The Myth of Asymmetry

Is asymmetric investing a golden ticket or just a seductive illusion? The real edge lies where markets misprice risk—not in lottery-ticket speculation. Are you looking in the right places?

“It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.” – Mark Twain

If there were a magical investing strategy that allowed you to consistently turn pocket change into generational wealth while reducing your risk to near zero, everyone would be doing it. The financial world would have no losers, and every investor would be a billionaire.

Of course, that’s not the world we live in. But that doesn’t stop Wall Street marketers, growth-stock evangelists, and crypto moonboys from throwing around one of the most misunderstood words in finance: asymmetry.

The promise of asymmetric investing is simple: make bets where the upside is enormous while keeping the downside limited. The phrase has an elegant appeal to it, like a scientific law that could be etched in stone.

But in practice, most so-called "asymmetric" investment strategies are little more than wishful thinking. They focus on potential jackpots while ignoring the far more critical element—the true probability of success. And in today’s speculative frenzy, that failure has consequences. So let’s dive in and discover what too look for, and what to avoid when it comes to real asymmetric investing.

The Real Risk: Unknown Unknowns

The biggest mistake investors make is assuming they can quantify risk using standard models. Analysts comb through financial statements, track price-to-earnings ratios, study volatility metrics, and construct elegant Monte Carlo simulations to calculate expected returns.

But the problem is that none of these models account for the most dangerous type of risk: unknown unknowns.

Every single investment exists within a complex, chaotic system of macroeconomic forces, geopolitical developments, regulatory changes, technological disruptions, and sheer randomness.

No risk model can predict the black swan event that wipes out an industry, the political decision that cripples a market, or the unforeseen breakthrough that renders a company’s competitive edge obsolete overnight.

This is why betting on a stock that could go up 10,000% is meaningless if your odds of success are lower than winning the lottery.

History’s Greatest Illusion: The Lucky Genius

The financial media loves to celebrate the outliers. The lucky few who stumbled into asymmetric windfalls are anointed as investing geniuses.

The guys who bought Facebook stock at $5, the venture capitalists who backed Amazon in a garage, the crypto bros who aped into Bitcoin at $50—these are the stories plastered across CNBC and Twitter.

But what you don’t hear about are the thousands of companies, projects, and investment ideas that failed miserably. The graveyard of startups from the dot-com era alone could fill a thousand Harvard case studies.

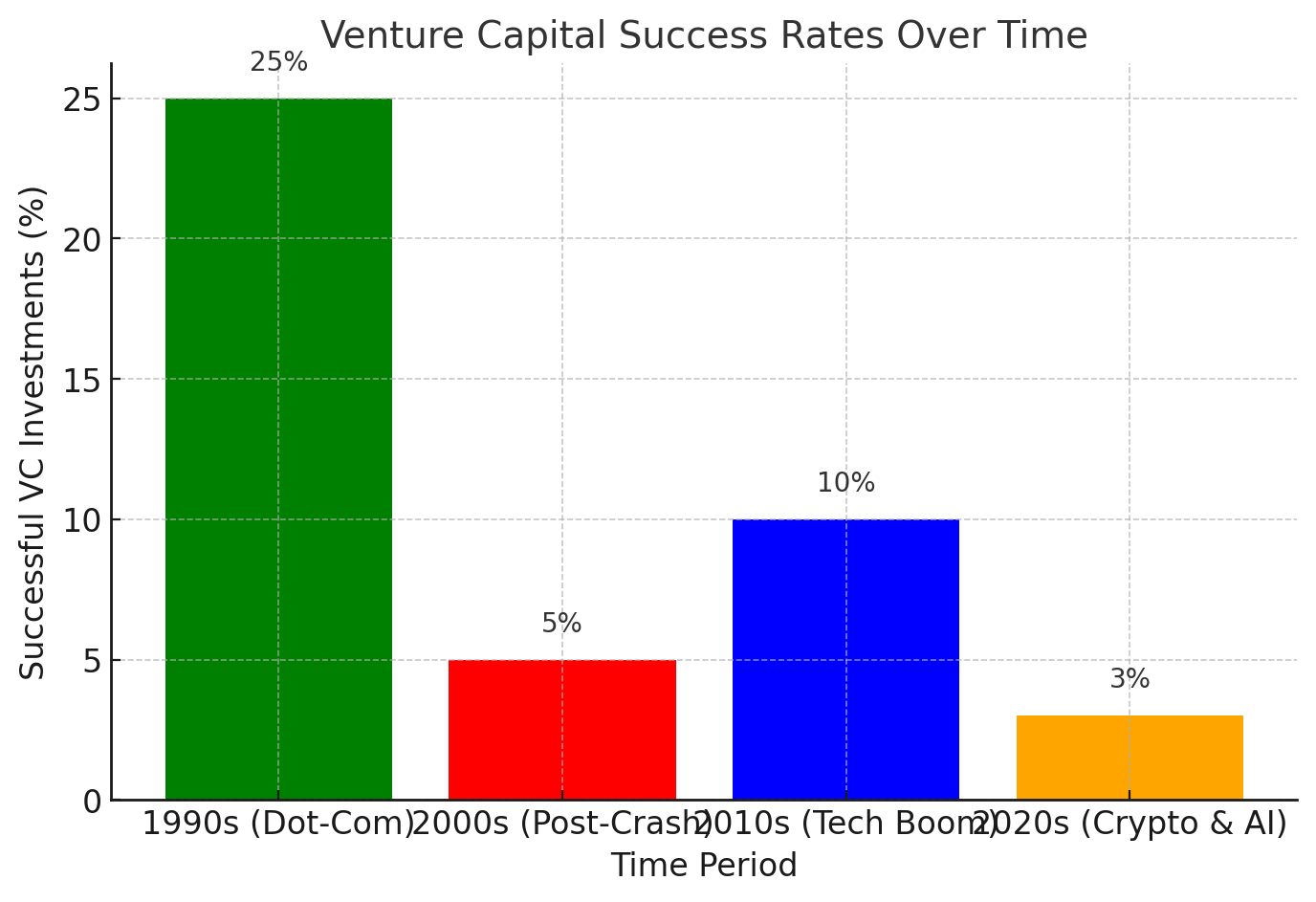

In the late 1990s, Silicon Valley venture capitalists were riding a wave of 10x and 100x returns. One in four of their investments hit the jackpot. But after the bubble burst, those odds shrank to one in 20.

The difference wasn’t the brilliance of stock pickers—it was the macro environment.

When capital floods a sector indiscriminately, fortunes can be made almost by accident. But when the tide goes out, even the best investors struggle to make money. The same pattern is playing out in the tech and crypto markets today.

The Crypto Mirage

Every crypto cycle, there is no shortage of people claiming to have found the next Amazon or Apple in the world of blockchain and decentralized finance.

And while it’s true that some companies in this space could become trillion-dollar giants, the vast majority are overhyped, overvalued, and running on borrowed time.

Investing in an unproven technology that requires dozens of unknown variables to align perfectly is not asymmetric investing—it’s just gambling with extra steps.

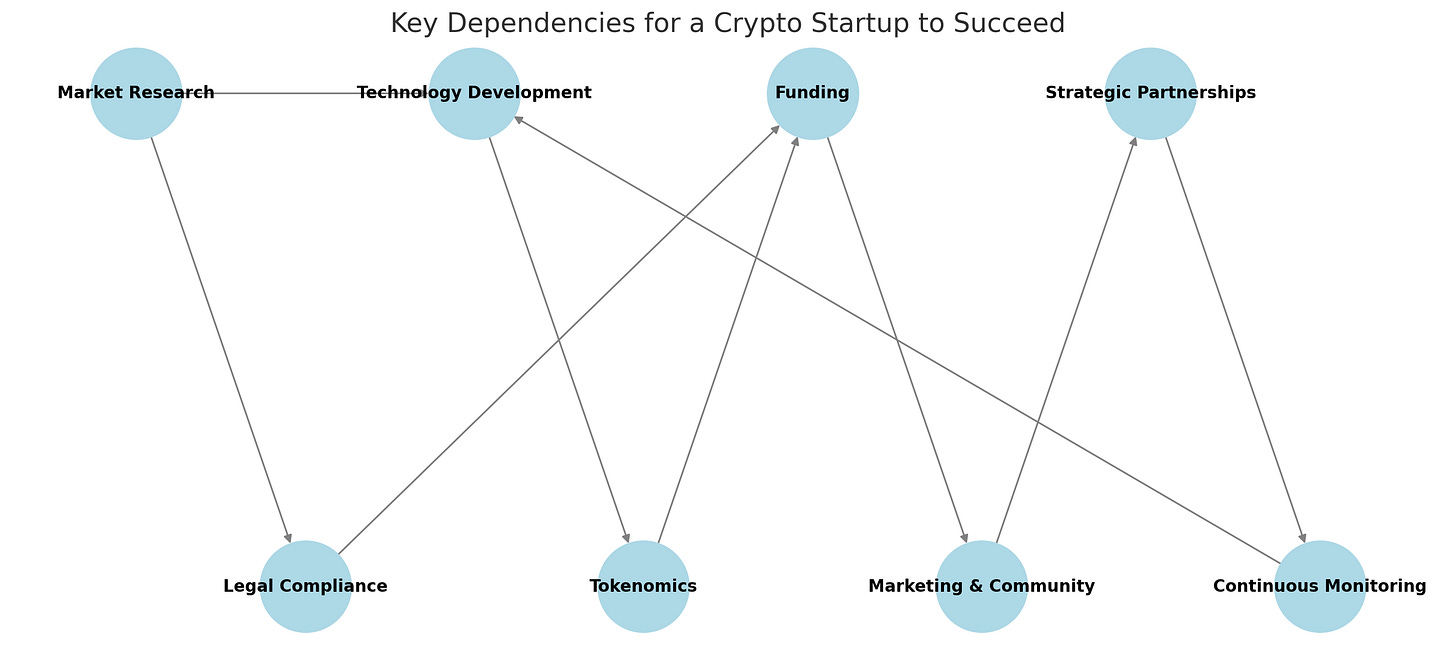

To properly assess asymmetry, you’d need to:

Study every competing project and their technological roadmaps.

Analyze the incentives of venture capitalists and large stakeholders.

Map out the evolving regulatory landscape in every major market.

Track the behavior of retail investors, market makers, and whales.

Forecast adoption timelines and market saturation curves.

Even with unlimited time and resources, no team of analysts could do this with certainty. That’s why most bets in emerging industries are high-risk, high-reward, not asymmetric.

True Asymmetry: The Overlooked Edge

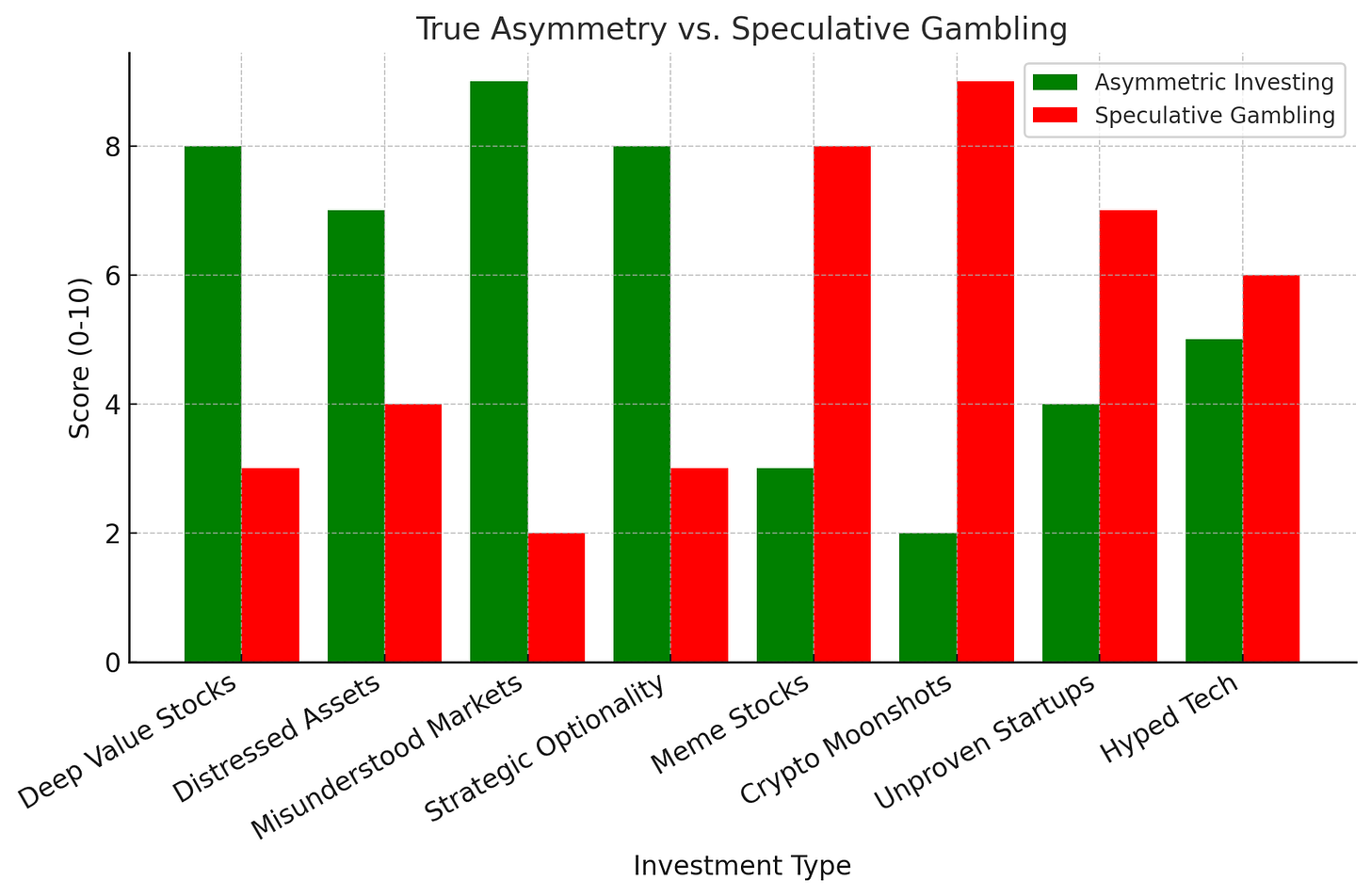

Real asymmetric investing doesn’t rely on hype cycles, narratives, or wild speculation. It exists in places where the market has mispriced risk.

Some examples include:

Deep value stocks: Companies trading at a discount to their intrinsic value due to temporary, fixable issues.

Distressed assets: Businesses with strong fundamentals but caught in short-term liquidity crises.

Misunderstood markets: Sectors ignored by mainstream investors due to complexity or stigma (think uranium in 2016 or energy in 2020).

Strategic optionality: Investments where the downside is capped due to hard assets or cash flows, while the upside remains open-ended.

Finding these opportunities requires patience, discipline, and the ability to go against the crowd. It means embracing areas where capital is scarce, sentiment is terrible, and few people are paying attention.

The Real Game

Most investors chasing asymmetric returns are playing the wrong game. They bet on moonshots with unquantifiable risk, lured in by the seductive promise of hitting it big.

But real asymmetry isn’t about taking blind leaps of faith—it’s about recognizing mispriced opportunities in industries and sectors where the market is wrong.

If you’re serious about making money, stop looking for the next crypto lottery ticket or the next "guaranteed" 100x stock. Start looking where nobody else is willing to go, where the downside is known, and where the upside isn’t already priced in. - Chris MacIntosh

That’s the real secret to asymmetric investing.

And if you think the next Facebook is lurking in your portfolio, take a long, hard look in the mirror and ask yourself: what if it just ain’t so?

😎 Invest in the same asymmetric opportunities we are: