The Probability Play: Gold Mining Stocks

Gold is soaring, but why aren’t miners following suit? Chris MacIntosh breaks down the hidden forces at play—will this be a golden opportunity or a costly trap?

“All investing, folks, is probability. There are no certainties.” – Chris MacIntosh

The Gold Rush That Wasn’t?

Gold bugs have waited patiently.

For years, they endured the mocking glances of their tech-stock-chasing peers, quietly accumulating ounces while the broader market soared.

Now, as gold flirts with record highs, shouldn’t the miners be soaring too?

Historically, when gold prices take off, the stocks of companies that pull it from the earth follow suit. But history is littered with cautionary tales, and the past doesn’t always repeat.

Chris MacIntosh, founder of Glenorchy Capital and Capitalist Exploits, is no stranger to the gold trade.

He’s seen the cycles, he’s placed the bets, and he’s watched mining stocks defy logic before.

The key question: Will miners rally with gold this time, or is something different at play?

The answer, he suggests, is all about the spread.

Mind the Spread: What Really Moves Mining Stocks

“It depends on the spread between the price of gold and the cost of producing it,” MacIntosh explains.

A simple equation, yet often overlooked.

If the cost of production keeps pace with the price of gold, miners see no real margin expansion—and if they aren’t making more money, why should their stock prices rise?

Consider energy costs.

Diesel, the lifeblood of mining operations, can account for 15-25% of total operating expenses.

If gold doubles but so does diesel, what have you gained? Nothing.

“If their margins aren’t increasing, then the stocks have no reason to be valued any higher,” MacIntosh notes. It’s a harsh reality that many overlook in the gold trade.

The Opportunity Beneath the Surface

Yet, even in this seemingly uninspiring setup, MacIntosh spots an opportunity.

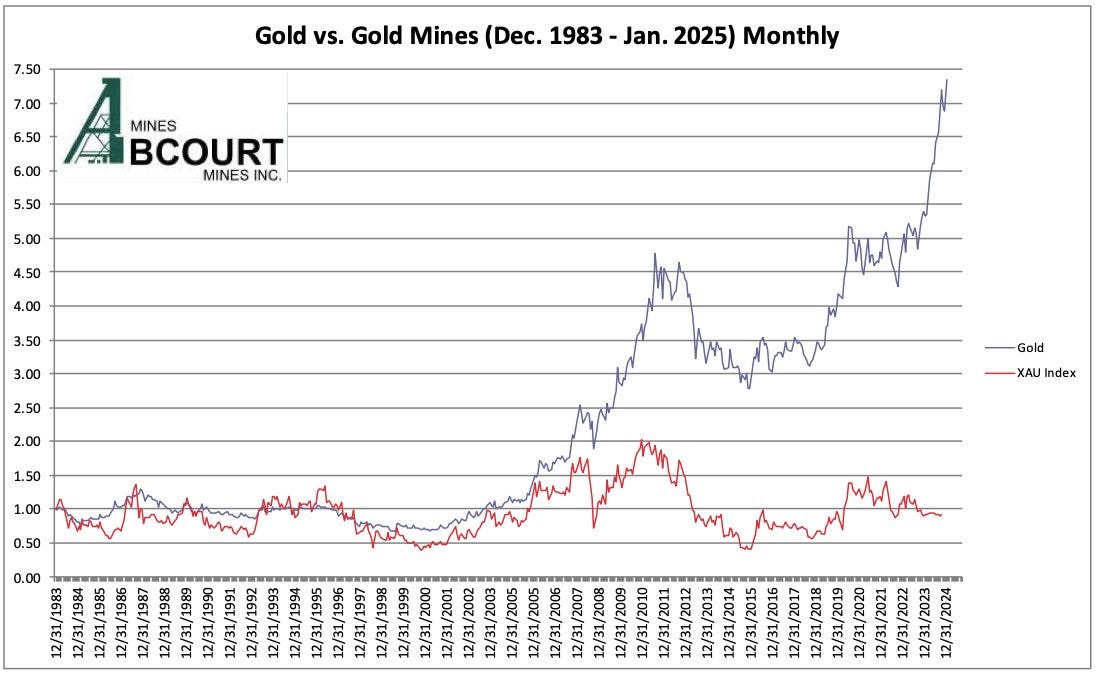

“Gold mining stocks are now the cheapest they’ve been in 40 years on a free cash flow basis,” he says.

A bold statement, but one that data supports.

Gold miners are at a historic valuation low—so why aren’t investors piling in? Are they missing something, or is this a rare moment of mispricing?

Let's explore what history and data suggest about the road ahead…

According to market reports, major gold miners like Newmont and Barrick are trading at historically low valuations relative to cash flow.

If cash flows are rising and stock prices remain depressed, the probability of a re-rating is high.

“The probability is that investors will realize this and start bidding up the stocks,” he argues.

But probabilities aren’t certainties.

When Gold Soared but Miners Didn’t

The concern voiced by skeptics isn’t unfounded.

Between 2008 and 2011, gold surged from $800 to nearly $1,900 per ounce, yet the NYSE Arca Gold Miners Index underperformed. Why?

Rising energy and labor costs squeezed profit margins, limiting upside for mining stocks despite gold’s meteoric rise. Could we be staring at a similar setup today?

MacIntosh acknowledges the risk but sees a crucial difference: “Unlike in past cycles, miners are actually profitable right now.”

They’re producing significant free cash flow, which wasn’t the case during previous bull runs.

A Probabilistic Approach to Gold Investing

Rather than deal in absolutes, MacIntosh advocates for a probabilistic mindset.

“Nobody knows for sure,” he says. “You construct a portfolio based on probabilities, not certainties.”

His take? Gold prices are unlikely to collapse, miners are trading at rock-bottom valuations, and cash flows are rising. On balance, the probability favors upside.

But how much should an investor allocate?

“That’s a personal decision,” he says. “Is it 1%, 2%, 5%, or 10% of your portfolio? You decide. Just don’t get so exposed that you need it to work. That’s where mistakes happen.”

Dismissing the Noise

For MacIntosh, the key to success is filtering out the noise. “People love narratives,” he says.

“Whether it’s the LBMA running out of gold or Trump revaluing gold overnight, these stories distract from the fundamentals.”

The fundamental reality? Monetary regimes change. When they do, fiat currency devalues, and real assets rise. Gold is one of them.

“Own it. Don’t get carried away with the narratives,” he advises.

The Final Bet

The setup is clear: Gold is strong, mining stocks are cheap, and cash flows are improving. If costs stay in check, mining stocks should follow gold higher. If not, history may rhyme once again.

The probability, MacIntosh believes, is in favor of the miners. But investing is never about certainty. It’s about placing the right bets, sizing them correctly, and letting the market play out.

Will miners finally catch up to gold? The odds are in their favor—but as any seasoned investor knows, probability is not the same as destiny.

And that, as always, is what makes the game worth playing.

Disclaimer: Not investing advice! This article is for educational purposes only. Seriously, we really do hope you become a better investor after reading our work. But always do your own due diligence and/or consult with a financial professional before making any investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.