Some Investors Are Batisht Crazy!

This stock is currently trading at a… deep breath… 600x earnings and 100x revenues. Truly batisht crazy! Why are people investing this way and what could they do to get more asymmetric returns?

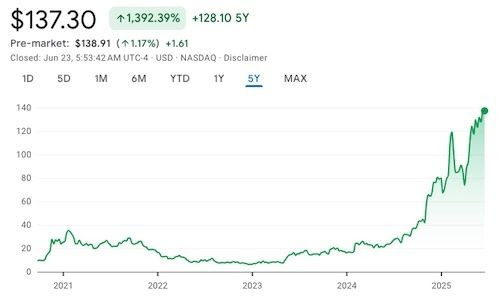

Alright, strap in because we’re about to wade into the madhouse of today’s stock market, where lemmings are hurling cash at overhyped darlings like Palantir Technologies (PLTR), trading at valuations so absurd they make dot-com bubble stocks look like garage sale bargains.

We’ve been shaking our heads at this lunacy for years…Zoom, Beyond Meat, Peloton, you name it…but Palantir takes the prize for sheer insanity.

While the herd chases these Nasdaq and S&P 500 unicorns, we’re out here hunting for real value, the kind that makes your portfolio sing over a 3-5 year horizon.

We’re deep-value, asymmetric investors, and today, we’re exposing why some investors are batshit crazy, what they’re betting on, why it’s a train-wreck waiting to happen, and how you can play the game smarter with themes like, Greek stocks, Argentine markets, shipping, offshore oil, uranium, precious metals, coal, agriculture, and natural gas.

Let’s dive in.

Why Are Some Investors Batshit Crazy?

Picture this: the market’s at all-time highs, and investors are acting like they’re snorting lines of FOMO off the Robinhood trading app.

They’re piling into stocks like Palantir, a darling of the AI hype train, with valuations that defy gravity…~600x earnings and 100x revenues. Why?

Because the crowd’s drunk on momentum, X posts hyping “the next Nvidia,” and the fear of missing out is stronger than a triple espresso.

Palantir’s S&P 500 inclusion last September didn’t help, forcing index funds to buy in and sending the stock into orbit.

But this isn’t about fundamentals…it’s about vibes, greed, and a collective hallucination that numbers don’t matter.

As one X post nailed it, “$PLTR now has a Market Cap of $308B. More than Coca-Cola $KO and $IBM. The market is still trying to figure out how to value a company.”

No isht, Sherlock.

While the herd chases American tech and Nasdaq glitter, we’re scouring the globe for mispriced gems…markets and sectors so unloved they’re practically begging for capital.

Think Argentine markets, shipping, offshore oil, uranium, precious metals, coal, agriculture, and natural gas.

These are where the real asymmetric bets lie, with massive upside and limited downside. Curious why? Stick around.

What Are They Investing In?

Let’s zoom in on Palantir, the poster child for market madness.

Palantir Technologies, co-founded by Peter Thiel, builds data-crunching platforms like Gotham and Foundry, used by governments and corporations to analyze everything from terrorist networks to supply chain hiccups.

Its AI-powered Maven Smart System is a hit with the U.S. military, and contracts are rolling in…$1.28 billion from the DoD alone.

Revenue’s growing fast: U.S. commercial up 54%, government up 40% year-over-year in Q3 2024. With $5.4 billion in cash and no debt, it’s no wonder investors are starry-eyed.

But here’s the rub: Palantir’s trading at a forward P/E of 238x and a price-to-sales ratio over 100x.

For context, during the dot-com bubble, Sun Microsystems’ CEO called a 10x revenue valuation “ridiculous.” Palantir’s at 100x.

To put this into perspective, here’s what the CEO of Sun Microsystems had to say about his company’s valuation at the peak of the dot-com bubble:

At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?

In other words, you’re paying $100 for a lemonade stand that makes $1 a year. Insane? You bet.

And it’s not just Palantir…Nasdaq and S&P 500 darlings are riding the same hype wave, leaving no margin of safety for investors who buy at these levels.

Who Is Palantir, and What’s Their Shady Past?

Palantir’s not just a stock; it’s a divisive and dangerous deep-state spy tool. Do you really want to invest that garbage?

Founded in 2003 with CIA backing via In-Q-Tel, it’s been knee-deep in national security, reportedly helping track Osama bin Laden (though they’re coy about it).

Its Gotham platform powers spy agencies, ICE, and the DoD, raising hackles over surveillance.

In 2025, lawmakers grilled Palantir over its government contracts, citing fears of a “master list” for tracking citizens.

Palantir insists it’s just a data processor, but the controversy lingers. Thiel’s ties to Trump and JD Vance don’t help, fueling talk of cozy defense deals.

Why do investors still pile in?

Because a 450% stock surge in a year blinds people to risk.

But we’re not here for Nasdaq hype. We’re hunting value in places the herd ignores…like offshore, uranium, and coal.

What Could Go Wrong (Why So Risky)?

Betting on Palantir at these levels is like juggling dynamite in a thunderstorm.

Here’s why:

1. Sky-High Prices: Palantir’s stock price is so high it’s like paying $250 for every $1 the company earns, expecting everything to go perfectly forever.

If the company stumbles even slightly, like missing a profit goal, the stock could plummet. Experts think it’s already overpriced, predicting it might drop by 25%.

People on X are freaking out, saying it’s like paying $78 for every $1 of sales the company might make next year…way too expensive for most!

2. Momentum Meltdown: Palantir’s 340% 2024 gain was pure hype. When momentum fades, as it did with a 20% drop earlier this year, the fall is brutal.

3. Insider Dumping: CEO Alex Karp and insiders sold $3 billion in stock over the past year. If the C-suite’s cashing out, why should you hold?

4. Competition: Palantir’s not the only AI game in town. OpenAI’s $200M DoD contract shows the field’s crowded, and rivals like C3.ai are circling.

5. Market Crashes: With markets at record highs, a correction could gut high-flyers like Palantir. X posts warn of an “AI war bubble” and “Russell rebalance risk.”

The herd’s betting on a monopoly that may never materialize. We’d rather bet on undervalued, unloved assets with real upside.

What Could You Do Differently?

Asymmetric Investing in Contrarian Themes

Instead of chasing Nasdaq unicorns, we’re playing the long game with deep-value, asymmetric bets. Our 3-5 year horizon targets sectors and markets the herd’s written off, where valuations scream opportunity.

Here’s how to build a portfolio that laughs at Palantir’s Trailing P/E that’s close to 600x earnings:

This is a back of the napkin example of how you could build out a simple asymmetric portfolio. If you are strapped for investing cash…Then consider finding the best ETFs in each theme (not all themes have ETFs) and just park 5-10% in each of the best ETFs…

Always due your won due diligence. None of this is meant to be individualized investing advice. Just education.

We manage hundreds of millions of dollars for our clients collectively and these are the things we are actively investing in.

1. Chinese Tech (KWEB ETF): Chinese tech stocks like Tencent and Alibaba are trading at dirt-cheap valuations…KWEB’s P/E is around 14x, with some firms at single-digit multiples. Why?

Regulatory crackdowns and geopolitical fears have crushed prices, but China’s digital economy is still growing at 7% annually. With $1.5 trillion in market cap and improving sentiment, KWEB offers a massive margin of safety. Upside? 50-100% over 3 years as sentiment shifts.

2. Greek Stocks: The Greek market (GREK ETF) is a hidden gem, trading at a P/E of 8x despite GDP growth outpacing the EU. Banks like National Bank of Greece are at 0.5x book value, with dividends yielding 5-7%. Why?

The 2008 crisis stigma lingers, but Greece’s debt-to-GDP is falling, and tourism is booming. This is a 3-5 year double waiting to happen.

3. Argentine Markets: Argentina’s Merval index is off the radar for 99.9% of investors, trading at a P/E of 6x. Economic reforms under Milei are stabilizing the peso, and energy exports are surging. Stocks like YPF offer 8x earnings with 30% revenue growth. Risky? Sure, but the upside could be 200% in 5 years.

4. Shipping: Dry bulk and container shipping stocks like Star Bulk Carriers and Pacific Basin Shipping are trading at incredibly low valuations…7.61x and 17.33x earnings, respectively…despite soaring freight rates driven by tight global supply chains.

Shipping keeps the world moving, yet these stocks are priced as if the industry’s on its last legs, with Star Bulk at $17.11 and Pacific Basin at just $2.02 after hitting previous highs of "See Alert" and $12.45.

With demand for goods showing no signs of slowing, we’re eyeing asymmetric returns over the next few years as the market catches up to this undervalued sector.

5. Offshore Oil & Gas: Offshore oil investment has been hammered, with stocks like Transocean and Valaris trading at low multiples (e.g., Transocean around 6-8x earnings based on recent cash flow estimates) despite global oil demand predicted to rise over time.

With underinvestment leaving supply tight, a potentially massive gain by 2028 is on the table as consumption outpaces production.

6. Uranium: Uranium stocks like Cameco are trading at around 20x earnings, with a looming 200-million-pound supply deficit by 2030.

Prices are up 40% in 2025, and miners could see significant upside as nuclear demand grows.

7. Precious Metals: Gold and silver miners like Barrick Gold trade at ~15x earnings, with gold at $3,306/oz and rising. Currency debasement and supply constraints point to a big upside.

8. Coal: Coal stocks like Arch Resources are at 3x earnings, despised by the crowd but critical for power generation. China and India’s demand is up 5% annually, and supply’s tight. A 70% return in 3 years isn’t out of the question.

9. Agriculture: Fertilizer stocks like Mosaic (MOS), Nutrien (NTR), and ICL Group (ICL) are good synthetic long positions for investors looking for easy access to rising food prices, with food prices set to climb due to inflation and supply chain woes.

10. Natural Gas: With LNG exports to Europe and Asia soaring. Supply-demand dynamics suggest big upside potential. We prefer the energy producers.

How to Build an Asymmetric Portfolio

Here’s the dirty little playbook:

- Precious Metals: Always own some physical gold (insurance).. Else, build a basket of precious metal stocks.

- Margin of Safety: Buy at valuations where downside is capped. KWEB at 15x earnings or Greek banks at 0.5x book value scream value.

- Diversify Across Themes: Allocate 5-10% to each sector…Chinese tech, Greece, Argentina, precious metals etc.…to spread risk while capturing upside.

- Positions Size: 1-2% per ticker in each theme bucket. Spread out your risk so you can sleep at night. The theme is what you should be focused on. Not the individual tickers.

A rising tide, lifts all boats (except the one or two stink bombs you didn’t see coming).

- Hold Cash: Keep 20% in cash to pounce on dips. Markets like Argentina are volatile…buy when panic hits.

- Manage your portfolio: You don’t have to stare at this thing daily. But check in on things every once in awhile and make sure the themes are still holding up. Check in with Chris MacIntosh from time to time…He offers monthly Q&As in Insider…

Answering Your Unasked Questions

- How do I find these opportunities? You can find these deep value plays yourself. We even made a video that shows you how to screen for them using Trading View.

Or, if you have the means, become an Insider subscriber and get access to our model portfolio’s and everything else that you need to build a rock-solid asymmetric portfolio.

- What if I own Palantir? Trim your position, sell covered calls, and build a deep-value asymmetric portfolio. Don’t marry a 246x P/E stock.

- Are these markets too risky? Argentina and China have volatility, but their valuations are so low the risk is priced in. Stick to a 5-10% allocation per theme.

- How do I start? If you are truly serious about constructing your own asymmetric portfolio then get educated and then get started building. Take advantage of our 30-day no questions asked money back guarantee and dive into the Insider program. If it’s for you, great! If not, ask for your money back. Very simple. Go here.

The Bottom Line: Don’t Join the Crazy

Palantir’s 600x earnings and Nasdaq’s hype train are a recipe for disaster.

We’re betting on the unloved stuff that people need. Plus, a couple other unloved deep value themes…Chinese tech, Greek stocks, Argentine markets, shipping, offshore oil, uranium, precious metals, coal, agriculture, and natural gas.

These are the asymmetric plays with massive upside potential and minimal downside, perfect for a 3-5 year horizon.

The herd’s chasing unicorns; we’re buying value. Your portfolio deserves better than a 100x sales gamble. What’s your next move?

🤔 Haven’t read the latest insider yet?

Direxion Daily PLTR Bear 1X Shares