From Safety to Suicide Pact

The “safe” mutual funds and ETFs in your retirement account might be your biggest risk. Want to see why?

Look, we’re not here to sugarcoat things or spin a yarn for the sake of drama.

The financial markets are sitting on a knife’s edge, and if you’re not paying attention, you’re going to get cut.

We’ve been banging on about this for a while, and it might sound like a broken record to some, but the risks are real, and they’re not going away.

Two areas are flashing red: sovereign debt & the concentration of capital in equities, particularly in the U.S. with the so-called Magnificent Seven, Nvidia chief among them.

Most investors don’t even realize what they’re holding…pension funds, mutual funds, ETFs, all stuffed to the gills with these ticking time bombs.

The old playbook of balancing stocks and bonds? It’s not working anymore.

Let’s unpack why, and more importantly, how to position yourself so you’re not the one left holding the bag when it all goes pear-shaped.

Sovereign Debt: The Creaking Foundation

Sovereign debt markets are in trouble. You don’t need to be a rocket scientist to see it…just look at bond yields.

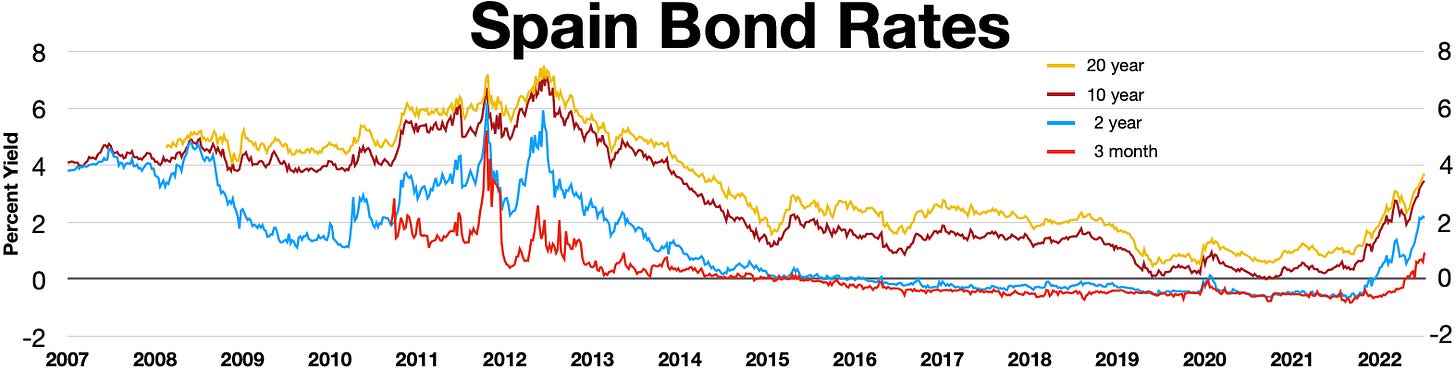

Take Spain’s 10-year yield, for instance.

As a function of time, it’s spiking, and while it’s not at the levels we saw during the PIIGS crisis, it’s a warning sign.

The “PIIGS crisis” refers to a period of severe economic hardship in the late 2000s and early 2010s, particularly during the European sovereign debt crisis, experienced by Portugal, Ireland, Italy, Greece, and Spain.

These nations faced high levels of government debt and financial instability, threatening the stability of the Eurozone and prompting interventions from the European Union and the International Monetary Fund (IMF).

The PIIGS moniker highlighted their shared economic struggles, including slow growth, high unemployment, and difficulty refinancing their debts.

That sudden move matters, not because Spain alone will topple the system, but because it’s part of a broader direction of travel. Yields across the board are heading higher, and they’ve been signaling this for years.

We said three, four years ago that bond yields were going up, and here we are. It’s not about predicting the exact day or the exact trigger; it’s about understanding the trend.

This isn’t just about government bonds. The pricing of debt is interconnected…sovereign yields push up corporate debt costs.

Companies refinancing in this environment get squeezed, and that hits everything from their expansion plans to their bottom line.

If you’re in mutual funds or a bunch of ETFs, chances are you’re exposed to this mess, whether you know it or not.

Your financial advisor might have sold you a “diversified” bond portfolio, but it’s likely loaded with this stuff.

The question isn’t whether Spain’s yield spike will cause a contagion like the 1997 Asian crisis…it’s whether you’re positioned to watch the chaos unfold without sweating bullets.

Equity Concentration: A House of Cards

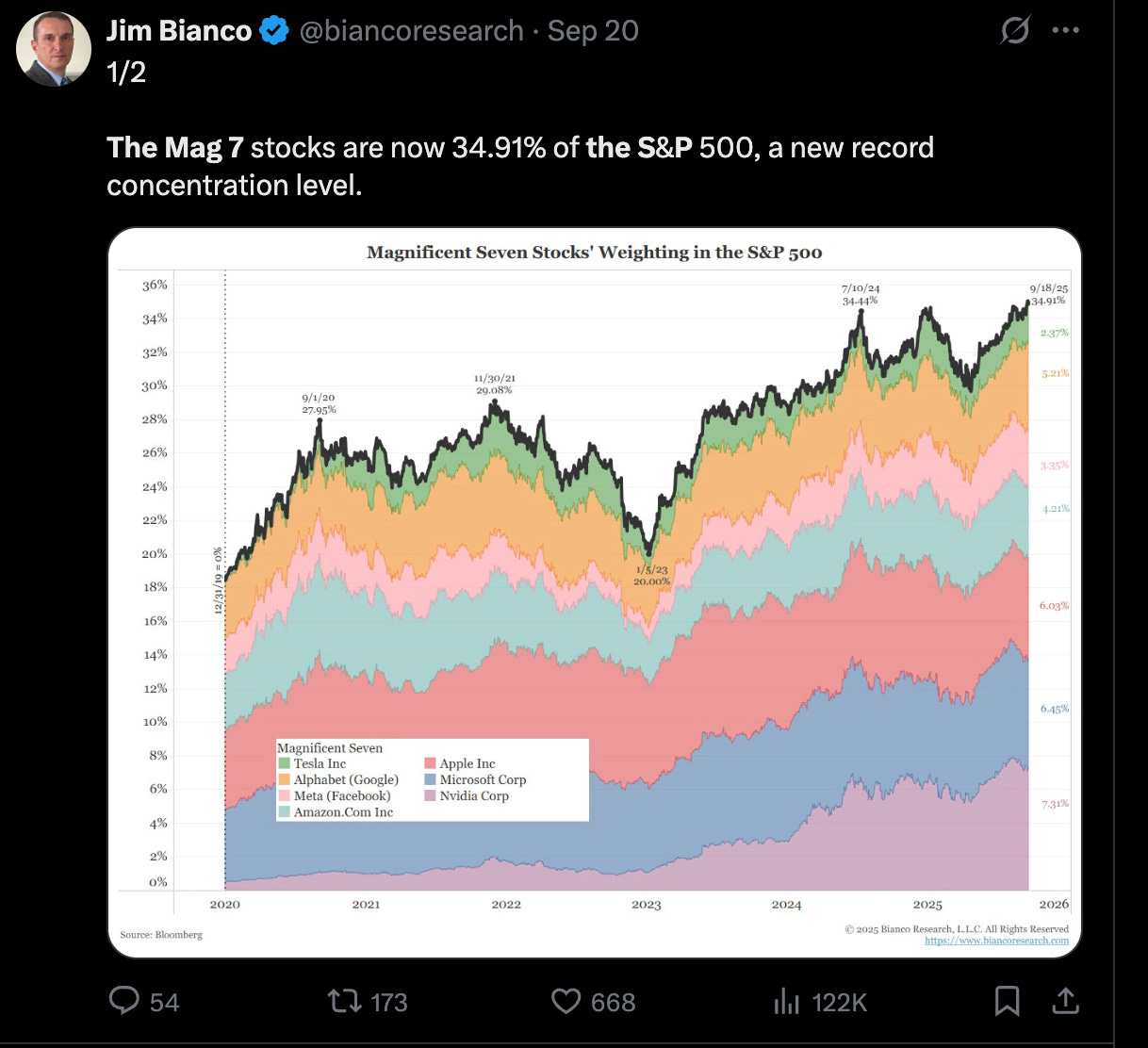

On the equity side, the picture’s just as grim. The U.S. market, particularly the S&P 500 and NASDAQ, is dangerously concentrated.

The Magnificent Seven…those big tech names…dominate, and Nvidia’s the poster child. It’s not just a stock…it’s practically the market’s heartbeat.

This wasn’t the case 15 or 20 years ago when indices were broader, more balanced.

Today, your S&P 500 ETF is less diversified than a Vegas casino’s blackjack table. If Nvidia stumbles, it’s not just a tech hiccup; it could drag the whole index down with it.

Most investors don’t see this coming.

They talk to their advisor, get funneled into some index fund, and think they’re safe because it’s “the market.”

But when a handful of stocks drive the bus, you’re not diversified…you’re dependent.

Pension funds, 401(k)s, they’re all in on this game. The risk isn’t just a market dip…it’s a structural flaw.

When the concentration unwinds, it’s going to hurt, and the average punter won’t know what hit them until it’s too late.

The Risk Parity Myth

Here’s where it gets really messy. The old risk parity trade…stocks for growth, bonds for safety…is broken.

The idea was simple: when equities tank, bonds rally, and vice versa.

It was a nice theory, but it’s not holding up.

Both your equity and bond allocations are now at risk of moving in the same direction…down. Why?

The structure of the market has changed.

Passive investing…those ETFs and index funds…has made everything more correlated. When panic hits, it’s not just stocks getting sold; bonds are getting dumped too.

This isn’t about some esoteric market theory. It’s about the reality of how portfolios are built today.

If you’re in a 60/40 stock-bond mix, you’re not hedged; you’re exposed.

The greatest risk isn’t in chasing the latest AI stock or crypto fad…it’s in the supposedly safe stuff you’ve been told to rely on.

The bond market’s direction of travel is clear, and it’s not your friend. The equity market’s concentration just adds fuel to the fire. So how do you avoid getting burned?

Invest in the same stocks we do:

The Fed’s Losing Grip

Let’s talk about the Federal Reserve. They’ve been holding the funds rate steady for a while, then started cutting in September 2024, with another snip in December.

Markets initially loved it…stocks popped, everyone cheered cheaper borrowing.

But the U.S. 10-year Treasury yield? It didn’t budge.

Normally, the 10-year leads, and the funds rate follows. Not this time. The yield stayed stubborn, climbing past 4% by late 2024, telling you the bond market’s calling the shots, not the Fed.

This is a big deal. The Fed issues debt, but the market decides who buys it and at what price. And the buyers are getting choosy.

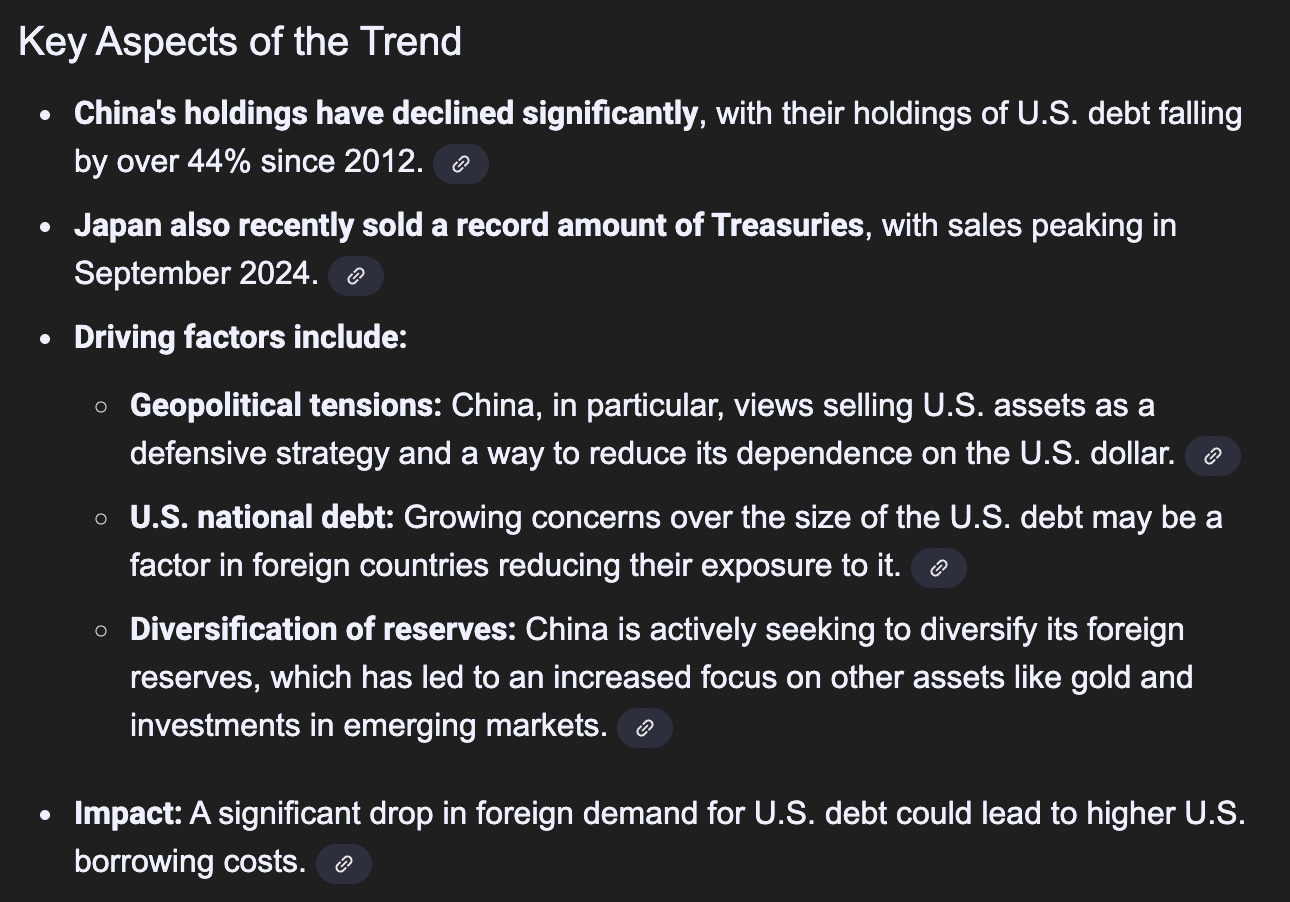

Foreign holders…think central banks, sovereign funds…are bailing.

China’s been offloading U.S. Treasuries for years, Japan too. The UK’s picking up some slack, but it’s not enough.

Why hold long-dated U.S. debt when geopolitical tensions are high and trust is low?

Nobody wants the 30-year…they’re sticking to short-term bills for liquidity. That’s a vote of no confidence in the long-term outlook.

The Treasury Exodus and Interest Costs

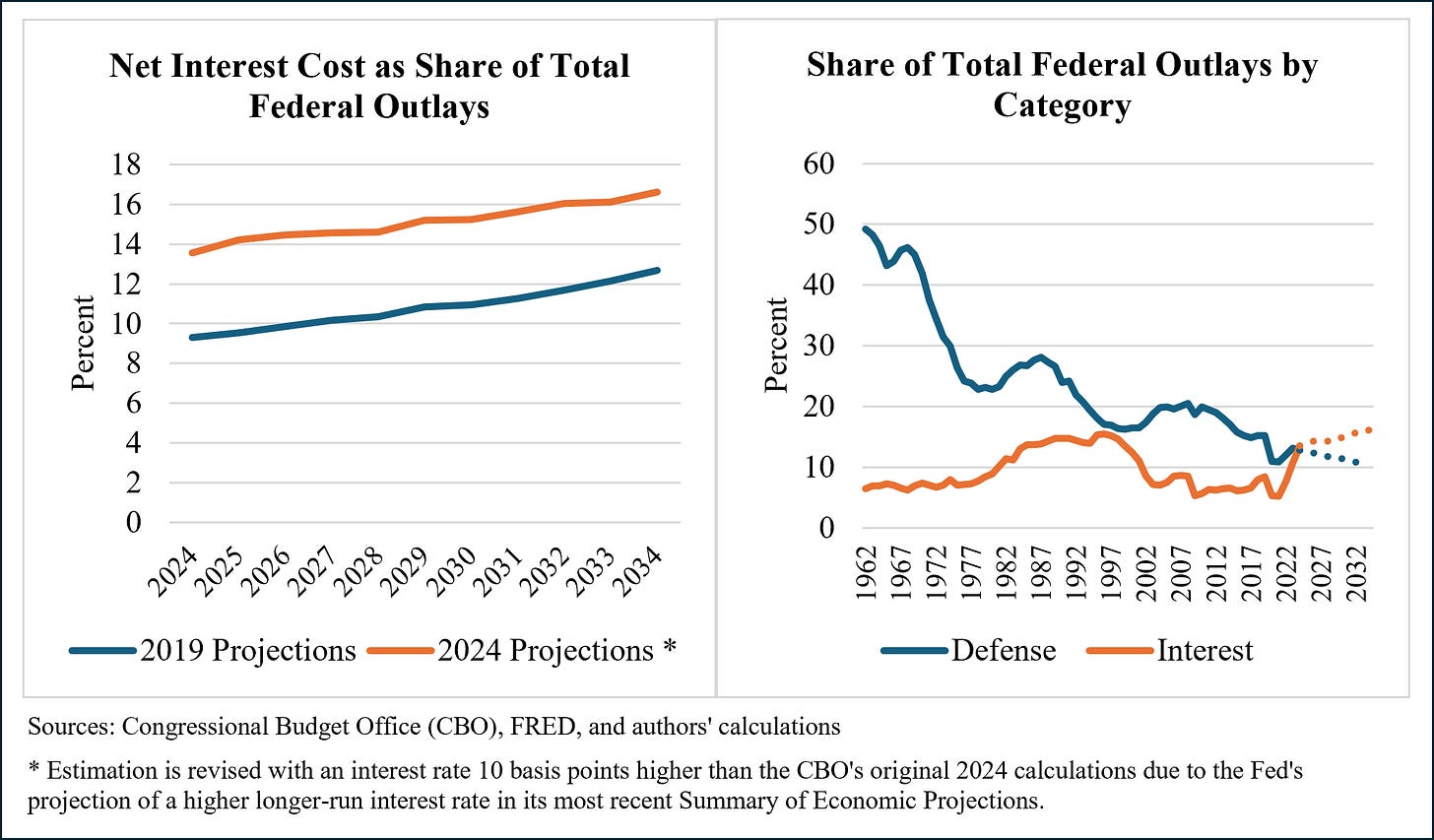

Look at the numbers. The U.S. government’s interest expense on its debt is neck-and-neck with defense spending.

If yields keep climbing…and we think they will, it’s not if but when…that interest bill could become the single biggest line item in the budget. That’s not sustainable.

It crowds out everything else: infrastructure, healthcare, you name it. The Treasury’s stuck issuing more debt at higher rates, and that’s a vicious cycle.

Foreign buyers exiting the market just makes it worse. China’s holdings are down significantly since 2022. Japan’s following suit.

The bond market’s not a charity…if buyers dry up, yields have to go higher to attract capital. And when they do, that interest expense balloons.

It’s not hard to see where this leads: a fiscal mess that’s harder to escape the longer it festers.

Signals in the Noise: Commodities Speak

Markets don’t lie…they signal. Right now, commodities are screaming. Gold’s been climbing, not because it’s shiny, but because it’s a hedge against fiat erosion.

Platinum and rhodium are moving too…precious metals are telling you something’s up.

Then there’s energy.

Everyone’s bearish on oil, coal, you name it.

But if oil ever breaks above $80 a barrel again, watch out. That’s inflationary rocket fuel, pushing yields higher and adding pressure to an already strained system.

These aren’t just assets to trade…they’re indicators of where the world’s headed.

Rising energy prices amplify inflation, which forces yields up. Gold and metals signal distrust in paper money.

If you’re not watching these, you’re missing the bigger picture. The question isn’t what’s happening today…it’s where the trend’s taking us tomorrow.

Can Growth Save the Day?

There’s talk about growing out of this mess, especially with recent political noise about abandoning fiscal restraint and betting big on growth.

Tariffs, tax cuts, infrastructure…it’s all-in on the idea that the U.S. can outrun its debt.

History’s not kind to this approach.

The UK pulled it off once in the late 1970s with North Sea oil, a stroke of luck that eased a balance-of-payments crisis when debt-to-GDP was around 45%.

The U.S. had its shale boom a decade ago, which helped, but that’s tapped out now.

Production’s flat at best, declining at worst.

There’s no magic wallet under the couch this time.

Growing out of a debt crisis is like trying to outrun a tsunami. It’s possible in theory, but the odds aren’t in your favor.

The U.S. is banking on a miracle…some new shale-like windfall…but miracles are rare.

Probability says this ends in pain: higher taxes, inflation, or worse.

Positioning for the Inevitable

So, what do you do? First, understand what you own.

If you’re in mutual funds or ETFs, you’re likely exposed to sovereign debt and concentrated equities.

Peel back the layers…check those holdings.

The S&P 500 isn’t the safe bet it was 20 years ago. Bonds aren’t your hedge anymore.

Step one is getting out of the risk zone.

Next, focus on the long-term trends. Yields are going up…that’s not a guess, it’s a fact.

Commodities like gold, platinum, and energy are signaling inflation and distrust. These aren’t short-term trades…they’re ways to protect your wealth.

If oil spikes, it’s not just a headline…it’s a portfolio killer unless you’re positioned right.

Look at uncorrelated assets, things that don’t move with the S&P or Treasuries. That’s where you find safety.

Finally, stay indifferent. Don’t get sucked into the daily noise…Spain’s yields, some Fed governor’s speech.

Watch the direction of travel, not the potholes.

If you’re positioned outside the blast radius, you can watch the chaos unfold without losing sleep. The market’s telling you what’s coming. Listen, position accordingly, and don’t be the one left holding the bag.

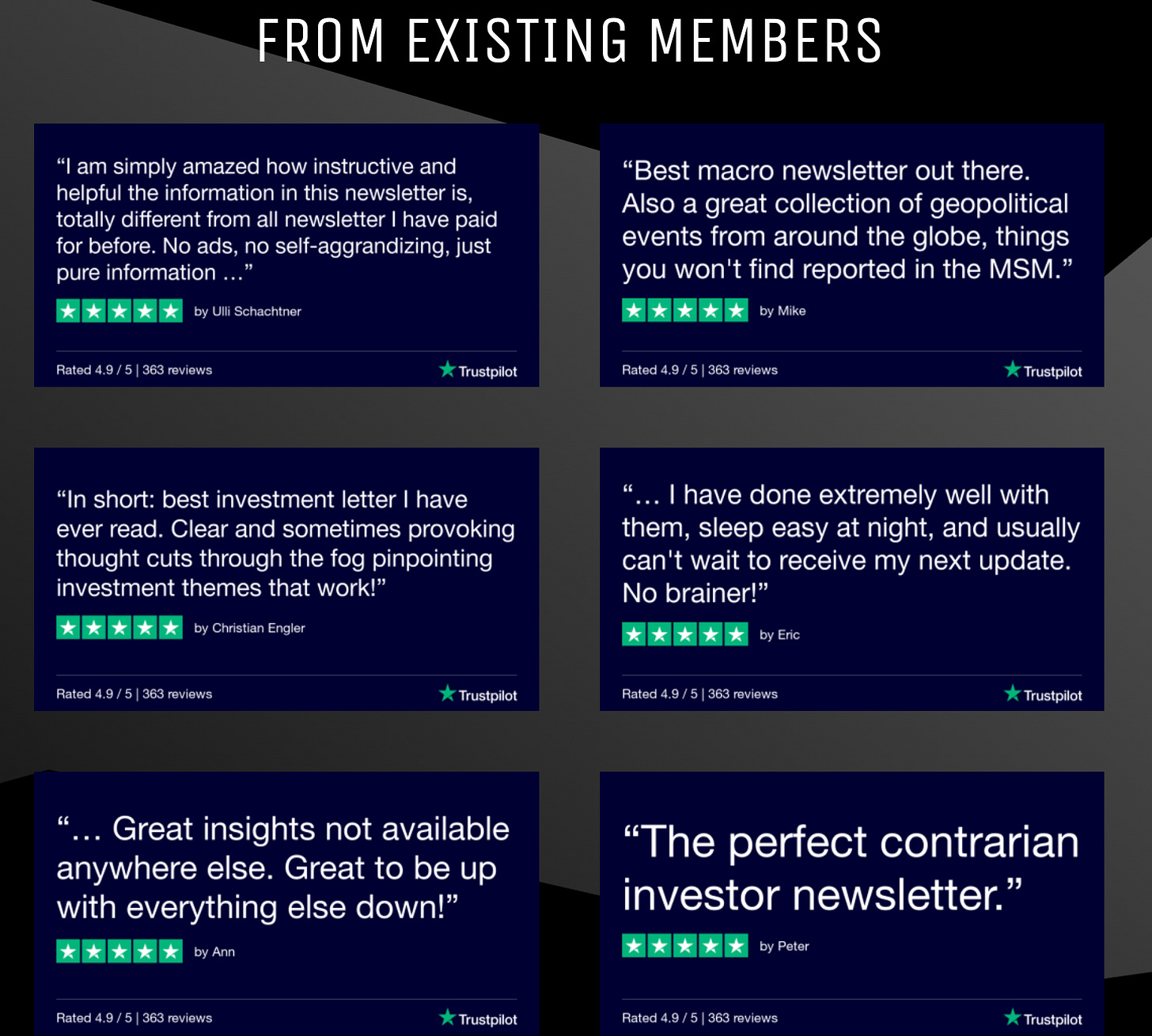

Not a subscriber to the Insider Newsletter? See what subscribers are saying:

Perhaps nothing stops this train :)

In Europe, your pension fund buys this junk for you. You have no say. Only the ratio between bonds & equities are adjustable.

Personally, I've not bought US since 2021. There's a real challenge of where one is allowed to put their money brewing for EU. Thanks for the Norway suggesties. Looking at CH.