When to Cash Out?

Under what specific conditions would Capitalist Exploits shift strategy and take significant cash off the table?

Here’s a question we received for our latest monthly webinar:

WHEN TO CASH OUT?

Several hedge fund managers…including Kuppy, Ray Dalio, Ken Griffin, Bill Ackman…have warned that the global economy is on shaky ground, with some pulling double-digit percentages of AUM into cash.

CapEx’s ethos is to stay the course with a 5–10 year view, riding out short recessions to capture long-term upswings. Under what specific conditions would CapEx shift strategy and take significant cash off the table?

This was a very good question and one that we get often, albeit different variants of it.

We did answer it during the webinar in a general sense, but let us get a little more specific.

Look at your portfolio and ask yourself: Are there any stocks that you objectively feel are too expensive. If so, sell. If not, hold. It is as simple as that.

But how do you objectively know when a stock is too expensive…especially when your lizard brain is screaming at you to do something when you should probably do nothing?

Let’s cut through the noise and break it down.

1. It’s Not About Price — It’s About Value

Just because a stock has run up doesn’t make it expensive. But if it’s trading on 30x earnings, priced for perfection, and the crowd has already piled in… chances are you’re the greater fool.

Ask yourself: Would I buy this today? At this price? With this risk?

If the answer is no, that’s your sell signal.

2. Asymmetry Is Gone? So Are You.

This entire strategy hinges on asymmetry: huge upside, little downside. If the upside has already played out…or worse, the risk of loss now outweighs the reward…you’re no longer holding an asymmetric bet. You’re just gambling.

And we don’t gamble. We position ourselves to get lucky… and we don’t overpay to sit at the table.

3. The Setup Matters More Than the Chart

What I mean by setup is that the big money is made by getting the macro, sectoral, and capital flow conditions right first…not by obsessing over technical charts or stock price movements.

If you’re holding a stock that’s already been bid up 600%, ask yourself: Where does it go from here?

Now compare that to something like an offshore oil driller, priced for bankruptcy, paying dividends, and sitting on a multi-year backlog with no capacity to expand.

Which one is truly expensive?

This isn’t about momentum. It’s about where capital is going to flow next.

4. Detach From Your Emotional Baggage

If you feel like a genius because the stock’s doubled…and you’ve started checking the price five times a day…it’s probably time to check valuations and consider a rebalance if warranted.

But first, take a deep breath, hold, release, then zoom out (literally, zoom out and look at a historical chart).

Imagine you didn’t own it. Would you still buy it? If not, you know what to do.

Expensive stocks are like overripe fruit…maybe they still look good, but leave them hanging too long and you’ll regret it.

If it’s no longer cheap, unloved, and dripping with asymmetry… sell it, walk away, and go sniff out the next opportunity the crowd hasn’t caught onto yet.

Because the big money isn’t made by riding trends. It’s made by buying what everyone else hates… and waiting.

We say “simple” because when you hear of well-known fund managers putting the “fear of the almighty” up you, it ain’t so easy to hold the line.

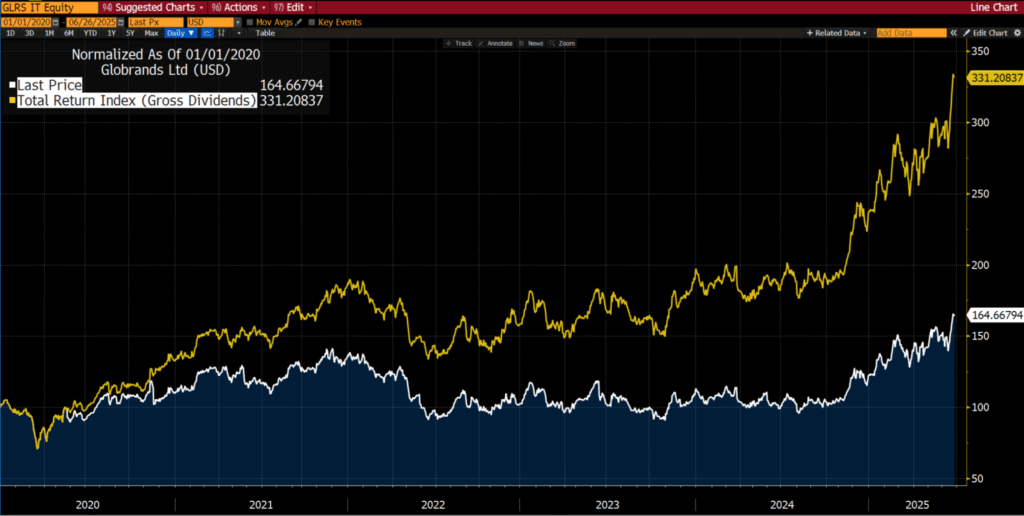

Here is a case in point: Globrands, an Israeli cigarette distributor. We have held it since we started the Dividend portfolio, and it has served us very, very well!

However, when we look at fundamentals here and now (8% dividend yield, 10x P/E, and little reason to believe that Israelis will quit the “horrid” habit), there is no reason to sell.

Well, at least there is one “upside” to the conflict…

Frankly, we can’t blame them. Some 20% of Israelis smoke.

There is simply no reason to NOT own this stock today, no matter what Dalio, Ackman, or Griffin say.

Of course, there is always a chance that a missile could hit a Globrands warehouse, sending all their cigarettes up in smoke. But that is why this company (as with all other stocks in our Dividend portfolio) only has a 1.5-3% weighting.

Risk, my friends, cannot be eliminated, but it can be managed.

So next time some headline hits your screen or someone on the interwebpipes yells and screams about the world ending, stop, breathe, and look critically at what you own, why you own it, and what your actual risk with each particular position ACTUALLY is.

Now, if you’ve built a portfolio of companies across sectors, many of which are unrelated to the others and dispersed geographically while all sporting deep value, then the real question to ask is: where else would you put your money?

Find out now by reading Insider #314.

Brilliantly coherent, as always.