When Capital Smells Freedom

I won’t spend too much ink on it, but Argentina is going to be an amazing investment for the next at least five years. It is hard to describe just how big this opportunity is going to be. Be long.

Argentina Tax System Overhauled

Argentina just passed Milei’s “Principle of Fiscal Innocence Law,” reversing the traditional paradigm of the tax system, shifting from a presumption of guilt (taxpayers had to constantly justify assets and spending) to a presumption of innocence.

The tax authority ARCA will now have to prove serious irregularities, rather than automatically pursuing minor discrepancies.

The government presents it as a measure to reduce “tax harassment.” Tax harassment indeed.

I point this out because while this is taking place, there are many countries (that are considered to be better, more stable) that are moving in the complete opposite direction. Pretty much all of Europe. Certainly the UK. Definitely the US. Absolutely Canada and Australia. And you know what? In all instances, the pricing of most every asset is not reflecting the unfolding reality. As a smart investor, your role is to ignore the crowd who are always late and invest according to these unfolding trends.

Trends such as…

Tsunami Incoming?

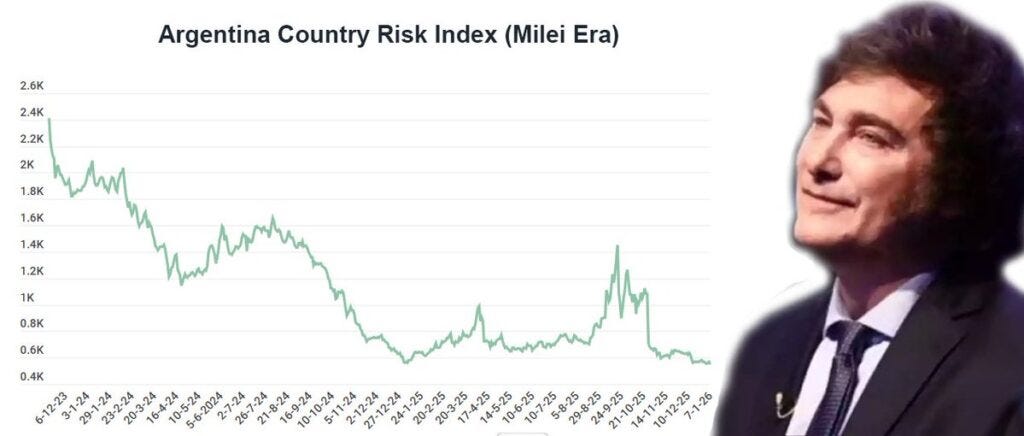

I mentioned this at our Mavericks event in Cayman last year. That when Argentina’s risk index drops sufficiently to be included in the emerging market status, there would be an immediate auto-execute bid for (by my calculations) at least $40 billion of capital.

Keep in mind that the entire market is still sub $100 billion… and this doesn’t include front-runners and many other participants. Here we are today with headlines such as the following:

ARGENTINA’s COUNTRY RISK PLUNGES TO 8-YEAR LOWS

In a significant boost to Argentina’s financial stability, the country’s risk index dropped to its lowest level since 2018, reaching 548 basis points.

The JP Morgan index fell 11 units to 554 basis points, reflecting renewed investor confidence.

Markets reacted positively: sovereign dollar bonds rose 0.3%, while Argentine ADRs on Wall Street climbed 1-2%.

Central Bank reserves hit a three-year high above US$ 44 billion, signaling reduced risks and stronger economic outlook.

And here is what will happen…

There simply aren’t enough assets in the listed pool to buy, and so what will happen is the capital will be forced to go hunting in private equity. This is where the real asymmetry lies. The wave of capital that will enter private equity will dwarf what we’ll see in listed equity.

Which brings me to…

Private Equity in Argentina (Three Funds, One Opportunity)

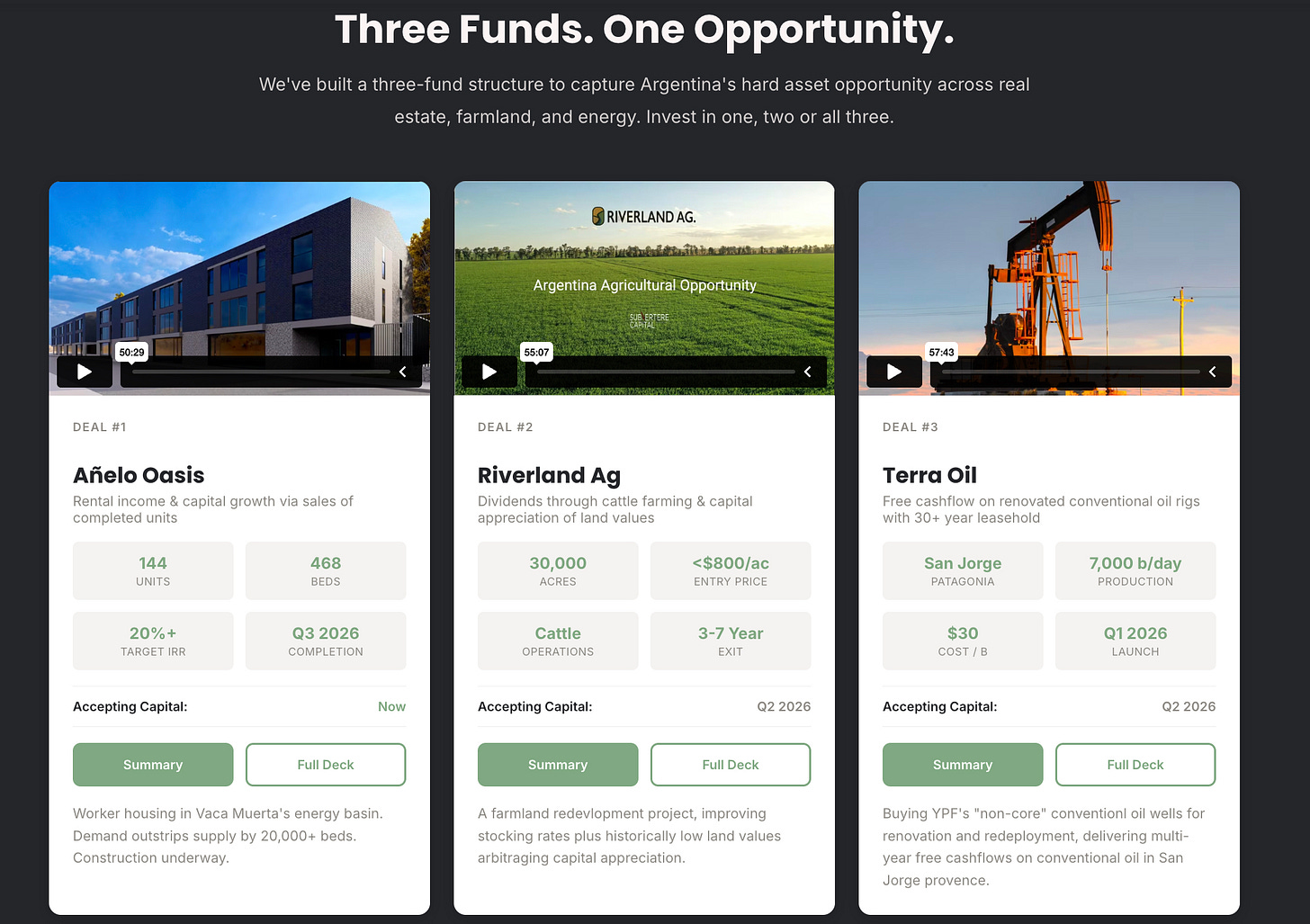

Digging into the private equity space in Argentina, we’ve built a three-fund structure to capture the country’s hard asset opportunity across real estate, farmland, and energy. Invest in one, two… or all three.

For those interested in what we’re doing down in the Southern cone, you can find out more here.

Milei seems more of a showman than a solid manager with a viable economic strategy. Argentina has what some might call a spotty record of consistent economic progress and stability. Not to say there could be some short term wins….