This Has All Happened Before… and It Never Ends Well

Four of histories biggest cycles are converging again. Will you ride the waves…or get dragged under? Dive in and find out.

Imagine a world chasing fleeting promises...grand visions of progress that dazzle with hope but blind us to deeper, more powerful currents.

Beneath the surface, four ancient tides are gathering: commodities, debt, money, and revolution.

These cyclical forces have sculpted history’s greatest triumphs and tragedies, toppling empires and forging new eras.

Today, their surge is undeniable, poised to sweep away fragile dreams and reshape society, yet again.

Those who cling to short-lived illusions may be caught unprepared, but those who heed history’s rhythm can navigate these waves to a new dawn.

Let’s journey through time, exploring the tides that bind past, present, and what lies ahead. Will we ride them, or be swept away?

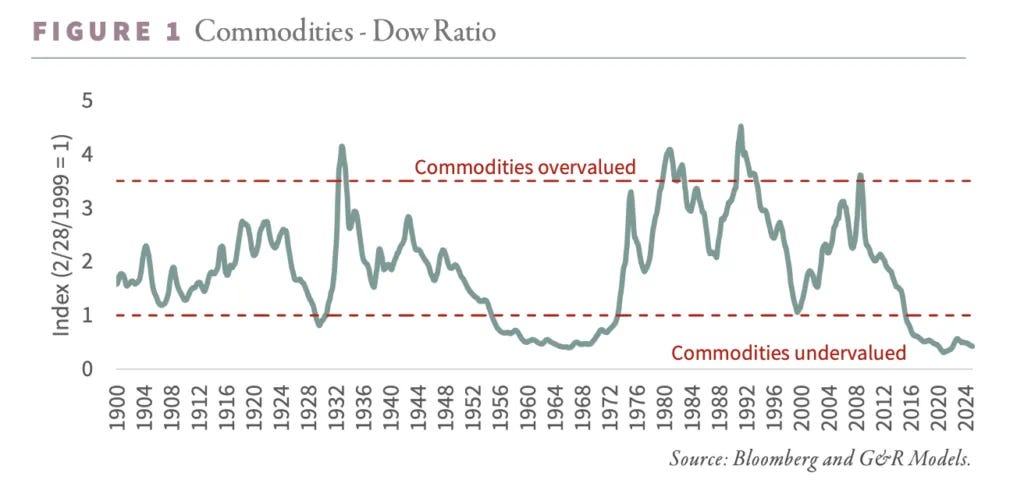

The Commodity Cycle: The Earth’s Heartbeat

The world runs on raw materials…oil, metals, fuels that drive its economic engines.

Yet, societies often spurn these essentials, chasing lofty ideals that can’t yet sustain reality.

The commodity tide surges when neglect collides with necessity, rewarding those who hold the earth’s gifts and punishing those betting on unproven dreams.

History’s Lesson: Britain’s Industrial Revolution in the 19th century drove massive coal consumption, fueling factories and railways, with production rising steadily and peaking at 287 million tons in 1913.

Overconfidence led to underinvestment, and by the 1920s, shortages worsened economic woes, fueling the Great Depression’s start in 1929.

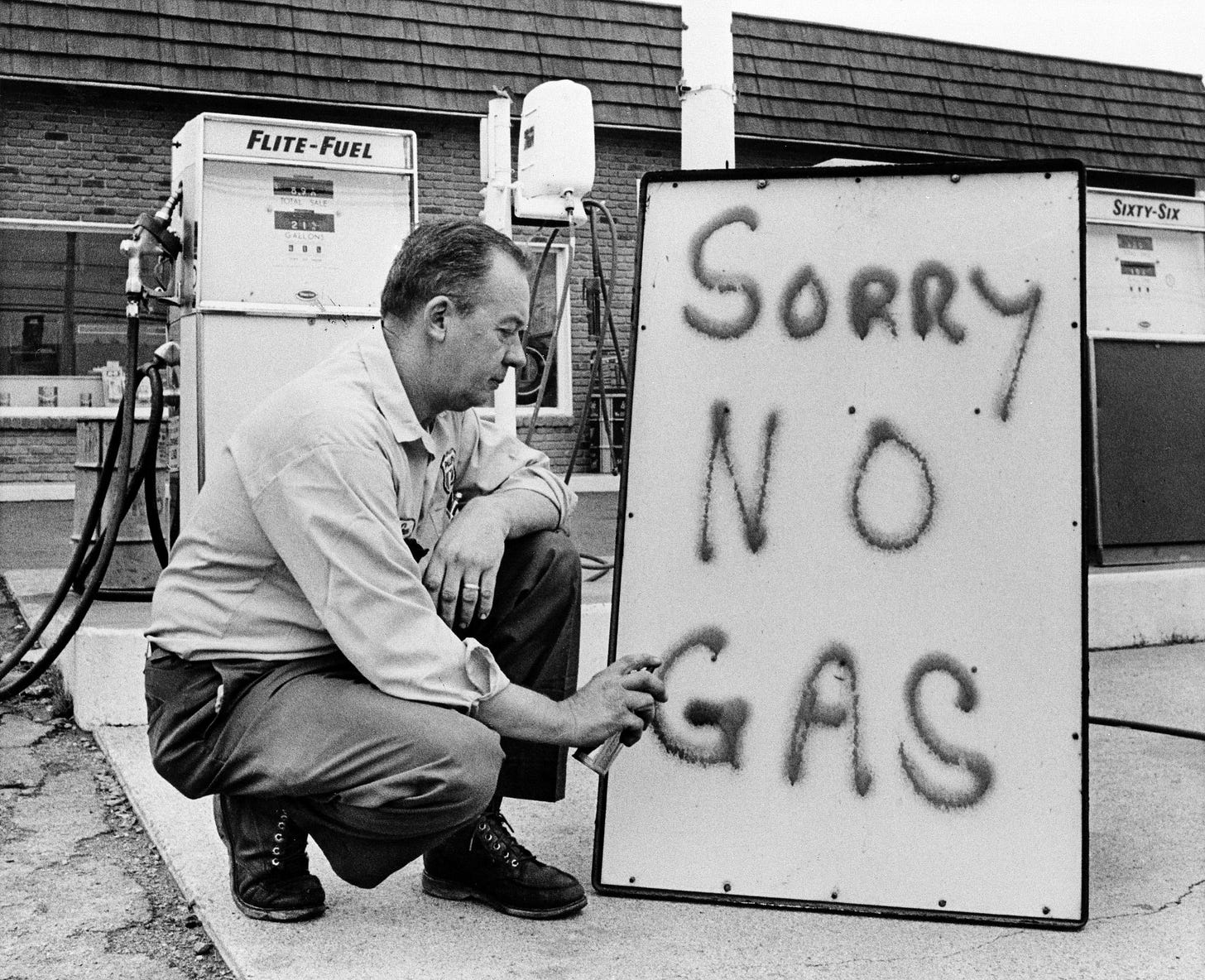

In 1973, the OPEC oil embargo cut global supply by 4 million barrels daily, quadrupling prices and triggering stagflation across the West.

Oil barons and miners thrived, while industries reliant on cheap fuel collapsed.

Today’s Signs: The commodity cycle is stirring. Years of focus on green energy…wind, solar, batteries…have sidelined oil, gas, and mining. Environmental policies have choked investment, leaving supply chains fragile.

Despite today’s volatility and recessionary fears, future demand for energy and metals will continue with growing cities, factories, and electric vehicles needing copper, lithium, and steel.

Nuclear power, once dismissed, is back in the conversation as policy makers are slowly waking up from their ESG hangover.

This echoes the 1970s, when underinvestment met rising demand, setting the stage for a supply shock.

Future Ramifications: If history repeats, this cycle will revalue raw materials.

Oil, metals, and uranium…once overlooked…will become prized, enriching those who own them.

Industries expecting cheap resources may face shortages, hiking costs and crushing profits.

Will this shift wealth smoothly to tangible assets, or spark chaos as nations fight for scarce supplies?

The tides of history rarely announce their arrival. They build quietly—then break loudly. We’ve seen it before. Now it’s happening again.

But what happens when these cycles no longer move in isolation…when they surge together, pulling capital, trust, and power in four different directions?

Will you float…or get dragged under?

The Debt Cycle: Castles of Credit

Debt is a bargain with tomorrow, a vow to pay for today’s desires.

In balance, it builds; in excess, it buries.

The debt tide rises when borrowing spirals, creating fragile empires that shatter when the waves hit.

History’s Lesson: In 1720, the South Sea Bubble saw Britain’s debt-fueled speculation collapse, erasing fortunes and sparking riots.

In the 1920s, borrowing grew, with advanced economies’ public debt averaging 30–80% of GDP, and U.S. private margin debt…reaching 16.3% of GDP by 1930…fueling a stock market boom that crashed in 1929, launching the Great Depression, when global trade fell 50% by 1933.

The 1982 Latin American debt crisis, sparked by U.S. rate hikes, led to Mexico’s default, plunging the region into a “lost decade.” Hard assets like gold shielded wealth, while credit-dependent ventures sank.

Today’s Signs: The debt tide looms. Governments, companies, and households have borrowed heavily, riding years of low interest rates.

Rising rates now strain those who overextended, with real estate markets faltering and corporate cutbacks spreading.

Nations rely on money printing to delay the reckoning, but cracks show…emerging economies buckle under foreign debts, and trust in credit wanes.

This mirrors the 1920s, when speculative borrowing preceded collapse.

Future Ramifications: History predicts pain. This late-stage cycle erodes wealth through inflation, as in the 1970s when U.S. prices doubled, or ignite defaults, as in the 1930s.

Those holding commodities or precious metals will likely endure, while speculative stocks or bonds crumble. Will this bring a managed unwind, or a global crash that reorders power? The castles teeter.

The Monetary Cycle: The Fall of Coin

Money is trust, a belief that paper or digits hold value.

The monetary tide shifts when trust fades, dethroning the world’s currency and sowing chaos.

This cycle, spanning centuries, marks the rise and fall of financial kings.

History’s Lesson: In the 1660s, Spain’s silver escudo, fueled by New World mines, faltered as war debts and over-mining sparked inflation, weakening its empire.

Britain’s pound sterling ruled the 19th century, but World War I debts and the 1931 gold standard exit eroded it, ceding ground to the U.S. dollar.

The 1971 Nixon shock, ending the dollar’s gold peg, unleashed fiat turmoil, with U.S. inflation hitting 14.8% by 1980. Gold surged tenfold, rewarding those who shunned paper.

Today’s Signs: The monetary cycle is turning. The dollar, long supreme, faces doubt as rival nations hoard gold and trade in their own currencies.

Central banks’ money creation devalues savings, pushing people toward alternative stores like cryptocurrencies or precious metals.

This echoes the 1970s, when dollar faith waned, and gold reigned. The world seeks anchors beyond fiat, signaling a shift.

Future Ramifications: If history rhymes, this cycle could unleash havoc…stagflation, currency collapses, or a new monetary order.

Those holding hard assets, (physical gold, silver, or energy, real estate) may prosper, as in the 1970s, while those tied to fading currencies lose ground.

Will this be a gradual drift, or a storm that crowns a new coin? The churn grows louder.

The Revolutionary Cycle: The People’s Fire

The revolutionary cycle is fiercest, flaring when economic hardship and distrust ignite.

It doesn’t just shift wealth…it breaks societies, rewriting history with fury.

History’s Lesson: In 1789, France’s debt and bread shortages sparked the French Revolution, toppling a monarchy by 1793.

The 1848 revolutions, driven by unemployment and famine, swept Europe, overthrowing regimes from Paris to Vienna.

The 1917 Russian Revolution, fueled by war and inequality, replaced tsars with soviets, reshaping global politics.

Each surge punished those tied to urban centers or elites, while mobile wealth…gold, foreign havens…escaped.

Today’s Signs: The revolutionary cycle simmers. Wages stagnate, homes grow unaffordable, and trust in leaders erodes.

Social media fuels rage, turning local protests into global waves.

Governments, cash-strapped, impose taxes and controls, deepening alienation.

Farmers clog roads, workers strike, and youth rally against a broken system.

Geopolitical clashes…proxy wars, trade spats…stir the pot, echoing 1848’s unrest.

Future Ramifications: History warns of upheaval. This cycle could yield protests that force reform, as in 1848, or revolutions that redraw borders, as in 1917.

Those with wealth spread across borders, rooted in hard assets, may evade the flames, while those in urban hubs or weak systems face danger.

Will this fizzle into change, or burn into chaos? The sparks are flying.

The Empire’s Counterstrike: The Iron Grip

As tides swell, empires don’t retreat…they tighten their hold. Facing loss of wealth and trust, rulers spin webs of control, cloaking coercion as care. This counterstrike is history’s refrain, and it’s closing in.

History’s Lesson: In 1793, France’s revolutionary regime used price controls and guillotines to quell unrest, prolonging turmoil.

Britain’s 1966 exchange controls, capping foreign cash at £50, curbed capital flight but bred black markets.

Argentina’s 2001 “corralito,” freezing bank accounts, triggered riots and a government’s fall. These moves delayed collapse but fueled the cycles, sparing those with wealth abroad.

Today’s Signs: The counterstrike tightens. Governments demand proof for money transfers, freezing funds under “security” excuses.

Taxes climb, masked as fairness, while surveillance expands. Capital flees to freer lands, but barriers grow—bureaucratic snares, exit fees, sanctions as policy.

War rhetoric rises, distracting from homegrown woes, much like 1971 Britain’s desperate grip.

Future Ramifications: History foreshadows escalation…wealth taxes, seizures, or wars to deflect rage, as in the 1930s.

Those with global wealth…gold, energy, safe havens…may slip the net, while those trapped in one nation’s grasp suffer. Will this hold the cycles, or hasten their wrath? The grip strengthens.

Charting the Course

How do you navigate these eternal, natural, human cycles?

Keep it simple.

Bet on what’s real, what outlasts empires, what powers the world.

Hard Assets: Gold, oil, real estate…tangible wealth endures when paper fails. Hard assets…your lighthouse.

Energy’s Core: The world needs fuel, not fantasies. Own wells, mines, reactors that drive reality.

Global Haven: Spread wealth beyond one flag. Lands with strong laws shelter you when empires clamp down.

Shun the Mirage: Speculative bets dazzle but crumble when trust breaks. Steer clear.

The Final Rhyme

Four cycles…commodities, debt, money, revolution…collide, a convergence unseen since the 1930s.

From the French Revolution’s blaze to the 1970s’ stagflation, these waves have crushed illusions and crowned realists.

Today, they roar again, and the world holds its breath.

Will you chase fleeting promises, hoping for calm? Or sail with history’s rhythm, grounded in what endures? The cycles wait for no one, but they reward those who see their flow.

🔴 The dollar’s in distress, China’s making moves, and Trump’s tariffs are a symptom...not the cause. Is this the end of U.S. monetary dominance? Let’s dig in.

In essence, the fourth turning. In the US, hastened by spending trillions of dollars on stupid wars and futile nation building in Afghanistan and Iraq as well more trillions on the COVID shutdown. No wonder we’re broke.

The level of your commentary here is what first drew me to you years ago. Whether we realize this now or they find a way to kick the can down the road again, I guess we'll see. I do hear the same beat of the rhyme but I've heard it now for two decades of Central Bank meddling. Eventually, though, the time will come when we hear "Last Call". Good write up Chris.