Remembering LTCM and Emerging Markets

Buying the bottom isn’t the hard part—it’s waiting out the long, volatile path to outperformance. Could energy today be the emerging markets of 1998? Time will tell…

Does anyone remember the LTCM crisis? We aren’t going to go into the specifics of it here (you can study it up). Rather, the point we want to make is that often the bottoming process can go on way longer than you initially thought was reasonable — even if you perfectly timed the bottom.

Let’s say we bought emerging markets (EEM) just after LTCM had made headlines in late 1998 (using the date of this WSJ article as the entry point).

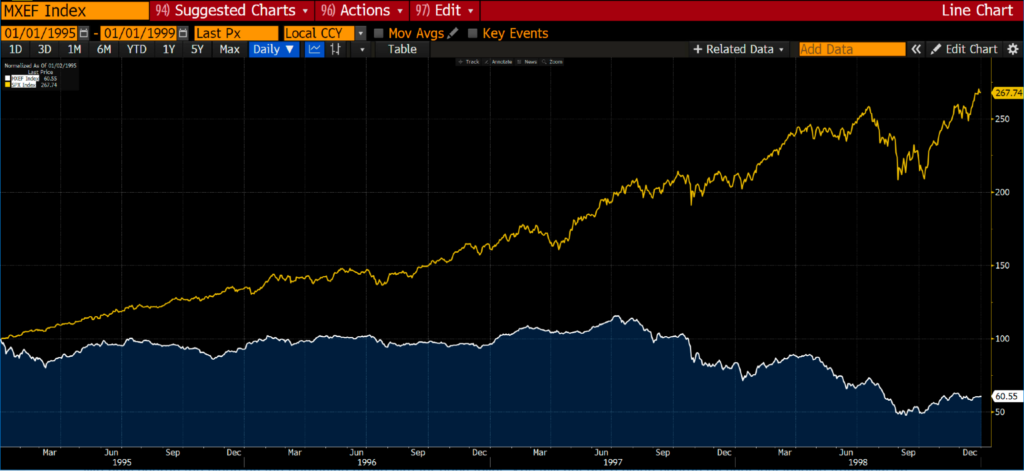

This wasn’t the bottom (about 15% from the bottom) but emerging markets (as per the MSCI Emerging Markets Index) were down some 40% since September 1997 (just before the Asian tiger crisis hit). Also notice how the LTCM thing didn’t really affect the S&P 500 (a minor correction).

From a broader perspective this is how emerging markets have performed relative to the S&P 500 since 1988.

If you had bought emerging markets in late 1998, they had hugely underperformed the S&P 500.

From the start of 1995 until November 1998, the S&P 500 was up some 167% while emerging markets were down by 40%. It would have taken “balls of steel” to have bought into emerging markets then… as opposed to holding onto the S&P 500.

This is what happened from November 1998 until the start of 2003. Yes, you would have outperformed the S&P 500. However, going up 80% after 18 months, only to see all those gains disappear over the next three years is far from a fun experience!

Emerging markets fell by the same as the S&P 500 from 2000 to 2003.

But if you had the wisdom and patience (you were able to put your head in the sand for nine long years), you would have been up some 320%… compared to 30% in the S&P 500.

The point of all this is bottoms in a market/theme/sector are far from obvious when you are at the coal face and are constantly bombarded by daily/weekly/monthly volatility.

By their very nature, the bottom in a theme takes a long time to play out.

The foregoing was all rather “easy” in hindsight, but what about the situation at hand, specifically the energy sector relative to the general market?

Below is the MSCI World Energy Sector relative to the MSCI World. The question is, did the bull market in energy relative to the broad market begin in late 2020?

Maybe. But one thing is clear — buying energy stocks then was about as unpopular as buying emerging markets in late 1998.

We believe that the bottom in energy relative to the general market occurred in late 2020, and come 2030, energy will have dramatically outperformed… and the outperformance will continue at least until 2035 (i.e. we will see energy outperform for at least the next 10 years).

Of course, now all we have to do is to wait it out as the outperformance is unlikely to behave in a linear way… as much as we would like it to.

We’ll continue talking about the themes we are investing in. If you want to follow along and you’re not already a subscriber…well then…push that red button.

Disclaimer: Not investing advice! This article is for educational purposes only. Seriously, we really do hope you become a better investor after reading our work. But always do your own due diligence and/or consult with a financial professional before making any investment. Capitalist Exploits reserves all rights to the content of this publication and related materials.