War Drums, Oil Shock, AI Meltdown: 2026 Is About to Get Loud

From Trump’s “Christian crusade” to OpenAI’s $207B hole...something big is breaking.

Hard to Keep Up

“Just because you don’t take an interest in politics, doesn’t mean politics won’t take an interest in you.” - Greek Statesman Pericles

So apparently Nigerians are killing Christians… and the Donald won’t have any of it.

But it’s okay because according to Lindsay “I’ve never seen a war I don’t love” Graham…

We’re killing all the right people.

This, on the back of the Donald looking to deal with that terrible “narco terrorist” Maduro.

It doesn’t take a genius to figure out that the Donald could care less about “narco terrorism” (after all, that would mean eradicating the CIA). And he certainly doesn’t give a flying monkey’s ass about “Christians being killed.”

What he cares about is the very thing that is now the most unloved asset class on this ball of dirt: energy…in particular, oil.

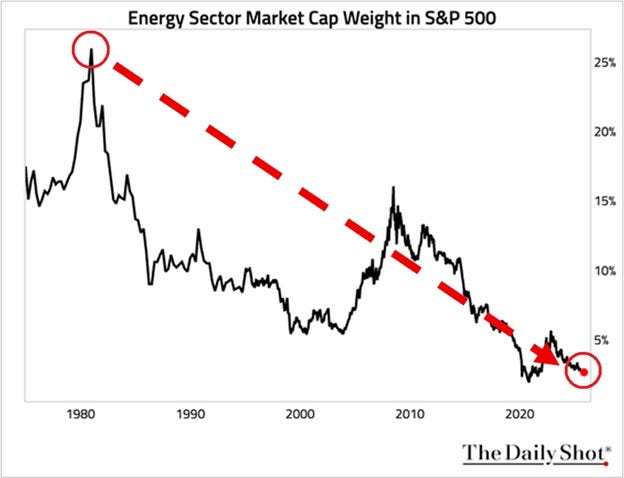

Odd then that the markets don’t seem to care. The US energy sector has been left in the dust.

The energy sector now represents just 2.6% of the S&P 500, near an all-time low.

Since the 2008 Financial Crisis, its weight has fallen 13 percentage points. By comparison, the energy sector made up around 26% of the entire index, back in the early 1980s.

To put this into perspective, Nvidia, alone makes up around 8.5% of the S&P 500’s market value.

This means Nvidia is now three times larger than the 22 energy stocks included in the sector COMBINED.

Meanwhile…

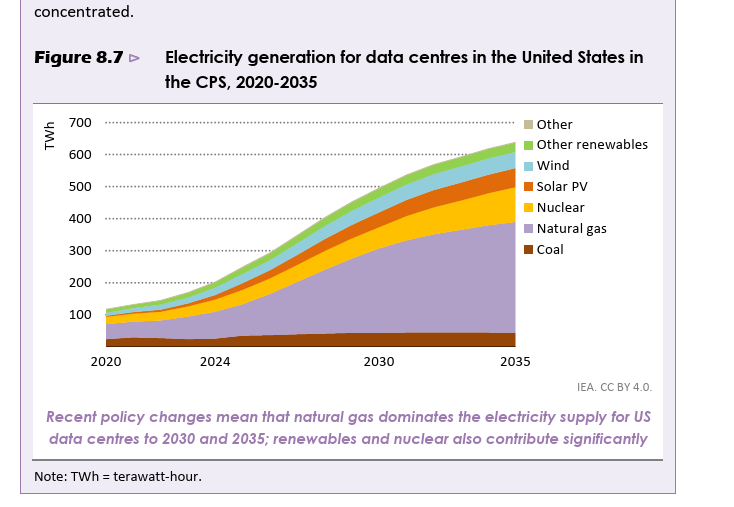

See that above? See the composition of energy? Yeah, so really the question is what are we missing?

Speaking of things that are missing…

How about the ability for OpenAI to actually pay for all the computational power it has already contracted.

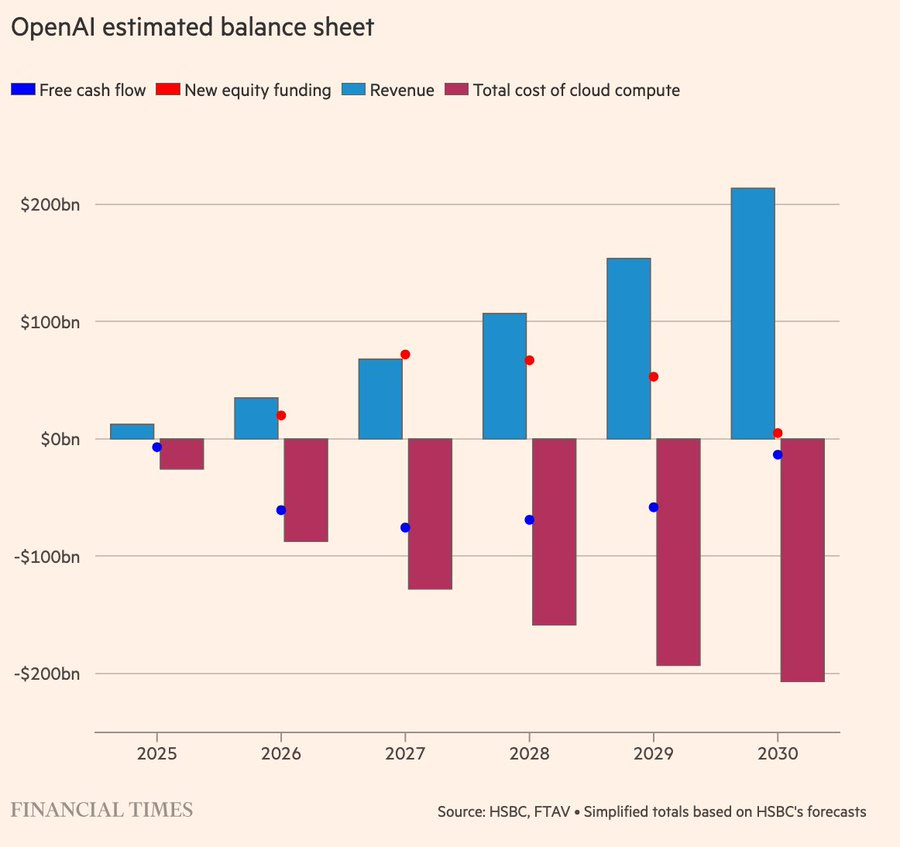

Well, as it turns out, HSBC built a model to figure out how this would happen. And the answer is…it can’t.

OpenAI has committed to $250 billion in cloud compute from Microsoft, and another $38 billion from Amazon.

All in, 36 gigawatts it has contracted to compute.

Based on the total deal value, which racks up to $1.8 trillion, HSBC estimates a heading for data center rental bills of about $620 billion a year, though only a third of that capacity comes online by 2030.

HSBC projects cumulative rental costs at $792 billion through 2030, rising to $1.4 trillion by 2033.

Against that, they estimate cumulative free cash flow of $282 billion, plus $26 billion from Nvidia’s cash injections and AMD share sales, $24 billion in undrawn debt facilities, and $17.5 billion in current liquidity.

Add it up and there’s a $207 billion funding hole, plus another $10 billion buffer HSBC thinks they’d need for safety.

HSBC assumes OpenAI reaches 3 billion users by 2030, which is 44% of the world’s adult population outside China. They assume 10% become paying customers, up from the current 5% now. They assume OpenAI captures 2% of digital advertising.

They assume enterprise AI generates $386 billion annually. Even with all those assumptions going right, OpenAI still can’t pay its bills. The best-case scenario HSBC can model still leaves a $207 billion hole.

Their suggested solution is that OpenAI might need to “walk away from data center commitments” and hope the big players show “flexibility” because “less capacity would always be better than a liquidity crisis.”

That’s a polite way of saying the business model doesn’t work and everyone involved might need to pretend the contracts don’t exist.

This is the company anchoring a $500 billion Stargate project and driving hundreds of billions in infrastructure spending across the industry.

Moreover, this is THE company holding the Nasdaq and S&P together.

Now you may better understand why we’ve bought downside protection on the Nasdaq… despite our having no investments in it.