BP: A Lesson in “Greed Is Good”

BP swore ‘no turning back’ on net zero. Five years later, it’s sprinting back to oil. What changed...and what does it reveal?

In the iconic 1987 film Wall Street, Gordon Gekko, played with charismatic menace by Michael Douglas, delivers a speech that has echoed through the decades:

“The point is, ladies and gentlemen, that greed…for lack of a better word… is good. Greed is right. Greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms…greed for life, for money, for love, knowledge…has marked the upward surge of mankind.”

Gekko’s unapologetic ode to self-interest remains one of the most memorable moments in cinematic history, not just for its bravado but for its uncomfortable kernel of truth.

It’s a quote that feels tailor-made for dissecting the corporate machinations of companies like BP, the British energy giant that has spent the last few years navigating a high-profile pivot, only to swerve back to its roots.

BP’s journey from oil titan to would-be green pioneer and back again is a case study in how economic realities often trump ideological promises, echoing Gekko’s assertion that greed…or at least the pursuit of profit…clarifies and cuts through.

BP’s Bold Promise: Net Zero by 2050

In February 2020, BP’s newly appointed chief executive, Bernard Looney, made headlines with an audacious pledge: BP would become a net-zero carbon emissions company by 2050 or sooner.

This was no small feat for a company whose core business was extracting and selling fossil fuels, responsible for over 400 million tonnes of carbon emissions annually… more than the entire United Kingdom.

Looney’s announcement came on the heels of growing public and investor pressure to address the climate crisis, with other oil majors like Shell and Total also setting ambitious environmental targets.

Looney’s vision was sweeping. He promised to tackle not only the emissions from BP’s operations but also the carbon embedded in the oil and gas it extracts.

“It’s clear that BP needed to change,” he told investors and analysts at the time. “We are heading to net zero. There is no turning back.”

The plan was to gradually shift investments away from oil and gas toward low-carbon businesses, such as renewable energy and hydrogen.

However, the specifics were hazy. Looney deferred detailed plans to a September 2020 investor meeting, describing the announcement as a “vision, a direction of travel.”

The pledge was met with a mix of optimism and skepticism.

On one hand, it signaled a seismic shift for an industry long criticized for its environmental impact.

On the other, critics pointed out the lack of a concrete roadmap.

How exactly would BP, a company built on hydrocarbons, decarbonize its portfolio while maintaining profitability? The answer, it seemed, would come later.

The Green Pivot: Ambitious but Vague

BP’s net-zero announcement was part of a broader trend among oil majors to rebrand themselves as energy companies rather than fossil fuel giants.

The company outlined plans to increase its renewable energy capacity to 20 gigawatts by 2025, invest in electric vehicle charging infrastructure, and explore hydrogen and carbon capture technologies.

It also committed to reducing oil and gas production by 40% by 2030, a move that would theoretically shrink its carbon footprint.

Investors, however, were wary.

BP’s stock price had been under pressure, and the company’s market capitalization was dwarfed by tech giants like Nvidia, whose 2% stock movement on July 30, 2025, represented a value equivalent to BP’s entire market cap or three times the Argentinian stock market.

The energy sector was no longer the darling of Wall Street, and BP’s pivot to renewables raised questions about profitability.

Renewable energy projects often require massive upfront investments and offer lower returns compared to oil and gas, especially when oil prices are high.

Looney’s vision was bold, but it leaned heavily on public relations.

The promise of “no turning back” sounded resolute, but without clear financial or operational details, it risked being perceived as greenwashing…a superficial nod to environmentalism to appease activists and investors.

By September 2020, BP released more details, including plans to develop offshore wind projects and partner with companies like Equinor on renewable energy initiatives.

Yet the financial community remained unconvinced, and BP’s share price continued to lag.

The Turnaround: Back to Oil and Gas

Fast forward to 2025, and BP’s net-zero dream has taken a backseat.

The company is now in the midst of what analysts call a “strategic turnaround,” refocusing on its core oil and gas business while scaling back renewable energy investments.

This shift, announced under new leadership and market pressures, reflects a stark reality: economics often prevail over ideologies.

BP’s recent moves include reducing capital expenditure on low-carbon projects, increasing investments in high-margin oil and gas assets, and implementing cost-cutting measures to boost shareholder returns.

The company has also streamlined its operations, selling off non-core assets and focusing on regions like the Gulf of Mexico and the North Sea, where oil and gas production remains highly profitable.

This pivot comes as global energy demand continues to rise, driven by economic recovery and geopolitical tensions that have kept oil prices elevated.

The decision to double down on fossil fuels has drawn criticism from environmentalists, who see it as a betrayal of BP’s 2020 commitments.

However, from a financial perspective, the move makes sense.

Oil and gas projects generate cash flow far more quickly than renewable energy ventures, which often take years to turn a profit.

With shareholders demanding higher returns and competitors like ExxonMobil and Chevron sticking to their fossil fuel roots, BP’s leadership faced a stark choice: stick to the green vision and risk further financial strain or return to what the company knows best.

This shift aligns eerily with Gordon Gekko’s philosophy: “Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.”

In BP’s case, the pursuit of profit has clarified its priorities.

The company’s leadership has chosen to prioritize short-term financial stability over long-term environmental goals, betting that the global transition to clean energy will be slower and more uneven than anticipated.

The Broader Context: Energy vs. Ideology

BP’s reversal is not an isolated case.

Other oil majors have also tempered their green ambitions in recent years, citing the need to balance environmental commitments with financial realities.

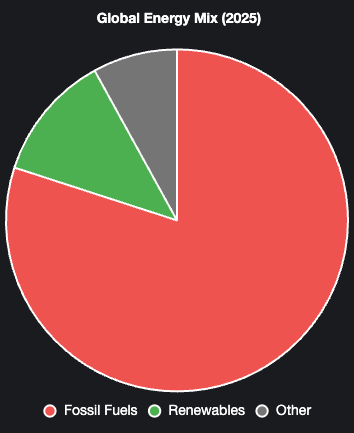

The global energy market remains heavily dependent on fossil fuels, which account for roughly 80% of primary energy consumption, according to the International Energy Agency.

While renewables like wind and solar are growing, they still represent a small fraction of the global energy mix.

High oil and gas prices, coupled with supply chain disruptions and geopolitical instability, have only reinforced the industry’s reliance on hydrocarbons.

Moreover, the energy transition is fraught with challenges.

Renewable energy projects require significant land, resources, and infrastructure, and their intermittency necessitates backup systems, often powered by natural gas.

Governments and consumers alike are grappling with the cost of decarbonization, especially in developing economies where energy access remains a priority.

For companies like BP, the temptation to lean on profitable fossil fuels is strong, especially when the alternative involves navigating uncharted financial territory.

The Role of Shareholders and Markets

BP’s strategic shift also underscores the power of shareholders in shaping corporate strategy.

In 2020, when Looney announced the net-zero goal, investor sentiment was mixed. Some applauded the move as forward-thinking, while others worried about the impact on dividends and stock performance.

By 2025, with BP’s share price still underperforming and tech giants like Nvidia dominating market narratives, the pressure to deliver returns became overwhelming.

The comparison to Nvidia is telling. On July 30, 2025, a 2% move in Nvidia’s stock, with its $4.39 trillion market cap, represented a value equivalent to BP’s entire market capitalization.

This stark contrast highlights the energy sector’s diminished status in a market obsessed with technology and innovation.

For BP, boosting shareholder value meant returning to its core competency: extracting and selling oil and gas.

Lessons from Gekko

BP’s journey from net-zero champion to oil and gas stalwart is a reminder that corporate strategies are often shaped by pragmatism, not ideals.

Gordon Gekko’s “greed is good” mantra may sound crass, but it captures a fundamental truth about capitalism: companies prioritize survival and profitability.

BP’s pivot reflects the tension between environmental aspirations and economic realities, a tension that will define the energy industry for decades to come.

As the world grapples with climate change, BP’s story serves as a cautionary tale. Bold promises are easy to make but hard to keep when market forces and shareholder demands come into play.

For now, BP has chosen the path of least resistance, doubling down on the fossil fuels that built its empire.

Whether this strategy will pay off in the long run remains to be seen, but one thing is clear: in the world of energy, as in Gekko’s Wall Street, greed…or at least the pursuit of profit…still clarifies and cuts through.

Was wondering how you guys look at Israëli equipes now. EU finance institutions are now being pushed to drop companies supporting / doing business with Israël.

That's a contrarian signal if there ever was one. Just weighing asset seizure risk. I'm still sitting on a RU etf that are not tradable.

This strategy by BP had very far reaching consequences Chris. BP dismantled their Exploration and Drilling groups around the world and now either depend on contractors or works with a perpetual skill shortage in oil and gas disciplines. I understand recruitment is also difficult, how does an employee know if the tide won't switch again with green energy coming back at the company.