The Silent Rally of Gold

Experience tells me that when this breaks, it will surprise most commentators in terms of duration and magnitude.

"Markets are a place where money silently flows from the ignorant to the observant." – Chris MacIntosh

Something peculiar is happening.

While everyone is hypnotized by the Magnificent Seven and dazzled by crypto's rollercoaster, gold has quietly hit new highs.

It's bizarre how unnoticed this is by outsiders.

But there's an even deeper story unfolding, hidden in plain sight.

The real story isn't just gold in dollars—it’s what's happening to gold priced in currencies other than the USD.

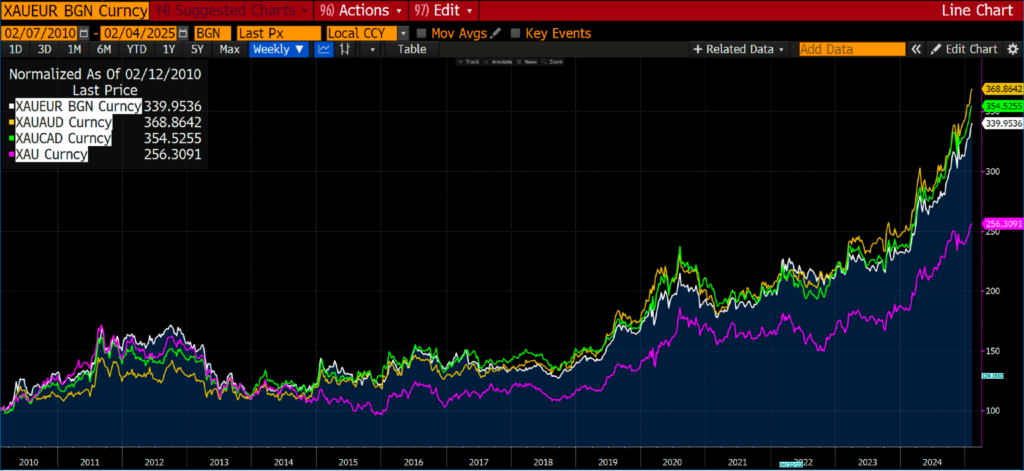

Here’s how gold has moved, indexed to 100, in EUR, AUD, CAD, and USD:

Notice anything striking? If your eye didn't twitch, look again. Gold isn't just rallying—it’s breaking free from traditional shackles across multiple currencies.

But gold’s silent ascent is just part of the story. Let's widen the lens a bit.

The Quiet Commodity Boom

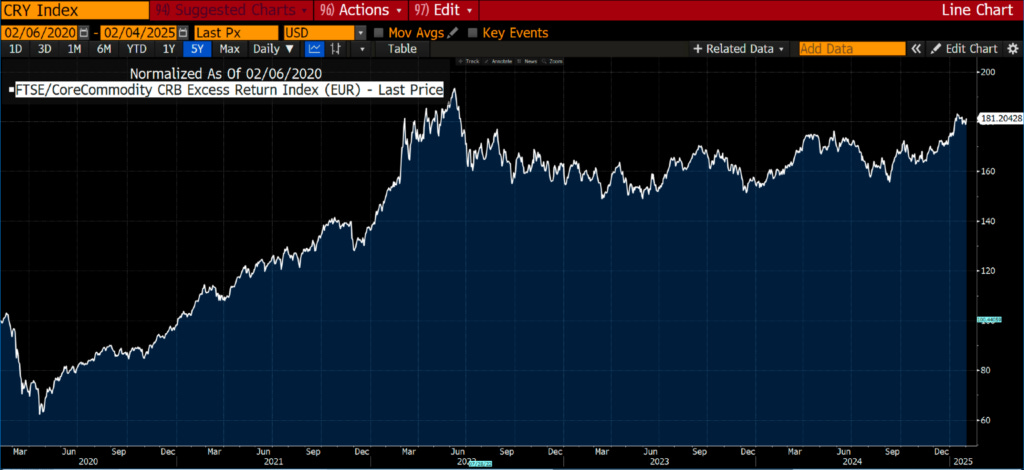

The FTSE/CoreCommodity CRB Index, the granddaddy of commodity indexes, is quietly approaching record highs.

Remember, commodities are the stuff of life—food, fuel, fiber. They're reality itself, quietly underpinning our entire civilization.

And the broader commodity complex. The old CRB Index (now called the FTSE/CoreCommodity CRB Index) is almost at a new high.

Commodities, quietly inching toward record highs, might be signaling something critical. Could we be witnessing the early tremors of an economic shift that few investors see coming?

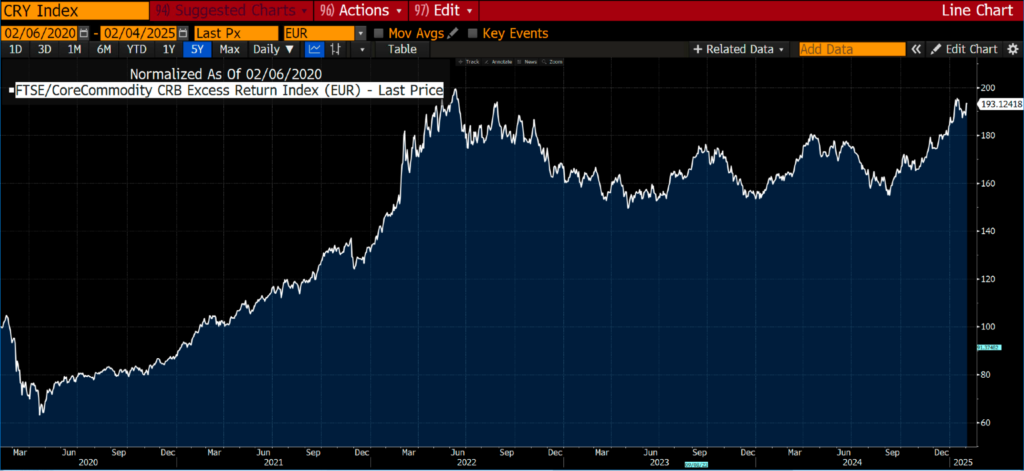

And in euro terms, it’s within 5% of a record high.

Why isn't this headline news? Well, let’s face it—it's less thrilling than debating Tesla's latest quarter or Bitcoin’s volatility. But ignoring commodities has consequences. Big ones.

The Industrial Backbone No One Talks About

Consider the CRB Raw Industrials Index. What’s that? Exactly.

It’s the heartbeat of global industry.

It's copper scrap, cotton, burlap, hides, rubber, tin, wool tops, zinc—basic stuff.

This index hasn’t budged significantly for two years, stuck in an unnervingly tight trading range.

Now, let me tell you from experience: when markets coil this tightly, the eventual breakout isn’t just strong—it’s explosive. It surprises even the seasoned pros in both scale and longevity.

The Next Commodity Supercycle?

Given what we're seeing in gold and the broader commodity indexes, this breakout might already be underway. Remember 2008?

The world blinked, and oil exploded to $147 per barrel, commodities soared, and inflation roared back. Investors scrambled to catch up.

Today, we're standing at the precipice of another such shift, and gold is your silent warning bell.

Gold’s Message Is Loud (If You're Listening)

Here's the blunt truth: gold doesn’t rally without reason. It moves because it smells trouble—fiat trouble, geopolitical stress, inflationary pressures lurking beneath the surface.

And when gold moves across multiple currencies simultaneously, the message is even clearer: trouble is not limited to the United States—it’s global.

Pay Attention to the Quiet Ones

So, why isn’t anyone screaming about this yet?

Maybe it’s easier to stay fixated on tech darlings and digital coins.

But commodities don’t care about narratives. They respond to supply, demand, and the subtle shifts that become seismic.

We live in an age where reality often gets overshadowed by hype. Yet reality always catches up. Gold’s breakout isn't a glitch—it’s a signal, loud and clear, that commodities might be about to deliver an inflationary shock few are prepared for.

Final Thought

Is your portfolio ready for this quiet revolution? Or are you still fixated on yesterday's news?

The next move might already be in progress. When the silent ones finally roar, it’s too late to position yourself.

Watch gold. Watch commodities. Position wisely. Because when markets move quietly, they're usually preparing to move violently.

If the behavior of the CRB Futures Index and gold is anything to go by, the next leg up in commodities has already begun.

Disclaimer: Not investing advice! This article is for educational purposes only. Seriously, we really do hope you become a better investor after reading our work. But always do your own due diligence and/or consult with a financial professional before making any investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.