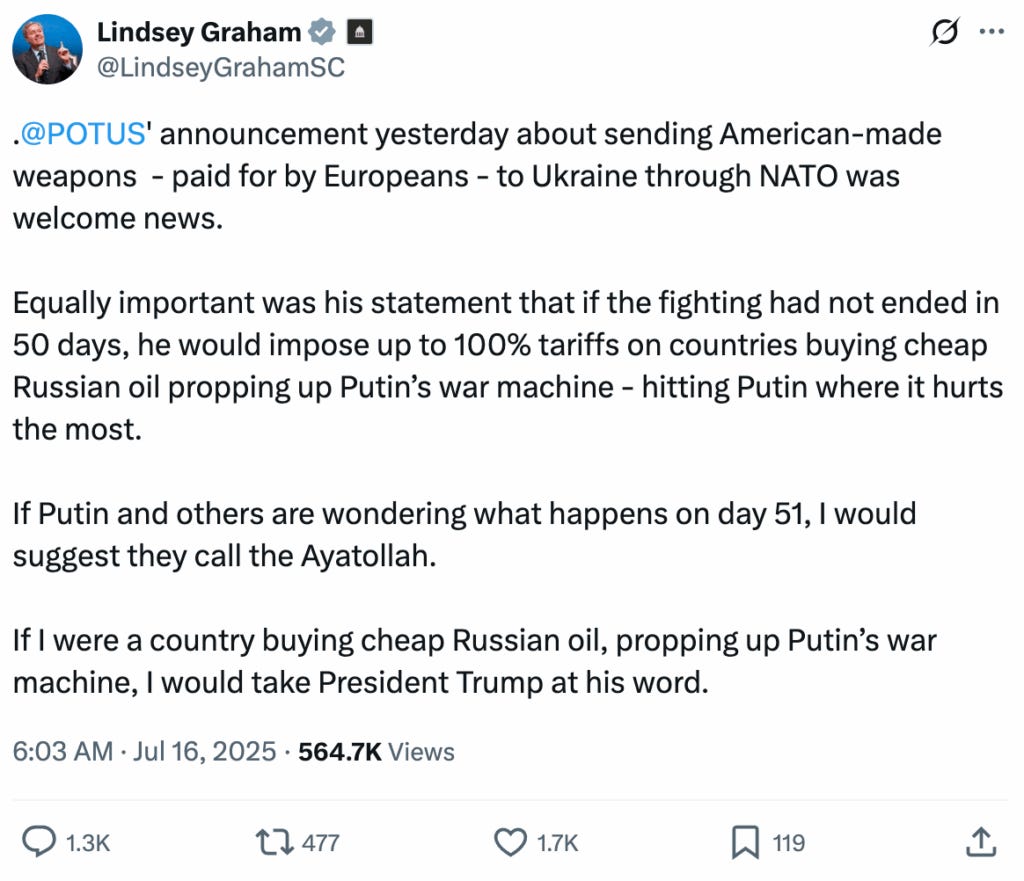

Let’s talk about the 50-day ultimatum that Trump has levied against Vladimir Putin, the Russkies, and all their “friends.”

Essentially, Trump had told the Ayatollah 60 days before that attack that if he did not renounce his ambitions to enrich uranium, he was going to find out. Then we had Lindsey “I Never Met a War I Didn’t Love” Graham.

If Putin and others are wondering what happens on day 51, I would suggest they call the Ayatollah. If I were a country buying cheap Russian oil, propping up Putin’s war machine, I would take President Trump at his word.

Senator Lindsey Graham, July 2025

Now, he wouldn’t say something that would compromise his relationship with his bestie Trump. That’s deeply worrisome.

The threat is that the Russkies are going to interpret this ultimatum not just as a threat to collapse the global economy by imposing 500% tariffs on the Chinese, Indians, and anybody else who is wholly dependent on Russian and Iranian oil, but as a direct threat to their very existence.

If we don’t end up in a global catastrophe here, what is absolutely clear as day is that this course of action will cement the bifurcation of East and West.

Something else…

Donald “I’m Going to End This Ukraine War” Trump is now giving Ukraine weapons (missile systems) that are highly technical and as such can only be used by Americans.

Each system takes over 100 men to operate… and they’re going to be Mericans. So the pretence of “Ukraine” fighting Russia rather than NATO fighting Russia is increasingly difficult to maintain.

Ok, so where does that leave us? First off, 500% tariffs on China would decimate the global economy, including the US. They make literally everything. Shutting them off from trade means the BRICS just trade.

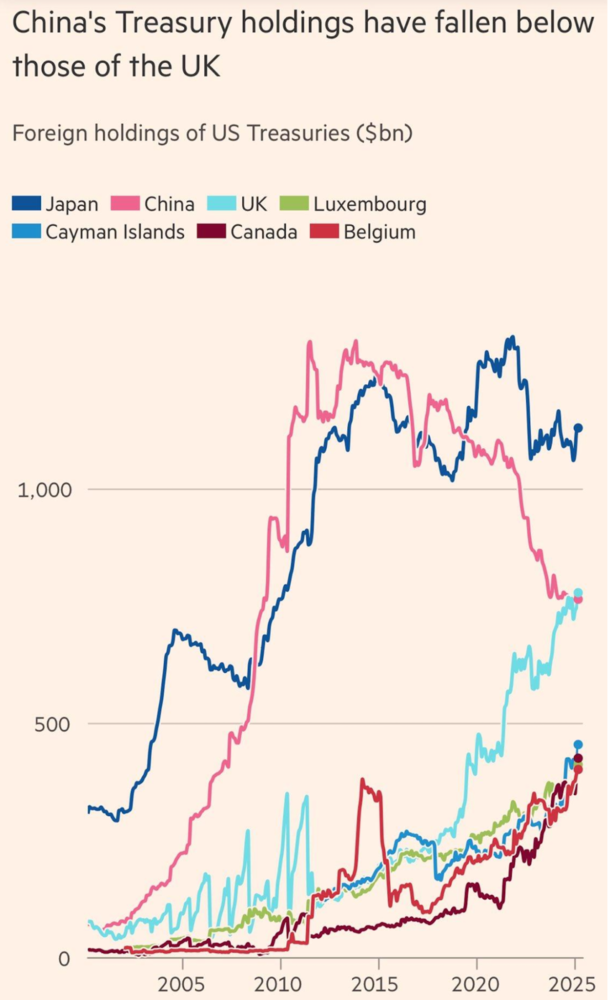

Speaking of the BRICS and the accelerating global bifurcation…

First, this bifurcation happens on a monetary level…

Then, it happens on a trade level with sanctions, tariffs, etc. And finally, on a military level.

The cycles of history repeat because the nature of man doesn’t change, and the neocons at the helm of the collapsing Western empire remind me of this.

☝️ Upgrade to the Newsletter Service to Get the Rest…