Navigating the Stagflationary Sh*t Storm

As the debt-fueled world wheezes toward collapse, gold gleams, oil teeters, and tariffs rewrite the rules. Where will smart capital run next?

If a global financial system engineered on low interest rates, bottomless debt, and reckless consumption finds itself wheezing as the tide turns against it, should anyone really be surprised?

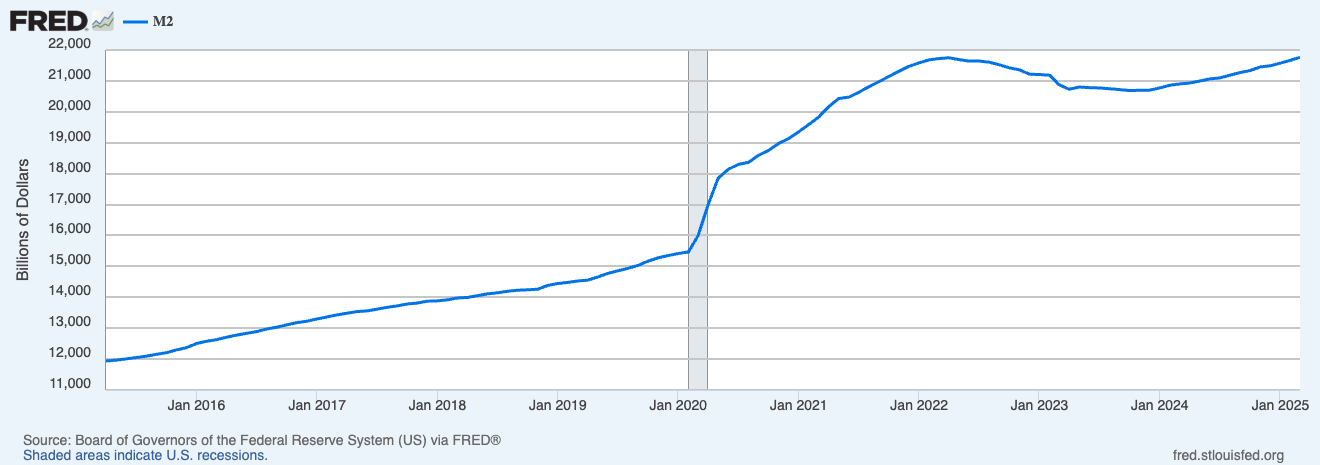

The aftershocks from 2020’s seismic shift in debt markets continue to rumble through the global economy.

Only now, four years later, are we beginning to see the full shape of the storm we’re sailing into: a toxic mix of debt-driven collapse, demand destruction, and political shenanigans.

And the survival kit investors choose today will decide who emerges from the storm intact.

The Day the Debt Died

It wasn’t a blip. It wasn’t a hiccup. It was the end of an era.

The pivot in debt markets starting in 2020 marked a structural shift…the kind that rewrites the rules for decades.

After riding a wave of easy money and near-zero interest rates for nearly half a century, governments now face a terrifying new reality: higher rates mean higher debt-servicing costs, and the bill is coming due.

As borrowing costs surge, economies slow.

Consumer spending…the lifeblood of modern GDP calculations…tightens. And commodities tied to economic activity, like oil, face a chilling demand-destroying environment.

Should we be rotating away from consumption commodities like oil and moving toward "real money" assets like gold?

As always, the truth is layered.

The Tug-of-War Nobody Wins

On the surface, rising rates and slowing growth paint a grim picture for oil. But another force is pulling hard in the opposite direction: chronic supply constraints.

Years of underinvestment, driven by ESG mandates, suffocating regulations, and outright political hostility to energy production, have left the world with dangerously thin supply chains.

Energy markets, gutted and starved of capital, now teeter on a knife’s edge where even baseline demand threatens to overwhelm available supply.

It's the classic clash: credit contraction versus physical scarcity. The immovable object meets the unstoppable force.

Who wins? History suggests neither side does…at least not cleanly.

The Geopolitical Wildcard

Just to make things more … interesting … the world’s geopolitical powder kegs are crackling.

From Eastern Europe to the South China Sea, tensions are rising.

And history offers a brutal reminder: conflict is inflationary.

Wars aren't funded from balanced budgets; they’re funded with printed money.

In a world where the old financial map is disintegrating, finding your north star becomes not just useful…but essential.

Which hidden assets will lead the charge as the tide turns?

In this environment, oil finds itself caught in a curious paradox: even as economic demand weakens, conflict-driven demand surges.

And unlike prior eras, today's supply constraints mean that any shock could send prices into the stratosphere.

Never in modern history have global conflicts collided with such under-built energy supply chains.

It’s a tinderbox begging for a match.

Money Printers: Start Your Engines

Of course, governments aren't blind to the risks. They see the debt bomb. They hear the ticking clock.

Their solution? Same as it ever was: print.

Trapped by sovereign debt burdens they can never realistically pay down, central banks are likely to lean even harder on the printing press.

In Europe, politicians are openly floating proposals like asset seizures and war-time fiscal measures to contain the uncontainable.

In the U.S., the strategy smells a lot like a corporate bankruptcy: slap on tariffs, rip up trade agreements, and try to restructure the balance sheet by brute force.

The Tariff Playbook: Bankruptcy on a Global Scale

Make no mistake: America's new tariff strategy…spearheaded under Trump and embraced with bipartisan zeal…isn't about "fair trade." It's about economic survival.

The tariff rates aren't crafted through the old "you subsidize, we tariff" logic. They're calculated bluntly: "If you run a surplus with us, we penalize you!"

Vietnam was slapped with a 47% tariff not because it cheats the rules, but because it sells more to America than it buys.

It’s textbook bankruptcy negotiation tactics, scaled up to a continental-sized economy.

But if Washington thinks ASEAN countries…whose $1 trillion annual trade ties to China are lifelines…will quietly comply, they are dreaming.

Canada might play along. ASEAN almost certainly won't.

The likely result? A fragmented, fractious global trade system with shifting alliances, strange bedfellows, and a world that's harder for everyone to navigate.

Meanwhile, the stagflationary brew of tariffs, money printing, and geopolitical turmoil bubbles hotter.

Capital Rotation: The Old Playbook Still Works

When the world goes sideways, capital doesn't vanish. It moves.

The question…should we rotate into gold and "real money" assets?…lands right at the heart of this next phase.

In every historical replay of systemic stress…debt collapse, currency debasement, war…capital has followed a predictable path:

First, it flees into gold.

Then, as confidence further erodes, it pours into other hard assets like natural gas, oil, and agricultural commodities.

Gold leads the way. Always.

Already, gold’s ascension is undeniable. As fear grows…fear of default, of devaluation, of systemic failure…gold's ancient role as "real money" reasserts itself.

But commodities won't be far behind.

Even in a demand-constrained world, the battered and bruised commodity sector… starved of capital for years…holds a trump card: supply scarcity.

You can’t consume what isn’t produced. And the world hasn't invested nearly enough to produce what it will need.

Valuations: The Canary in the Coal Mine

Take Valaris (VAL), It has a P/E around six.

Six!

Do you wait for five? Or two?

Historically, valuations this low scream "buy with both hands."

Of course, markets can stay irrational longer than investors can stay solvent. Timing it perfectly is a fool's errand. The wiser strategy? Disciplined allocation.

Focus on the fundamentals. Buy what’s cheap. Balance exposure between safe havens like gold and cyclical opportunities like energy and agriculture.

Stick to the knitting.

Opportunities Hidden in Chaos

This isn’t a time to despair. It’s a time to prepare.

Yes, the U.S. tariff strategy is messy.

Yes, ASEAN defiance could blow up trade routes. Yes, supply shortages will whip inflation back and forth like a bullwhip in a hurricane.

But chaos creates winners.

Regional trade networks may thrive where old ones fail.

Supply-constrained commodities…especially energy…offer asymmetrical bets that could reward patience and courage.

And gold…the eternal safe haven…reminds us that, amid the folly of governments, some things never change.

Be Nimble, Be Ruthless

It’s time to think like a survivor.

Own real money assets like gold.

Own hard assets with constrained supply.

Maintain flexibility, avoid over-complication, and allocate with discipline.

We are deep into a capital rotation phase. And if history is any guide, the rewards for those willing to seize opportunity…even in the teeth of the storm…will be immense.

The rules are changing.

Are you?

I know what my father would say. “He is a complete bullshit artist.”

Well, probably with a few illustrative adjectives chucked in for good measure.

How the hell can literally one man hold the world to ransom?

This tariff thing is truly bizarre (and probably unconstitutional, which we’ll touch on below) and like nothing we have ever seen before.

Although come to think of it, whenever “uncertainty” is this high, it always seems like “nothing we have seen before.”

Remember some five years ago (sorry for digging up this nightmare)? It was Armageddon!