Steady as She Goes

Offshore oil is battered, bruised…and brimming with opportunity. But will patience pay off before the herd catches on? The real game starts here.

"The market is a device for transferring money from the impatient to the patient." - Warren Buffett

If you’ve ever found yourself staring at a screen full of red and wondering if you’re the crazy one…congratulations. You’re officially an investor.

In the wild world of capital markets, patience is not just a virtue; it’s a survival tactic.

And nowhere is this clearer than in the story unfolding today around the battered, bruised, and bewilderingly overlooked sector of offshore oil.

While the herd stampedes toward the latest shiny object…The Bag 7, crypto, and the latest news headline…savvier hands are looking elsewhere.

Somewhere cheaper. Somewhere forgotten. Somewhere brimming with opportunity.

And they’re doing it with a cold beverage in one hand and a spreadsheet in the other.

But let’s not get ahead of ourselves.

Betting Against the Crowd

First, a confession: markets are cruel teachers.

They lure you in with promises of easy riches and then, just when you think you’ve figured it out, they rearrange the furniture and slap you upside the head.

One Capitalist Exploits member recently posed a deceptively simple question: when do you know it's time to double down on a beaten-up sector like offshore oil?

It’s a million-dollar question. Maybe a billion-dollar one. And it demands a straight answer.

So let’s dive into it.

The Core Strategy: Buy Cheap, Hold Long

At Capitalist Exploits, the strategy could be printed on a bumper sticker:

Buy what’s cheap. Avoid what’s expensive. Hold for years. Ignore the noise.

Simple. But far from easy.

Because cheap things? They can get cheaper. And then cheaper still.

That's where most investors lose their nerve. They confuse volatility for risk. They chase the high-flying sectors. They panic at the first whiff of a downturn.

Meanwhile, the pros are quietly picking through the wreckage.

But how do you know when something’s truly cheap…and not just a falling knife?

Here’s where probabilities, not crystal balls, come into play.

Valuations and Cycles

Imagine you’re eyeing offshore oil stocks.

For simple math, let’s say they hypothetically trade on average around a 10x or 11x price-to-earnings (P/E) ratio. That’s their "normal" range.

Now imagine they’re sitting at 7x P/E.

Is that a screaming buy?

Maybe. But not necessarily.

You check the sector’s cycle history.

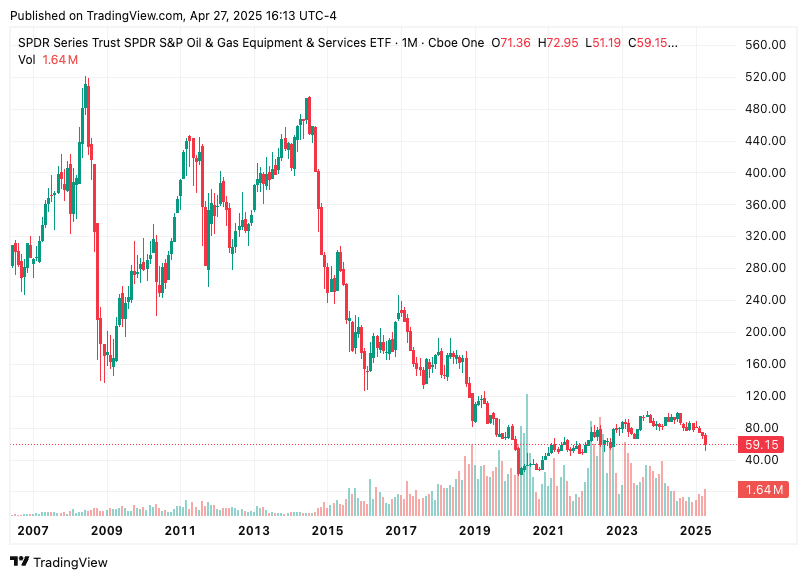

Offshore oil tends to have vicious, decade-long busts. Eleven years into a down-cycle? That's when smart money starts poking around.

It’s not about catching the bottom.

It’s about tilting the odds in your favor…stacking the probabilities so that, over time, you come out ahead.

You’re not playing roulette. You’re counting cards in a casino full of day traders.

Just ask anyone who stuck with uranium through its nuclear winter years ago. They waited. And waited. And waited.

Four long years of ridicule and underperformance.

And then... BOOM.

The payoff came.

And the cycle turned.

The Ego Trap: “I Know Better”

Nothing gets investors into trouble faster than ego.

Doubling down on a deep-value stock that's tanked feels bold. It feels smart. It feels like something out of a Michael Lewis book.

But most of the time, it feels that way because your ego is writing checks your portfolio can't cash.

You’re not just making an investment. You’re making a statement: "I know better than the market."

Sometimes you do. More often, you don’t.

That’s why portfolio management matters.

You don’t "bet the farm" on anything, no matter how cheap it looks.

You size your positions with humility, knowing that even the best analysis can (and will) be wrong half the time.

Offshore Oil: A Different Beast in 2025

Now, let’s get specific. Offshore oil.

Back in 2019, you’d have needed a death wish to pile into offshore names.

Debt levels were a disaster. Oil prices were shaky. The companies were teetering between survival and bankruptcy.

Buying more after a dip? That was playing Russian roulette…with all six chambers loaded.

But it’s not 2019 anymore.

It’s 2025. And the landscape has changed.

The debt bombs have been defused. Balance sheets are cleaner. Backlogs are growing.

Subsea service companies are booked solid for three years out. Three years!

That’s a massive green flag.

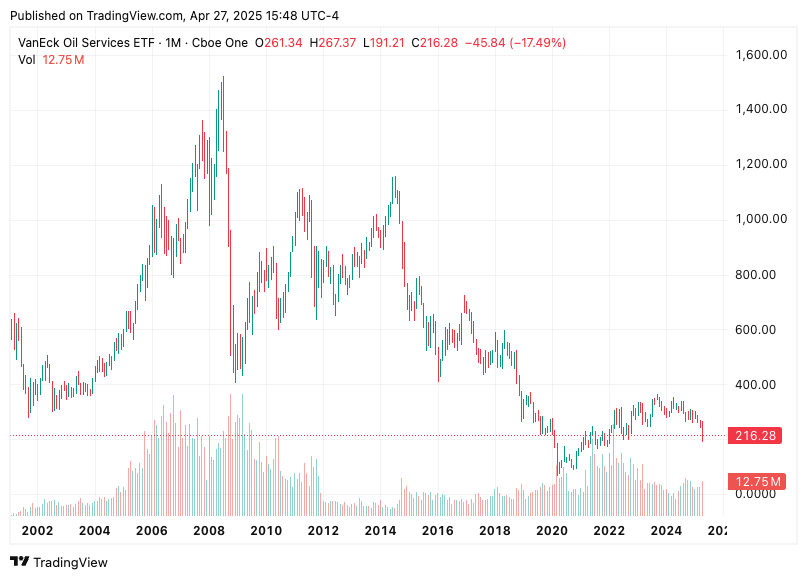

Companies like Vallourec (pipeline and drill pipe manufacturing) and Noble (offshore drilling) are no longer bankruptcy plays.

They’re cash machines.

And they're still cheap.

But Wait…Isn’t Trump Making Waves?

Cue the headline panic: “Trump Shock Rocks Markets!”

Sure. Tariffs. Trade wars. Tweets.

All very exciting. All very loud.

But the fundamentals? The stuff that actually drives multi-year investment theses?

They barely budge.

Offshore oil companies aren’t selling drill ships to Trump. They’re selling to countries and corporations desperate for energy.

The Trump shock is a blip. A noisy blip. An opportunity in disguise.

Timing the Turn: Good Luck With That

Here’s the harsh truth:

Nobody rings a bell at the bottom.

Nobody throws a parade when the cycle turns.

You won't get a notification on your phone saying, "Congratulations, you have perfectly timed the market!"

Instead, you buy when the odds are tilted. You hold when it’s boring.

And you resist the urge to tinker when the inevitable pullbacks happen.

Patience isn’t just a virtue.

It’s a weapon.

Fact-Check Reality

Let’s anchor this with hard numbers.

According to the International Energy Agency, global oil demand is projected to rise by 1.2 million barrels per day in 2025.

However, recent reports have indicated that this projection has been revised downward due to factors like escalating trade tensions and economic uncertainty, as reported in April 2025.

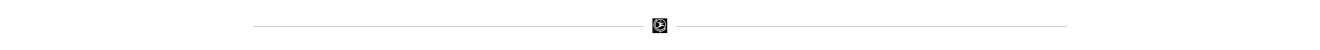

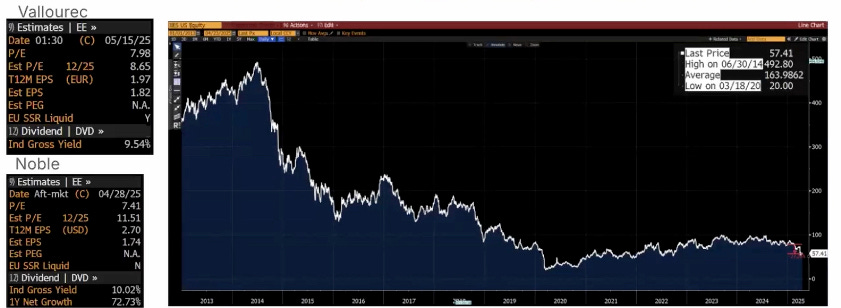

Meanwhile, offshore rig counts?

Still below 2014 levels despite surging demand, as reported by the U.S. Energy Information Administration.

And the companies?

Vallourec hits target of zero net debt one year ahead of plan.

Noble boasts a $7.2 billion backlog, with 80% of its fleet locked into contracts through 2027, according to their latest earnings report.

These aren’t hopes and dreams.

They’re facts.

And they paint a picture very different from the one most investors are seeing.

Cash Versus Assets: The Real Tradeoff

If you’ve got cash sitting around, averaging down on quality offshore oil names makes all kinds of sense.

Cash is losing value every year thanks to inflation.

Hard assets?

They don’t just survive inflation.

They thrive on it.

Patience, discipline, and smart positioning have always been the keys to unlocking asymmetric returns.

But what if the biggest opportunities aren't just surviving in the wreckage…but quietly gathering strength?

If you’re thinking about selling other positions just to pile into more offshore oil, tread carefully.

Your portfolio is positioned-sized (0.5% -2% per ticker) for a reason.

Don’t turn it into a one-legged stool because you got excited.

Lessons From the Trenches

The greatest danger isn’t the Trump shock.

It’s your own emotions.

When prices wobble, when Twitter is screaming, when your neighbor is bragging about their AI stock portfolio...

That’s when the mistakes happen.

That’s when the discipline crumbles.

That’s when portfolios die.

But if you can keep your head while others are losing theirs?

You’ll come out the other side battered, bruised... and likely beating the market.

Play the Long Game

Our Insider member asked a great question.

And here’s the real answer:

The offshore oil sector is cheap.

The fundamentals are solid.

The cycle will turn.

If you’ve got fresh capital, it’s a smart place to allocate.

If you’re already holding, resist the urge to tinker too much.

And if you're hoping for a bell to ring?

You’ll be waiting a long time.

The market isn’t a game of perfect.

It’s a game of probabilities.

Play it like a pro.

Steady as she goes.

⭕️ Markets in chaos, tariffs flying, banks tightening their grip... and yet, value quietly outperforms growth. What’s the real opportunity hiding in the fear?

Disclaimer: Not investing advice! This article is for educational purposes only. Seriously, we really do hope you become a better investor after reading our work. But always do your own due diligence and/or consult with a financial professional before making any investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.