The $16 Billion Backfire

Argentina just got slapped with a $16.1B bill for a 2012 oil grab...and it might be the best thing to happen to YPF. But will Milei let go?

“Every government enterprise begins as a noble crusade and ends as a bloated disaster.” — Tax Payer

Nationalization by Hubris, De-nationalization by Court Order

If you ever needed a case study in how governments ruin what they touch, Argentina’s oil saga has just gifted us the deluxe edition…platinum cover, embossed legal filings, and all.

On June 30, 2025, a U.S. federal judge dropped a $16.1 billion wrecking ball on Argentina, ordering the country to surrender its controlling stake in YPF SA, the national oil and gas crown jewel. The reason?

A 2012 move by the Argentine government to seize majority control of YPF from Spain’s Repsol without bothering to read the fine print. That decision, bold and bombastic at the time, has now detonated spectacularly.

But here’s the twist: this might be the best thing to happen to YPF in decades.

Could it be that losing control is the only way Argentina regains it?

Let’s rewind, just for a second.

The $16.1 Billion Mistake That Took 13 Years to Bloom

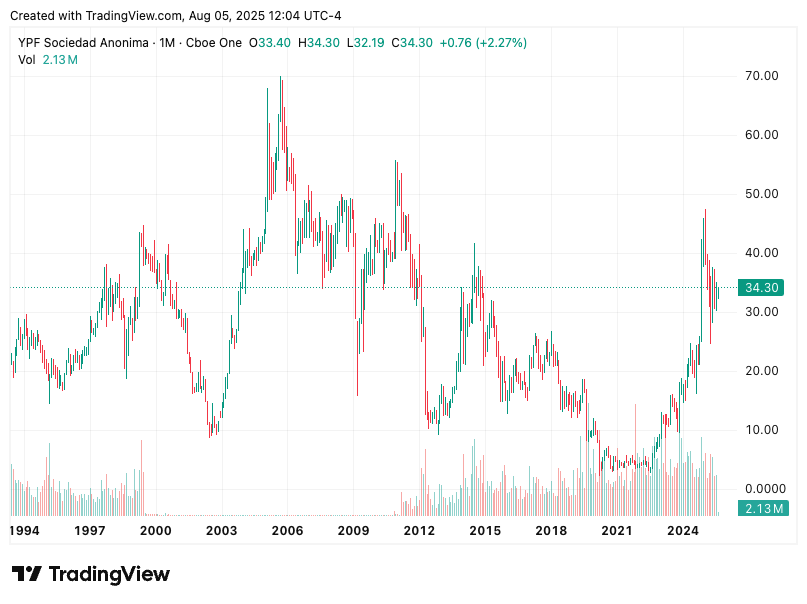

YPF wasn’t always a punching bag.

Back in 1922, it was the world’s first fully state-owned oil company. That worked, briefly. Then the 1990s happened, and privatization took over. Spain’s Repsol ended up with the keys.

Enter Cristina Fernández de Kirchner in 2012, fueled by nationalism, political theater, and what can only be described as economic fan fiction.

Her administration grabbed 51% of YPF, citing the “public interest.”

The real reason?

Votes and headlines.

But there was a tiny hitch…they forgot about the minority shareholders.

Turns out, publicly traded companies have rules.

One of them is: if you buy a controlling stake, you have to make a tender offer to the other shareholders. Oops.

That oversight turned into a decade-long courtroom drama starring Petersen Energia, Eton Park, a very patient litigation funder named Burford Capital, and eventually Judge Loretta Preska, who ruled in 2023 that Argentina owed $16.1 billion in damages.

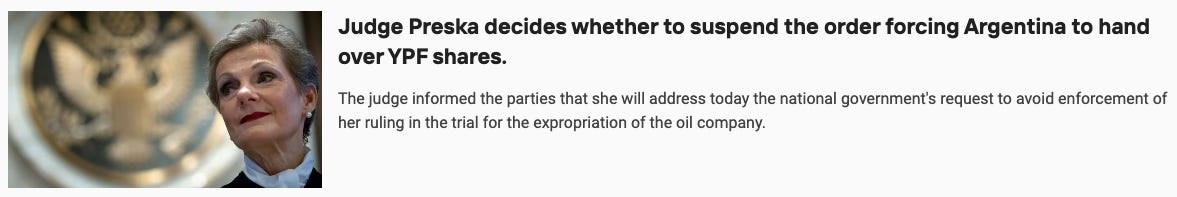

By mid-2025, Judge Preska went further: hand over the shares. Put them in a custody account at BNY Mellon. You’ve got 14 days.

Argentina, now under libertarian President Javier Milei, is appealing. But here’s the real question: should he?

What if this court-mandated unwinding is actually the one path out of Argentina’s energy quagmire?

A Rare Opportunity Disguised as Legal Humiliation

Let’s talk about what the government has done with YPF since 2012.

Spoiler alert: not much.

Sure, YPF reported a $2.4 billion profit in 2024, a pleasant bounce from a $1.3 billion loss the year before, thanks mostly to Vaca Muerta…Argentina’s shale formation that rivals the Permian in scale.

But for a company sitting on 308 trillion cubic feet of gas and 16 billion barrels of oil, progress has been glacial. Bureaucratic drag, political interference, and a lack of capital have kept the firm from fully monetizing its assets.

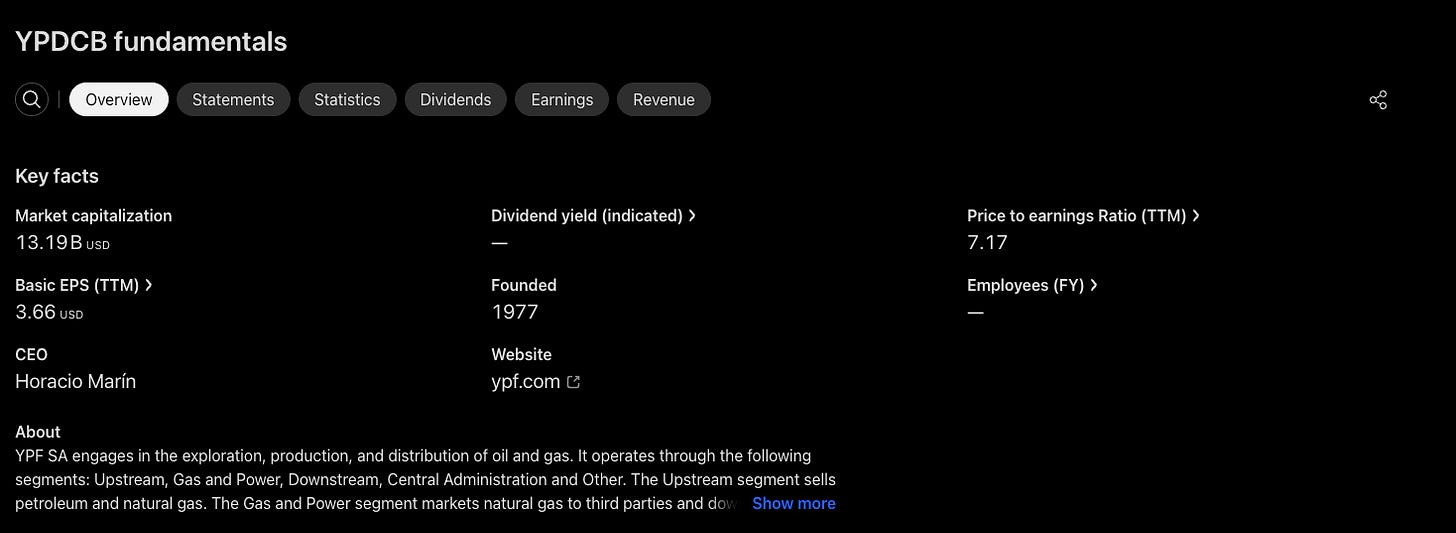

YPF’s market cap today? About $13.2 billion. You read that right. The legal judgment exceeds the value of the company.

If that doesn't scream “governance premium,” I don’t know what does.

Now imagine YPF in private hands.

Imagine ExxonMobil or Chevron getting involved…not as saviors, but as rational actors chasing profit and willing to put billions into Vaca Muerta.

Strip away the political meddling, and the value locked beneath the surface could be unleashed.

But wait…hasn’t this sort of thing been tried before?

Oh yes, and not too far away.

Venezuela’s PDVSA: What Happens When the State Won’t Let Go

Let’s take a field trip to Venezuela.

Once the toast of OPEC, PDVSA used to pump over 3 million barrels per day. Then Hugo Chávez nationalized the oil industry, booted out the talent, and turned PDVSA into a slush fund.

Fast forward to 2025, and PDVSA’s production is below 300,000 barrels a day.

Equipment’s rusted, workers have vanished, and refineries are ghost towns.

Venezuela now imports gasoline.

This is what happens when a government trades engineers for cronies and capital for slogans.

And before you say “Argentina isn’t Venezuela,” remember: YPF was halfway there.

The 2012 nationalization already cost Argentina $5 billion in a settlement with Repsol.

The current $16.1 billion judgment is just the final invoice.

The key difference? Venezuela is still clinging to its failed oil socialism. Argentina, under Milei, is being forced…and perhaps finally willing…to let go.

Nationalization: A Graveyard of Good Intentions

YPF is not an isolated case.

PEMEX in Mexico has become a debt-riddled, production-declining dinosaur.

Bolivia scared off investors by nationalizing gas fields.

Even Norway, often cited as the gold standard, only works because it acts like a capitalist in socialist clothing.

A World Bank study in 2018 found that privatized firms in developing nations see productivity gains of 20–30% within five years. Compare that with the stagnant, subsidy-sucking wreckage that state-run enterprises usually become.

Nationalized firms often serve two masters: economics and politics.

The first demands discipline. The second demands dysfunction.

The result? You get neither.

And now Argentina’s sovereign immunity defense…once a legal get-out-of-jail-free card…has been shot down. The precedent? Foreign governments can’t violate commercial contracts and then cry sovereignty.

That matters. A lot.

Because if Argentina loses the appeal, that $16.1 billion ruling doesn’t just threaten YPF…it could put the brakes on future nationalization fantasies worldwide.

Can YPF Rise From the Ashes?

Let’s be clear: this isn’t a fairy tale. De-nationalizing YPF won’t solve all of Argentina’s problems overnight. But the context has changed…dramatically.

Inflation is finally falling. Fiscal responsibility is being imposed. Milei has slashed spending, stabilized the currency, and brought credibility back to Argentine institutions. The old narratives no longer apply.

Stripping YPF from state control could inject desperately needed capital and operational expertise into Vaca Muerta.

The formation is already showing signs of life…output rose to 447,000 barrels per day in March 2025, up from 354,000 the year before.

That’s the market’s signal: the geology is sound. What’s lacking is structure.

And if Burford Capital and its clients don’t actually want to run an oil company…if they’re angling for cash or bonds instead of board seats…that opens the door to real energy companies stepping in.

Yes, there will be political fallout. Milei’s economic reforms are already controversial.

Losing YPF might sting national pride. But economic survival tends to trump emotion, especially with a President who has made it clear that the days of state-owned everything are over.

Lessons in Letting Go

The painful truth? Governments aren’t designed to run companies. They’re designed to extract taxes, draft legislation, and hold elections. Anything beyond that usually ends in tears.

Argentina has a choice. It can keep pretending YPF is a “strategic asset” best run by bureaucrats. Or it can face the music, let go, and unlock the full potential of one of the most valuable shale formations on the planet.

The legal ruling might feel like a punishment. But it’s actually an opportunity.

A painful, humbling, billion-dollar opportunity.

So what now?

Will Milei double down on the appeal, or let the market finally breathe life into YPF?

Will Argentina cling to failed models, or chart a new course through de-nationalization?

And the real question...

Will anyone in Buenos Aires be brave enough to say what everyone’s thinking…that maybe, just maybe, the state never should’ve been in the oil business to begin with?

The clock is ticking. And every day that passes adds $2 million more to the tab.

Tick. Tock. Tick. Tock.

Venezuela brings back many memories of working in O&G with genuinely talented Venezuelan petroleum engineers who had fled the Chaves industry destruction to the UK. I wonder where they've gone now with Milliband's net zero destruction?

Ye old chainsaw’s revenge. Eina.