The Hard Asset Trade Turns

Bull markets creep up on folks when they least expect.

Bull markets creep up on folks when they least expect. Unbeknownst to 99.98% of investors across the globe, commodity producers have been hammering out a long-term bottom relative to the world stock market (MSCI World) ever since 2020.

The best representation we could find of the global commodity producer sector is the Fidelity Global Commodity Stock Fund (code FFGCX). Here are the components:

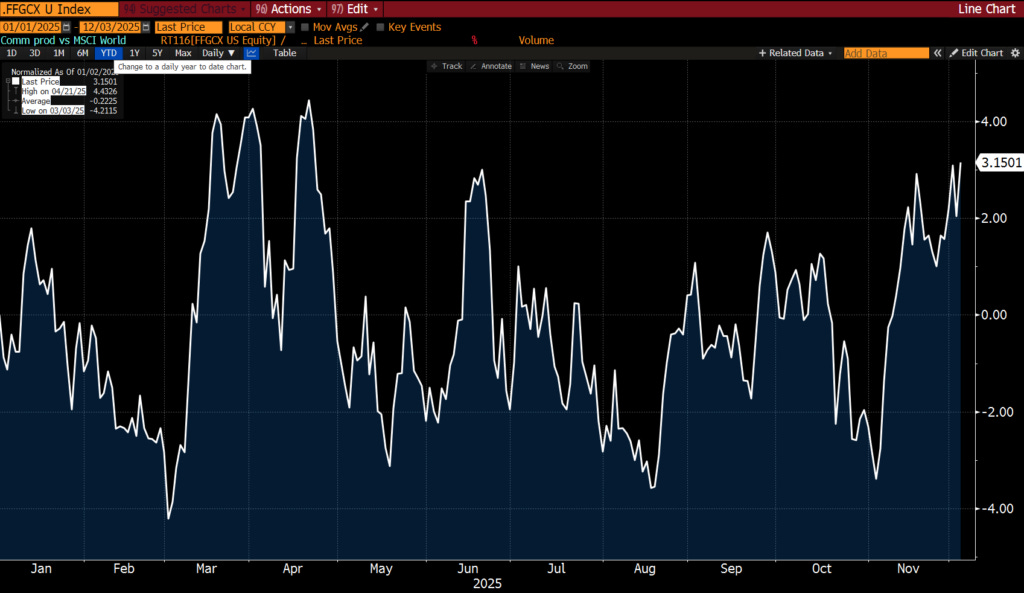

If we look at the performance on a total return basis (gross of dividends), here’s the Fidelity Global Commodity Stock Fund relative to the MSCI World (and indexed to 0):

A few observations:

Commodity producers are way out of favor, the most out of favor from a global industry perspective.

Granted, it’s messy… and we could be accused of seeing things that are just not there. However, it does look like a bottoming process has been in the making ever since 2020.

Few folks would be aware that commodity producers are outperforming year-to-date (okay, only by some 3%, but few would have guessed they have outperformed in the first place).

Even fewer would be aware that commodity producers have performed in line with the world stock market since early 2016.

If we looked at the performance of the Fidelity Global Commodity Stock Fund (FFGCX) relative to the S&P 500, the outperformance would be some 6% year-to-date.

Granted, it isn’t 20%, but the fact that this is positive in light of all the talk of AI and the weighting of the Mag7 in the S&P 500… this is very significant!