Insider Newsletter: Issue #312

Lights out in Europe. Millionaires fleeing. Bitcoin rising. Is this the end of the old system—or just the opening act of something far more radical?

Greetings, friends!

They told you the future would be electric. Turns out, they were half right. Europe just got its first real taste of net-zero: zero volts.

On April 28, the lights went out across the Iberian Peninsula in one of the worst blackouts in European history. What caused it? Renewable failures? Policy missteps?

Or is this just the beginning of something much darker—where failed ideology meets physical reality?

In this issue, we connect the dots between energy collapse, capital flight, and the silent war on savers. It’s all part of the same system failure—and it’s accelerating.

First off, we have a brief video for you, where we cover some of the topics in this Newsletter issue. Click here or on the image below to watch it.

From Ramiro taken from the top floor of his building in Montevideo, Uruguay looking east into lake Calcagno. I’d call that a “bird’s-eye view.”

And from Henry in Point Lonsdale, Straya.

And while not a sunset or sunrise shot I had to share this one with you all, from subscriber Paul. It did make me laugh.

Celebration

In the last week of April, the peasants in Europe celebrated net zero day. Zero electricity, that is.

An abrupt and widespread blackout, one of Europe’s worst in living memory, affected the entire Iberian Peninsula on April 28.

Alongside Spanish opposition parties, some external observers have flagged renewables and net-zero emissions targets as possible reasons for the outage.

Henrik Andersen, CEO of Danish wind turbine manufacturer Vestas, said “a degree of statesmanship” is required, particularly as Spanish policymakers continue to investigate the outage.

Frankly, I’m rather surprised that a sufficiently “diverse” panel of “experts” has not been trotted out to explain that no, it’s because of

global warming climate changeclimate emergency… or Putin.Actually, maybe they already have been. I’ve stopped looking at the BBC, so it’s possible.

At least they’re not now spending millions blocking out the sun. Oh, wait! Oh, dear!

The UK government, through its Advanced Research and Invention Agency (ARIA), has allocated approximately £56.8 million (around $75 million) to fund solar geo-engineering research projects aimed at exploring methods to artificially cool the Earth by reflecting sunlight away from the planet.

This funding supports 21 projects, including five small-scale outdoor experiments such as thickening Arctic sea ice, cloud brightening, and studying non-toxic materials for stratospheric aerosol injection.

The projects are part of ARIA’s five-year “Exploring Climate Cooling” program and represent one of the largest government investments in solar geo-engineering research globally.

You know, I used to think these muppets were simply stupid. But no. It is clear they are evil and they do desire pain and suffering on us all.

Anyway this was all entirely predictable. How do we know?

Well we predicted it years back. Well if a few grumpy hedge fund managers can figure it out then really it isn’t that hard.

We have been accused of being smart, but never geniuses.

If you think this was a one-off event, think again.

The truth is, Europe’s energy grid is being reprogrammed in real time—not by engineers, but by ideologues.

What happens when you inject fantasy into a system that demands reality?

The result isn’t just a blackout. It’s a blueprint for collapse. And Europe is just the first test case…

Which brings me to…

Incoming

Theft, that is.

Consider that the deindustrialisation of the communist union of Europe continues apace and with it the acceleration of the bankruptcy.

Of course, the blow dried TV robots won’t tell you this, but…

The next step in this process is asset seizure.

Remember when they first printed trillions and told us inflation was “transitory?”

Now, they’re taxing trillions and telling us taxes are transitory.

France just announced new tax hikes. Italy is raising capital gain taxes from 26% to 42%.

The UK got rid of their “non-dom” rules essentially destroying tax incentives, and across the rest of Europe it’s plain wealth taxes.

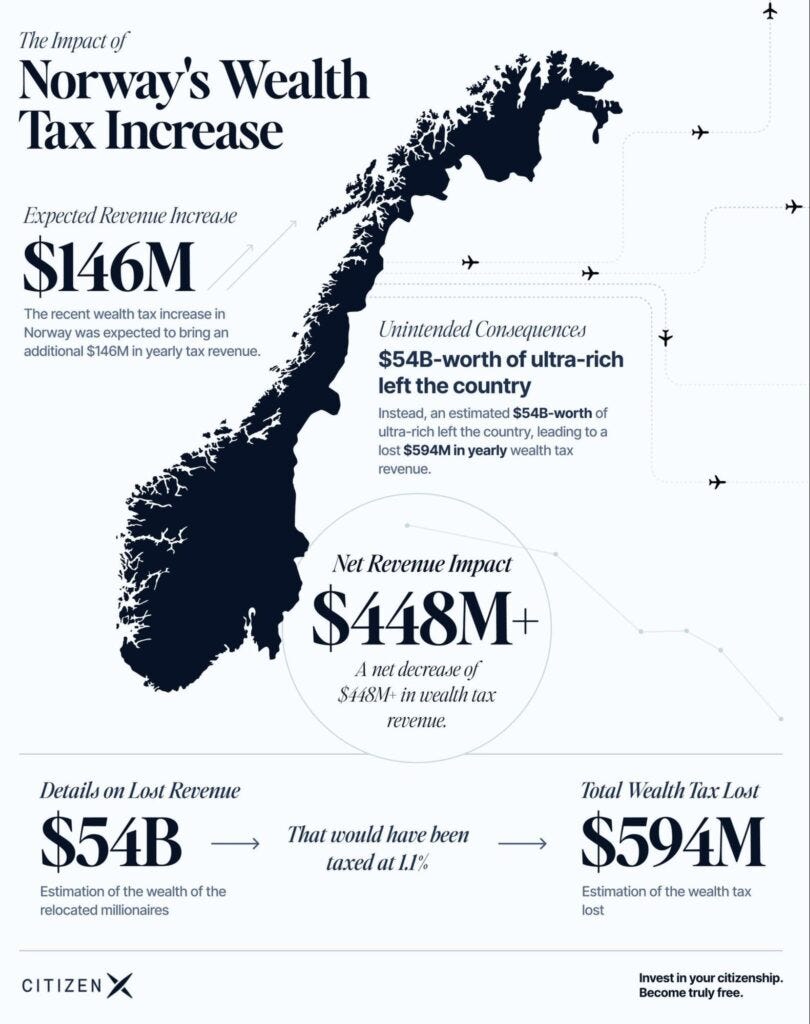

Norway showed us how this will transpire. The muppets in power there raised wealth taxes to bring an additional $146 million in yearly tax revenue.

Instead, individuals worth $54 billion left the country, leading to a loss of $594 million in yearly wealth tax revenue. A net decrease of $448 million.

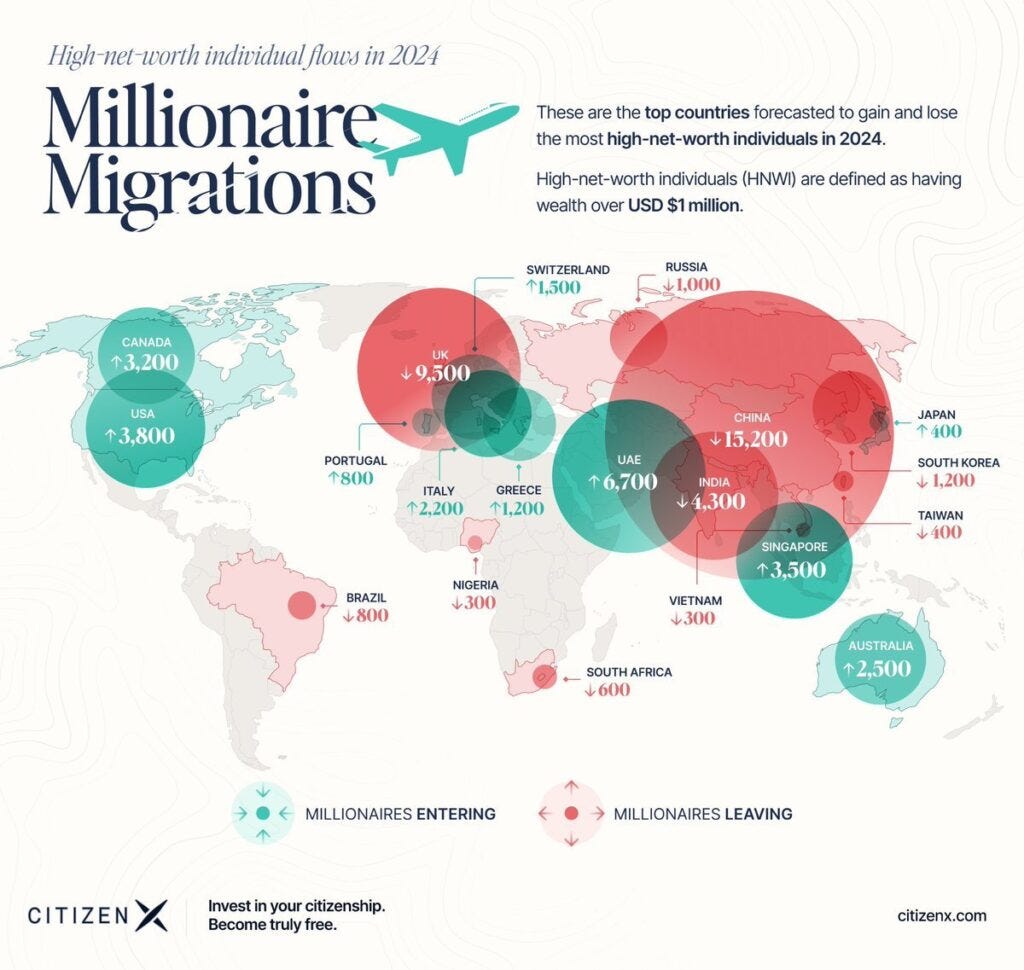

Spain just recorded 1,000 fewer high-net-worth taxpayers. It was the first negative millionaire migration for the country since they imposed a wealth tax.

Thousands of millionaires are leaving while (coincidentally) tax pressure is at all-time highs.

Democracy is a joke. Who for example voted for higher taxes? Nobody of course, but the peasants will get them anyway.

In the UK, it’s the same story. Millionaires and billionaires are escaping as fast as they can.

Just in 2023, the UK lost around 12,500 high-net-worth individuals (HNWls). Another 9,500 more are expected to have left in 2024.

The proposed solution? An exit tax for citizens leaving the country.

Modern feudalism is already here in Europe.

I don’t want to sound like a broken record, but the next steps are all too obvious. We’ve had inflation, taxation, and next comes confiscation.

The first steps towards this have been taken. The requirement for all citizens to register all your assets in a central EU register to “help with financial transparency.”

Eliminating cash is well underway.

Your bank accounts, shares, cars, real estate, precious metals, works of art, that old bottle of plonk that might be worth a few hundred bucks… and crypto, of course.

Be a good little peasant and register it all to “fight money laundering.”

They’re going to seize it all. Watch!

When the parasites run out of your income to tax, they’ll come for your balance sheet.

We’re now entering the “confiscation” phase of the cycle—asset registries, exit taxes, digital control grids. Most investors aren’t ready.

But a handful of strategies—ignored by Wall Street and shunned by regulators—still offer a way out.

Let’s talk about one of them…

This brings me to Bitcoin…

I haven’t spoken much about Bitcoin as it’s not in our portfolio. The reason is simple.

Buying Bitcoin in your Interactive Brokers account means you’re losing the most critical value component of it: the ability to self custody.

Buy Bitcoin and get it off exchanges. They can’t seize Bitcoin you self-custody.

What will they do instead? Probably revoke your passport, which is another excellent reason to get more than one.

Most people still think Bitcoin is just a speculation vehicle.

But for those who understand history—and what’s coming—it’s something else entirely: an escape hatch.

Just remember, they can’t seize what they can’t touch. But they’ll try.

So what does true sovereignty look like in the modern financial panopticon?