The Clock Is Ticking on the Nuclear Fuel Shortage

Future uranium demand is soaring, supply is shrinking...and yet the buyers aren’t buying. What happens when the standoff breaks and panic sets in?

If fundamentals are screaming and equities are bleeding, something weird is happening.

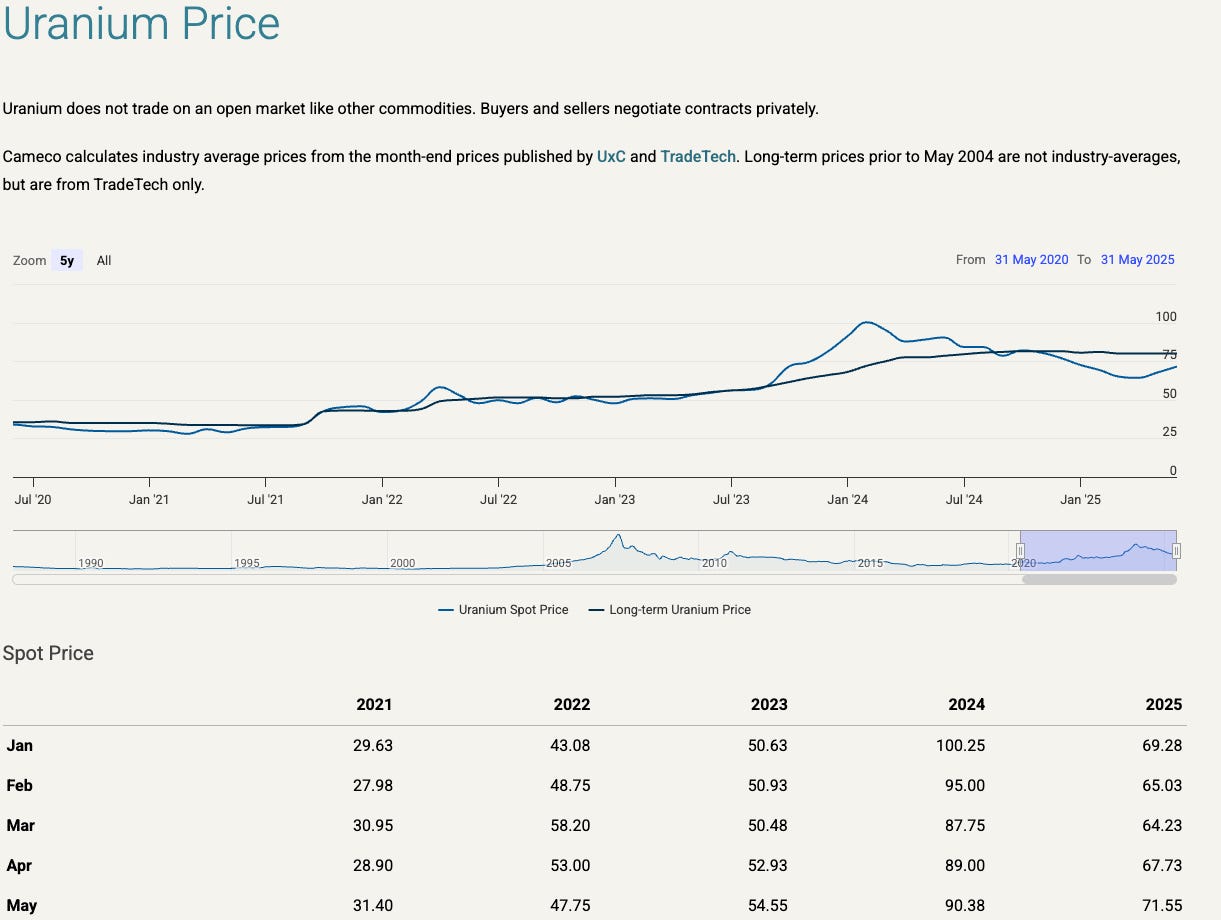

Welcome to uranium investing in 2025, where demand is surging, supply is tightening, and stocks are down 40%, off 2024 highs.

The spot price slumps, the term price spikes, and the only thing more volatile than uranium is investor emotion.

We’re not here to predict price action...we’re here to explore why uranium might be one of the best asymmetric plays in the market, despite the chaos.

The twist? Most of the world’s nuclear future rests in the hands of utilities who appear to be… not buying.

Let’s break that standoff wide open.

The Buyer’s Strike

Imagine selling umbrellas during a monsoon, but nobody’s buying because they “already have one.” That’s the uranium market today.

Term prices...what utilities actually pay for their fuel...have surged to 17-year highs around $80 per pound. That’s the real market. The adult table. It governs over 75% of global uranium transactions.

Meanwhile, the spot market, that sideshow casino where hedge funds and newsletter bros love to play, is drifting around 72 bucks per pound. It’s thin, illiquid, and borderline irrelevant.

Only 25%–26% of uranium changes hands there, and utilities...who account for just 4% of spot volume...are barely participating.

Why the disconnect?

Utilities have been lulled into complacency. Some are drawing down stockpiles. Others are holding out for lower prices.

Many are distracted by political noise: tariffs, Russian dominance in enrichment and conversion (30%–40% of those markets), and a spot market so thin it can’t sneeze without tanking the price.

But the math doesn’t lie. We’re burning more uranium than we’re digging up.

The Real Supply Crunch

The world burns 190–200 million pounds of uranium yearly to power 440 reactors, with 65 more under construction.

Add in extensions, up-rates, and restarts...like Microsoft’s Three Mile Island revival, eating 500,000 pounds per reactor annually...and demand is relentless.

Supply?

A total mess.

Encore Energy fumbled production. Floods hit Kazakhstan and Namibia. NexGen’s Rook I won’t see daylight until 2030, maybe later.

Since early 2023, nearly half of expected production has vanished.

Kazatomprom, the world’s top dog, saw costs soar to $30 per pound in 2024, despite a Kazakhstani tenge that’s weakened 40% since their IPO projections.

We’re staring at a 10–40 million-pound annual deficit, with 2.1 billion pounds of uncovered demand by 2040.

That’s not a gap...it’s a canyon.

When Everyone Waits… Nobody Wins

In 2025, only 25 million pounds have been contracted so far. That’s 40% of what’s needed just to maintain the status quo.

Utilities are playing a game of chicken...waiting for someone else to blink first.

But inventories are thinning, with most holding just 2–3 years’ worth of fuel, per Euratom and Western standards.

They’re also sidetracked, scrambling to secure enrichment and conversion capacity amid Russian supply risks.

This is not the kind of commodity you want to panic-buy.

When the switch flips...whether from geopolitics, a supply shock, or sheer inventory panic...the price won’t just rise. It will melt faces.

Investing in the Miners (or Just Riding the Wave)

Uranium equities are levered plays on the underlying commodity. The logic is simple: when uranium runs, the miners run faster.

But if you think you can stomach the swings, remember that 2025 has already gifted investors a 40% drawdown. And if the broader market tanks...say, the S&P 500 falls below 5000...smaller names could get crushed.

For those who prefer fewer sleepless nights, ETFs like URNM (Sprott Uranium Miners ETF) and URA (Global X Uranium ETF) offer a diversified way to play the sector without the roulette-wheel risk of betting on one explorer with no cash flow.

URNM focuses more heavily on miners. URA includes nuclear infrastructure companies as well. Both track the uranium theme. Neither will protect you from volatility.

For exposure to the metal itself, SPUT...the Sprott Physical Uranium Trust...holds 66 million pounds of the stuff.

Think of it as the “vault play,” though it’s stuck trading at a discount to NAV, limiting its market muscle since 2023, when it accounted for just 6% of spot volume.

The Kings of Yellowcake

A few titans dominate uranium production:

Kazatomprom (Kazakhstan) – Produces 40% of global supply (60 million lbs/year). Low-cost, but fighting inflation and a tenge that’s depreciated from 340 to 500, eroding margins despite earlier projections of $11.50 per pound.

Cameco (Canada) – Athabasca Basin royalty, 22.4 million pounds in 2025, and blessed with long-term contracts indexed to term pricing.

Orano (France) – A solid 18 million pounds annually from three continents, though Niger’s instability casts a long shadow.

These aren’t meme stocks. They’re the backbone of global energy security. But even they’re grappling with higher costs, delays, and political uncertainty.

Dividends? Don’t Hold Your Breath

Looking for income from uranium stocks? Don’t.

Most players are pouring every dollar back into operations.

Even Cameco...far and away the most mature of the bunch...pays a token 0.2% dividend (CAD 0.12 per share).

This is not a dividend sector. It’s a growth sector. You’re buying these stocks for capital appreciation, not yield.

Digging in the Canadian Shield

Canada’s Athabasca Basin is the Fort Knox of uranium. With grades hundreds of times higher than global averages and stable geopolitical risk, it’s a premium region.

But even in Canada, nothing moves fast. Environmental reviews, local politics, and permitting bottlenecks slow everything down.

Still, for those seeking long-term upside in stable jurisdictions, this is where you go prospecting.

The Simple Way to Ride the Cycle

You don’t need to become a uranium geologist to profit from this sector.

A 5–10% portfolio allocation to something like URNM captures the theme.

It owns majors, juniors, and everything in between. It rides the cycle without demanding you choose the right horse.

Want more torque? Add SPUT or layer in a few high-conviction bets after doing your homework. But be prepared to get shaken. These stocks disappear into the basement before heading for the moon.

The Clock Is Ticking

The uranium story isn’t just a resource story. It’s a geopolitical, technological, and behavioral story all rolled into one.

Small modular reactors (SMRs) could drastically increase demand. Government subsidies are already flowing. And the anti-nuclear stigma is finally breaking, even in places like Germany and California.

Utilities, sitting on dwindling stockpiles and mounting regulatory uncertainty, are one headline away from panic-buying.

Once the contracts start flying, the game changes.

The Setup from Hell (for Utilities)

They’ve waited too long. The shelves are thinning. The miners are limping.

And the rest of the world is quietly building reactors and loading fuel.

If you believe in mean reversion, uranium isn’t just “interesting.” It’s potentially explosive. But like any asymmetric bet, it demands one thing:

Conviction.

And in 2025, that’s in short supply.

So… what happens when the buyer’s strike ends?

Let’s revisit that term price. $80… and climbing.

How high will it go before the silence breaks?

We’ll see you in the core.

🔴 Invest in the same things we are…

Kazatomprom has been paying good dividends for years. I don't say Uranium and miners even more won't skyrocket, as have done already several times, but I am deeply skeptical of any market statistics, as market is deeply non-transparent. One has always have to have in mind, that Uranium isn't used used solely for electricity, therefore it is absurd to excpect that governments would show the real stockpiles. and then is also always question of secondary supply, from old weapons