The Pariah Turns Prodigy

Greece just became 2025’s top stock market. But this isn’t a comeback story...it’s a rerating in disguise. Is it too late or is the rally just getting started?

“In markets, as in life, the best returns are made betting on the unloved. Provided, of course, they’ve stopped bleeding.”

If you'd asked the average investor in 2015 to name a functioning equity market least likely to produce a record-breaking run a decade later, Greece would’ve topped the list.

Beset by riots, bailouts, and a sovereign credit rating that flirted with the financial Mariana Trench, it was the butt of every fiscal joke in the Eurozone.

The phrase “Greek equity” was a punchline, not a pitch deck.

Fast forward to mid-2025, and that same joke is now the best-performing stock market in the world.

Let’s unpack what just happened…and what most investors are still missing.

From "Don’t Touch" to "Must Watch"

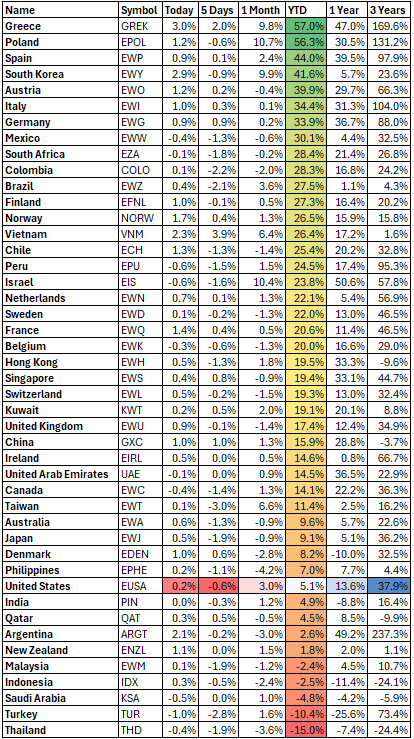

A 57% year-to-date return will do strange things to people’s memories.

It’ll make them forget Greece was once the poster child for Western financial dysfunction, its stock market eviscerated and its people buried under IMF paperwork and German lectures.

But when markets have fallen far enough, and for long enough, even a faint pulse feels like a miracle.

This isn't the first time a country written off as terminal stages a comeback…but it might be one of the most misunderstood. Because behind the headlines, something quietly competent has been taking shape. And if you're paying attention, you can spot it.

But first, let’s rewind to how Greece landed in this unlikely spotlight.

A Market No One Wanted

Post-2008, Greece wasn’t just broken…it was radioactive.

By 2015, the Athens Stock Exchange had shed over 80% of its value from the 2007 peak.

Greek banks…over-leveraged and riddled with non-performing loans…were shut down, recapitalized, and shut down again.

Capital controls meant you couldn’t even get your money out, even if you were foolish enough to still have some in.

And yet…

As 2024 unfolded, signs of stabilization emerged…quietly. Fiscal reforms began to stick. NPL ratios trended down. Tourism roared back. EU recovery funds started flowing.

It was at that inflection point that we added Greece to the Insider portfolio. Not because it was “safe.” But because it was hated, cheap, and turning a corner.

Which is when markets start to rerate.

Anatomy of a Reversal

Let’s not pretend this was luck.

Greece in 2025 is benefiting from a convergence of three structural forces:

A leaner, more disciplined fiscal framework.

EU capital pouring into productive sectors.

Dirt-cheap valuations that made rerating almost inevitable.

You can argue about the sustainability. You can even argue about the depth of reform. But you can’t argue with price.

The Global X MSCI Greece ETF (GREK) is up 57% this year. Banks…once the deathtrap of the Greek market…have led the charge. Alpha Bank, Piraeus, and National Bank of Greece are all up 50–70% YTD.

They’ve gone from “zero” to “less than zero.” And that’s often all it takes.

Still Cheap. Still Ignored.

Here’s what gets lost in the noise: even after this year’s monster rally, Greece is still trading at a P/E of 10x. That’s less than half the S&P 500 and below the Euro Stoxx 50.

The banks…still the index’s backbone…are offering 4–5% dividend yields and are just now starting to expand credit again.

This isn’t about buying into a perfect system. It’s about buying into a system that went from terminal to functional.

And the best part? Nobody cares.

The crowd is still chasing Nvidia’s shadow, pretending there’s no risk in piling into trillion-dollar tech. Meanwhile, Greece is rerating from junk status to something like… normal.

Which, at 10x earnings, is a gift.

Europe’s Tariff Problem Is Greece’s Diversification Gift

As U.S. trade rhetoric shifts, particularly under the Trump administration’s second act, European exporters face real risk. Tariffs on autos, chemicals, and machinery could wreak havoc on Germany and its neighbors.

But Greece? Greece exports beaches, feta, and sunshine. Tourism represents 20% of its GDP…and 2025 is already a record-breaking year for arrivals.

Which means this rally isn’t just banking-driven. Hospitality, infrastructure, and real estate are all riding the wave.

And while the rest of Europe worries about how Trump’s next tweet will hit BMW’s margins, Greece is quietly enjoying a decoupling dividend.

The "Bad to Less Bad" Playbook

This is classic capital rotation.

When an asset goes from bad to slightly less bad, and the price hasn’t yet caught up, you get explosive returns. But the real money isn’t made in the spike…it’s in riding the rerating process over years.

That’s the opportunity in Greece now. And here’s what you need to weigh.

Three Risks That Could Spoil the Party

Let’s keep this grounded. This isn’t a “back up the truck” moment. Greece has risks…big ones.

Sector Concentration

GREK is still nearly 40% banks. If the NPL cleanup hits a wall, or if credit expansion falters, the index takes a hit. This is not a balanced market.External Shocks

A hawkish ECB or U.S.-EU trade war could derail sentiment quickly. Greece isn’t immune to macro tremors…it’s just not the first house to shake anymore.Liquidity and Access

Outside of GREK, you’re dealing with ADRs or direct ASE exposure. Thin trading volumes can punish you in a hurry if the tide turns.

Who Should Care…and Who Should Stay Away

If your idea of investing is “buy S&P, hope it goes up,” this isn’t for you.

But if you:

Think 10x earnings is better than 22x.

Like getting paid 4–5% dividends while you wait.

Want a hedge against U.S.-centric portfolios.

…then Greece might be worth a look.

How We’re Playing It

We took a modest position in Greek equities through GREK and a basket of individual names back in 2024. That position is now one of our top performers this year.

We haven’t added into the rally…but we haven’t sold either. Because unlike the momentum-chasers, we didn’t buy Greece for the headlines.

We bought it for the math.

And the math still works.

A Blueprint for Exploring Greece Now

Want to go deeper? Here’s how to approach it:

Step 1: Track the GDP Beat

Greece is projected to grow 3.2% in 2025…twice the Eurozone average. If it keeps beating, earnings will follow.Step 2: Monitor EU Capital Flows

The NextGenerationEU fund is a structural tailwind. If the cash keeps hitting the ground, Greece’s fiscal trajectory stays intact.Step 3: Focus on Income + Growth

Banks offer yield and upside. Add exposure to tourism and infrastructure for diversification.Step 4: Don’t Chase, Don’t Panic

If you’re not in yet, wait for a pullback. This is a multi-year story, not a Q3 trade.

Closing Thoughts: The Door’s Not Shut Yet

Markets are forward-looking machines. But they’re also dumb. They overlook what’s hard to explain and slow to react when unloved turns to unstoppable.

That’s what Greece is right now…a market most people still associate with debt crises and riots, even as it posts the best returns on the planet.

The opportunity isn’t to chase what’s already moved.

It’s to understand why it moved…and ask yourself if the story has legs.

We think it does. And we’re still holding.

Join the Insider Community

At Capitalist Exploits, we spotted Greece’s potential in 2024, adding it to our Insider portfolio months before the 2025 surge.

Our team scours the globe for asymmetric opportunities—markets and assets ignored by the masses but poised for outsized returns.

Whether it’s Greece, Argentina, or the next hidden gem, we provide actionable insights to help you build wealth over the long term.

To get started, subscribe to our free Insider articles on Substack for weekly market analysis, investment ideas, and updates on trends like Greece’s rally.

For deeper dives, including our full portfolio recommendations and real-time trade alerts, join the Insider service at capexinsider.com.

Our premium members get access to our proprietary research, risk management strategies, and a community of like-minded investors.

Don’t miss the next Greece.

Subscribe to the Insider Newsletter at substack.capitalistexploits.at/subscribe or unlock the full Insider experience at capexinsider.com.

Your portfolio deserves an edge…let us help you find it.