Investing vs. Speculating

Argentinian stocks up 10x? Gold soaring while markets sink? Value beats hype...but are you investing…or just speculating? Find out before the crowd does.

OPPORTUNITIES IN ARGENTINA

First up, a quick invitation…

Later this week, Chris will be speaking at the Crisis & Opportunity at the End of the World online event…together with George Gammon and Charles Sizemore and host Joel Bowman (joelbowman.substack.com), who’s based in Buenos Aires.

The focus of the event will be on the opportunities in Argentina.

Here at Capitalist Exploits, we’re no strangers to the “Land of Silver”.

We started buying Argentinian equities back in late 2021.

That was pre-Milei, when 99.99% of investors wouldn’t dare so much as look at Argie stocks, let alone buy them (in fairness, with a decades-long track record of Peronists-in-charge taking a wrecking ball to the local economy, can you really blame them?).

Since then, our trades are up anywhere between 2-10x, and we’ve also been poking around private equity plays in the country with our Mavericks network.

Having spent some time on the ground there over the past couple of months, our belief is that the local economy is just starting to hum along and that Argentina will play an important role in the geopolitical arena…especially with the North-South alliance now quickly shaping up (something we highlighted a few weeks ago).

It’s no coincidence that Milei was the first foreign political leader to visit Trump after his 2024 re-election and that Milei’s government is supposedly already at the negotiating table to get Trump’s tariffs dropped.

More importantly, we believe there’s still a lot of asymmetry in Argentina.

Many stocks with exposure to the local economy are still attractively valued.

Given the macro tailwinds, a modest allocation to Argentine investments could go a long way.

Chris will discuss his perspective on Argentina and the most exciting opportunities he’s seeing there right now at the upcoming Crisis & Opportunity at the End of the World event.

The event is on Wednesday, 9 April at 3PM EST (8PM London time / midnight Dubai time / 6AM the following day Sydney time).

It’s virtual and free to join for Capitalist Exploits readers. You can sign up here. It promises to be a good one!

INVESTING VS SPECULATING: A MASTERCLASS

This video with investing legend Seth Klarman is a masterclass in value investing.

The following part (emphasis ours) is particularly relevant right now, when just about every possible market and asset class (with the exception of gold and bonds) is coming unglued:

I think we all know that people, maybe at a cocktail party, will talk about that great new investment that they made, that they’re very excited about.

The goal is not your personal excitement. The goal is to make money safely and predictably over a period of time.

The strategy of going after the hot new thing has some serious disadvantages.

First of all, the hot new thing…because everybody can see it’s the hot new thing…tends to be priced a little bit for perfection.

People have already built lofty expectations into it, so sometimes even the slightest disappointment will cause a rather severe loss.

The place where the difference between investing and speculation becomes clear is when you think about downside.

Speculations tend to be focused all on upside. How much can I make? But investment is focused both on upside and on downside.

The challenge is that if you look to the market as a source of advice, you’re getting drawn into short-term thinking. But if you look to the market as a source of opportunity, you’re on the track to being a value investor.

And that’s my mindset, that the market, it gyrates a lot, and sometimes it gyrates for good reason.

But because you can apply discipline and analysis and logic, you might be able to find times when the market has irrationally reacted.

And that creates opportunity, but only if you’re willing to go outside the box and against the grain.

Reading this, you might be thinking something along the lines of “but, this time is different…Trump seems to be hellbent on taking the entire global economy.”

And you’re probably right.

It is different in that every market crash seems unique…especially as we find ourselves in the thick of it.

Today’s tariff turmoil is different from the 2020 COVID crash…just like that one was different from the GFC ishtshow…and once again, that one was in many respects different from the dot-com bust.

And yet, every crisis has one thing in common…people!

Sure, there are algos, T-0 trading, AI, etc. But at the end of the day, it’s still us bipeds driving market action.

And our wiring today is still the same as when Hendrik and Willem were trading shares of the Dutch East India Company in the 17th century.

While we weren’t around to trade through the Dutch Golden Age, we figured it would be helpful to dust off Insider Newsletter issues from the COVID crash days and reflect on what it was like to navigate the markets when the world was collectively losing its mind over corona.

This is what Chris wrote in March 2020:

Everyone now is fearful. They feel like they need certainty. They feel like they need to have it right before they move. That works most of the time. Probably 99% of the time.

That other 1% of the time, speed matters more than obtaining perfection. I believe speed right now trumps perfection.

When I look at our portfolio, it is quite literally built for what’s coming out at the end of this. That it’s taken a beating along with everything else is painful yet understandable due to the fact that liquidity comes first in such a shock.

While these periods are never pleasant (even for finance types like ourselves), coming out on the other side ultimately makes you a better investor…as cliché as that sounds.

Now, speaking of opportunities amidst the rubble…

GOING FOR GOLD

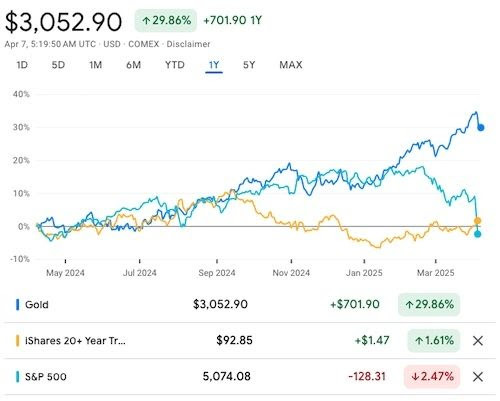

With every other market in full meltdown mode, gold sits firmly above $3,000 per ounce.

It’s up almost 30% over the past year, which is pretty impressive, especially when you compare it to other asset classes.

But it’s not just in dollars.

Gold has been running like the police are after it in every major currency.

It’s up 40% in euros, 50% in yen, and more than 60% when measured in Indian rupees.

We’re witnessing a global flight into the “shiny pet rock.” But it’s not retail and/or institutional investors leading the way.

No, gold has been moving on the back of record global central bank buying.

For now, retail and institutions couldn’t care less. The following chart (h/t @GarrettGoggin) shows how most investors feel about gold right now.

But this could change very quickly, especially with stocks now in free-fall and gold creeping higher.

What that means is that the real bull market in gold still lies ahead. Insider member Claus pointed out something curious:

When gold broke through USD 2000 in Oct. 23 it took 4 months before it started in Feb. 24 from USD 2010 to 2600 in Dec 2024. Let’s see how long the USD 3000 barrier will resist.

Now, what else does this mean for the smart folks reading this article?

It also means that the equities relative to the physical are even more under-owned (not to mention the fact that their valuations are the cheapest they’ve been in 40 years). Because central banks don’t buy gold equities. They buy bullion.

This is why gold has been running with gold equities hardly moving.

We believe that when institutional money enters the market, it will swiftly be followed by retail, and both of these will buy the equities as well as physical gold.

In other words, we’re still early.

WEEKLY HUMOUR

A little humor goes a long way when trying to ride out bumpy markets.

Here’s something to bring a chuckle to what’s shaping up to be another chaotic day in today’s tariff-laden world.

Wishing you a great…and resilient…week ahead!