Echoes of Empire

How Global Cycles Are Rewriting the Rules of Wealth

Imagine a world where the mightiest economy hoards two-thirds of the planet’s stock market riches while contributing just a quarter of its output.

Where a single chipmaker balloons to nearly $5 trillion in value, dwarfing entire nations, and ragtag rebels armed with $2,000 gadgets humiliate billion-dollar war machines.

This isn’t dystopian fiction…it’s the financial frontier we’re hurtling toward.

As invisible cycles churn beneath the headlines, savvy investors aren’t chasing the next meme stock frenzy. They’re mapping the seismic shifts in money, power, and machines that could redefine prosperity for the next decade.

Buckle up: we’re diving into the four-stage maelstrom that’s turning markets upside down, and uncovering the strategies that turn chaos into compound interest.

Stage One: The Sovereign Debt Squeeze…When Nations Borrow Their Way to Brinkmanship

Picture this: a family maxed out on credit cards, arguing over whether to cut the grocery budget or sell the family heirloom. Scale that up to superpowers, and you’ve got the monetary and credit cycle in full throttle.

Sovereign debt isn’t just a ledger line…it’s the fuse lighting up global finance.

Countries drowning in IOUs face a stark choice: inflate away the pain, default spectacularly, or slash spending in ways that spark riots.

We’re deep in this phase now, with legacy powers…think the West’s economic titans….grappling with ballooning deficits that make the 2008 crisis look like a rounding error.

The math is merciless. Interest payments alone are devouring budgets, crowding out everything from infrastructure to innovation.

Central banks, once hailed as saviors, now print money like it’s going out of style, eroding the dollar’s throne.

But here’s the twist: this isn’t isolated.

Cross-border capital flows are accelerating the exodus.

Investors, spooked by eroding purchasing power, are rerouting funds through non-Western channels…think digital bridges bypassing SWIFT or crypto corridors linking Shanghai to São Paulo.

It’s a quiet revolution, where the old guard’s monetary monopoly crumbles, paving the way for multipolar money.

Yet, amid the bond yields spiking like a fever, opportunities lurk.

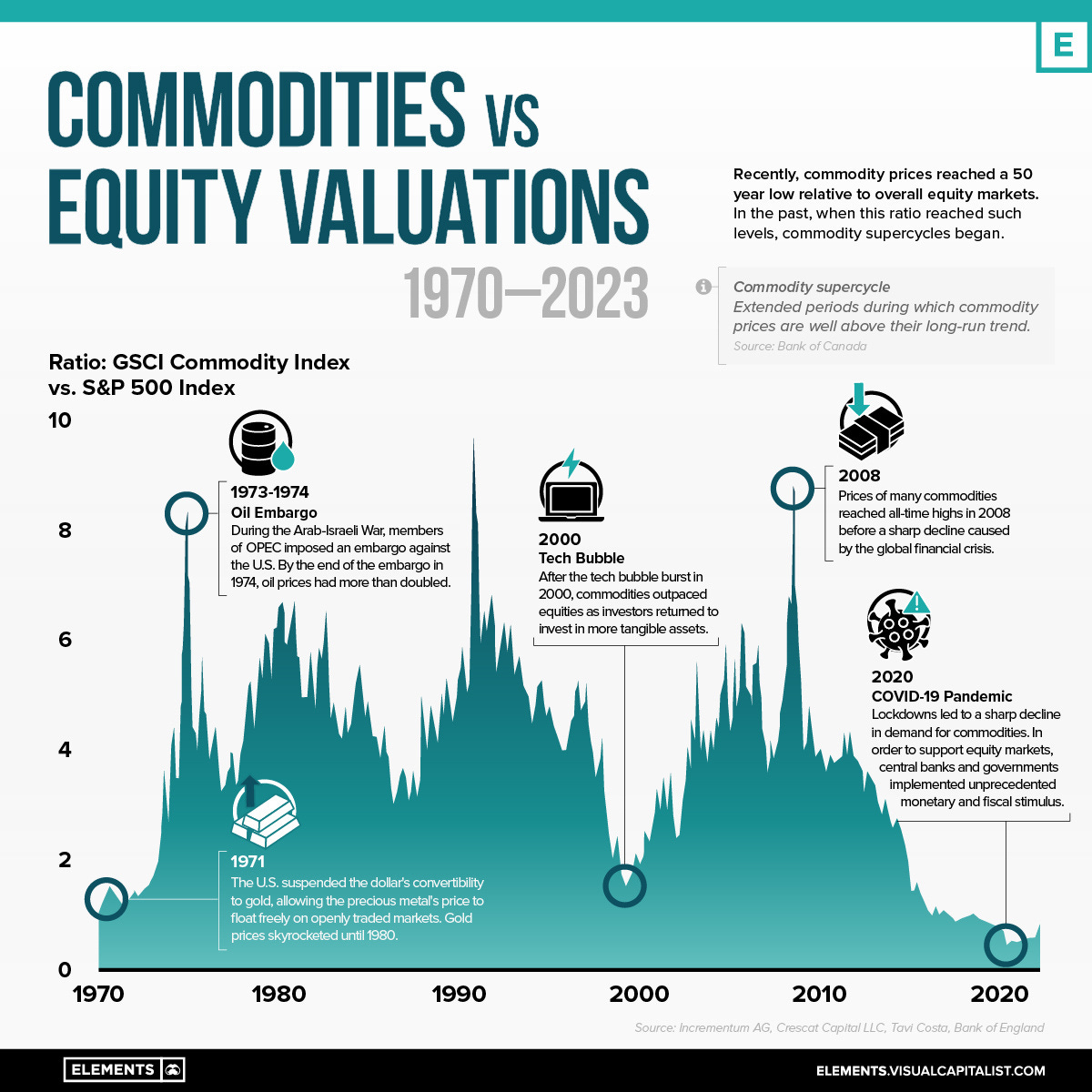

Commodities, battered for over a decade, trade at discounts that scream “bargain basement.”

Producer stocks versus broad equities? Down a gut-wrenching 73% in 14 years.

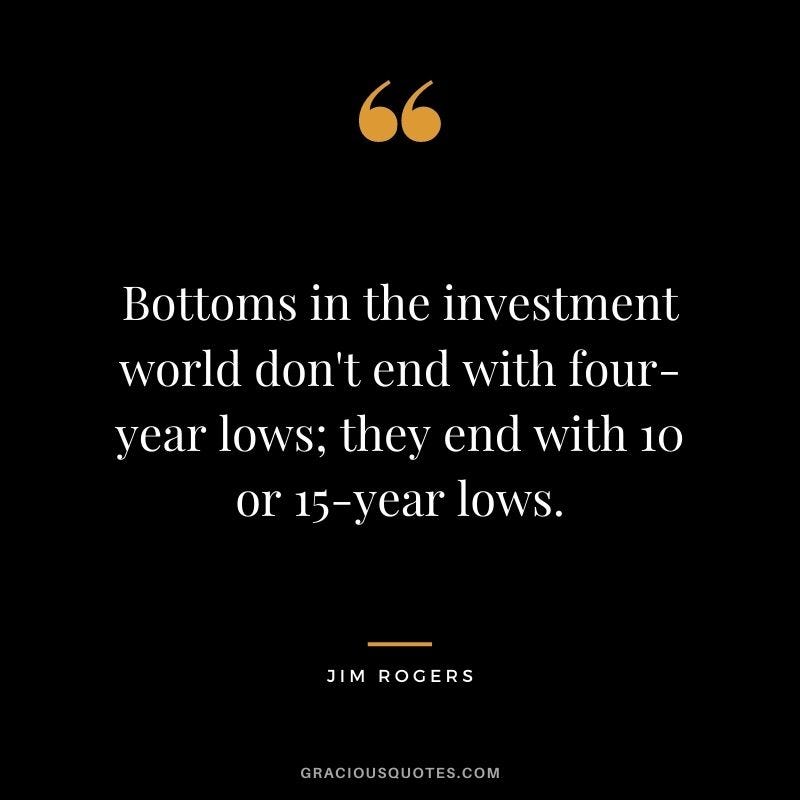

As Jim Rogers once quipped, true bottoms don’t form in a weekend…they simmer over 10- to 15-year cauldrons.

Investors wise to this cycle aren’t betting on quick flips…they’re stocking up on real assets that thrive when fiat falters.

Gold? Sure, but also the unglamorous miners in far-flung locales, churning free cash flow while empires teeter.

This debt domino doesn’t topple alone, though.

As fiscal nooses tighten, the squabbles at home get personal. What if the rice bowl fights escalate from dinner table debates to street-level showdowns?

Stage Two: Domestic Discord – The Family Feud That Fractures Economies

Hard times breed hard feelings, and when nations hit the financial skids, the gloves come off internally.

Political disagreements, once hashed out over handshakes and headlines, morph into irreconcilable rifts.

It’s not hyperbole…history’s littered with examples where debt crises ignited civil strife, from bread riots in revolutionary France to the austerity-fueled populism of 1930s Europe.

Today, we’re witnessing the sequel: polarized parliaments gridlocked on everything from tax hikes to trade pacts, while social media amplifies the echo chamber into a coliseum.

The mechanics are brutally simple. As governments slash services to service debts, inequality widens like a chasm. The top 1% scoops up assets inflating on easy money, while the middle class watches real wages evaporate.

Enter the demagogues: promising walls, tariffs, or tech utopias to paper over the pain.

Discourse dies, replaced by decree…or worse, division.

We’ve seen it in election cycles that feel more like cage matches, with turnout spiking not from hope, but from hate.

Economically, this discord is a drag. Consumer confidence craters, capex freezes, and markets whipsaw on tweet-sized policy pivots.

Valuations? They’re decoupling from reality faster than a bad breakup.

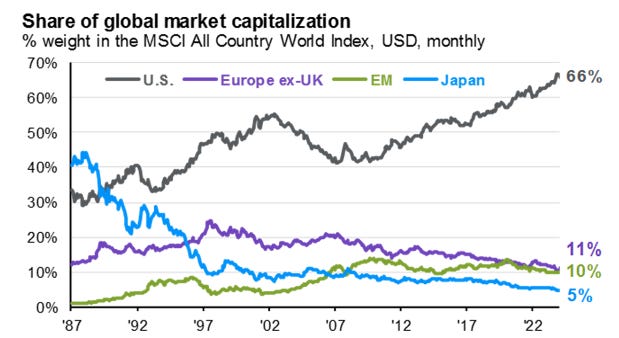

Take the U.S. stock market: commanding 65% of global capitalization despite a mere 25% slice of GDP.

That’s not efficiency—it’s euphoria on steroids, fueled by foreign inflows at all-time highs and domestic institutions piling in like lemmings.

The S&P 500’s breadth? A joke…490 stocks treading water for two decades, while seven tech behemoths (the so-called Magnificent Seven) rocket skyward.

Nvidia alone? A $4.7 trillion behemoth, representing 8% of the index. It evokes the late ‘80s Japanese bubble, where Tokyo’s Imperial Palace grounds outvalued all of California.

But bubbles burst, and when they do, domestic fractures amplify the fallout.

Retail investors, hooked on the highs, face margin calls that turn optimism into outrage.

Institutions, bloated on passive ETFs, stampede toward liquidity, leaving many small caps in the dust.

Small versus large? The ratio’s at rock-bottom levels, with under-owned gems trading at dirt-cheap multiples…often sub-8 P/E, low debt, and dividends gushing from genuine cash flow. As these internal tempests rage, eyes turn outward.

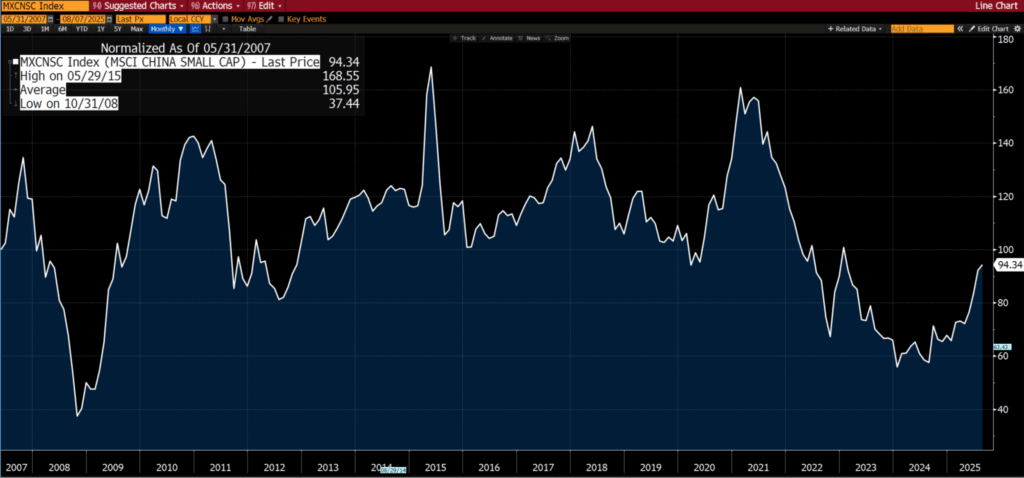

Buying Chinese Small Cap Stocks

We are increasing our exposure to China by buying the iShares China Small Cap ETF (ECNS) with a 5% weighting. This ETF tracks the MSCI China Small Cap Index.

This addition will take our exposure to China in the Asymmetric strategy to about 10%.

Why Chinese small caps? Simply put, smaller capitalized stocks in China make one of the most unloved or overlooked stock markets in the world (from a geographical perspective). At the same time, they offer surprisingly good value.

During our global adventures to find value, there seems to be a disproportionately higher number of smaller cap stocks from China and Hong Kong popping up on our “value radar.” This radar looks for both value and positive price momentum over a range of time frames.

While we still see huge value in the global energy and related services sectors, adding more of these stocks to our portfolio doesn’t achieve anything in terms of lowering risk or volatility.

However, the addition of Chinese small caps brings a differing risk profile — one that, on a long-term (five years or more) view, has little to do with the behaviour of the S&P 500 or the behavior of the broad energy sector.

Why a Chinese small cap ETF rather than individual stock picks? There is so much value on offer within the Chinese small cap stock universe across a number of sectors that we just couldn’t decide which stocks to pick. So we have gone for a small cap ETF.

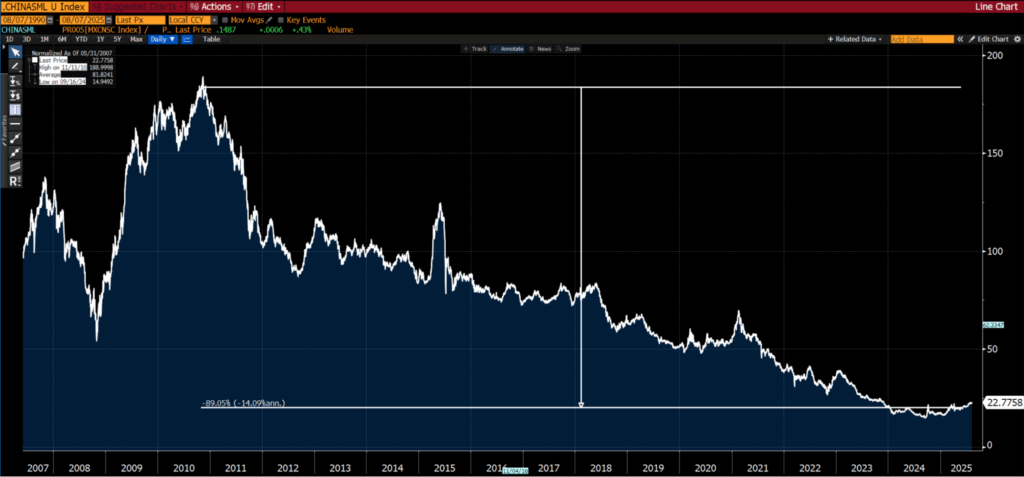

Let’s take a look at the performance of Chinese small cap stocks. This should give you an appreciation of how out of favour they are and why they appear to have broken the long-term downtrend of underperformance relative to other world equity markets.

From an absolute perspective, it is at the same level now as 2007. Yes, 18 years of going essentially nowhere. We are automatically drawn to markets where no one has made money from over the last 10 years… or, better still, lost substantial money.

This suggests that weak hands have all been flushed out of the market. In the case of Chinese small caps, these “weak hands” would typically be short-term oriented flows from global investors.

We see little evidence of global investors buying Chinese equities let alone smaller caps issues.

That insignificant “blip” on the chart from mid 2024 is about a 50% move. On a P/E basis (earnings before extraordinary items), the index sits on 12x. This is about half of the S&P 500 and 50% less than the Russell 2000.

But markets don’t exist in isolation. It’s the performance of Chinese small caps relative to other markets that is more revealing.

Relative to the S&P 500, Chinese small caps are down some 90% since 2010.

Granted, 2010 levels may have been a “little elevated.” However, even since 2015, there has been a 75% fall and 50% since the worst of the GFC in 2008.

It’s not hard to come to the conclusion that Chinese small caps are out of favour to an extreme degree.

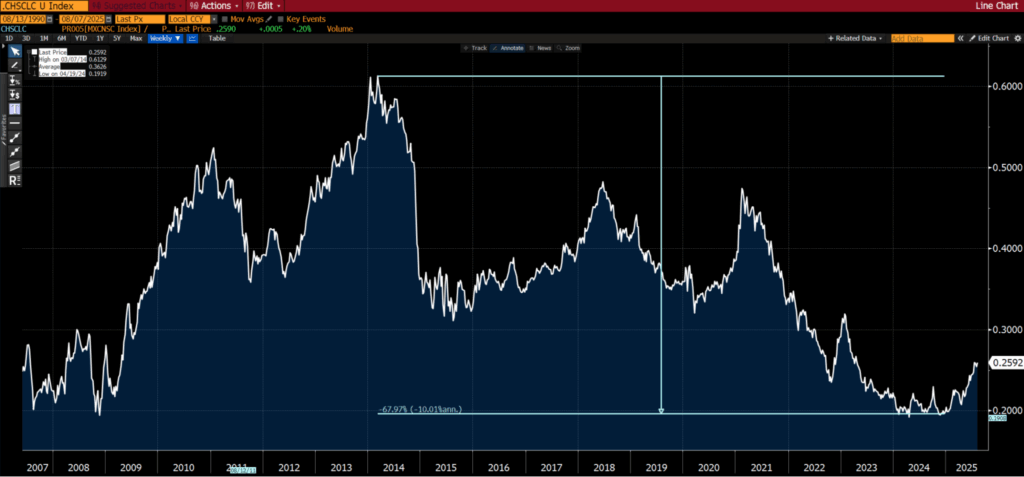

Even relative to the Shanghai Composite, they are down materially over whatever time frame from 2010 to 2021 until recent.

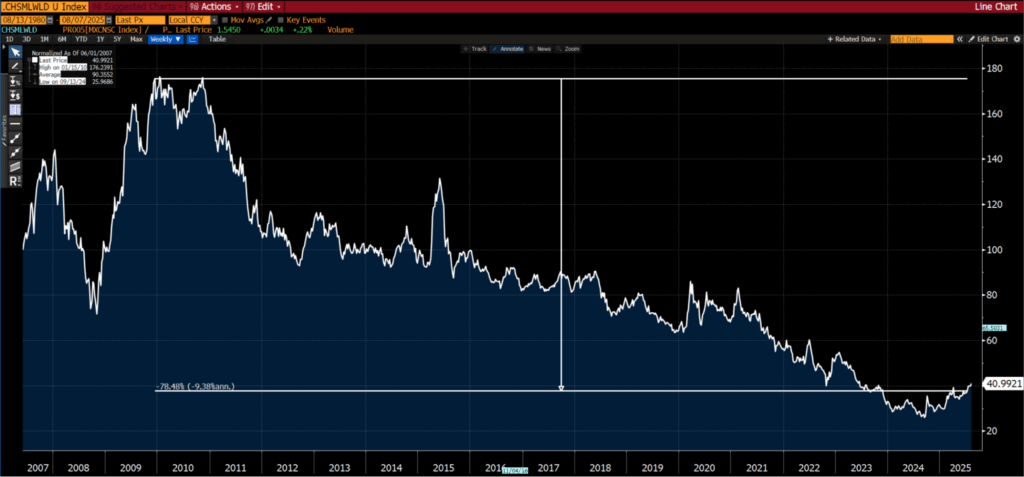

Relative to world small caps, they are down some 80% over the last 15 years.

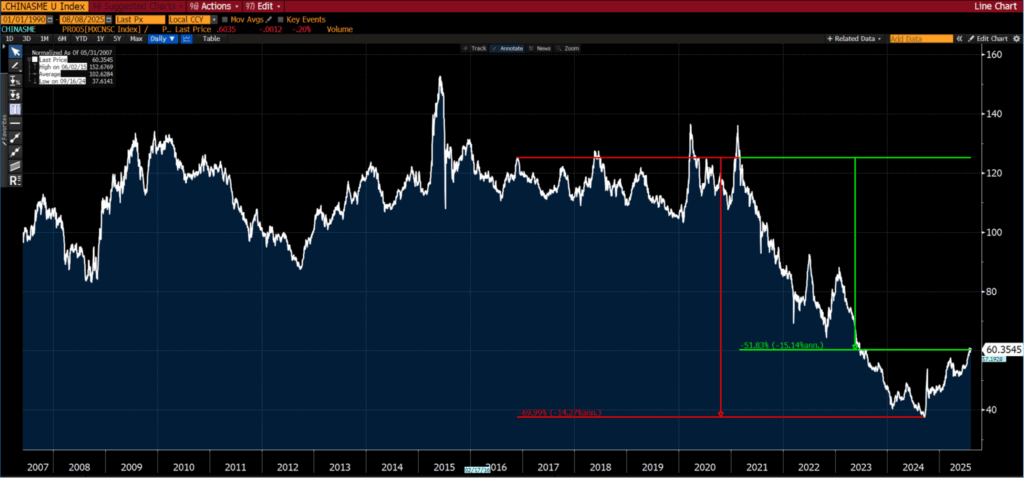

And even relative to emerging markets small caps, Chinese small caps are down 50% since 2015 (and were at one point down 70%).

Slice and dice it whatever way you want — Chinese small caps are one of the most unloved and out of favour equity markets out there.

What happens when a rising giant knocks on the door, not with olive branches, but with tariffs and troop movements?

Stage Three: Challengers Rising – From Trade Skirmishes to Shadow Wars

Empires don’t fade quietly…they clash. As legacy powers bicker over scraps, a new contender emerges, hungry for the throne.

This is the geopolitical pivot: a rising force…be it a BRICS bloc or an Eastern powerhouse…challenging the status quo not just militarily, but monetarily and commercially.

Trade wars precede the hot ones, with sanctions slicing supply chains like a scalpel.

We’re living it: export curbs on chips, energy embargoes, and currency swaps that sideline the dollar’s dominance.

The playbook’s ancient…think Britain’s opium wars with Qing China or Rome’s Punic clashes with Carthage.

Today, it’s subtler: a web of alliances rerouting oil from petrodollars to yuan-denominated deals, or rare earth monopolies flipping the script on green tech.

International conflict simmers, often sparked by resource grabs or border beefs, but always underpinned by economic envy.

The U.S., with its market cap eclipsing the combined bourses of Europe, China, Japan, India, the UK, and a dozen others, feels the heat.

Foreign holdings of its assets? Peaking like never before, a sign of overextension begging for reversion.

For investors, this stage is a gold rush disguised as a minefield.

Geographies matter more than ever…coal miners in Indonesia thrive while German counterparts wither under green mandates.

Sector rotations accelerate: defense stocks surge on drone diplomacy, while legacy exporters bleed.

The key? Spotting the underdogs.

Emerging markets versus developed? Ratios echoing the ‘90s bubble peaks, but with reversion in sight.

Chinese equities, hammered by delisting fears in 2023, saw large caps like Alibaba tank as institutions fled. Yet smaller plays? Untouched, compounding quietly at 10-15% yields, immune to the big boys’ fire sales.

These clashes don’t erupt in a vacuum, however. What if the next disruptor isn’t a nation, but a gadget that levels the playing field overnight?

Stage Four: Tech Tsunamis – When Innovation Ignites the Powder Keg

Technology isn’t a side dish—it’s the accelerant. In past turns, it was the steam engine shattering guilds or railroads knitting empires. Now, it’s asymmetric warfare and borderless capital that upend the board.

Drones aren’t just Amazon deliveries; they’re $2,000 equalizers turning million-dollar missiles into expensive fireworks. Houthis in the Red Sea? A ragtag force dictating terms to superpowers, proving cheap tech trumps pricey hardware every time.

Monetarily, blockchain and stablecoins enable capital flight from sanctioned shores, while AI crunches data to predict debt defaults before they detonate.

Warfare evolves: cyber salvos precede sorties, and supply chains digitize to dodge tariffs.

This disruption cascades…valuations in tech soar to absurd heights (hello, Nvidia’s trillion-dollar sprint), but bubbles form where froth meets fundamentals.

As economist Richard Werner unpacked in a viral deep dive, banks don’t lend savings; they conjure credit from thin air, inflating assets until the spell snaps. Bubbles aren’t accidents—they’re baked into the system.

The ramification? Violent repricings across classes. Equities crater, bonds buckle, commodities rebound. Investors who grasp this don’t panic—they position.

Asymmetric portfolios chase high-conviction bets: sectors mispriced by macro madness, like undervalued miners or overlooked utilities.

But what if survival demands more than smarts—does ironclad discipline separate the compounders from the casualties?

Forging Resilience: The Art of Asymmetric Armor

In the eye of the cycle storm, portfolio construction isn’t about diversification for its own sake—it’s engineered asymmetry.

One blueprint: a dividend fortress built on deep value. Target assets trading below 8 times earnings, saddled with minimal debt, and yielding robust payouts from unadulterated free cash flow.

Geography? Sector? Irrelevant—cast a global net for 80 holdings, each capped at 1-2% to mute the misses.

Since early 2021, this setup has delivered 60% total returns, split evenly between yield reinvestments and reluctant revaluations.

Low volatility reigns; even if a Ukrainian holding vaporizes to zero, it’s a 1% shrug.

Boring? Absolutely…window washers, auto parts fabricators, even kindergartens. But boring wins wars.

Quarterly trims enforce the creed: when a 12% yielder triples, its appeal evaporates. Sell, redeploy, repeat. One outlier?

An Israeli detonator firm, scooped pre-conflict at 15% yield, exploded 50-fold amid the chaos. Sold per protocol, forgoing windfalls…but dodging the dive when yields normalized.

The asymmetric cousin? Sector-savvy, geography-tuned. Mining’s a dog—depleting assets, geopolitical roulette—yet it’s where value hides. Don’t chase lone gems; buy the boulevard. An entire street of cheap drillers beats one flawed fixer. Why?

Company-specific snafus (crooked CEOs, bad luck) sink singles; sectors lift in tides.

Passive behemoths, gorging on ETFs, shun small caps—$800 million market caps are kryptonite to billion-dollar funds. Result? Tiny titans trade at fire-sale prices, profitable and potent, compounding sans the crowd.

This isn’t theory—it’s trench-tested. Chinese small caps in 2023? Institutions dumped blue-chips like Baidu, igniting headlines of meltdown. Micro-plays? Climbed 30% unmolested, their illiquidity a shield.

As one quip goes: if the elephants can’t sell what they don’t own, you’re the tortoise lapping the hares.

Discipline, though, is the secret sauce. Subscribers chase sirens, bloating positions to 30% on a hot tip—thrilling until the rug-pull. The lesson? Size slays. A 1% stake in a quadrupler nets tidy gains; a house bet invites house fires.

In cycles this feral, purpose anchors: walk the dog, feed the cat, nurture the next generation. Wealth’s a means, not the end—echoing Alan Watts’ rats-in-mazes parable, where endless cheese hoarding hollows the soul.

But can this blueprint weather the full turn? As ratios revert—small caps to large, commodities to equities, EM to DM—what hidden gems will surface next?

Invest in the same things we do:

Hunting Horizons: Sectors, Cycles, and the Comeback Kids

Zoom out, and the map reveals mispricings begging for bids.

Small caps, starved by passive flows, brim with bargains: profitable outfits at single-digit multiples, dividends double-dipping into teens.

Large caps? Overcrowded casinos, ripe for the reckoning.

Commodities? A 14-year rout positions producers for a Rogers-style renaissance—decades in the making, explosive in arrival.

Sectors steal the show.

Defense? Drone economics dictate dominance—low-cost swarms versus legacy leviathans.

Energy? Transition talk belies the thirst; undervalued extractors in compliant climes (Indonesia’s coals over Europe’s edicts) pump cash while headlines howl “net zero.”

Utilities and staples? The unglamorous anchors, yielding steadily as spectacle stocks sputter.

Geopolitics sharpens the lens: sanctions sideline silos, boosting border-agnostic plays.

A portfolio blending 30% EM exposure—Hong Kong-listed minnows, say—sidesteps the stampede, turning panic into premium.

The math? If big funds can’t touch it on the way in, they won’t torch it on the way out. Compound at 10% annually? Beach-bound bliss beats boardroom battles.

Human folly fuels the fun.

Bubbles swell on borrowed bucks, as Werner demystifies: banks birth booms, then busts, in a credit-creation carousel.

When it pops—Nvidia’s peak mirroring Tokyo’s ‘89 hubris—violent vectors vector across assets.

Shorts tempt, but value vultures thrive: ignore the sex-and-violence trades, hunt the steady eddies.

Turning Tides: Positioning for the Post-Bubble Dawn

As the four stages converge—debt’s drag, discord’s din, challengers’ charge, tech’s torrent—the turn accelerates.

Markets, larger than life (U.S. equities outcapping a global gaggle), teeter toward mean reversion.

Foreign fat trimmed, Mag Seven mania muted, breadth broadens.

The playbook? Asymmetric armor: dividend deep dives for income insulation, sector sweeps for upside asymmetry. Discipline as dogma…trim winners, ignore noise, embrace the boring.

This isn’t doomsaying; it’s dawn-breaking. Cycles crest and crash, birthing bargains from the breach.

Investors attuned to the rhythm—monetary metronomes, geopolitical pulses, innovative inflections—don’t just survive; they sovereign their futures.

In a world of $2,000 drones toppling titans, the real power play? Owning the streets where value rebuilds, one undervalued block at a time.

The question lingers: when the bubble bursts and the board resets, will you be the builder or the bystander? The cycles whisper…choose wisely.

Join the Insider Community

At Capitalist Exploits, we scour the globe for asymmetric opportunities…markets and assets ignored by the masses but poised for outsized returns.

Whether it’s Greece, Argentina, or the next hidden gem, we provide actionable insights to help you build wealth over the long term.

To get started, subscribe to our free Insider articles on Substack for weekly market analysis, investment ideas, and updates on the latest trends.

For deeper dives, including our full portfolio recommendations and real-time trade alerts, join the Insider service at capexinsider.com.

Our premium members get access to our proprietary research, risk management strategies, and a community of like-minded investors.

Don’t miss the next bull run.

Subscribe to the Insider Newsletter at substack.capitalistexploits.at/subscribe or unlock the full Insider experience at capexinsider.com.

Your portfolio deserves an edge…let us help you find it.

Appreciate your thoughts here. There are so many poster child opportunities available if you wish to make a point regarding risk. My personal favorite is TSLA. A company that’s worth $1.5 trillion yet currently just breaking even. It’s been public for 15 years. 24/7/365 hype via its CEO, legions of knucklehead influencers and millions who want to “believe”. Sustainable Abundance per Master Plan 4? Good grief. What does that even mean? Meanwhile the Chairman of the Board has done nothing other than sell her stock upon exercising options. Hmmm…..Maybe I’m just a curmudgeon who’s wrong. Robotaxi and humanoid bots will print trillions of profits.

Berkshire Hathaway also worth a bit more than $1 trillion. As of 6/30/25 it was sitting on $340 billion in cash. That’s almost 1/3 of its market cap, yet it has retired zero of its own shares in the last 12 months, while taking no major positions in any other publicly traded stocks. (FYI….I’ve owned it for almost 26 years)

Private equity a ticking time bomb? My inclination is yes. WMT (another company I’ve owned for 20 years) trading at approximately 40 p/e. What? How fast can it grow to justify that? The list just goes on and on…..and on.

Another tidbit….I reference MSCI ACWI facts to people quite often. Generally it leads to nothing more than a shoulder shrug from listeners (probably more like non-listeners).