The Supply Squeeze Play

While the masses chase AI and meme stocks, Chris MacIntosh and Brad McFadden are playing the long game—betting on industries the world has left for dead. What happens when reality catches up?

Chris MacIntosh and Brad McFadden are no strangers to being patient.

While the masses chase the latest AI stock, meme craze, or speculative crypto token, these two seasoned investors are content to do something old-fashioned—buy valuable things nobody else seems to want. Their strategy?

Identify supply constraints before the market prices them in, sit tight, and wait for reality to catch up.

“We look for industries that are structurally essential but cyclically hated,” says MacIntosh.

“When supply is constrained and demand remains steady, you don’t need a crystal ball to see where things are headed.”

Sounds simple, right? And yet, few investors have the patience—or the stomach—to follow through.

The Shipping Time Bomb

One such opportunity sits in the global shipping industry, where years of underinvestment and regulatory confusion have set the stage for a supply-side crisis.

Below is a snippet from Insider #306 (Dec 2024) detailing their base case for shippers.

From the report…

…As many of you may be aware, tanker stocks have fallen rather significantly over the last six months.

While we are “less than impressed,” we aren’t concerned, and we haven’t changed our long-term bullish view on the sector.

Our reasoning?

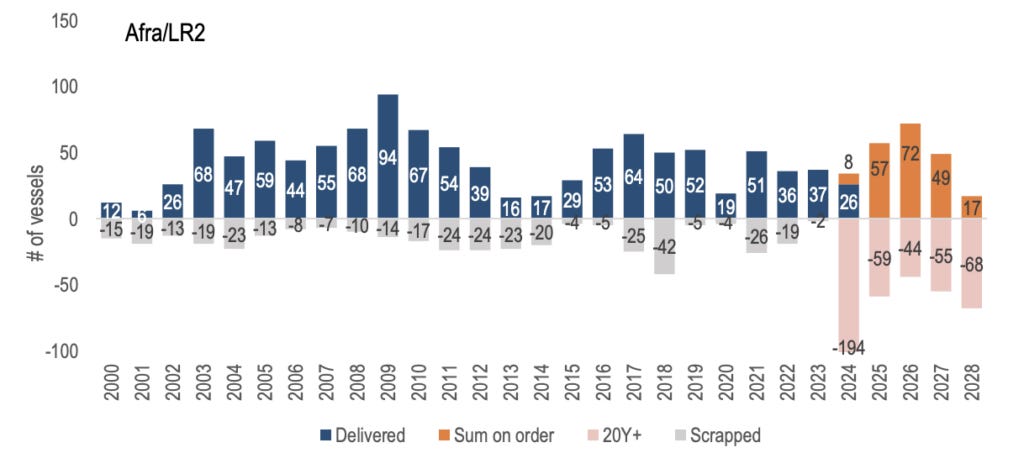

In short, the global fleet is rapidly aging, and although new-builds have picked up, the level of new-builds will not offset the number of vessels reaching scrapping age (+20 years).

Return profiles of Frontline and Hafnia are still better than the S&P 500 over the last five years, but the last few months have been rather brutal.

Here is the essence of our bullish position.

Note the percentages of vessels above 20 years of age (generally accepted as the age where they are sent to a beach in Bangladesh) and then compare this to the percentage of the fleet on order.

Also consider the percentage of vessels that will be over 20 years of age five years from now.

If one puts the deliveries and likely scrapings together, it gives you an idea of the net addition or subtraction of shipping capacity for various tanker classes.

So it would seem to us that a deficit in supply tanker vessel capacity is looming.

The “trick” is being able to hold that long-term view, particularly when stock prices go against you (as they have over the last six months)…

“Ships age,” MacIntosh explains.

“The global fleet is old, and shipyards aren’t building new vessels at the rate needed to replace them.

We’re seeing scrapping rates outpace new builds by a factor of four to one in certain segments.

The math is pretty simple—fewer ships mean higher shipping rates.”

Shipping has always been a brutally cyclical industry.

Investors who pile in at the top usually get crushed when new capacity floods the market.

But what happens when the usual response—massive new shipbuilding—doesn’t occur?

“This is exactly what we look for,” says MacIntosh. “A slow-moving supply train wreck with a clear resolution.”

Cash Flow Over Hype

For McFadden, the trick is in understanding what really matters.

“People obsess over commodity prices, but they forget to look at cash flows,” he says.

“A good company doesn’t just extract or move commodities—it prints money regardless of the noise.”

Take oilfield service companies. Many assume that if oil prices stagnate, these companies struggle. Not so.

“The majors still need to drill. They still need to service wells. There’s a baseline demand for this expertise that doesn’t disappear just because a barrel of oil drops ten bucks.”

McFadden points to the early 2010s shale boom as an example.

“Companies like Halliburton and Schlumberger weren’t just making money off high oil prices. They were making money because they had something producers needed—better technology, efficiency, expertise.”

And this is where McFadden sees another opportunity—an industry that’s been left for dead despite its critical importance.

The Last Coal Boom?

Coal. The ultimate contrarian bet.

“Coal is the cigarette stock of our time,” McFadden says. “Everyone hates it. ESG funds won’t touch it. And yet, more than a third of the world’s electricity still comes from it.”

Western governments have gone out of their way to kill coal, but reality keeps interfering.

Demand from Asia is surging, and the energy transition isn’t happening as fast as policymakers promised.

As a result, coal miners are printing cash, yet their stock prices trade as if bankruptcy is imminent.

“This is classic mean reversion,” says MacIntosh.

“Markets overshoot in both directions. Coal miners are paying double-digit dividends, they’re buying back shares, and they’re not adding capacity. What happens when people realize that coal demand isn’t disappearing overnight?”

The historical parallel? Tobacco stocks.

Demonized, regulated, and written off, yet they generated some of the best returns in stock market history for those willing to look past the headlines.

Gold’s Second Chance?

Another sector these two investors are watching closely: gold miners.

Gold mining stocks (the S&P 500 Metals and Mining Index which the XME ETF tracks) relative to the S&P 500.

Gold prices are at record highs, yet the miners have spent a decade in the wilderness.

“Since 1984, gold miners have underperformed the S&P 500 by 96%,” McFadden points out. “That’s an absurd gap, given where we are today.”

Why the disconnect? Decades of poor capital allocation, too much debt, and a reputation for burning shareholder money.

But after years of discipline, balance sheets are stronger, production costs are lower, and free cash flow is improving.

“When the sentiment turns, these stocks could rip,” MacIntosh adds.

“Gold has always been the insurance policy against monetary insanity. When people wake up to that, they’re going to want exposure to miners.”

The Power of Patience

So, what’s the takeaway for investors looking at these unloved sectors?

“Be patient,” MacIntosh advises. “Markets eventually price in reality, but they take their sweet time getting there.”

“Look for businesses with real cash flow,” McFadden adds. “If you can buy them when they’re cheap and wait, you’ll do well.”

Connecting the Dots

If history teaches us anything, it’s that supply and demand are immutable forces.

Time and time again, industries fall out of favor, capital dries up, and investors flee—just before the tide turns.

Take the 1970s oil embargo. The world learned the hard way what happens when supply is artificially constrained.

Energy stocks went from afterthoughts to the darlings of the market.

The uranium boom of the early 2000s followed a similar pattern—years of underinvestment met a surge in nuclear power demand, and prices skyrocketed.

The same dynamics are playing out now.

Whether it’s shipping, coal, oilfield services, or gold miners, the story remains the same. Supply constraints meet inevitable demand, and prices respond accordingly.

For those who understand this cycle, the opportunities are clear. For those who ignore it—well, they’ll be the ones buying at the top while MacIntosh and McFadden cash in.

The Setup for 2025 and Beyond

Looking ahead, the structural imbalances in key industries show no sign of abating.

Governments can mandate all the ESG policies they want, but they can’t change physics.

The world still runs on energy, raw materials, and transportation infrastructure—sectors currently neglected by mainstream investors.

“The best opportunities often emerge when the consensus is wrong,” MacIntosh notes.

“Right now, the market is pricing in a fantasy world of limitless green energy and endless technological growth. Reality will assert itself, and when it does, we’ll be ready.”

McFadden agrees. “Find the bottlenecks, invest in cash-generating assets, and wait. The money will follow.”

In a world obsessed with the next shiny object, Chris MacIntosh and Brad McFadden are content to bet on the old-school laws of supply and demand.

And if history is any guide, they’ll be on the right side of the trade.

🔴 Haven’t caught up with Chris MacIntosh’s latest Insider, Issue #309?

Disclaimer: Not investing advice! This article is for educational purposes only. Seriously, we really do hope you become a better investor after reading our work. But always do your own due diligence and/or consult with a financial professional before making any investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.