Insider Newsletter: Issue #308

Gold at historic highs, AI disrupting the Mag 7, and oil services gearing up for a boom—what's next in this shifting financial landscape? Could the cycle be turning?

Greetings, friends!

Torrey Pines State Beach in Del Mar, California, courtesy of your fellow member Andrew.

The Next Stage of the Cycle?

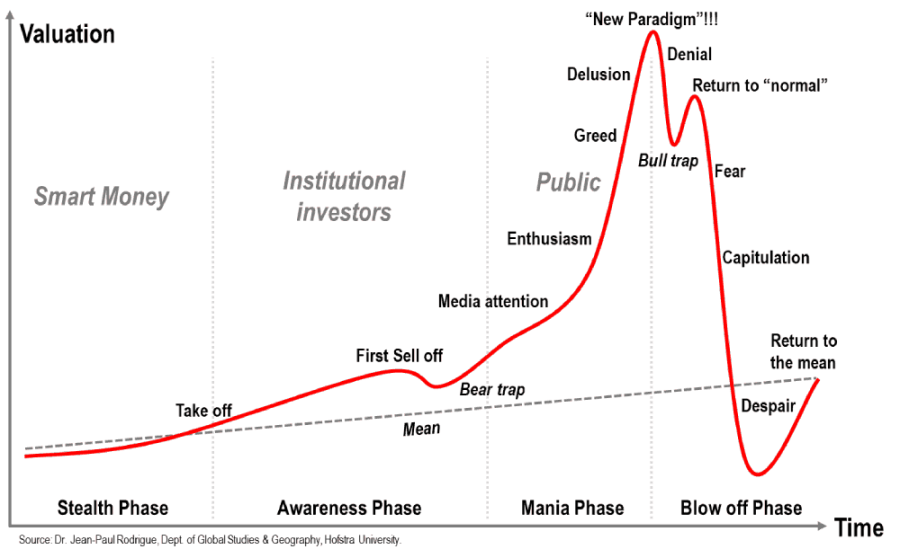

There are several stages in a bull market. Below is a decent representation:

Keep this in mind. Then consider where things are at with this following chart:

And this beauty!

Now consider this article just published:

Oil services stocks could be entering a promising phase in 2025, if George Soros’ “boom and bust sequence model” plays out as expected, according to Bernstein analysts. The sector is believed to be at the start of phase 4, which has historically aligned with strong equity returns driven by the gap between improving fundamentals and investor skepticism.

Could it be an awakening from the slumber? The slow movement of institutional capital shifting as per the earlier chart?

We believe that we’ve been through the stealth phase of this market. We’ve had a good pullback and may now be entering the next phase.

And what stage do we think we’re ultimately going towards?

To answer that I leave you with a… ahem… quote:

Speaking of bull markets…

Gold

It isn’t the first time we’ve mentioned the shiny stuff. But repetition, they say, is the mother of skill, so…

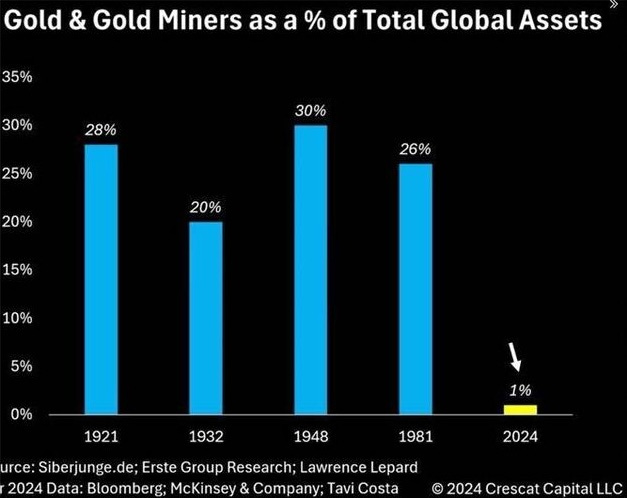

Gold has continued to move higher… and higher… and the media attention as well as institutional capital participation remains in the doldrums (it remains mostly sovereign buying).

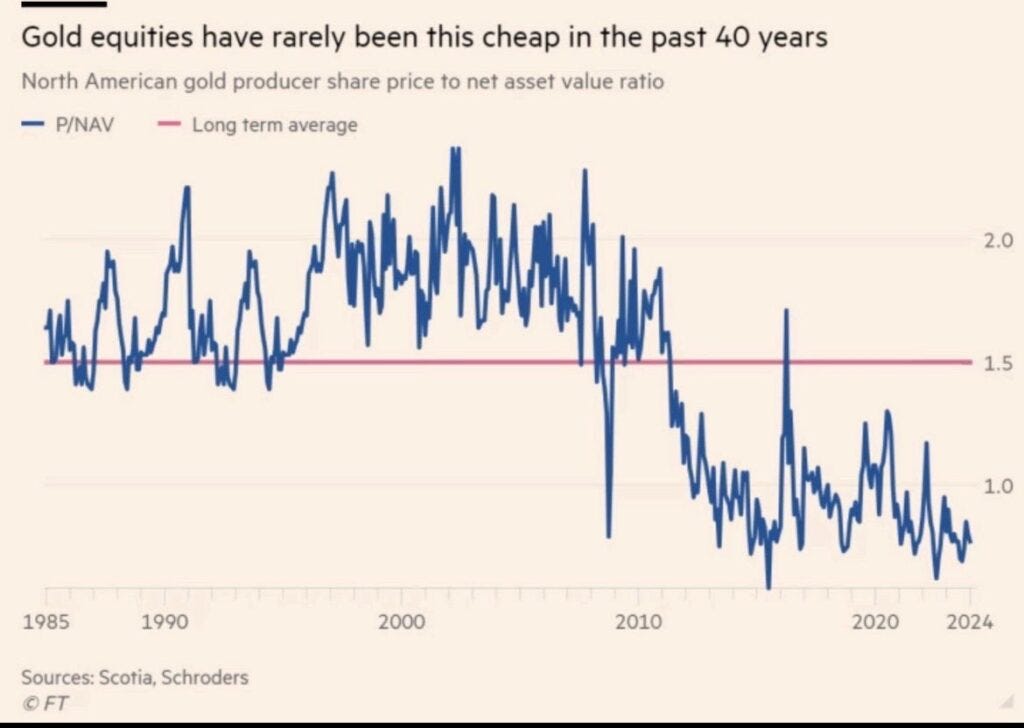

The pointy shoes are still chasing shiny objects in the Bag 7 Mag 7. It is at this point worth reviewing valuations relative to historical valuations.

Based on price-to-net asset values, gold equities have not been this cheap for forty years.

In other words, we have to go back to when Americans put their tail between their legs and left Vietnam to find the same valuations.

That’s pretty remarkable!

Ah, but are they profitable, you might be wondering? The most profitable in 13 years.

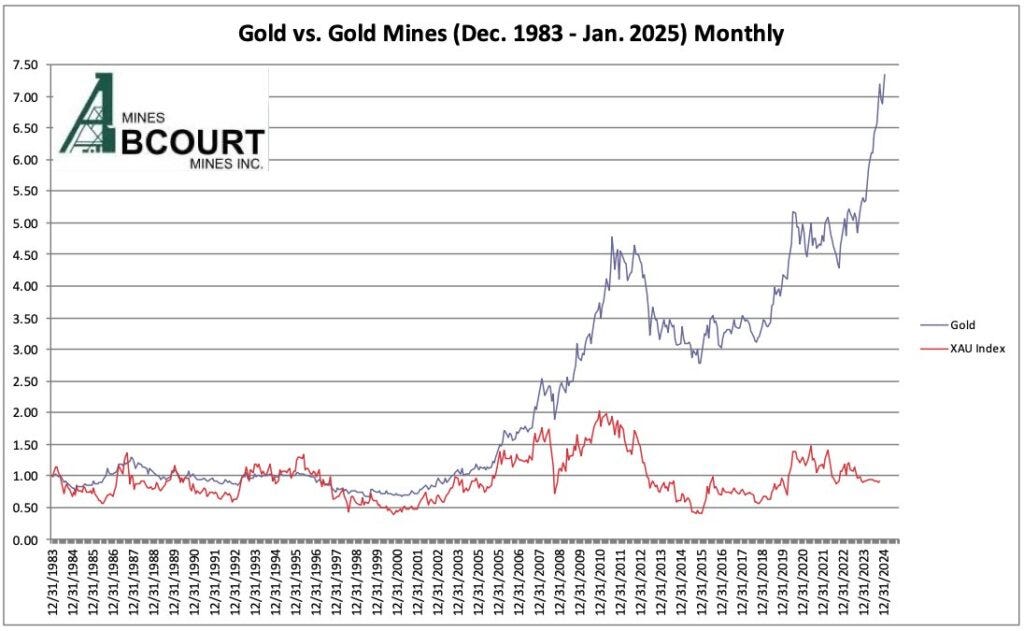

Looked at from a different angle, here is the disconnect between gold and miners.

Another way of looking at it, here are gold miners (XAU Index) relative to the S&P 500 indexed to 100.

Yes, down some 97% since 1984.

We can’t go back anymore than 1984 in Bloomberg sadly, but if I could, 1983 would probably have been the peak.

Taking the last 30 years, it’s still down 90% — as out of favour as they were in 2000 when folks were buying Pets.com thinking they were going to get rich. In other words, at the peak of the TMT bubble.

But more importantly, look at that ultra-long-term bottoming formation and also note the trading range compression over the last four years.

Yes, there is more to a bullish thesis than the “angle of a chart,” but sometimes a chart tells you the majority of what you need to know.

So if our experience is anything to go by, a breakout of the trading range above will result in a significant move that will surprise everyone, both in terms of duration and magnitude.

We find it hard to comprehend that the move will be to the downside.

In case you don’t find this last chart convincing, remember that cycles exist and you make money in this game buying raincoats when it’s sunny, not torrential.

But how does this connect to broader market dynamics and the surprising shift in AI and tech?

The latest developments might just rewrite the playbook for investors…