The Asymmetry of Value vs Growth

Value investing is on life support while growth stocks reign supreme—but history warns that this won’t last. What happens when the tide turns? 🔥

The Great Divide: Why Value Investing is on the Brink of Revival

"The stock market is filled with individuals who know the price of everything, but the value of nothing." — Philip Fisher

There was a time, not too long ago, when Wall Street titans made their fortunes scouring financial statements for undervalued companies with strong balance sheets and steady cash flows. This was the world of Benjamin Graham, Warren Buffett, and Peter Lynch—the realm of value investing. But in today’s market, that world is gasping for air.

Over the last decade, growth stocks have dominated, driven by the meteoric rise of Big Tech and an era of cheap money.

The S&P 500 has effectively been hijacked by a handful of tech giants—so much so that if you didn't own the “Magnificent 7” (Apple, Microsoft, Nvidia, Amazon, Google, Meta, and Tesla), your portfolio likely underperformed. The narrative? Growth at any price.

But history whispers a warning: This is not the first time we've seen such an extreme divergence between value and growth—and it has never ended well.

This is a tale of financial cycles, investor psychology, and the stark reality that trees don’t grow to the sky. Could the pendulum be about to swing back? The evidence suggests that we’re nearing an inflection point.

And if that’s true, the impact could be seismic.

A Brief History of Growth and Value Cycles

To truly grasp how extreme the current divide has become, we need to step into a time machine and visit the ghosts of bubbles past.

The Nifty 50: A Lesson in Growth Obsession

It was the late 1960s and early 1970s. Wall Street was obsessed with a group of elite stocks known as the "Nifty 50"—companies like IBM, Coca-Cola, and Xerox.

The narrative was that these were invincible, must-own businesses, capable of compounding earnings indefinitely. Valuations soared as investors paid any price for perceived growth.

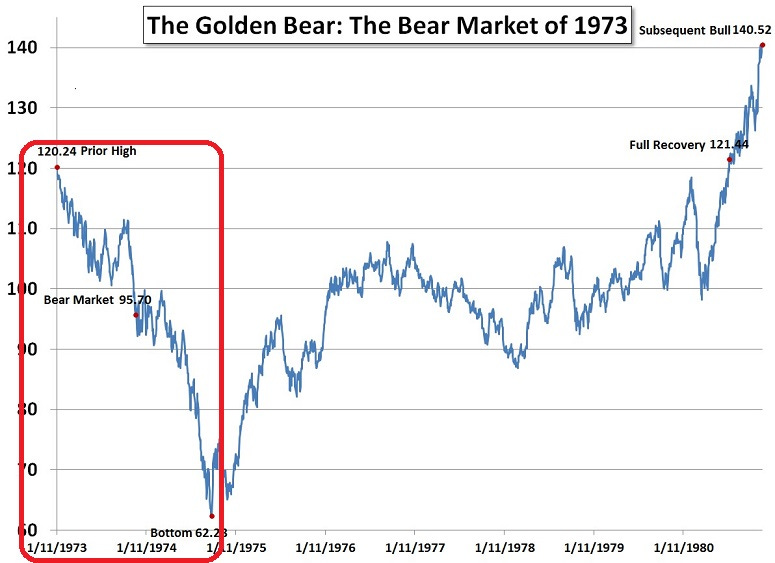

Then the bear market of 1973-74 arrived. Inflation spiraled out of control, the U.S. dollar was decoupled from gold, and the Federal Reserve was forced to jack up interest rates.

The Nifty 50?

Decimated. Valuations collapsed, and investors who had piled in at the top suffered brutal losses.

The lesson? Growth stocks don’t defy gravity forever.

Dot-Com Mania: The First Big Tech Bubble

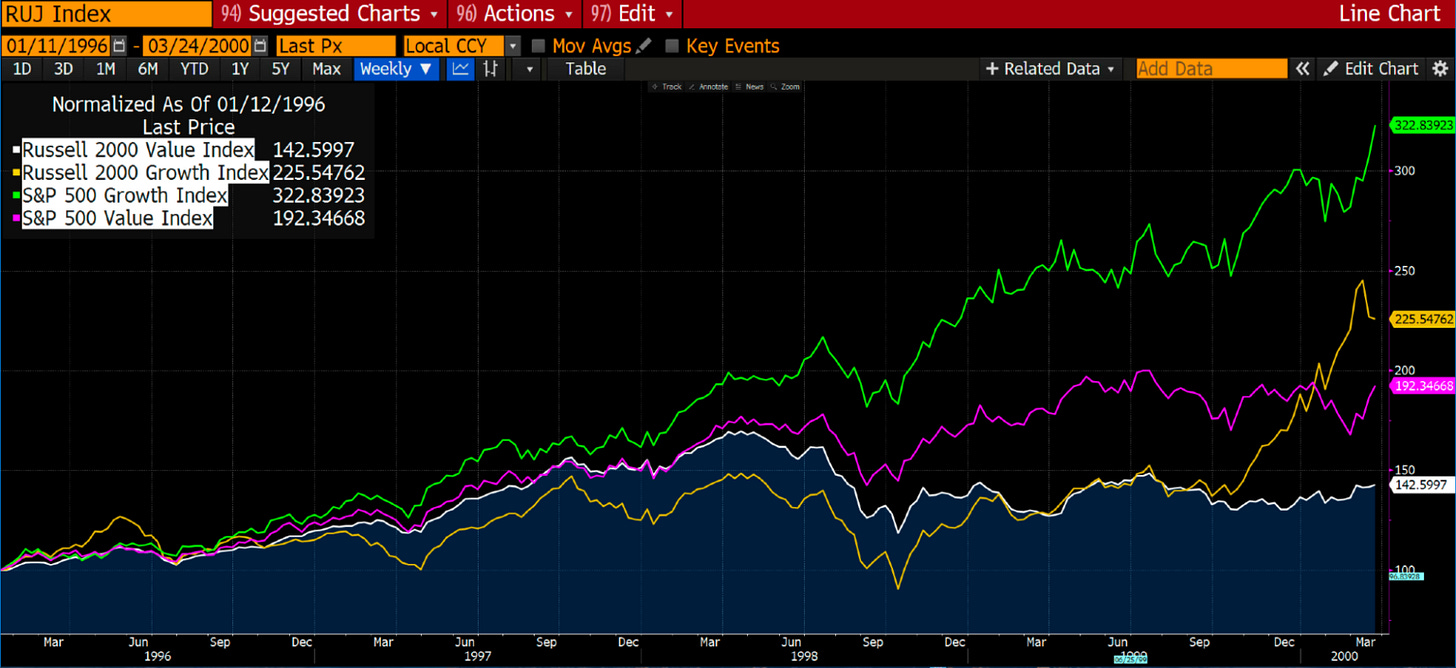

Fast forward to the late 1990s. A fresh wave of speculation gripped the market. The internet was the future (which was correct), and any company with “.com” in its name was bid up to absurd heights (which was incorrect).

Once again, value stocks were left for dead as capital flooded into high-flying tech names like Cisco, AOL, and Pets.com.

Then, in early 2000, the music stopped. The Nasdaq crashed by nearly 80% over the next two years, wiping out trillions in investor wealth. Value stocks?

They survived. And in many cases, they thrived.

I recall back then a colleague I worked with (who then was in his 60s) comparing the TMT craze to the Nifty 50 craze he observed when he was in his 30s.

In late 1999, he kept on saying, “This will all end in tears, just like the Nifty bubble.” He was right, and he didn’t have to wait long to be vindicated.

2024: The Most Extreme Case Yet

Today, we are witnessing a similar pattern—but arguably even more extreme than previous cycles.

Large-cap growth stocks have outperformed value stocks by 22% in 2024 alone.

The disparity over the last five years is staggering. Investors are once again paying obscene premiums for future earnings, just as they did in the Nifty 50 and dot-com eras.

The difference this time? The dominance of a handful of companies is so extreme that the top 10 stocks in the S&P 500 now account for nearly 35% of the entire index. Historically, these conditions don’t last.

In 2024, value has underperformed growth by some 22%. Yes, it is as bad as 1999/early 2000, and so is sentiment towards value.

What has made this so darn hard (putting it politely) is just when you thought value had bottomed against growth in 2021 (if 2020 wasn’t bad enough)… well, here we are again at the lows of 2021. Four years later! This has been hard to stomach to say the least.

So, what could trigger the long-overdue resurgence of value investing?

Catalyst #1: Rising Interest Rates and the Cost of Capital

For years, growth stocks thrived on cheap money.

The Federal Reserve’s zero-interest-rate policies (ZIRP) fueled a decade of tech dominance by making capital virtually free.

Companies could borrow at near-zero costs, expand aggressively, and justify sky-high valuations.

But the world has changed.

The Fed has raised interest rates at the fastest pace in history, and higher rates disproportionately hurt growth stocks. Why?

Because growth investing is all about discounting future cash flows, and when the discount rate (interest rates) rises, those future earnings become less valuable.

For value stocks, which are often cash-flow rich and less dependent on cheap debt, rising rates are far less of a headwind.

If rates remain elevated—or climb even higher—growth stocks could face serious valuation compression. And that could spell a long-overdue comeback for value investing.

Catalyst #2: Energy and the End of Cheap Oil

One of the most overlooked yet critical drivers of economic cycles is energy prices. Over the last 15 years, nearly 70% of global oil production growth has come from U.S. shale. This explosion of supply kept inflation low, interest rates suppressed, and tech valuations soaring.

But there's a problem.

U.S. shale is plateauing. The industry has exhausted its best drilling locations, productivity gains are slowing, and capital expenditures in new projects remain dismal.

Meanwhile, global energy demand continues to rise—particularly in China and India.

If oil prices rise significantly due to supply constraints, it will crush growth stocks in two ways:

Higher energy costs drive inflation, which pressures the Fed to keep rates high.

Higher energy costs make the cost of capital more expensive, reducing liquidity and risk appetite for speculative investments.

On the flip side, rising oil prices benefit energy stocks, commodities, and industrial businesses—all traditional value plays.

So what would lead to value outperforming growth? The most obvious is higher commodity prices, particularly energy related.

Not only would this help energy stocks outperform.

It would raise the cost of capital (interest rates), which negatively affects the high valuations of growth stocks.

Now, what would push up oil prices? Obviously a number of factors, but here is one thing to consider — what if US shale oil production started to negatively surprise?

Remember, all the growth in oil production over the last 15 years (at least 70%) has come from US shale.

Take a look at US oil production and growth relative to value…

If one was to take out the impact of Covid (2020-2022), then the relationship looks strong. Or is it just a spurious correlation?

Catalyst #3: A Crumbling Dollar and the Rise of Hard Assets

For decades, U.S. equities have benefited from global capital flows into the dollar. But cracks in the system are beginning to show.

Countries like China, Russia, and even Saudi Arabia are diversifying away from U.S. assets, increasing their reliance on commodities, gold, and alternative currencies.

This shift could be a tailwind for real assets and hard-money plays, such as:

Commodities (oil, copper, uranium)

Energy producers

Infrastructure plays

Precious metals

Many of these sectors fall squarely into the value investing universe—industries that have been left for dead while tech soared.

What Comes Next?

Here’s the bottom line: We are staring at the most extreme valuation gap between growth and value stocks in history.

If history is any guide, this will not last.

Either:

Growth stocks will crash and burn, handing the reins back to value.

A rotation will take place, gradually shifting capital toward undervalued businesses.

To give you an idea of how extreme the “TMT” or “dot com” bubble of late 1999/early 2000 was, it exceeded the Nifty50 craze of the late 1960s/early 70s.

It is hard to get good illustrations of value vs growth going back to the 1960s.

The chart below is about as good as I could get (note the last date was 2015 or 10 years ago).

So, how should investors position themselves?

1. Look for High-Quality Value Plays

Not all value stocks are created equal. Focus on companies with:

✅ Strong balance sheets

✅ Consistent cash flow

✅ Low debt levels

✅ Pricing power in an inflationary world

2. Consider Energy and Commodities

The world is facing a supply-side crisis in energy. Capital has been misallocated, ESG policies have disincentivized investment in oil and gas, and demand isn’t slowing. This sector is likely undervalued relative to its future cash flow potential.

3. Be Cautious About Chasing Growth at Any Price

The greatest risk today isn’t missing out on the next AI boom. It’s overpaying for growth at absurd valuations, just as investors did in 2000. Those who ignore history risk repeating it.

The Market Inflection Point is Near… But What Happens Next?

The investment world has been conditioned to believe that growth will outperform forever. The data, however, tells a different story.

Could we be on the cusp of a historic mean reversion?

There’s one final piece to this puzzle—a macroeconomic shift no one is talking about yet—that could accelerate the return of value investing and upend market assumptions.

😉 Invest in the same asymmetric opportunities we are:

I needed this article today, as I question a few energy investment choices!