Is Silver’s Gold-Silver Ratio a Golden Ticket?

Silver’s Shining, But Is Your Precious Metals Strategy Missing the Mark?

If you’ve been watching gold prices climb this week, you’re not alone. Gold is trading at approximately $3,372.00 per ounce, up sharply on growing fears around war, fiscal discipline, monetary mismanagement, and a reawakening of inflationary pressures.

And silver? Still the underdog, but catching a bid. It’s hovering around $34.50 an ounce, enough to provoke retail investors.

Which brings us to the gold-to-silver ratio…now sitting around 97:1. That’s high.

Historically high. And if that means anything…and it might…then silver is undervalued.

Or so they say.

The Ratio That Launched a Thousand Clicks

We’re hearing it everywhere: “Silver is going to explode!” “The ratio always reverts to 60!” “Gold has had its run, silver is next!”

That last one’s a fan favorite. Especially as gold miners digest a little of their recent parabolic gains.

Here’s the thing: the gold-to-silver ratio is a clue, not a commandment. It hints. It suggests. But it does not guarantee. And most importantly, it tells you nothing about when.

That doesn’t stop influencers from acting like it does. But you’re smarter than that.

You’re not here to gamble. You’re here to allocate.

If you think about it, investors should hold more skepticism regarding silver outperforming gold to close this ratio gap.

Gold remains favored by central banks, and Bitcoin now absorbs some of the speculative and “hard money” capital that used to go to silver.

Therefore, do not expect a historic mean reversion. Gold is more likely to outperform or at least maintain its dominance over silver.

The Problem with Picking Favorites

Nobody knows which precious metal will outperform next month. Or next year.

Gold is a monetary ballast. Silver adds industrial kick. Platinum is a stealthy side bet on decarbonization. Palladium is a volatile wildcard. And miners?

They’re a coin toss on top of a commodity bet inside an operating company roll of the dice.

Worse, the long-term track record for buy-and-hold investors in mining stocks is filled with cautionary tales.

These companies face a perfect storm of variables: political risk, fluctuating input costs, labor disputes, permitting delays, and poor management decisions.

Even during bull markets for metals, many miners fail to reward their shareholders.

Dividends are scarce, capital is often misallocated, and dilution is a constant threat. For every ten investors who hold miners through the cycle, history shows most end up with regret, not returns.

To think you can reliably pick which miner will outperform is like thinking you can choose the fastest raindrop on your windshield. Possible? Maybe. Repeatable? No.

The Case for the Basket

That’s why we build baskets.

Not because we lack conviction, but because we understand the unknowable. Because while the crowd is betting on what to chase, we’re setting up what to catch.

A diversified basket of gold, silver, platinum, and mining equities spreads exposure, smooths volatility, and reduces the odds of looking foolish. If one shines, we participate. If another tanks, we absorb the hit.

And when it comes to mining stocks, diversification becomes even more critical.

Owning individual miners exposes you to idiosyncratic risks…company-specific issues that can torpedo performance even in a bull market.

One mine gets flooded, one CEO makes a dumb acquisition, one country changes the rules…your single-stock bet can go to zero fast.

That’s why ETFs like GDX and GDXJ exist.

They allow investors to gain exposure to the sector without trying to outguess geology or geopolitics.

You spread the risk across dozens of miners, smooth the ride, and avoid the heartbreak of betting wrong on a single name.

No single metal…or miner…is guaranteed to own the future (except…perhaps…gold).

But a basket? That gives you a fighting chance.

Miners: The Glitter and the Guts

Let’s talk miners.

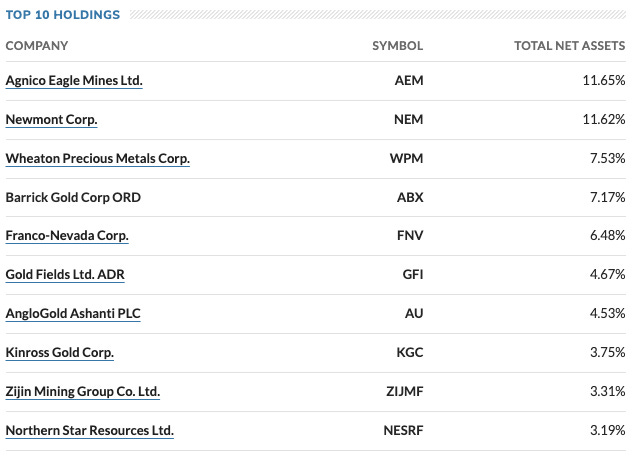

The GDX ETF gets you broad exposure to large-cap producers.

The GDXJ dips into the riskier world of junior miners…those wildcatting for ounces in places with more dirt and rocks than rules.

Picking the right individual miner is like picking the right lottery number. You need geology, governance, cost curves, local politics, and luck to line up.

We don’t try to out-research the geologists. We allocate through the ETFs. Then we let the market do what it does.

Don’t Get Played by the Clickbait

If you’re managing real money…yours or anyone else’s…the worst thing you can do is chase clickbait narratives from people who don’t.

Certainty is for showmen. Doubt is for professionals.

Howard Marks is the billionaire co-founder of Oaktree Capital Management, known for his insightful memos and contrarian investment philosophy focused on risk management and distressed debt.

He is best known for his memos, which distill complex market insights into clear, contrarian wisdom revered by top investors like Warren Buffett.

He doesn’t pretend to know the future. He studies probabilities and plays the long game. He knows conviction without accountability is just noise.

So when some guy on YouTube says silver’s going to $500 an ounce next month because “the ratio,” smile politely…and ignore him.

Play Defense Like a Pro

A proper metals basket isn’t a bet—it’s a hedge.

You’re not buying to make a killing. You’re buying to avoid being killed.

Think of precious metals as portfolio insurance. They aren’t meant to triple your money overnight.

They’re meant to preserve purchasing power when the monetary system starts cracking at the seams.

That’s the role they’ve played for centuries, and that’s what they still offer today.

If you’re looking to get rich off mining stocks, you’re not an investor…you’re a trader.

And traders need sharp timing, constant vigilance, and the humility to admit when they’re wrong. Most don’t have that.

Long-term holders of miners often find out the hard way: the market doesn’t care how long you’ve held…it only rewards those who bought right and managed risk well.

You need to know what you’re betting on. Because at the end of the day, that’s all you’re doing: betting.

There’s no shame in that…as long as you admit it. Just don’t confuse it with a conservative investment strategy.

In a world where fiat is fraying, central banks are winging it, and trust in institutions is evaporating, hard assets become your insurance policy.

But let’s be clear…insurance only works if you hold it before the fire.

If you are like us, our Glenorchy clients, or our insider members, and you are playing the long game, then what should a prudent portfolio allocation to precious metals look like?

It Puts the precious metals in the basket or it gets the hose again

We recommend allocating about 10% of a total investment portfolio to precious metals.

Here’s one way to break down that 10%:

Physical Gold: 5% of your total portfolio. It’s the monetary constant.

Silver: 2% of your total portfolio. Higher upside, higher volatility.

Platinum & Palladium: 1% combined. Small but potent.

Miners: 2% of your total portfolio. GDX for majors, GDXJ for spice.

Every individual investor should make physical gold a priority. If it’s not in your hands, it’s someone else’s promise.

Think of it like building a fireproof room in your financial house. You hope you’ll never need it…but if the time comes, you’ll be glad it’s there.

Beware the Moment of Popularity

Nothing screams "top" louder than daytime “Cash for Gold” commercials or your Uber driver giving you mining stock tips.

And lately? The noise is back.

YouTube thumbnails are screaming about silver.

Tweets are flooding timelines with charts, ratios, and moon-bound projections.

Self-anointed gurus are banging the table on $100 silver, like it’s just around the corner and you’re a fool for not maxing out your brokerage account.

That’s not analysis…that’s a sentiment spike.

When precious metals become popular, they become risky.

Popularity drives price…then kills it. Mania sucks in the latecomers, and the latecomers usually end up holding the bag.

We’ve seen this movie before. The crowd piles in. The narrative goes parabolic. The trade gets crowded. Then it turns.

We don’t buy the trend. We buy the value. And we wait.

FOMO isn’t a strategy. And when the dust settles, it’s the patient, not the popular, who survive.

This isn’t about timing the market. It’s about surviving the transition.

You’re not buying metals to get rich. You’re buying them so that when the music stops, you still have a chair.

The next monetary regime is coming.

We don’t know what it looks like. But we do know this: when the world gets repriced, the people holding real assets won’t be the ones panicking.

They’ll already have the basket.

If you're looking for professional investment ideas and want to dig deeper into asymmetric investing, subscribe to our insider newsletter here on Substack.

Every month, we share high-conviction, time-tested strategies straight from the desks of Chris MacIntosh and Brad McFadden.

Newsletter subscribers also get access to a simple to follow 5-part series outlining our asymmetric investing framework…designed for long-term thinkers who want to stack the odds in their favor.

And if you’re ready to build your own long-term portfolio and want access to our portfolios, plus direct Q&A access to Chris and Brad, then step behind the paywall and join our community. Click here to learn more about the perks of becoming a full Insider member.

None of this matters. The fraud in these markets is off the charts and its not just bullion banks with a finger on the scale.