Insider Newsletter: Issue #310

Markets in chaos, tariffs flying, banks tightening their grip... and yet, value quietly outperforms growth. What’s the real opportunity hiding in the fear?

Greetings, friends! We recorded a little bonus this issue where we dig into some of the topics covered, click below to watch it.

The following is from David. A sunset in Spanish Wells, Eleuthera, Bahamas.

If you can keep your head when all about you

are losing theirs and blaming it on you,

If you can trust yourself when all men doubt you,

But make allowance for their doubting too!- Rudyard Kipling: A Father’s Advice to His Son

Keep Your Head

I know what my father would say. “He is a complete bullshit artist.”

Well, probably with a few illustrative adjectives chucked in for good measure.

How the hell can literally one man hold the world to ransom?

This tariff thing is truly bizarre (and probably unconstitutional, which we’ll touch on below) and like nothing we have ever seen before.

Although come to think of it, whenever “uncertainty” is this high, it always seems like “nothing we have seen before.”

Remember some five years ago (sorry for digging up this nightmare)? It was Armageddon!

This from the Sydney Morning Herald:

Then came the lockdowns and runs on toilet paper, etc. It really did seem like the end of the world as we knew it.

Of course, those times did pass.

Markets have a strange ability to bottom at the height of uncertainty, just when you least thought it possible.

Of course, this raises the question of what is the height of uncertainty or maximum pessimism?

There is no way of knowing from an absolute perspective how crazy human behavior can go.

But we have a few gauges that give an approximation of the level of fear and how much more fearful folks can become.

The VIX is a good proxy for the level of fear/uncertainty that is already priced into the market.

It used to be calculated based on the S&P 100 (the VXO), but it stopped in 2021, and the VIX took over (based on the S&P 500). But the VIX didn’t start until 1990.

So we have to overlay the VXO and VIX to get a reading for the 1987 crash.

Currently (as of close Friday, 5th April) it stands at 45. It has only been higher on three occasions: the 1987 Crash, the GFC of 2008, and the corona.

This is a rather sudden move in the VIX. Most of it accounted for over the last two days.

Based on this we can say that the probability is that we have already seen the majority of the downside.

With the high level of the VIX (panic), value stocks aren’t doing so bad — down 4% YTD whereas growth is down some 16%.

Here are the sorts of stocks included in World Value:

And for World Growth:

Just a reminder of how out of favour value is relative to growth — we think that value vs going through a bottoming process compared to growth.

This process started in 2020, and five years from now value will have handsomely outperformed growth.

And from another angle, here’s US value vs growth.

Once again, the sell off in growth has been about double that of value.

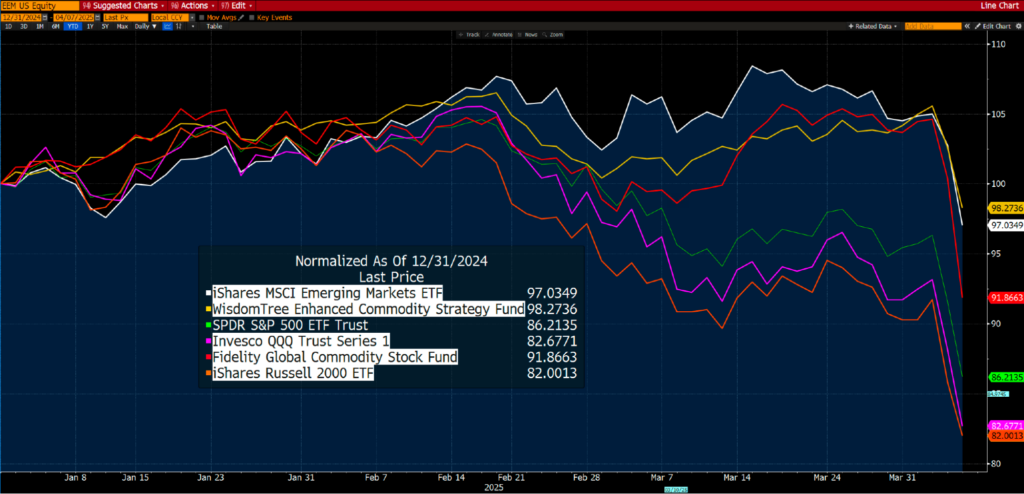

Looking at emerging markets (EEM), commodities (GCC), commodity related stocks (FFGCX), S&P 500 (SPY), Nasdaq (QQQ), and Russell 2000 (IWM) — all indexed to 100.

So for all the talk that the world as we know it is coming to an end and the associated high levels of uncertainty, if you have concentrated on emerging markets, value stocks, and commodity related sectors, you haven’t done nearly as badly as if you’d been invested in growth and certainly in the Mag 7.

The challenge for us is that we are in the business of doing, and being accountable for it rather than the business of talking and sounding sophisticated.

No doubt you will have heard on TV or YouTube commentators saying words to the effect that “there is more downside to come.”

However, is this really helpful?

Unless words translate into actions, they are hollow and rather useless.

The questions that need to be asked are:

If you were fully invested:

Would you hold or sell, and if you were to sell, how much?

At what level would you get back into the market, presumably buying back those positions you had… or maybe something else?

If you had cash on hand:

Would you buy now (at market)or wait?

If you were to wait, what would you be waiting for? A certain level for a stock to hit? And what if that level was never achieved?

We are often presented with statements along the lines of “we are waiting for things to settle down.”

When quizzed about “settling down,” no one seems to be able to give us an objective answer.

We suspect that these folks will only deploy their cash after considerable upside has already occurred, thereby missing out on buying absolute bargains.

These moments of high fear and uncertainty tend to produce the most remarkable long-term opportunities…but only for those prepared to act decisively.

What happens when you lean into discomfort instead of waiting for clarity?