Shorting the Nasdaq

There’s a way to bet against the Nasdaq without losing your shirt. But only if you do it right…

"In markets, as in war, victory goes to those who wait. But what if patience isn’t enough?"

We are discussing the Nasdaq because a number of subscribers have raised questions about “shorting” the index.

The short answer is to stick to your knitting. We ask folks to seriously consider their investment strategy.

If you are a long-term deep value investor, then you would be well advised to stick with your strategy (i.e. looking for deep value globally) and not be swayed by talking heads on Youtube, Twitter, etc. about the financial system coming to an end (call it what you will).

When you can find enough value across diverse geographies and industries, then stay fully invested. If the value is limited to a few sectors or geographical regions, then have a portion of your portfolio in cash waiting for value to appear.

Don’t ask us how much to keep in cash — it is up to each individual to make this call.

Positioning to make money on markets/securities going down is darn hard. Trust us, we have a wardrobe full of T-shirts. This is because of the limitations on the two ways of betting on downside (i.e. outright shorting or buying long-term puts).

With outright shorting, you become a hostage to volatility. We have an innate tendency to underestimate volatility and how much a position can go against you before ultimately going for you (i.e. the market always seems to find your stops before going in the direction you are positioned for).

And with buying long-term puts, it is a race against time (two years is nothing). Why is it that things often/always take way longer to play out than you anticipated?

We prefer to buy deep value because you can sit in a position for five years plus. The only risk you bear is running out of patience.

If you have plenty of patience, then you don’t run the risk of being knocked out by the position taking “a little longer” to play out than expected or see a material drawdown on the position (let’s say it loses 40% before coming back up to new highs).

And of course, you open yourself up to one or two positions really making you (thanks to asymmetry) rather than one or two positions sinking you.

We highlight the practicalities of “being bearish” by our experience with the Nasdaq some 25 years ago. We won’t forget it ever!

Yes, the Nasdaq did go down some 80% from top (March 2000 to October 2002). Now, let’s get practical.

Let’s say you went short the Nasdaq (via futures) in late December 1999 at 3,500 — not unreasonable given how expensive it was even then.

Come October 2000, it was at the same level. However, in between it went from 3,500 to 4,700 (up another 34%). Good luck on holding that short position! And if you had increased your short position as the market sold off, you would have had to contend with at least four periods where the market rallied at least 30%, with two instances where it rallied 50%.

There is no way you would have held any short positions if you had added to the short just prior to those rallies.

Getting a little more micro, 20% rallies were so common.

In other words, shorting the Nasdaq was a nightmare.

I know, I went through it, and it was one of the roughest times in my life. I did come out ok in the end, but even the good payout wasn’t enough to offset the psychological trauma that I carry to this day (subconsciously perhaps).

What about puts? The problem back then (in early 2000, before the Nasdaq started to tank) was they were not cheap. It was hard to get a good payoff.

Looking back on things, one would have been better served to look for value rather than betting on the Nasdaq going down. It wasn’t hard to find value in early 2000.

Small cap value had been absolutely left for dead (much like the energy sector of today).

Then from 2000 to 2003, small cap value did reasonably well — very well if you took the time frame to mid-2002 (just prior to the Enron debacle) where the Small Cap Value Index was up some 50% while the Nasdaq was down 60% and the S&P 500 was down about 33%. Of course, it would have been a lot easier if 9/11 had not occurred in between, too.

Isn’t hindsight a wonderful thing? Hopefully we can learn a thing or two from it.

For what it is worth, let’s look at the Nasdaq today. Yes, it has gone up a lot, but that has been accompanied by rising earnings and cash flows.

The way we see it, the enemy of the Nasdaq is going to be the high expectations of earnings growth. Right now, it sits on a P/E of 36x.

One has to ask how earnings growth is going to be maintained, especially when nine out of the top 10 stocks in the World Stock Market are from the Nasdaq (10/10 if you consider that if Taiwan Semi had its primary listing on the Nasdaq, it would be in the Nasdaq top 10).

Given the size of these companies, doesn’t their growth in earnings have to converge on world GDP growth? I guess eventually that will happen.

The issue is how far off is this eventually? We romance with the idea that sooner rather than later.

Be that all as it may, here are a few ideas for folks who are hell bent on making money on the downside in the Nasdaq by buying puts.

No wild price move is priced into the options market, so if we are going to observe big moves, then options are cheap.

VIX indices only take into account volatility of 1-3 month options, which is of not much use for us if we are buying long-term options.

If we look at the volatility of 12-month to expiry options, it also appears to be trading at levels not expecting a big move in the Nasdaq.

If (and a BIG IF) this is the top in the Nasdaq (or within 20% of it) for the next couple of years, then how much could we reasonably expect to see the Nasdaq to fall by?

Let’s raise a few more questions here (don’t be expecting us to know what is reasonable), but 400 would see it back to levels it was trading at 12 months ago (a 23% fall) and 300 would see it back to the 2022 sell off (near enough), which is a 40% drop.

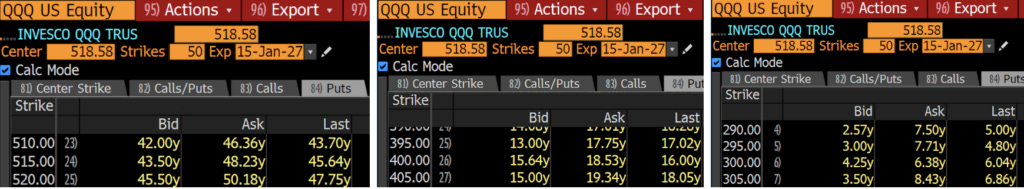

Here are the option chains:

In the calculations below, let’s assume the payoff at expiry of the option (January 2027).

So an outright put ATM two years to expiry (520, January 2027) will cost about $48 ($4,800 per contract).

To break even, QQQ would have to fall 9% (to 472), 18% for 100%, and 27% for a 200% payoff (to 374).

If you are looking for a good hedging trade (one that isn’t going to take much capital but provide a lot of cushioning for a big fall in the Nasdaq), then buying ATM puts isn’t going to be ideal. You would have to put up too much capital to get your desired hedge.

Next idea…

OTM puts. A 400 strike January 2027 put will cost about $16. A 200% return will occur at about 350 — a 32% fall. And if QQQ got to 300 (a 42% fall), that would be about a 5.25x return.

Not bad, but that is a hell of a fall in the Nasdaq over a two-year period — a big call!

What about an OTM bear put with buying the January 2027 400 and selling the 300?

That spread would cost about $10. We would break even at 390. For a 100% return, it would have to drop to 380 and to 300 for a 9x return.

That is a respectable payoff (a $5,000 allocation in a $100,000 portfolio would become $45,000). But that is a “calamity trade” as QQQ has to fall by about 40%.

Recalling the tech bear market of 2000-2003. Let’s say you were “smart enough” to buy puts on the Nasdaq back then (we don’t know what they cost so we can’t get payoffs).

Yes, the Nasdaq did fall by 55% from January 2000 to January 2002 (a 68% drop “if” you caught the top in March 2000).

But before you get stars in your eyes about how far the Nasdaq could fall based on the chart above, take a look at what happened in the five years prior to 2000.

Yes, it was up some 8x.

And in the last five years, the Nasdaq is up 140%, so somewhat of a different setup.

We would be hesitant in anticipating a repeat of the magnitude of the 200-2003 TMT calamity.

But even if we were expecting a repeat of the 2000-2003 bear, we would probably be better served by looking for deep value globally rather than trying to make a buck or two on the Nasdaq going down materially.

Sincerely,

Chris MacIntosh + Team

Founder & Editor In Chief, Capitalist Exploits Independent Investment Research

Founder & Managing Partner, Glenorchy Capital

Here’s what you get:

Insider Newsletter w/ Audio - 2x/month

Post comments and join the community

Subscriber-only posts and archive

Unauthorized Disclosure Prohibited: The information provided in this publication is private, privileged, and confidential information, licensed for your sole individual use as a subscriber. This is not investing advice! Do your own due diligence and consult a financial professional before making any kind of investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.