Why the Next Resource Bull Market Could Catch Everyone Off Guard

These stocks have been brutalized for over a decade...but are we finally seeing a bottom? One chart hints at a breakout that could surprise us all…

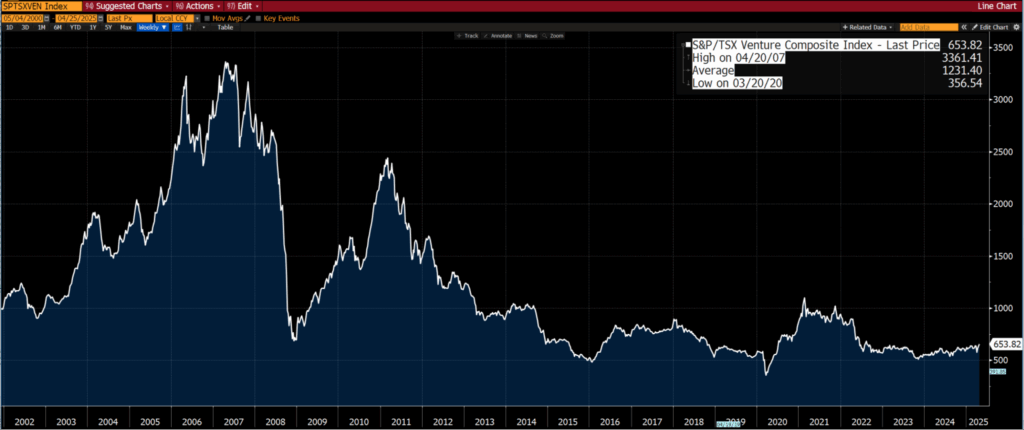

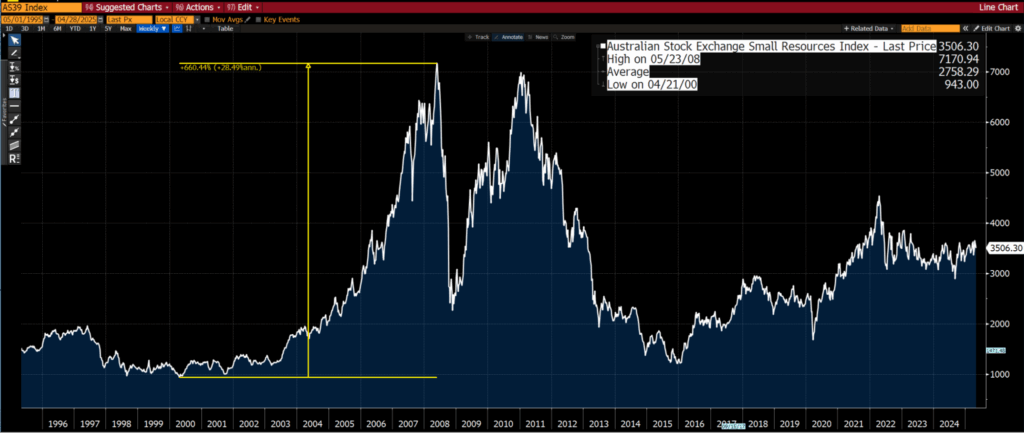

There are a couple of indices that folks should pay close attention to, namely the Canadian Venture Capital Index and the Australian Small Cap Resources Index. Why small cap indices?

Because they tend to be a lot less noisy than their large cap indices, and when you are looking at a chart, noise is your biggest enemy.

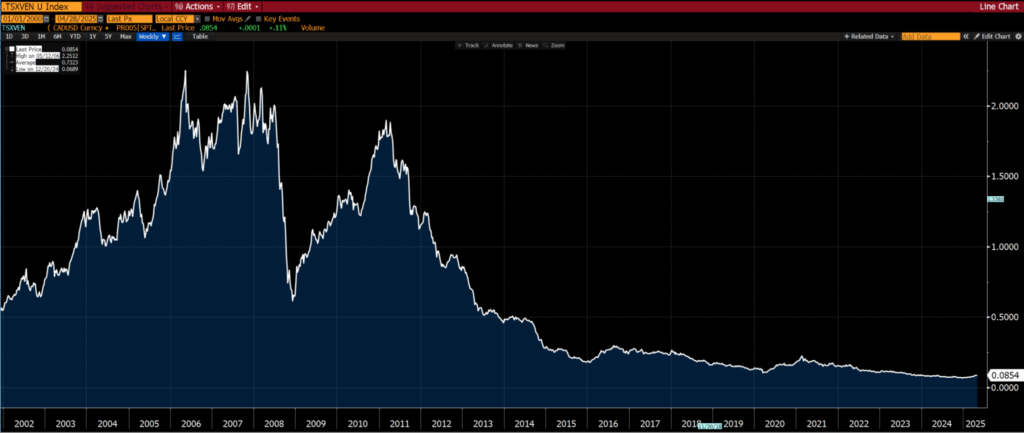

One can approach looking at charts from an absolute perspective (on their own) or relative to something else, say the S&P 500. We find that trends are more clearly depicted in relative charts.

From an absolute perspective, the TSX Venture Capital and ASX Small Resources indices look “ragged,” with no clear start of a bull market, although the behavior since the start of the year is encouraging.

True bull markets in resource stocks are “enlightening.” They tend to surprise everyone in terms of magnitude. Just look at the move in the ASX Small Resources Index from 2000 to 2008 — almost 700%.

From a relative perspective, it is hard to argue that a bull market has started. Yes, the uptick since the start of the year is encouraging, but it is still merely an uptick.

However, we have had a bear market since the start of 2011… and a brutal one at that. Small cap resource stocks (in fact, resource/energy stocks in general) have dramatically underperformed the S&P 500.

The chart above says it all — as unloved (out of favour) as they were at the height of the TMT bubble.

Perhaps, as of January this year, we have seen the bottom. Perhaps not quite yet. But one thing is for sure — the next big move will be to the upside, and the duration and magnitude of that move will surprise even ourselves.

Now you may better appreciate why we have been searching for bargains in the resources/energy sectors, particularly of the small cap variety. We need to maintain our steadfast patience, which isn’t easy.

I spend much of my time researching the Canadian Venture Capital Index. This is my lot in life. For my sins when I look at regular Canadian equities I think to myself, "yes please, but I do love a bargain. Do you by chance have something smaller and shadier?"

Given the prolonged bear since 2011, it does feel like we’re at a pivotal moment, but patience will be key. Curious—what signs or catalysts are you watching most closely that might confirm this bottom and signal the next major upswing?