They’re Down 60%...The Most Absurd Valuation in Energy

This weakness is completely absurd…Here’s why that’s a gift for asymmetry.

The weakness in drillers is completely absurd… to put a polite spin on it. As a group, they are down on average 60% over the last 12 months.

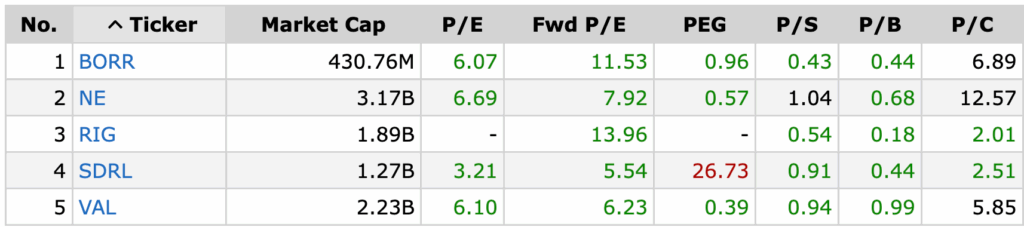

Why absurd? Take a look at valuations:

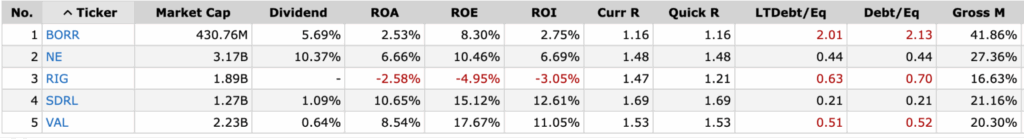

And profitability, liquidity and gearing (note that RIG suffered a recent loss due to non-cash write down or rig values):

It would seem that the market is positioned as if there is going to be a repeat of the wipeout of drillers as there was in 2020.

We can’t say “for sure” that there won’t be any material and sustained downside in the price of oil (we think it is highly unlikely).

However, what we can say is that drillers’ debt levels are light years from where they were in early 2020.

They are simply not going to run into the same liquidity issues they ran into during the COVID crisis… but the market seems to be anticipating they will.

And there is something else that few are taking any notice of: order books of drillers and utilization of rigs. Order books are somewhat full.

Noble’s recent earnings results highlighted in Upstream magazine:

Offshore driller Noble Corporation saw its backlog swell by 30%, or more than US$2 billion, in the first quarter thanks to large awards from Shell and TotalEnergies, according to the company’s latest earnings report.

The total value of Noble’s new contracts ranges from $2.2 billion to $2.7 billion. Noble said the deals include performance incentives and unexercised options.

Noble’s first quarter revenue grew 37% year over year to $874 million, and its profits inched upward 13.7% to $108 million.

Its adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) jumped 85% to $338 million.

Despite global volatility in oil prices, Noble still estimates its revenue will fall somewhere between $3.25 billion and $3.45 billion in 2025, along with adjusted EBITDA $1.05 billion to $1.15 billion, as it originally predicted.

Yet Noble finds itself 20% below its relisting level. How bizarre!

☝️ The dollar’s in distress, China’s making moves, and Trump’s tariffs are a symptom...not the cause. Is this the end of U.S. monetary dominance? Let’s dig in.

OMC How bizarre https://www.youtube.com/watch?v=y2oC99e_xPY