Out of Kilter

US stocks now make up more than Europe, China, Japan, and India combined...driven by fewer names than ever. But what happens when the power runs out?

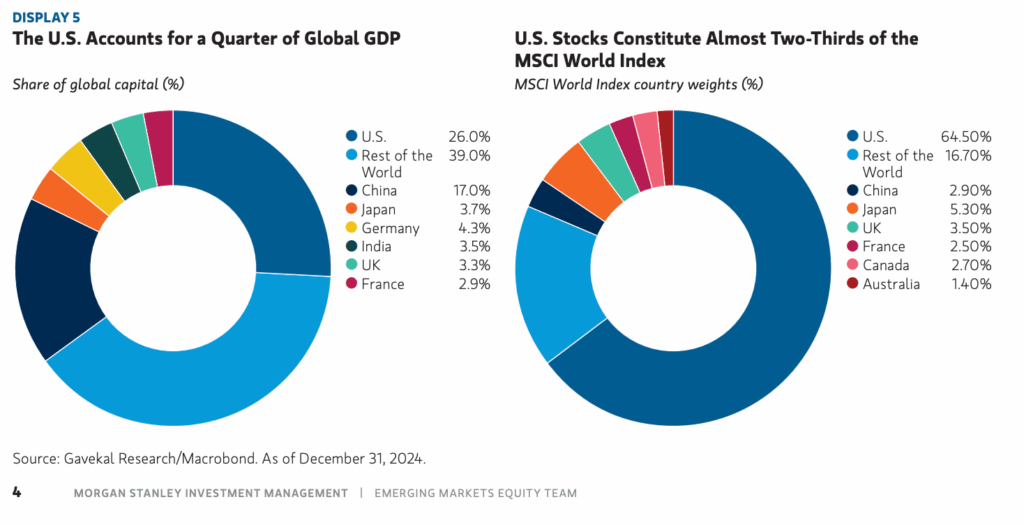

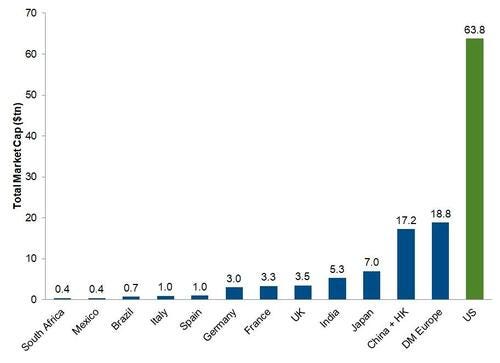

While the US currently accounts for 25% of global GDP, it commands a disproportionate 65% share of global market capitalization.

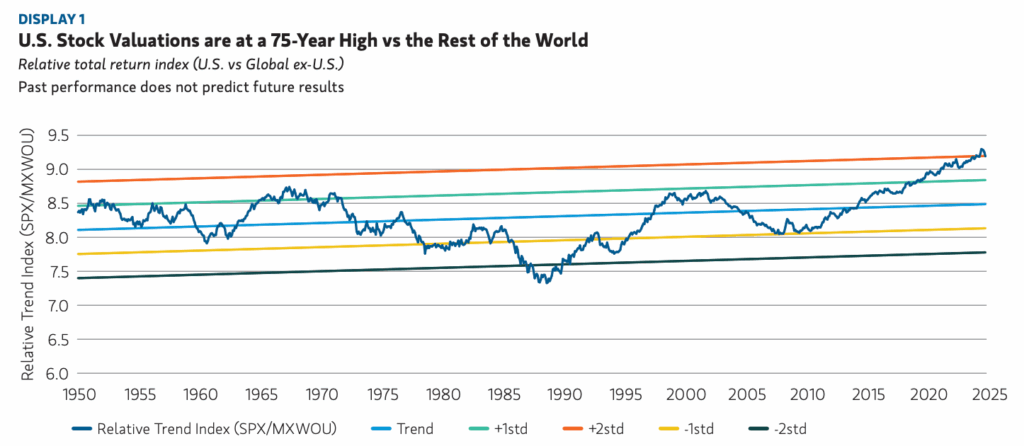

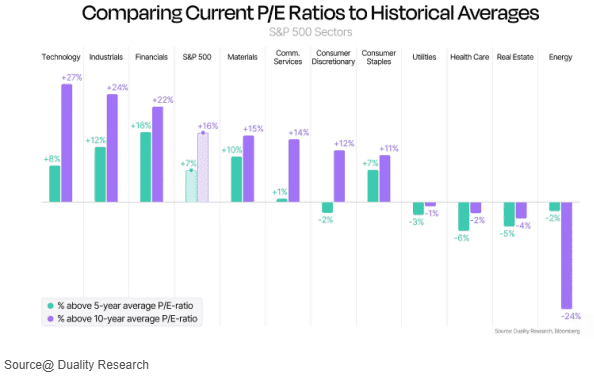

And US stock valuations are at record highs.

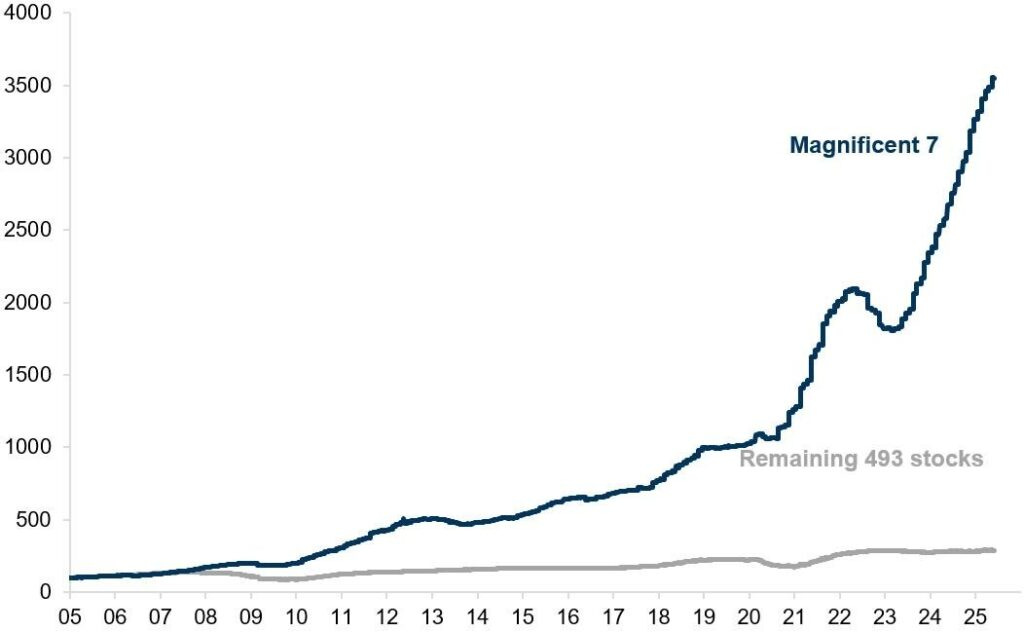

But wait… there’s more. Guess where most of the capital is concentrated within the US markets?

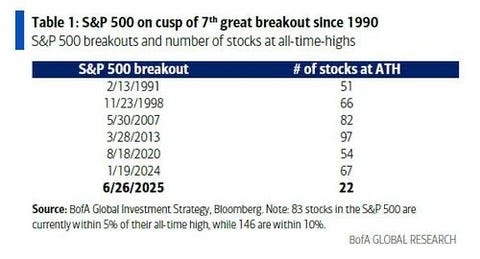

And here we see that — despite higher highs — we’re seeing it all take place on the back of the smallest amount of companies… EVER.

And no, it’s not just Americans investing at home. Foreigners are seriously overweight, too.

The US stock market now has a higher market cap than Europe, China, Hong Kong, Japan, India, United Kingdom, France, Germany, Spain, Italy, Brazil, Mexico, and South Africa COMBINED.

On top of that, the S&P 500 has never been more concentrated in a single stock than it is today, with Nvidia representing close to 8% of the index.

Ok, so we know what’s loved. What about the ugly ducklings? Energy stocks are trading at 24% BELOW their historical P/Es.

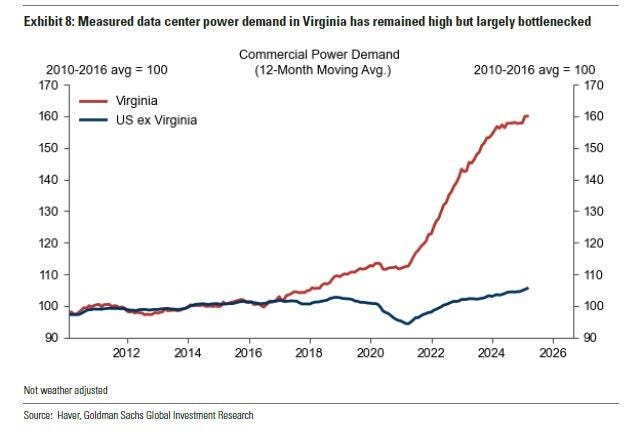

The following chart is the one to rule them all… or at least the one to watch.

It is the Fidelity Global Commodity Producer Fund (energy, mining, agriculture, steel, etc) vs the MSCI World Tech Index. With the scale indexed to 100, it’s down 87% (this is total return).

The irony of all of this is that the aforementioned “darling” stocks all require energy, not the least of which is, of course, the big daddy. Nvidia.

Speaking of energy…

Just this morning we warned readers that America’s largest power grid, PJM Interconnect, which serves 65 million people across 13 states and Washington, DC, and more importantly feeds Deep State Central’s Loudoun County, Virginia, also known as ‘Data Center Alley’ and which is recognized as one of the world’s largest hubs for data centers…

… had recently issued multiple ‘Maximum Generation’ and ‘Load Management’ alerts this summer, as the heat pushes power demand to the brink with air conditioners running at full blast across the eastern half of the U.S.

But as anyone who has not lived under a rock knows, the deeper issue is that there’s simply not enough base-load juice to feed the relentless, ravenous growth of power-hungry AI server racks at new data centers.

We remain solidly long our energy plays.

🔴 Upgrade to Insider for access to our stock portfolio’s: