Insider Newsletter: Issue #304

Argentina’s energy is exploding, gold is flashing signals, and offshore oil is tightening. The big money hasn’t noticed yet—but when they do, where will you be standing?

Greetings, friends!

My back garden with my daughters two hayburners (if you look closely).

And from fellow member Clint, who was enjoying a glass of wine on his back porch in Serenbe, Georgia.

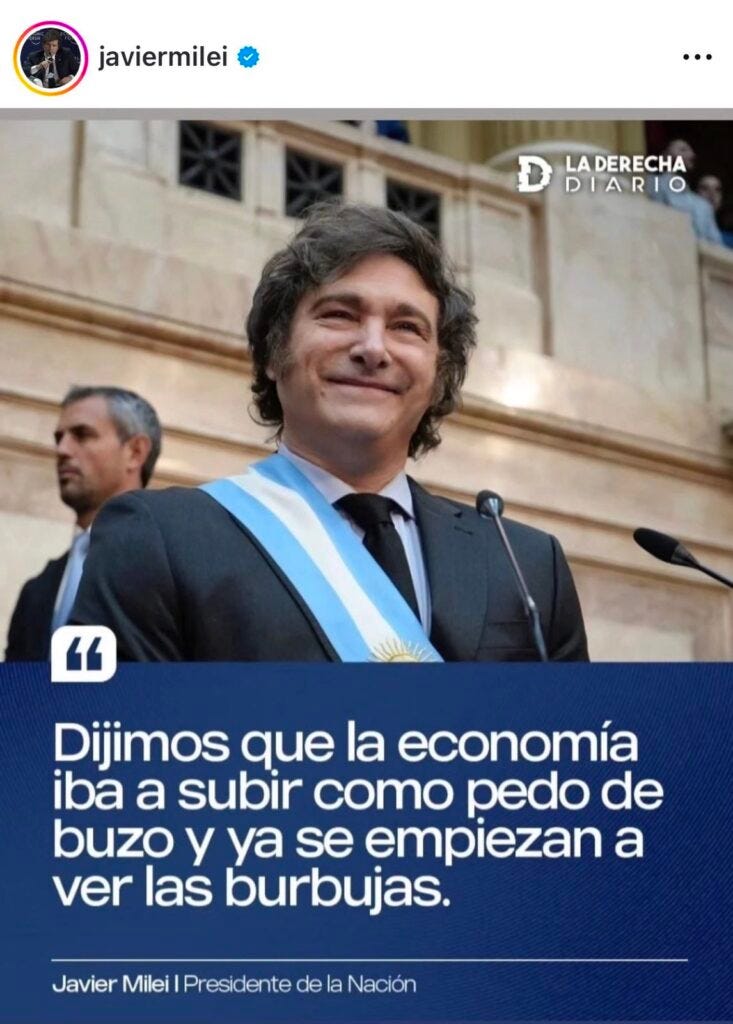

A Diver’s Fart

Argentina continues to do good things, but it is largely going unnoticed by Joe Sixpack investor.

This, of course, makes us warm and fuzzy — like a hot chocolate with a feel good movie on a rainy night.

A 2% exposure to Argentina would be 2% less to stocks like Nvidia and the rest of its “AI” mates… and that’s fine by us.

We were just down in Argentina for the Mavericks meetup.

This is a land where vegans will suffer. Here’s our head trader Brad caught in the action.

700 grams….

…down the chute.

But clearly that wasn’t enough, so…

Clearly, Brad is doing his bit to help the vegans. We wouldn’t want an oversupply of meat now, would we? Of course, it’s not only the steaks.

As beautiful as the scenery is… and as tasty as the steaks are, the reasons we’re down here have more to do with the opportunities we have identified and are investing in.

For years, Argentina’s shale fields were trapped in a bureaucratic nightmare, with socialism and incompetence keeping a lid on one of the world’s biggest energy opportunities. But that’s changing fast.

With the government finally stepping out of the way, production is surging—and the big money hasn’t even shown up yet.

So what happens when Wall Street wakes up and realizes what’s happening?

Let’s just say, those who see it now won’t be complaining later…

We’ll start with one of the main opportunities as referenced in this article highlighting how Argentina’s shale (oil and gas) field is developing:

The biggest problem that has been facing Argentina’s shale fields was a socialist hellscape created by a retarded government.

That problem no longer exists, and the intrusive insanity of the state is being shredded daily — quite literally. It’s amazing to watch.

Outside of that, the problem facing Argentina’s shale is infrastructure, in particular getting oil and gas to export terminals.

And with gas in particular, the need for gasification plants (converting gas into LNG).

This will take time, so don’t be expecting any material increase in supply hitting international markets until after 2030 (particularly natural gas).

By that time, all Argentina’s shale will be doing is making up for losses in production from US shale fields.

From an investing perspective, we are happy to be invested now in anticipation of the infrastructure being developed.

Because once everything is in place, the good news will already be baked into stock prices at multiples to those we have in front of us today and asymmetry will have been lost.

You could be forgiven for thinking that the asymmetry is already gone, with YPF up some 5x since we first started buying it.

However, we feel the best is yet to come, and with the company sitting on a forward P/E of 5x, we don’t think any optimism is priced into the stock.

Furthermore, the average investor — both retail and the pointy shoes on Wall Street — has yet to even find the ticker on their Bloomberg screen. Meanwhile…

YPF: la producción de petróleo shale creció un 36% en el tercer trimestre

From the article:

Durante el tercer trimestre, la producción de petróleo shale promedió los 126 mil barriles por día, un crecimiento del 36% respecto al mismo período del año anterior y un 11% respecto al segundo trimestre de este año.

Hoy, representa el 49% de la producción de petróleo total de YPF (2T24: 46% y 3T23: 39%).

Let me translate this for you: BUY.

Ok, that’s the simple translation. Here’s the one for us dummies whose espanol remains in dire need of work.

During the third quarter, shale oil production averaged 126,000 barrels per day, a growth of 36% compared to the same period last year and 11% compared to the second quarter of this year.

Today, it represents 49% of YPF’s total oil production (2Q24: 46% and 3Q23: 39%).

And before we leave the topic of Argentina behind, I highly recommend spending a couple of minutes and listening to President Javier Milei at the United Nations, where he exposes the communist tyrannical agenda of the Agenda 2030 program.

Well said señor. Well said!

Getting in on the Ground

As a point of reference as to how we put our money where our mouths are, we are investing directly into the Vaca Muerta project with Mavericks.

The particular private equity deal is just far too good to pass up and it ticks sooo many boxes for us — literally.

We just took some of the most handsome (of course) Mavericks to the site to look and fully grasp the enormity of the opportunity in front of us.

If you’re an accredited investor and interested to learn more, the window for participating alongside the Partners is closing shortly.

Please reach out to admin@mavericksproject.org for more information.

And while you’re doing that, I saw this gem…

Translated:

We said the economy was going to go up like a diver’s fart and now the bubbles are starting to show.

Positioning oneself to “get lucky” has a lot to do with figuring things out before Joe Sixpack and his wannabe Wall Street flunkies finally “get it.”

We don’t know how long that will be, but we’re devouring all we can at the buffet table while it’s still screaming cheap.

The tides are shifting, and the mainstream hasn’t caught on yet. What does this mean for those who position themselves early?

And more importantly—how can you turn these overlooked opportunities into financial gains?