Venezuelan Oil: Supply Coming?

The story goes: Venezuela equals cheap oil. The reality is far stranger—and far less comforting. What if the supply surge never comes?

Wow, 2026 is off to a spicy start. Civil war is brewing in the US as ICE agents run amok and Americans face the cold hard reality that their “rights” don’t mean “isht.”

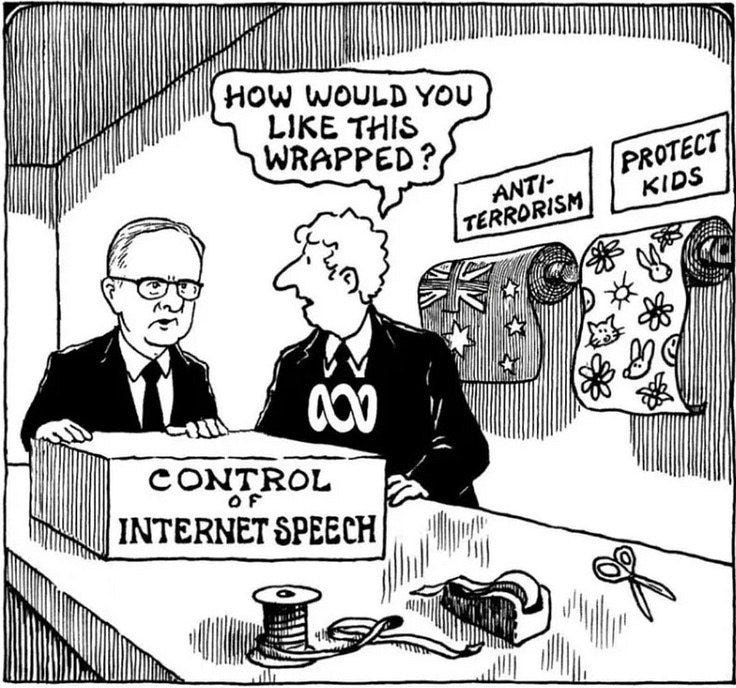

Trump’s support base is collapsing as MAGA increasingly realise they’ve been conned (again), and the deep state runs the show. International laws are being broken (again) as Maduro takes a vacation in the US, escorted in on a free US flight. On the other side of the planet, the Ozzies just took another step towards banning free speech.

And oh, how could I miss mentioning it… the head of the Fed is under investigation by none other than the Department of Justice.

My take is that this is just prepping for the new narrative, which will go something like this.

See, we actually can’t trust these individuals. But hey, we fortunately have our tech oligarchs who can help us as they’ve this system which is far superior. We call it __________, and, of course, it’ll be a digital currency. Jerome is simply a sacrificial lamb for something that’s been long agreed upon prior.

This is simply theatre for the peasants ahead of justifying why the absolute need for a blockchain currency system is the answer. Maybe I’m wrong, but I don’t think so. Let’s watch…

I’ll stop there and deal with the Venezuelan spectacle because many are concerned that there’s a gob load of oil that’ll hit the market and we’ll see a supply glut. After all, Chairman Trump said we’ll get $50 oil, so it must be true.

My friend Tracy Schuchart makes the point well:

Canada exports 4.3M bpd to the US. Venezuela’s entire production is 23% of what Canada already ships.

The rebuild timeline is a decade minimum, likely longer. Rice University’s Monaldi says at least 10 years and $100+ billion in investment to get back to 4 million bpd. PDVSA itself says $58 billion just for pipelines that haven’t been updated in 50 years. That’s before you drill a single new well.

Here’s the part markets are missing: Trump doesn’t control the oil. The VP who hates the US is in charge. No stable pro-Western government means no foreign investment. Nobody’s pouring $100 billion into a country run by someone hostile to them. The whole supply increase story requires political stability that doesn’t exist.

Canadian infrastructure is already built and connected. Alberta to US Gulf Coast and Midwest refineries through established pipelines. Those refineries are configured for Canadian heavy crude after decades of optimization.

Even if Venezuela eventually gets production up in the 2030s, it’s the same heavy sour crude Canada produces. More heavy crude globally just validates continued investment in heavy crude refining infrastructure, which benefits Canada.

Well stated, Tracy!

Venezuela has a huge problem. Expecting the country to pump over three million barrels per day and crash oil prices is something only in the head of idiot politicians. Thirty years of socialist mismanagement destroyed everything, and the infrastructure is, as they say in Australia, buggered!

PDVSA (Venezuela’s state oil company) went from a world-class operator to a complete disaster. Refineries are rusting. Pipelines are leaking. Equipment is ancient. The realistic cost to fix it runs from $100 to 180 billion over the next 10–15 years.

Nobody has that kind of money, especially not for a country that has a history of asset seizures. And oh, the idea that Trump is already “running” the country is absurd.

Yanking Maduro out of bed and putting boots on the ground, dealing with militias and so forth are not at all the same thing.

Next, we have legal issues. For example, Exxon…

Venezuela owes $60 billion in unpaid arbitration awards. Exxon, ConocoPhillips, and others got their assets seized in 2007. They won in international court, but Venezuela never paid them. Now, Trump’s calling oil execs and telling them to “invest in Venezuela.” Their response is, logically, “Show us the rule of law first.”

Then we have the Chevron reality example…

Chevron’s the only major still there, operating under a special US license. According to them, the best case scenario with their current setup would be to add between 200,000 and 500,000 barrels per day. That brings Venezuela from 900,000 bpd to maybe 1.1 to 1.5 million bpd.

For reference, the US consumes over 20 million bpd, so this is negligible (and that’s their best case scenario).

Then we have the Orinoco problem. You see, Venezuela’s oil is heavy crude from the Orinoco Belt. It’s thick, sulfurous, and costly to extract. Before it’s useful, it needs special refineries to process. At current oil prices, the margins are horrible.

Why would any company invest billions for 8–12% returns when they can get 15–20% in US shale? They wouldn’t.

Then we’ve something else which is humorous…

Trump keeps saying he wants $50 oil. But $50 oil destroys the investment case for Venezuelan production. You can’t spend $180 billion rebuilding infrastructure if oil prices are suppressed. The economics simply will not work.

So either oil stays at $50 and nobody invests in Venezuela. Or oil rises to $80 (or more) and Venezuela becomes viable, but they still require political certainty… and we’re a long way from that

Trump can’t have both. So even IF someone could rebuild the infrastructure, Venezuela’s political situation is still a mess. Maduro’s gone. Fine, but now what?

Nobody knows what the government will look like in a month, let alone 12 months. Major oil companies don’t invest billions into that level of uncertainty. They need 10-year stability guarantees. As of right now, Venezuela can’t provide that.

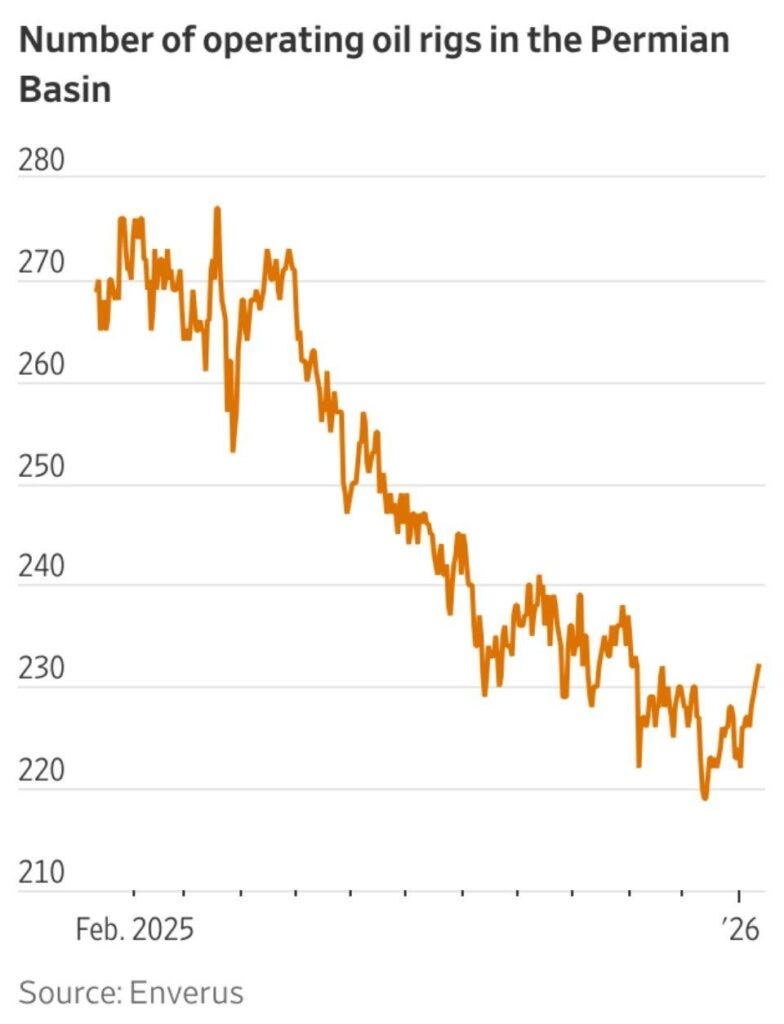

Meanwhile, Trump’s threatening to cut oil prices even as the US rig count is already falling.

Fifteen percent down in the last year. Woosh!

Shale producers are pulling back on new drilling. If the government artificially suppresses oil prices, pray tell, how we’re going to get the much needed additional capital investment Trump is so eager for oil execs to plough in. And by the way, this is not just in Venezuela. This is a global issue.

Low prices mean less investment, which means tighter supply later. It’s basic economics.

Trump’s $50 oil talk is exactly that: talk. The gap between political promises and physical reality has never been wider. You can’t tweet oil fields into existence. You can’t executive order decades of infrastructure neglect away. And you definitely can’t rebuild a collapsed petro state while simultaneously crashing the price of its only export.

The well-respected energy firm Rystad poured similar cold water on the idea of Venezuelan oil.

Based on our assessment and expected project timelines, it could take around 15 years to get back to 3 million bpd, so production can return to late 1990s levels by 2040 if the new investment cycle starts as early as 2026.

Then there’s the not-insignificant fact that before any company deploys hundreds of millions or billions of dollars (which is what’s required), they won’t be doing so unless they can see stability and longevity of stability.

Exactly!

The US has a debt problem, and part of going after Venezuela may well be to build up additional collateral for the teetering debt markets.

The issue that the US government faces is that kidnapping a dude in his pyjamas isn’t quite the same thing as “running” the country as Trump is promising.

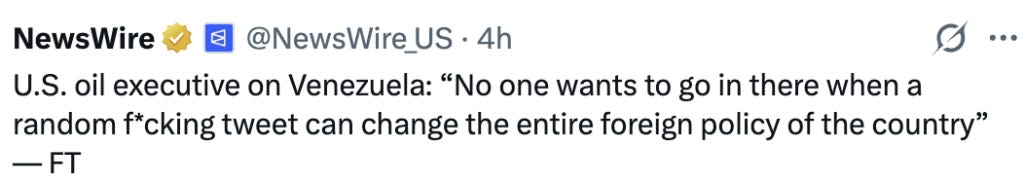

Oil execs wonder what may happen in a few years time when the baton at the White House changes hands. Hands up, who wants to spend billions of dollars only to have the rules change on them?

The US may not actually get to “run Venezuela.” Will the Venezuelan government not seize assets again? It’s called risk premia, and when it comes to Venezuela, it’s sky high.

Then there’s the fact that it’s entirely possible nobody “runs Venezuela.” The place turns into a Libya, with warring factions all over the show, bugger all ability to enforce legal contracts, yada, yada, yada.

Thx Chris for clarifying the narrative around the Canada vs Venezuela thing. Most Canadians just don’t get it, that Alberta is a key resource base for the US with an existing infrastructure that’s been operating for decades and will continue to do so. Whether Ottawa and Carny recognize this or not, Washington does. They will likely take the necessary steps to protect their Canadian energy supply chain.

The infrastracture gap is crazy underrated. People hear "oil-rich country" and assume you just flip a switch but decades of deferred maintanence means PDVSA's pipelines and refinaries are held together with duct tape. Even with political will and capital the rebuild timeline hits that 10-15 year mark minimum, and thats assuming no further disruptions.