The Value Mirage

Value investing has been left for dead—but history says that won’t last. With growth stocks stretched to extremes, is the long-awaited reversal finally near?

For nearly four decades, investors have been asked to make a choice: are you a seeker of value, or a believer in growth?

The debate is as old as the modern stock market itself, and yet, rarely has the playing field been as tilted as it is today.

If history is any guide—and it always is—this imbalance won’t last forever.

The Eternal Duel: Value vs. Growth

At its core, the battle between value and growth investing is a battle of narratives.

One side preaches patience, prudence, and the long-term payoff of buying solid businesses at a discount.

The other touts innovation, disruption, and the promise of tomorrow’s riches.

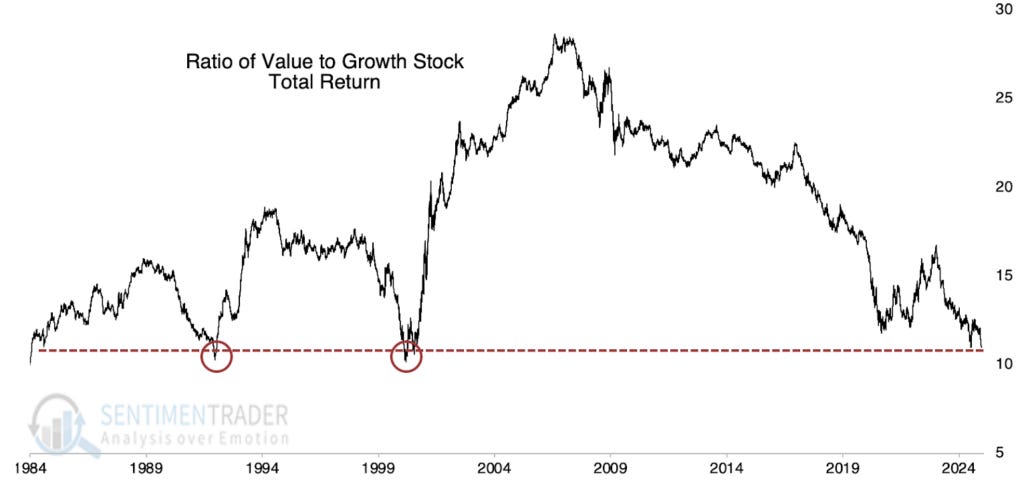

The past 40 years have been marked by a relentless decline in the relative performance of value stocks compared to growth stocks.

Indeed, the concept of "value investing"—once the gold standard of prudent investing—has been so thoroughly beaten down that it now rests at its lowest relative performance level since the early 1980s.

This is not just a passing phase; it is a multi-decade trend that has reshaped global capital markets.

For years, investors have treated this debate as if it were settled—growth stocks have won, value stocks are relics of the past.

But every cycle has its breaking point, and this one is no exception. The deeper we dive, the clearer it becomes: this historic divide is on borrowed time.

The Growth Obsession

Consider the modern investor’s predicament.

The world is awash in easy money, central banks have made a habit of suppressing interest rates, and the dominant players in the market are rewarded for growth at all costs. The result?

A massive overweighting of capital into companies whose valuations depend not on today's earnings, but on hopes and dreams for tomorrow.

As we’ve seen before, the problem with growth stocks isn’t just that they command nosebleed valuations—it’s that they demand perfection.

When a high-flying tech company misses a revenue target by even the smallest fraction, the market swiftly and brutally corrects its expectations.

Meanwhile, value stocks—those plodding, reliable workhorses of the investment world—have been left for dead.

And yet, their relative underperformance suggests something fascinating: they may be the cheapest they’ve been in generations.

We’ve seen this movie before—an era of cheap money, an infatuation with high-flying stocks, and a market convinced that “this time is different.”

But markets have a way of humbling even the most confident investors.

The cracks in the growth narrative are already forming.

The only question is, what happens when they become impossible to ignore?

A 40-Year Low for Value

If we step back and look at the bigger picture, the divergence between growth and value stocks has never been more extreme.

Consider the dot-com bubble, the last time growth stocks reached such an absurd valuation premium.

When that bubble burst, value stocks entered a period of massive outperformance that lasted nearly a decade.

Could we be on the cusp of another reversal?

The conditions are eerily similar: sky-high valuations, speculative euphoria, and a general disdain for anything that isn’t promising triple-digit revenue growth. The only thing missing is a trigger.

If the last great value resurgence came in the wake of the dot-com collapse, then today’s setup should make investors take notice.

The valuations are even more stretched, the speculation even more extreme.

The question isn’t whether value will make a comeback—it’s whether you’ll be positioned before it happens.

Value’s Last Stand?

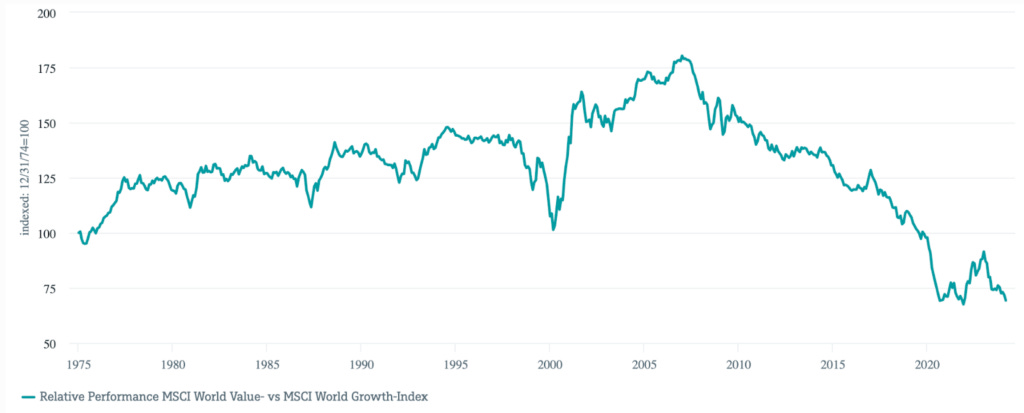

The global picture is just as bleak for value investors.

If the U.S. market’s preference for growth stocks is bad, the global market is even worse.

The relative valuation gap between value and growth worldwide is now wider than at any point since the early 1970s—far eclipsing the extreme levels reached during the dot-com mania of the late 1990s.

The implications of this are profound.

If history repeats itself, value investing—now an almost forgotten art—could be on the brink of a major renaissance.

The market’s obsession with growth at all costs has left countless undervalued companies trading at generational lows.

When sentiment shifts, the snapback could be extraordinary.

History is clear: when the market reaches this level of extreme dislocation, the reversion is swift and brutal.

The world has forgotten value investing, dismissing it as an outdated relic.

But markets have a habit of reminding people—violently—why fundamentals still matter.

Small Caps in the Same Boat

And it's not just large-cap stocks feeling the pain.

The same imbalance extends to small caps, where the relative valuation of small-cap value stocks has plummeted to levels rarely seen before.

Investors, it seems, have simply lost patience for anything that doesn’t promise immediate, explosive growth.

But here’s the thing: the world doesn’t change overnight. Economic cycles still matter.

Market forces still apply.

And when the tide turns, those who have patiently held onto value stocks may find themselves sitting on a mountain of mispriced assets.

The neglect of small-cap value stocks isn’t just a market inefficiency—it’s a historic anomaly. But anomalies don’t last forever.

When sentiment shifts, the opportunity in these overlooked names could be staggering.

The Market Always Corrects

So, what’s an investor to do?

If history is any guide, the answer is simple: bet against consensus.

The market has never stayed this lopsided for long, and it won’t this time either. When the rotation begins, the reversal could be violent.

The best opportunities tend to come when the world has fully convinced itself that an idea is dead.

Value investing isn’t dead—it’s just waiting for its moment.

And if history tells us anything, that moment is coming.

Every cycle has an expiration date. Every mania ends. And when this one does, those who bet against consensus—who saw through the growth illusion—stand to reap the rewards.

The question is: will you be one of them?

The market’s extreme imbalance won’t last forever—but when it turns, it will turn fast.

Are you positioned for the shift? Do you have access to the insights that will help you capitalize on this rotation before it happens?

🔴 Check out our latest newsletter to gain more insights on this topic.

Disclaimer: Not investing advice! This article is for educational purposes only. Seriously, we really do hope you become a better investor after reading our work. But always do your own due diligence and/or consult with a financial professional before making any investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.