Will Germany Be the Country That Ends the EU?

And What That Means for Investors

It would be almost ironic.

Germany, the economic engine of Europe, might now be the one pulling the plug on the European Union experiment.

The latest draft platform from Germany’s AfD (Alternative for Germany) party isn’t mincing words:

A national currency over the euro

An end to EU-imposed economic sanctions on Russia

Recommissioning Nord Stream pipelines

Tighter abortion laws

Leaving the European Union altogether

In essence, the AfD is calling for a full-scale deglobalization of Germany. If implemented, this would be the biggest political and economic shift in Europe since Brexit.

But here’s the thing… this isn't just another populist manifesto that gets dismissed.

The macro trends are decisively against the European Union, and if Germany actually moves in this direction, the consequences could be catastrophic for European markets.

Let’s break it down.

The EU’s "Planned Economy Super-State" is Failing

The AfD’s platform describes the European Union as a "planned economy super-state"—and they’re not wrong.

Over the past decade, the EU has increasingly centralized economic control, forcing weaker economies like Italy, Greece, and Spain to comply with one-size-fits-all fiscal policies. This has led to:

Anemic growth

Inflationary spirals

Rising discontent across member states

The EU’s Economic Decline in Numbers

The European economy is in worse shape than most people realize:

Germany’s GDP growth has stagnated—It grew only 0.2% in 2023, the worst performance among G7 nations (source).

Eurozone inflation remains high—Despite ECB rate hikes, inflation has stayed elevated, crushing household savings (source).

Debt-to-GDP ratios are unsustainable—Italy’s debt-to-GDP is over 140%, making future bailouts inevitable (source).

The EU’s reliance on bailouts, massive deficit spending, and strict regulatory policies is turning it into a bureaucratic economic dead zone.

And that’s before we even get to the energy crisis…

Germany’s Energy Pivot: Recommissioning Nord Stream?

The proposal to recommission the Nord Stream pipelines is another direct challenge to EU leadership.

Ever since the “mysterious” explosion that took out Nord Stream 1 & 2, Germany has been forced to buy higher-priced LNG from the U.S.—crippling its once-mighty industrial sector.

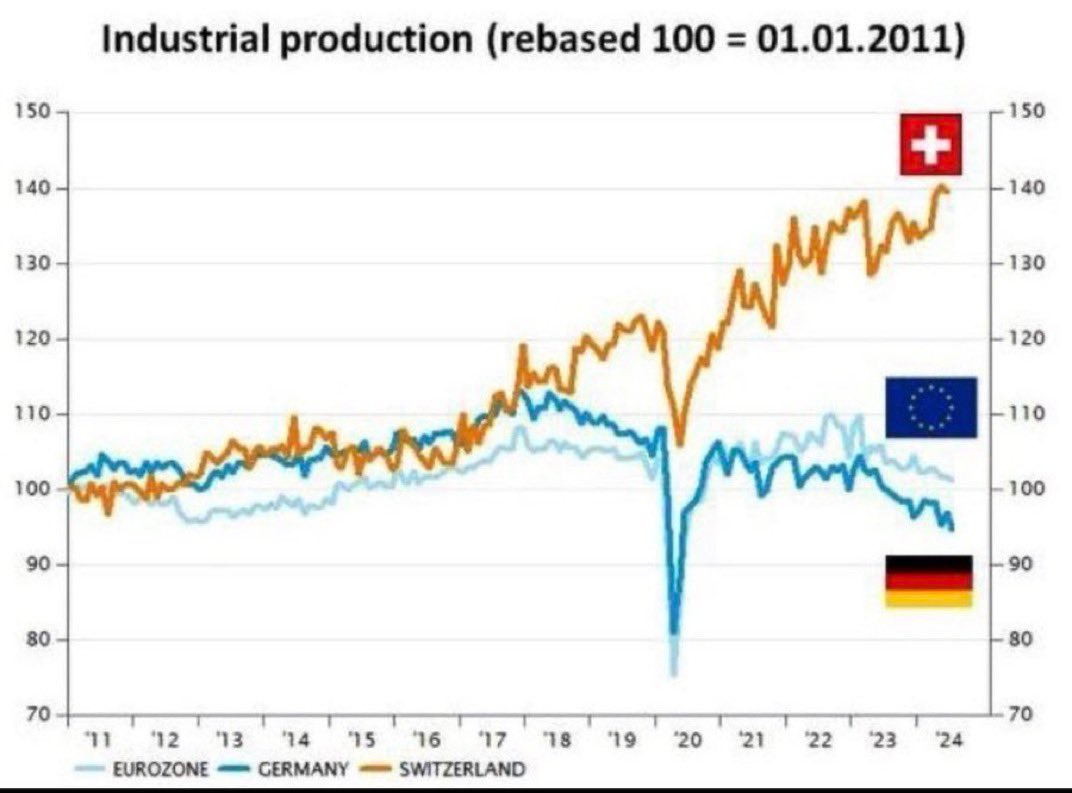

Germany is now deindustrializing at an alarming pace:

BASF, the world’s largest chemical company, is shutting down key production lines in Germany and shifting operations to China (source).

Volkswagen and BMW are outsourcing production to the U.S. and Asia due to high energy costs (source).

Germany’s steel industry is collapsing, with companies like Thyssenkrupp on the brink of insolvency (source).

The AfD’s stance is clear: restore cheap Russian gas and prioritize Germany over Brussels.

But there’s a problem—Washington won’t allow it.

Germany’s exit from EU energy policy would directly undermine U.S. energy dominance over Europe, which is precisely why this move, if pursued, will likely trigger massive economic and political retaliation.

Historical Parallels: Is This the Next “Brexit” or Something Bigger?

The last time a major country voted to exit the European Union, it was the UK in 2016.

That event, known as Brexit, sent shockwaves through global markets.

The British pound plummeted to its lowest level in decades.

Investors fled UK assets, expecting economic collapse.

The EU retaliated by making Brexit as painful as possible for Britain.

Yet, despite the doom-and-gloom predictions, the UK has outperformed the EU on key economic metrics since leaving:

✅ UK GDP growth has been stronger than the EU average (source).

✅ UK inflation has been lower than in the eurozone (source).

✅ UK labor markets have been more flexible post-Brexit (source).

If Germany chooses to leave, the impact would far exceed Brexit.

Investment Implications: The EU is Uninvestable

Quite honestly, it’s impossible to justify holding any European assets at this point.

1. The EU is on the Verge of a Banking Crisis

If Germany pursues an exit strategy, expect:

Massive capital flight—Investors will dump EU financial assets.

A euro collapse—Germany is the main backer of the currency.

European bank stocks to crater—Especially Deutsche Bank, BNP Paribas, and Santander (source).

Final Takeaway: The EU’s Days May Be Numbered

Germany isn’t the first country to threaten an EU exit, but it’s the first with enough economic weight to make it a reality.

If this movement gains momentum, expect the following:

A severe decline in the euro—potential parity with the dollar or worse.

Massive outflows from European stocks and bonds.

Potential contagion to U.S. markets—especially for multinational banks.

How to Position for This?

👉 Avoid European exposure—especially banks and industrial stocks.

👉 Consider alternative energy plays—Germany will turn back to coal and nuclear.

👉 Watch gold and Bitcoin—if trust in fiat collapses, hard assets will surge.

The biggest question now isn’t whether this could happen—but how soon?

If history is any guide, the EU’s days may be numbered.

😉 Subscribe to our Insider Newsletter for deeper insights and top asymmetric opportunities!

Disclaimer: This is not investing advice! Do your own due diligence and consult a financial professional before making any kind of investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.