Betting on the Inevitable

The cheat codes are taped to the wall, but most investors are too distracted to see them. What if the chaos isn’t random… but right on schedule?

“If you understand the situation you’re in from a historical perspective, then those things can be put into context such that you don’t get emotional about them.” – Yours truly

Every so often, investors forget they’re playing a game with the cheat codes taped to the wall.

Not because they’re dumb. But because they’re distracted.

They chase headlines. React to tweets. Fumble over Fed policy tea leaves.

All while the real signals…those embedded in centuries of cyclical history…flash like neon, screaming for attention.

We don’t make emotional decisions. We make cyclical ones.

And when you learn to read the cycles…war, monetary, revolutionary…you see today’s chaos for what it is:

Predictable. Inevitable. And, importantly… profitable.

The Pattern is the Point

You want to understand what's coming?

Step back. Way back.

Zoom out to generational timelines. To macro cycles shaped by debt blowouts, political friction, and resource scarcity. That’s where the real story lives. Everything else is noise.

The Middle East isn’t “heating up”…it’s right on time.

The Fed isn’t “pivoting”…it’s trapped.

Trade wars, energy bottlenecks, deglobalization…these aren’t black swans. They’re the result of overlapping, well-documented historical patterns. We’ve seen them all before. We’ll see them again.

And every one of these cycles sets the stage for massive capital misallocation.

Which means, if you’re not following the crowd, you’re likely standing on the winning side of the trade.

But what does that actually look like?

Own What’s Hated. Sell What’s Loved.

Here’s the thing most investors never grasp:

The best time to buy an asset is when nobody else wants it. When it’s hated, ignored, and starved of capital.

Right now, that includes commodities, gold, and emerging markets.

We don’t touch tech, AI, or whatever the hell CNBC is pumping this week. You want to know where money goes to die? Follow the trend-chasers.

Instead, we go where capital isn’t.

Global capital investment in commodities is below 1%. Emerging markets? Just above 2%. And yet the demand side remains unchanged. Which means supply will eventually get bid up.

It always does.

The market doesn’t reward comfort. It punishes it. If you want returns that matter, you need to hold your nose and buy what nobody else will touch. And right now, that means sectors that feel radioactive… until they don’t.

Because when the macro breaks, energy writes the rules.

When the World Breaks, Energy Leads the Way

Let me ask you something:

When has there ever been a geopolitical conflict that didn’t involve energy?

The answer is never.

Pipelines, ports, CapEx… these are the first casualties of war. They’re also the primary drivers of market dislocation.

Nord Stream, Strait of Hormuz, Iran and Israel… pick your poison. The specifics don’t matter. What matters is that the global energy system is being held together with baling wire and optimism.

Meanwhile, traditional energy infrastructure hasn’t seen real investment in two decades.

Everyone’s hoping U.S. shale can keep the party going. It can’t. The treadmill is broken. The decline rates are real.

This isn’t a matter of if the system breaks.

It’s a question of who gets paid when it does.

You can’t wage war or run economies without energy. And yet the global system has been cannibalizing itself for decades, pretending this reality doesn’t exist.

Well, the bill’s coming due…and the first to understand it get the first bite of the upside.

Let’s talk about how we build portfolios during times like these.

Portfolio Construction

We don’t chase headlines. We position for outcomes.

Our portfolio doesn’t change much, even when the world burns. That’s by design.

You see, we didn’t need Iran to go toe-to-toe with Israel. We didn’t need oil at $100. We didn’t even need a banking crisis.

We were already positioned for predictable structural outcomes:

Underinvestment in resource extraction.

Supply constraints baked into the cake.

Capital malinvestment across developed markets.

You can panic-trade the news cycle if that’s your game. We’ll sit here, long commodities, long energy, long patience.

We’re not forecasting. We’re tracking inevitabilities.

Forget pivot talk or yield curve gymnastics.

We’re not in this to predict headlines…we’re here to front-run structural shifts.

And that means portfolios built for endurance, not dopamine.

Because when your positions are grounded in inevitability, you don’t panic when the world burns.

Next, we crack open a few themes we’ve been buying while the rest of the market naps.

Where We’re Putting (some) Capital

Let’s talk brass tacks.

1. Commodity Producers

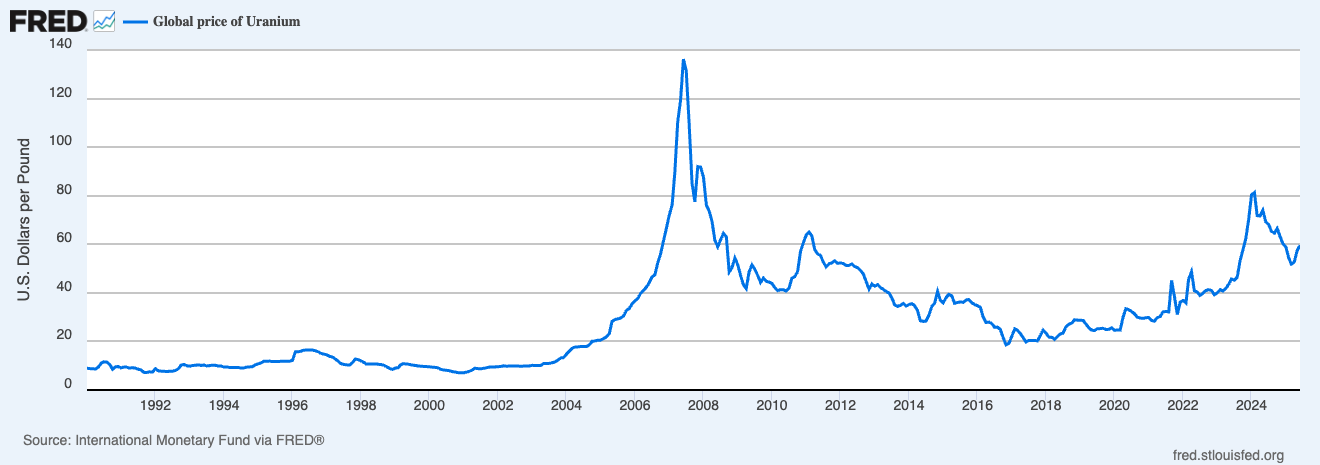

Commodities like uranium and platinum were left for dead, shunned as contrarian nightmares while the world chased tech and glamour stocks.

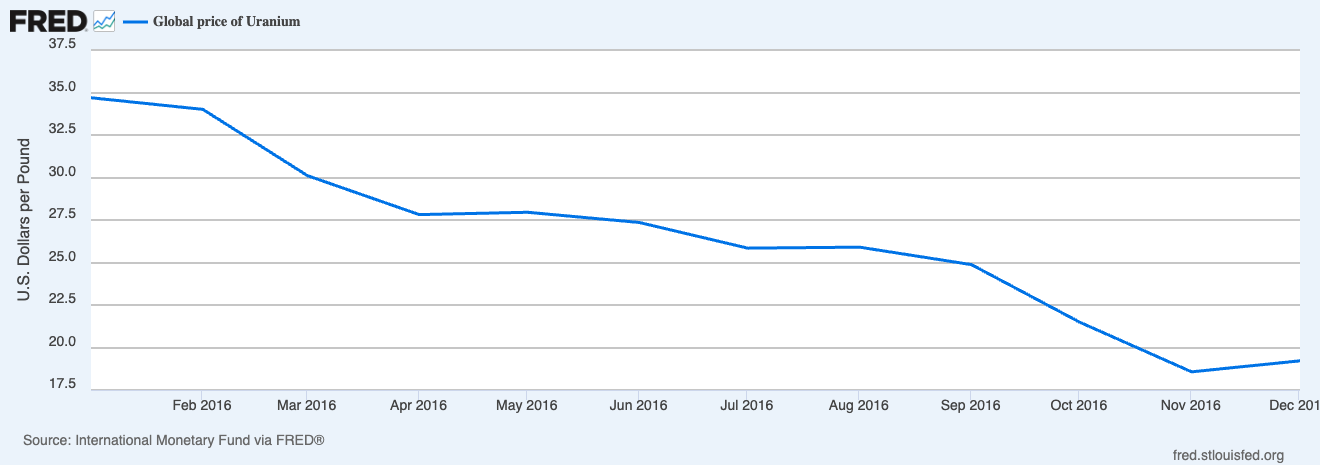

Picture uranium in 2016: a horror show, unloved, unwanted, with prices in the gutter.

Bets were placed when nobody else dared touch it, and yeah, there was blood…drawdowns stung.

But holding firm paid off, and now the gains are screaming. Platinum’s the same story.

Early bets got hammered, but supply’s now a trainwreck, demand’s creeping back, and prices are finally waking up.

This isn’t luck; it’s how commodity cycles work…every damn time.

The setup’s simple: capital flees commodities, with global investment scraping below 1%.

Mines are shuttered, CapEx is gutted, and nobody’s building new supply.

Meanwhile, demand doesn’t vanish…industry, energy, infrastructure all need these raw materials.

When the world realizes there’s nothing left in the cupboard, prices don’t just rise; they explode.

Take platinum: South African mines are on life support, and catalytic converter demand is rebounding as electric vehicle hype fizzles.

Or uranium: years of neglect flipped into a supply crunch that sent prices soaring.

Patience is the edge…individual investors can stomach the wait while institutions panic over quarterly reports.

Ignore the noise, the Fed’s yapping, the daily headlines.

Buy what’s cheap, hold through the pain, and when the cycle turns, the profits are obscene. Commodities aren’t sexy; they’re inevitable.

2. Gold & Precious Metals

Gold’s already on a tear at $3,300+, but the real story’s in the miners…still mispriced, still despised, still dirt cheap.

These companies are trading at a fraction of their true worth, with free cash flow multiples scraping historic lows.

The market’s asleep, ignoring the screaming asymmetry that builds real wealth.

If gold doubles…and in a debt-soaked, crisis-riddled world, that’s no stretch…miners won’t just double.

They could 5x, maybe 10x, as their fixed costs amplify every dollar of gold’s rise.

A miner scraping by with a $100 margin at $3,000 gold sees profits explode at $6,000.

While gold’s shining, miners are the ugly stepchild nobody wants, with gold mining ETFs like GDX at near all-time lows relative to the metal.

Capital’s fled, with precious metals drawing just 2% of global investment.

But crises…debt spirals, monetary chaos…love gold, and miners are the leveraged play.

The crowd’s in denial, pouring cash into overpriced growth stocks while inflation’s reality stares them down.

Patience is the edge here: individual investors can sit tight, ignoring the noise of Fed banter or daily price wiggles, and wait for the inevitable.

When the world wakes up to gold’s rally and miners’ profitability, the gains will be obscene.

Buy what’s hated, hold fast, and let the cycle deliver the kind of wealth that makes trend-chasers weep.

3. Emerging Markets

Emerging markets have been ignored so long they’re practically invisible, scraping by with less than 1% of global capital while tech and blue-chip darlings hog the spotlight.

But capital doesn’t stay put forever. It rotates. Always has, always will.

When it does, emerging markets are set to go vertical…not because they’re trendy, but because they’re the last outpost of value in a world stuffed with overpriced assets.

It’s simple math: markets cycle, people forget, and underfunded sectors get starved until the pendulum swings back.

With investment in emerging markets at rock-bottom levels, the setup screams opportunity.

Think obscure plays like an Israeli cigarette distributor with a 25% dividend yield or Chinese oil service stocks no one’s talking about…not sexy, just dirt-cheap.

The bet is on inevitability: supply-demand imbalances and geopolitical shifts will force capital to flood back, lighting up markets neglected for over a decade.

Patience is the secret weapon here…individual investors can hold steady while institutions sweat quarterly numbers.

When the crowd finally wakes up, the upside will be massive, not because emerging markets are “hot,” but because they’re the only place left where capital can find real value.

Skip the hype, buy what’s hated, and wait for the world to catch up.

4. Oil & Energy Services

Oil prices…languishing at $65 a barrel…are a sideshow.

The real story is brutal: nobody’s investing in supply.

For nearly two decades, capital has fled oil and energy services, chasing tech and other overhyped fads, leaving the sector starved.

Global commodity investment is scraping by at under 1%, and the world’s been leaning hard on U.S. shale to keep the lights on.

That’s a house of cards.

When demand shocks hit…China’s economy revving up, Middle East conflicts erupting, or chokepoints like the Strait of Hormuz clamping shut…prices will rocket.

It’s not if, it’s when.

The smart money’s already positioned in the names set to cash in, especially in emerging markets where the value is so cheap it’s almost criminal.

This isn’t about today’s price swings; it’s about a structural trainwreck.

Years of slashed CapEx mean no new wells, no new pipelines, no new refineries.

Supply can’t keep up, and any spark…geopolitical flare-ups or a resurgent China…will ignite a price surge.

Emerging market oil service stocks, like those in China, are ignored gems, trading at dirt-cheap valuations while the crowd obsesses over AI and tech giants.

Energy security is king in a world of chaos; history shows infrastructure gets targeted in conflicts because it’s the economic jugular.

Patience is the edge here…individual investors can wait out the cycle while institutions sweat short-term metrics.

Ignore the daily noise…Fed chatter, price dips…and bet on the inevitable: supply’s tight, demand’s coming, and those long in oil and energy services will clean up when the world wakes up.

The Only Edge That Matters: Patience

Commodities take time.

You don’t get rich chasing pops. You get rich holding unpopular truths through painful drawdowns.

That means living through 40% declines. Seeing red on your screen for months. Sometimes years.

Most people can’t do it.

But that’s where the edge is.

Because when sentiment shifts…and it always does…it happens fast, violently, and without warning.

And if you’re not already positioned… you miss it.

Patience isn’t just a virtue. It’s a weapon.

Ignore the Noise. Follow the Money.

Let’s be clear.

None of this has anything to do with Jerome Powell. Or the next rate cut. Or whatever economic fiction Washington wants you to believe this week.

The U.S. deficit is $37 trillion. No amount of cost-cutting is going to fix that.

Lowering rates? Good luck. Inflation isn’t cooperating, and bond yields are already voting with their feet.

We don’t base decisions on fiscal soundbites.

We follow capital.

And capital always returns to the places with scarcity, asymmetry, and yield.

Right now? That’s not tech. It’s not ESG. It’s not “AI startups on the blockchain.”

It’s dirt. Rocks. Molecules. Mines. Stuff you can touch.

You Know What Happens Next

You already know how this plays out.

We’ve been here before.

Cycles turn. Capital rotates. And those who front-run the obvious get paid.

Our job isn’t to predict the future. It’s to identify where we are in the cycle and act accordingly.

Right now, we’re in the early innings of a massive capital rotation…from overvalued dreams to underpriced reality.

The time to move was yesterday. The second-best time is now.

Get positioned. Sit tight. And don’t blink.

Because once the sentiment shifts, the door will close fast.

Want to know what happens next?

Stick around. The real show is just getting started.

This sounds like AI wrote this. Bring back the true words of Chris Macintosh. Keep it raw, keep it rough.

I have funds in a 401k that are commodity and energy focused but yet snuck NVDA into the top 10 holdings.