The Irony of Saylor's "Never Sell" Bitcoin Rule

I just had to share this with you…

It is easily the most ridiculous, absurd, self-loving, arrogant, and silly sign of hubris I’ve come across in a long time.

A lesson of mean reversion is in the making. We have always found, albeit nine times out of 10, that stocks come back to the point at which they went parabolic.

For Microstrategy, that would be $15. We have no position, so frankly don’t care too much. Rather, this remains an intellectual exercise, so let’s see if this plays out this time around.

In the meantime, Saylor is just another actor in the theatre of the markets. A colorful charlatan bamboozling the peasants with the idea that borrowing dollars (being short dollars) to buy Bitcoin (long BTC) is somehow a “treasury” company. Sorry… no.

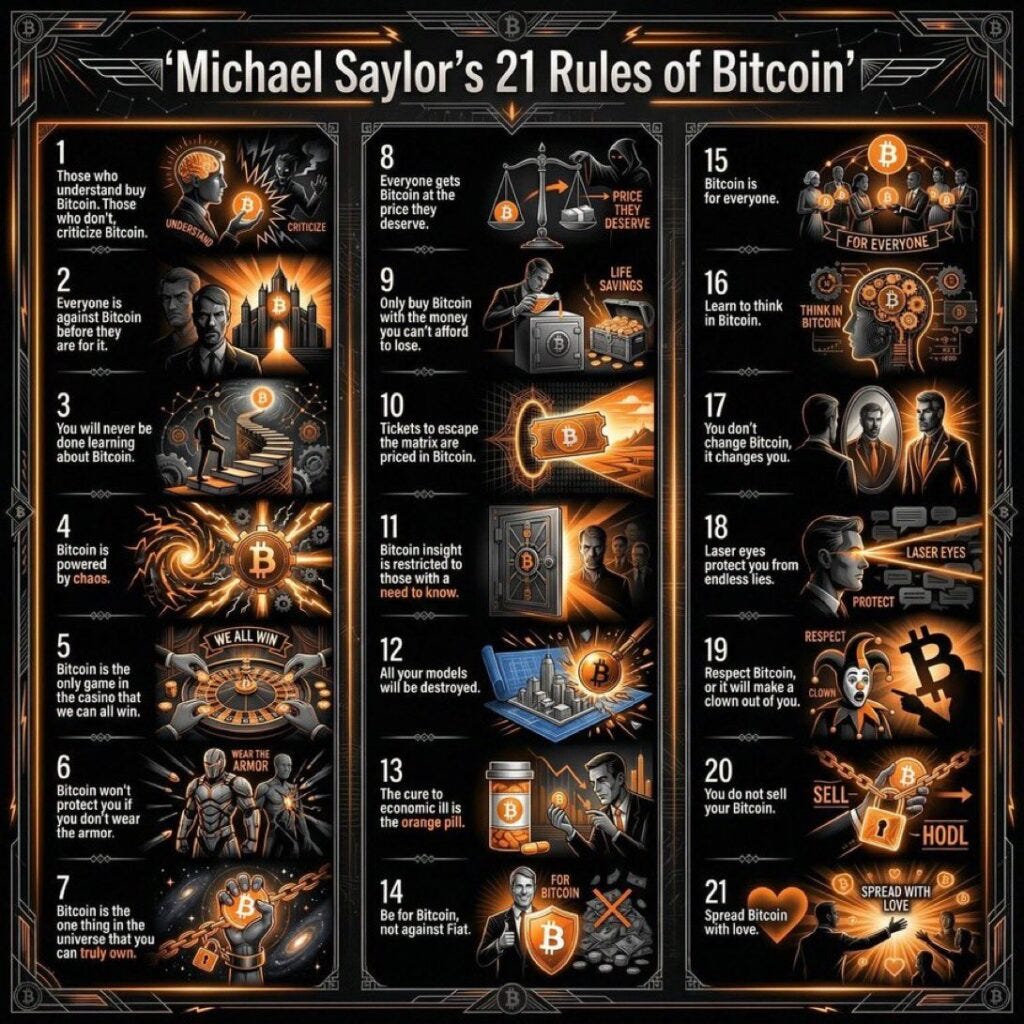

You’re simply levered to a volatile asset while retaining obligations in dollars. The irony is that one of his “rules of Bitcoin” is to never sell, except that now he’s selling Bitcoin to raise dollars. This is what happens when shulbit narratives meet financial realities.

Inside this Issue:

Why Venezuela isn’t about “narco-terrorism” — it’s about energy dominance and Monroe Doctrine 2.0.

How Argentina’s Vaca Muerta just morphed from a “distressed shale play” into a strategic geopolitical asset.

Why capital controls are no longer theoretical — and where smart money moves before they arrive.

How energy access mechanically creates national wealth (and why ESG narratives are collapsing under reality).

Why commodity producers are quietly bottoming while the crowd piles into overvalued megacaps.

Five deeply unloved, deeply asymmetric contrarian ideas most investors won’t touch until it’s too late.

I just recently subscribed. When does the "paid content" get published?