This One Metric Shows the Market’s Breaking Point

Exposing the Market’s Biggest Illusion.

It is no secret that we are increasingly concerned about the valuation of the US stock market.

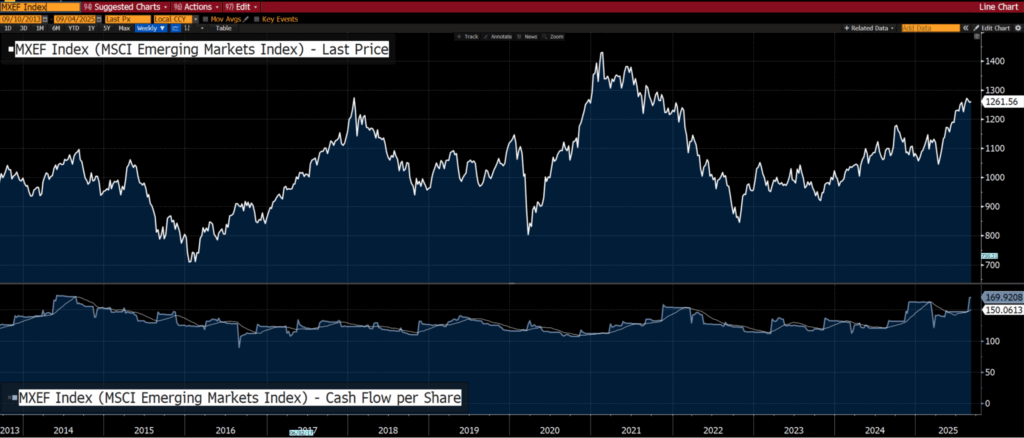

However, there is plenty of value lurking in markets outside the US, especially of the “emerging” variety.

We are going to look at valuations based on Cashflow Per Share (CFS).

Why not earnings?

Because it is very difficult to fudge cashflow compared to earnings (unless you are Enron executives).

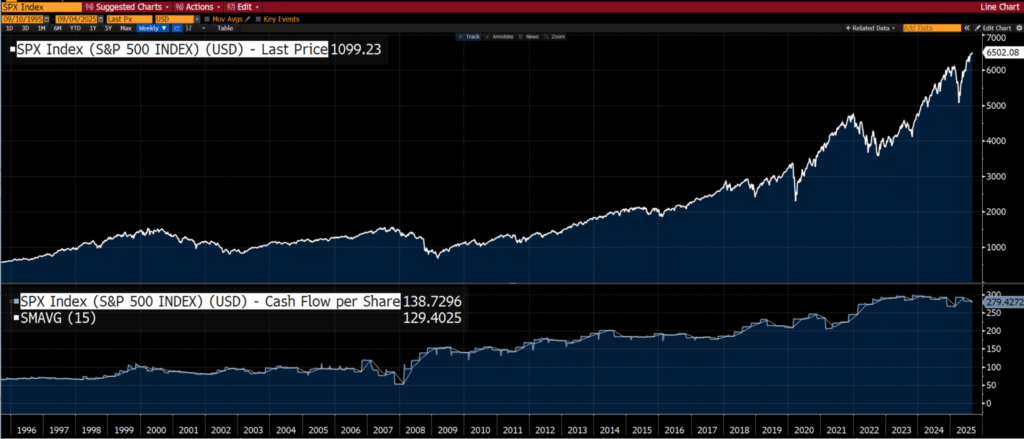

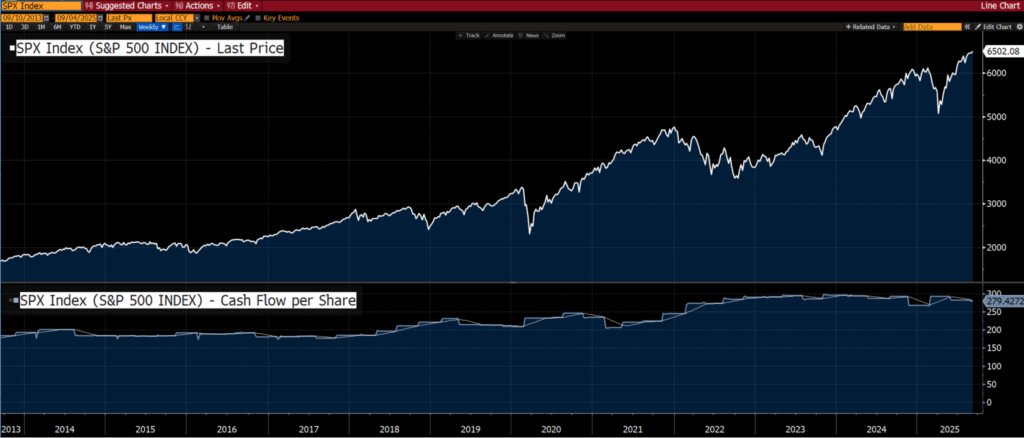

In 2014, cashflow per share for the S&P 500 was 200, with the index at 2,000.

Today, the CFS is 280 (40% higher) and the S&P is at 6,500 (225% higher).

That’s a move in the price/cashflow per share from 10x to 23x.

Let’s go out a few more years to a point where we know, with the glory of hindsight, that the S&P 500 was expensive — the TMT bubble of 2000.

Back then, cashflow per share was 100 with the S&P 500 at 1,500, for a price/cashflow ratio of 15x.

Now, it is 23x (6,500/280).

So on a price/cashflow basis, the US stock market is about 50% more expensive than the peak of the TMT bubble.

You may argue that valuation is a little more complicated than that. Perhaps you are right, but the point is that there can be “no doubt” that the S&P 500 is materially more expensive than at the height of the TMT bubble.

Put another way, assuming earnings/cashflow doesn’t change too much, the S&P 500 could fall by some 35% and only be back to the same valuation as the peak of the TMT bubble.

A 60% fall would get it back to 2014 valuations.

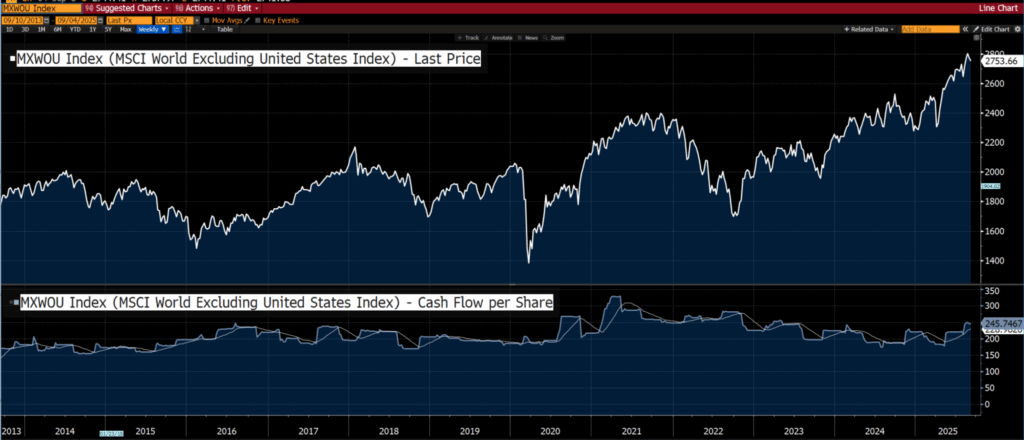

Additionally, there is good value outside of the US.

The price/cashflow ratio of the world ex US was some 10x in 2014.

Today, it sits at 11x.

And for emerging markets, in 2014, price/cashflow was 7x.

Today, it’s 8.4x.

Yes, the price/cashflow ratio of emerging markets is 8.4x (compared to the S&P 500 of 23x).

On that basis alone the S&P 500 is some 170% more expensive than emerging markets.

Is there any way that this valuation differential can be justified?

If you expect the earnings of the S&P 500 to grow at a far more rapid rate than emerging markets, you could find some justification.

But a differential of 170% suggests that earnings growth in the S&P 500 will be almost 2x (200%) that of emerging markets for a number of years — a fantasy to say the least.

Yes, a very long winded way of saying best to look for value outside the US with a particular focus on emerging markets.

By the way, you might like to listen to the legend speak about the valuation of the S&P 500.

If you don’t want to listen here is the essence:

JP Morgan published a chart around the end of 2024 it showed that historically, if you bought the S&P500 when the PE ratio was 23 in every case, there were no exceptions. In every case, your annualized return over the next 10 years was between 2 and minus 2.

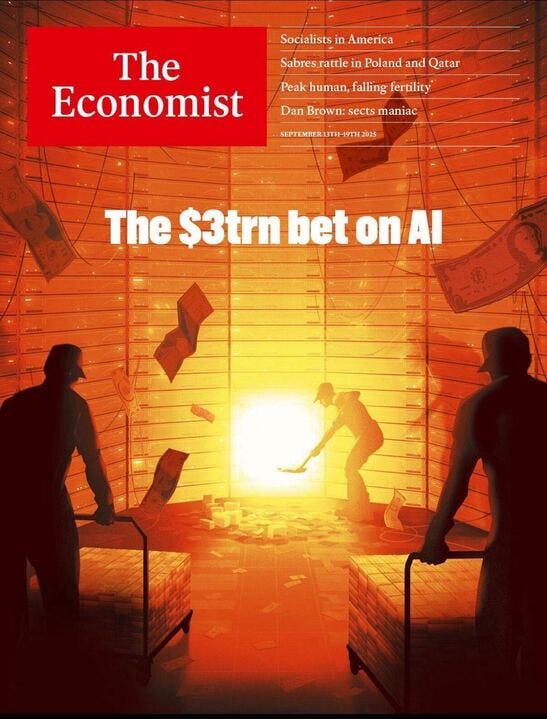

So there ya go! Oh wait… lastly, in terms of signs of the top, I present to you the following:

When price outruns cash by this much, gravity isn’t a risk…it’s a schedule.

So where do you go when multiples defy math at home?

Simple: you follow cash flows where they’re still cheap and hated.

Speaking of breakouts, let’s talk about the one pattern that turns impatience into profits.

Continue Reading Insider #318 (stock picks inside) »