Insider Newsletter: Issue #302

Bitcoin bonds, AI’s hunger for power, and the hidden gems of deep value investing—this week’s dispatch dives into the unseen forces shaping our world. Are you watching closely?

Greetings, friends!

Tain from the recently completed (and epic, I may add) Mavericks event in El Salvador.

Note from Tom:

As I take a breather on a damp morning, it gives me a chance to catch up on other non harvest matters such as the most recent weekly.

And given one of the sections regarding producing siht the world needs I thought everyone could once again enjoy a couple of sunset shots from the last few days worth of harvesting out here in Saskatchewan.

All the best to everyone. - Tom.

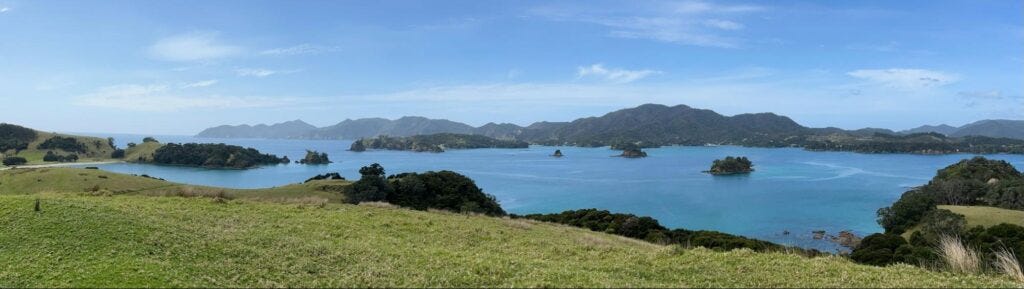

And the beautiful Bay of Islands in New Zealand, where Brad is currently holidaying with family. Insanely beautiful, and no snakes, spiders, flies, box jellyfish, stone fish, or blue octopus… or bush fires.

Lastly, my current office where I’m finishing this edition from. Cabo ”full of gringos,” Mexico.

The Savior

That, of course, is the literal translation.

El Salvador, the tiny Latin American country that is now the safest country in the Western hemisphere, gave the middle finger to the IMF, World Bank, and global monetary terrorists, instead opting to finance operations by issuing Bitcoin bonds.

And the result? It has paid off. Handsomely.

No word from the IMF, who have relentlessly criticized the path taken.

Something else. Please pay attention, because the world that you likely think you live in is not ACTUALLY the world you live in.

The media, the political class, the shills — they all create an illusion for you.

Take a look at safety. Arguably one of the most important factors in economic growth. Of the Western countries, Norway is the only one in the top 10.

I would encourage you to watch the short clip below, excerpted from Bukele’s address at the UN.

In a nutshell, that was why we were down there building networks and getting to understand things better.

In any event, I did find that Google Maps only works so well. In many parts of El Salvador it leads you down a garden path. Fortunately for me, I like garden paths.

They’re exciting and, as it turns out, filled with midgets. I gave these folks a lift up a donkey track road as they were carrying a lot of baggage (on their heads). I learned that they are indigenous.

The lass in pink has seven children, and the chap on my right is her husband.

What I did find driving around (it is a small country, and I clocked a lot of mileage) was a lot of infrastructure spending that you could see has taken place in just the last few years, with a lot ongoing.

Pretty serious highways are being constructed all over the place.

As well as things such as water treatment plants (Chinese-built and financed).

Real estate is not cheap. It is, in fact, very expensive.

I came away with the impression (conversations had with some influential folks) that Bukele is using a Singapore-type approach.

But since El Salvador doesn’t have a port to start with, he is targeting blockchain technology and attempting to attract human capital accordingly.

This is, I think, the sector to be focussed on here, though as of now, I’ve not any obvious plays, certainly not in the listed equity space. But I will be watching it closely as will the team at Mavericks

Revising the Extremes in Global Equity Markets

It really is a strange world.

Between blue-haired one-legged lesbian eco loons destroying artwork to save the planet, a braying donkey running for President in the not-very United States, a global campaign to turn little boys into girls, and a raft of other insanity, it can be tough to keep one’s head amongst the chaos.

But that’s exactly what we must do. In our world of global equity markets, the disconnect from reality (boys pretending to be girls, if you will) is clearly evident when looking at the value vs growth indices.

Consequently, it really isn’t very hard to find good value in traditional value stocks (low P/Es, high dividend yields, etc). And this brings me to…

History has a habit of punishing those who chase overvalued assets. But will this time be different? The answer lies in what happens next…