Insider Newsletter: Issue #300

Society’s true producers are dwindling while the “comfort class” expands—leading to dangerous delusions, economic chaos, and political tyranny. How does this end?

Greetings, friends!

Cholula, Mexico — thanks to the perpetual vagabond Annet.

The closer the collapse of the Empire, the crazier its laws are.

Cicero

Thoughts on How We Got Here

Let’s begin with how society functions. Today, we are in this unfortunate situation where the ostensible pillars of production are distinct from the actual pillars of production.

Let me explain…

The actual pillars of society (at least in terms of production) are agriculture, mining, fabrication, and transportation. All of these industries have benefited massively from technological advancements. Agriculture, for example, now uses harvesters as opposed to, say, oxen.

As a result, the actual number of people employed in agriculture continues to… you guessed it, fall. That’s a good thing! It frees up time for folks to do other things — build isht that doesn’t yet exist (this is how humans have advanced) or paint pretty pictures, play music, or write novels.

The entire arts owes its existence to reducing the amount of time needed to actually provide for life functions. Stay with me because this part is important. The number of folks employed in “the arts” has therefore exploded upwards.

People tend to like these jobs, too. They’re more comfortable and less taxing on the body and increasingly less taxing on the mind as well. It is how we have such soft-brained individuals littering society today.

The fact is, today we are drowning in comfort. Society is saturated with it. This is how universities have liberal arts degrees and gender studies, as if there’s more to know than that there are 2. There isn’t. That’s it.

Additionally, each group of people act like gangs. Consider the schoolyard. The kids who play football think they’re better than the kids who play chess (nerds).

Well, today the kids drowning in comfort are finding that their “value” they bring to the table isn’t quite so high — hence they advocate for mandating and forcing society to value them. This is how we were told to “accept” all the “underprivileged,” except this term has been hijacked.

You see, the thing is these people were always accepted.

They just weren’t praised for these attributes. Today, we have to exalt them to media star status for their inadequacies.

Today, you can be a victim for any number of reasons. Fat? No problem, you’re a victim. Ugly? You’re a victim. Stupid? Victim. Can’t do math?

It’s the patriarchy or white supremacy and racism. You’re a victim. As daft as this is, we’ve moved beyond it.

Take that disgusting obese lesbian (no sane man would touch her, so…) who we’re told we must applaud. When we don’t, we’re labelled any number of stupid things. Sexist, fat shamer lesbian hater, etc.

Here’s the kicker. These people vote. Their vote is equal to everyone else’s. Frighteningly, the pink-haired angry lesbian with a liberal arts major who now heads up the “Diversity and Equity” department at Lululemon has the same weight in vote as does a farmer.

One produces for the world while the other detracts value.

What’s worth understanding, too, is that with the advancement of technology, which builds on previous underlying fundamentals such as electricity, for example, there are more and more folks who fall into the “comfort saturation” bucket than fall into the “produce isht we need” bucket.

Technology, remember. Combine harvesters don’t vote.

What’s more is that the “comfort class” have an inability to understand the connection between their liberal world and that of the reality world. Case in point. They are champions of electricity.

In fact, they see it as part of the cosmic firmament. It’s just there, like the air you breathe, and therefore should be a right.

At the same time, they are ready and willing to deface beautiful artwork, glue themselves to bridges, and become general nuisances to society in an effort to end the use of coal and natural gas.

Their inability to understand the connection between what they see as a right (electricity) and what they see as evil (coal and natural gas) is complete. 100% complete.

Because these people are useless and an actual menace to society, they’re not wanted. Pray tell, who wants this?

It is why they have to resort to violence to demand society like, accept, and “value” them. Communists are always the same.

They’re the parasite class in their early phase, but like any cycle before us (Mao’s China, Pol Pot’s Cambodia, Stalin’s Bolsheviks), they resort to tyranny. Always and every time.

You can easily spot tyranny because it always comes in the name of compassion and equality of outcomes.

It is a road paved with cowards, conmen, corrupt bureaucrats, high taxes, debauchery, mass menticide, and the moral depravity of distracted and diseased materialists conned by chosen ones who monopolise control of information, media, spy agencies, war machines, and money.

We’ve moved past the phase where we can vote our way out of the destruction.

No, the deep state is a real thing. We still have politicians and politics, but it’s a facade. Today, politics is the entertainment division of the military industrial complex.

Take a look around you and tell me that this time is different.

They demand you like them and accept them, and they will cancel, and when the time comes, murder those who disagree with them.

The EU commission threatened Elon Musk with broadcasting an interview with Trump (election interference by a foreign entity?). The are now daily reports of folks being thrown into prison for sharing evidence of rioting in English towns and cities.

At the last count, over 400 people have received prison sentences for disagreeing with the government… online. They’ve not thrown any rocks, not punched anyone, not rioted — just voiced their discontent online.

This, folks, is the rapid march towards genocide.

I know, it may sound absurd, but that is the story of history. Don’t believe me, just go read up a bit.

We can watch this from a psychological point of view as well as financial. The two go hand in hand.

The UK currently has a tax burden of 33% of GDP and rising fast — that is while a mass invasion continues (yes, it’s an invasion, and if you need more information, go and read about the Kalergi plan and then reconcile it with what’s taken place).

This is important because a good majority of these folks are coming for the free benefits which increase the burden, all the while the UK is raising taxes.

You know why the UK is one of the countries with the highest level of rich people leaving?

Because rich people look at this stuff, see the writing on the wall, and get out before they have their assets stolen from them by a collapsing economy, communist power grabs, and capital controls… which are all coming. Watch!

Oh, and one other thing I’ll mention…

Historically, revolutions take place when the income tax burden surpasses 30% of GDP. The UK budget office is projecting it will hit 37% of GDP by 2027.

The first step towards solving any problem lies in acknowledging its existence.

Rampant Censorship

Tech can continue to be a liberator. The events unfolding in Britain now should usher in a newfound awareness of the risks to tying any account with your details.

The communist Guardian published this:

Aimed at teaching critical thinking? God, these people lie through their teeth. This is EXACTLY the opposite of what they are teaching:

That’s why our curriculum review will develop plans to embed critical skills in lessons to arm our children against the disinformation, fake news and putrid conspiracy theories awash on social media. Our renewed curriculum will always put high and rising standards in core subjects – that’s non-negotiable.

It is worth knowing our history. In the Bolshevik revolution and the former USSR, children were taught to rat on their parents and their own family.

Divide and conquer has been the strategy employed in every communist fascist movement since the dawn of time.

Remember last week when we spoke about the Bolsheviks in Britain? Europe under the EU is doing their part to usher in the great reset — a technocratic world with one world government and humanity enslaved.

Over in Frogland, they just passed a law that allows the government to open the camera and microphone of any phone remotely and without any legal process. Politicians are exempt, of course.

Lavrentiy Beria was the notorious chief of the Soviet secret police under Joseph Stalin. This phrase encapsulates the idea that authorities can fabricate or manipulate evidence to incriminate anyone they choose, regardless of actual guilt.

Beria’s approach was to identify a target first and then find or create a crime to justify their persecution, reflecting a profound abuse of power within totalitarian regimes.

Rules for thee, but not for me. Take it you peasants and shut up!

The Bolsheviks at the European Union sent a letter to Elon Musk, demanding he censor their Donald Trump interview. They threatened Musk with legal consequences if he does not prevent the spread of what they label as “disinformation.”

Remember when these same clowns were blaming Putin for “interfering in US elections?” Oh, the irony.

Meanwhile the chief Bolshevik here, the EU commissioner Thierry, who is actually Senegalese (yup, he’s African, no, really), you see, this turd, who lectures all the European peasants and earns his income from them at the point of a gun only pays a 5% income tax thanks to a cosy dual national relationship with the French Ministry of Economy.

The conditions are now being set for a digital ID required to access the internet. First, they’ll conjure up all manner of misdeeds (riots, for example) and then build the narrative that it was social media posts that fomented this violence.

The police will therefore need “extra powers” to deal with this. They’ll couch it in terms that are entirely warm and cosy with safety thrown around a lot.

Europe (and with that I would include Britain as well) is — and I believe this to be a technical term — F.U.K.T.

Which brings me to…

Ahead of the Migration

Certainly we’ve been ahead of the major migration patterns now unfolding at ever increasing speed and intensity.

We’ve spilled a lot of ink on highlighting first how cheap Dubai was relative to many other cities in the world (we began talking about it in 2018).

Factors involved are the collapse of civil society in the UK, Europe, and the US and five eyes. Sadly, pretty much all of the West.

When it is hard for citizens who are paying their government exorbitant taxes for the privilege of… well, I’m not sure, actually. But they’re paying and struggling.

Well, illegal immigrants get a better deal. How ‘bout dat?

Meanwhile, California just keeps getting stupider.

California Is Relaxing The Punishment For Adults Buying Children For Sex

SB 1414, new law in California. The punishment for buying a child for sex in California is now punishable by 2 DAYS in county jail. 2 DAYS in county jail. It’s no longer punishable by prison

Now, here’s the good news: people are fleeing.

You can check out a recent study done on just what this looks like. Here’s the top five on both ends of the spectrum.

Influx:

Florida

Texas

North Carolina

South Carolina

Arizona

Outflow:

California

New York

Illinois

Massachusetts

New Jersey

Making sure you’re ahead of these trends is profitable. Here’s one example…

One of libertarian Javier Milei’s first initiatives after winning the presidency of Argentina in November was getting rid of the country’s notoriously clumsy and counterproductive rent controls.

The results are in, and rents are falling sharply in Argentina as the housing supply explodes.

On a similar topic, related at least insofar as how violently and swiftly the world is changing.

Telegram founder Pavel Duvov was kidnapped in Paris last week. His crime? Not censoring information on the channel. In particular, the genocide taking place in Gaza.

We all saw how the entirety of the US poodles Congress clapped like well trained seals as Netanyahu basically told them all that the entire Western world (what he called the civilised world) would need to go to war with the uncivilised world.

It was stunning, not only in the claims made, but that he wasn’t called out for being a genocidal maniac.

In any event, Pavel is now in prison. It highlights how dangerous it is becoming to speak one’s mind. I still find it strange that people tell me that if you’re not some hotshot, you’re fine.

This is how all totalitarian systems start. They take out the big names and those that are influential and then work their way down the line and finally drive the nail into the coffin with total “got you by the balls” control.

Make no mistake — they are coming for you. Right now, folks like Pavel are standing in their way.

Any one of us can comment on social media, and if the powers that be don’t like it, they can send an arrest warrant out to all of their captured governments. Flying through any of these airports now represents risk.

As mentioned in the previous issue, the Brits now have the ability to extradite someone for posting content on social media which by their own definition “incites violence.”

This includes simply highlighting crimes being committed as we’ve already seen this in play.

Post a video of some thugs tearing up your town or raping some little girls and suggest that maybe they ought to be brought to justice and you’re “inciting violence.”

So what’s the good news? There is actually quite a bit. Hallelujah!

First up, Nayib is good news. It seems that our event there in just a couple weeks’ time presents perfect timing.

Next… Well, the Russki embassy told the frog embassy to immediately explain themselves. As did the UAE:

The United Arab Emirates calls on France to provide ‘all consular services’ for Durov, says ensuring care of UAE citizens is a ‘top priority’.

Pavel is a citizen of both countries… as well as France, mind you.

Anyway, the really important thing is this — and it’s actually far bigger than most likely think. The UAE has gone a step further.

…the UAE has already frozen the implementation of the contract for the purchase of 80 fighters from France.

So Macron and clowns just lost €17 billion in a day. Not bad, even for numbskull socialists.

Worse still, it turns out that the French president invited Durov to dine together. Pavel told the French newspaper Le Canard Chainé this during interrogation by the police.

But instead of lunch, Durov was met in France by local police. Macron did not officially confirm this. But local politician Florian Philippot said that this was “quite in the spirit of the French president.” Put another way, he’s a duplicitous count but without the “o.”

Why do such a thing?

The Israeli newspaper Haaretz has reported that Telegram has posed a ‘significant challenge for Israel’, just days before CEO Pavel Durov’s arrest:

“Many tech firms have streamlined mechanisms through which states can reach out to them to censor content, but Telegram is the least cooperative of them all.”

They also add that Telegram has failed to remove antisemitic content.

Now, before you get all wild-eyed and excited that the UAE is the bastion of freedom, realise that the world works very differently to what Hollywood movies show.

Do the rulers of the UAE care about Durov? Not directly. They’d gladly hang him if it made sense. This isn’t about human rights.

A tiny teensy part of it may have to do with protecting Emirates and sending a statement on that front, but I don’t think that’s the primary reason.

No, this was a strategic decision which went something like this:

The existing ruling world order is in collapse mode. This creates a power vacuum as the West collapses. We are now well into the timeframes where maps get redrawn and chips are up for grabs — chips that were previously off the table.

In this environment, the UAE is simply pressing the accelerator on what has worked so well for them for the last three decades. In other words, present itself as a place that is highly attractive to capital.

Which brings us to…

The CEO of Rumble fled Europe after the arrest of Pavel Durov as France also threatened their platform.

Rumble CEO Pavlovski exits Europe amid Durov’s detention crisis

After the detention of Telegram founder Pavel Durov in France, another social media CEO, said that freedom of expression is under threat in Europe and announced his safe exit from Europe.

There aren’t that many places for Chris to go to. For now, the UAE looks like one of them.

Now, take this situation and multiply it thousands of times.

Right now, this is an equation that every businessman with any company that could potentially fall under the scrutiny of Western powers (which at this point covers pretty much everything) is making.

Now, how much additional capital gets drawn to the UAE under what amounts to one of the best marketing campaigns ever?

What else? As for Europe and the UK, capital controls are the next step. Watch!

Best to be bullish chaos!

Necessity Is the Mother of…

Invention — or so the saying goes.

Now, consider the Russkies. They’ve been cut out of the international payments system, and though they’ve built an alternative to SWIFT, this is simply a messaging system and access to international banking is still impeded.

Now, we also know that banking as it operates today is still in the dark ages. The costs are prohibitive, the movement of capital can take days, the service level has done nothing but fall globally, and, of course, it is Western controlled as most capital lands up moving through intermediary banks in New York.

I was reminded of this when recently speaking with a businessman in El Salvador. Getting capital into the country can take up to 6 months. Why?

Well, their current President Nayib Bukele has become rather well-known for a number of things. One of those things is that he’s called out the IMF as a criminal cartel (which is, of course, accurate).

Certainly, it’s one of the reasons why getting capital into El Salvador is difficult. They are effectively under silent sanctions. So now we have two countries. One under direct overt sanctions and another under covert silent sanctions. Keep this in mind as you read on.

The Russian government has approved two key cryptocurrency bills that aim to disrupt its international trade and financial landscape, according to local media sources.

Faced with the mounting pressures of Western sanctions following its invasion of Ukraine, the Russian government has turned to the power of digital assets as a strategic tool to circumvent economic constraints and bolster its economic resilience.

The first of these landmark bills, approved by the State Duma (the lower house of the Russian parliament), permits businesses to utilise cryptocurrencies for international transactions. This legislative shift represents a pivotal step in Russia’s efforts to mitigate the disruptions caused by sanctions, which have severely impacted its ability to conduct seamless cross-border trade.

Western sanctions have significantly hindered Russia’s international transactions, leading to prolonged payment delays and restricted access to traditional financial channels. The new law empowers the Central Bank of Russia to launch a pilot program that will explore the integration of cryptocurrencies into the country’s cross-border payment infrastructure. By leveraging the borderless and decentralised nature of digital assets, Russia hopes to circumvent the constraints imposed by the SWIFT system and the dominance of the US dollar and Euro in global commerce.

Alongside the cryptocurrency initiative, Russia is also actively promoting the BRICS Bridge project, a collaborative effort with its BRICS partners (Brazil, India, China, and South Africa) to facilitate settlements in national currencies. This multi-pronged approach aims to reduce the reliance on Western-dominated financial networks and foster more resilient economic ties within the BRICS bloc.

Ok, you got all that? Now, here’s what just happened in El Salvador…

Following Russia’s recent legal shift regarding the asset class, El Salvador has proposed using crypto for trade with the BRICS alliance, in order to ditch the US dollar. Indeed, Russian diplomat Alexander Ilyukhin said the measure would simplify trade dealings, as the greenback is the Central American country’s official currency.

It is worth noting that Bukele has been a thorn in the side of the globalists ever since he was first elected.

Telling the IMF to take a hike was one of the first things he did, only to then finance the government with Bitcoin bonds, which have worked out spectacularly well and no doubt pissed off the globalists who have used debt as their main tool for oppressing and controlling the third world.

Then, of course, he’s invited to foreign investment capital from multiple mostly-non Western countries — again, pissing off the globalists.

So even though it’s not stated right now, it has become clear to me in talks with insiders in the country (we’re running an event there shortly) that they are under quiet sanctions.

So bypassing US intermediary banks using blockchain makes all the sense in the world.

You see they can still use the dollar but without the Western financial infrastructure.

This is, in fact, how much of the sanctioned (by the West) world is now transacting — via USDT, which, if you’re unfamiliar with the term, is tether.

It’s a US dollar token, backed by US treasuries. It provides all the liquidity needed that the US dollar provides without the need to use Western financial institutions. It’s really rather smart and highly cost effective.

I have a lot more to say on this topic, but will save it for another issue. For the time being, keep one thing in mind.

The Chinese have a massive hoard of US treasuries.

What if — instead of dumping them, which doesn’t serve their interests — they repatriate them back to China and into Chinese banks (already largely done) and then simply use these reserves for liquidity and on the blockchain, which bypasses any Western sanctions and allows them to rapidly and efficiently continue developing trade outside of the Western banking system. It would be a stroke of genius.

Moving on…

Value Stocks: Back to the Future

As we all know stocks took a “bathing” a few weeks ago, but we are not phased. Here’s why…

The stuff we are invested in (characterised by being small cap value oriented) are not expensive and remain extremely out of favour over the long term and over the last few years haven’t really done too much.

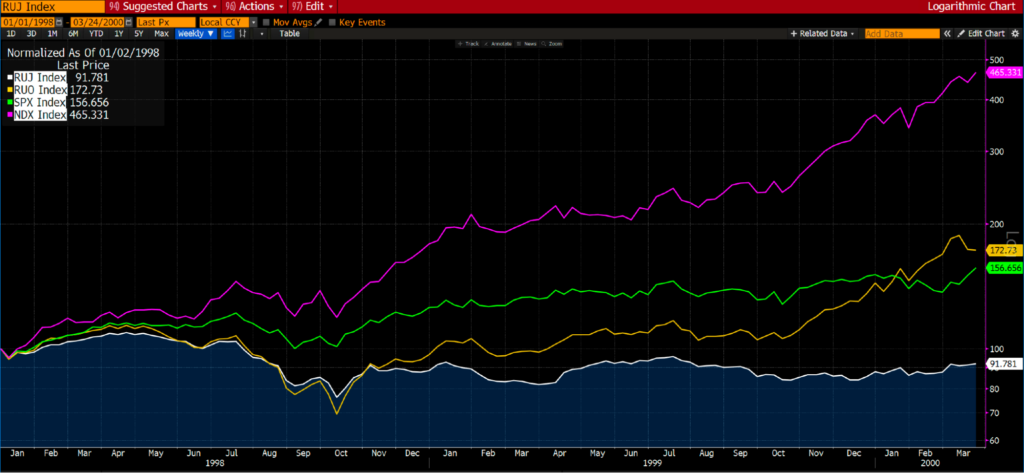

We want to remind folks of a couple of situations that we have experienced before (we can’t believe that we are going back almost 30 years now).

In the five years leading up to the peak of the TMT bubble in 2000, growth stocks (namely tech, media, and telecoms) had done exceptionally well. The Nasdaq was up some 900% with a lot of those gains coming from late 1998 onwards.

However, small cap stocks and in particular value stocks had not done so well. They were up about 70%, having gone nowhere in the preceding three years and down some 10% over the previous two years.

What happened from March 2000 to 2003? The dot-com bubble came undone, and the Nasdaq fell by some 80% while the S&P 500 and Russell Growth fell 45% and 50%, respectively. At the same time, Russell Value was up 7%.

We would like to believe that the reason why value stocks came out ahead in the shadow of the S&P 500 losing almost 50% was because value stocks (particularly of the small cap variety) were extremely out of favour come March 2000.

It was a wild time to say the least, and it wasn’t fun for anyone from June to October 2002.

But what about the GFC, you may ask? Yes, everything got belted to “hell and gone.” There was no escaping if you were invested in equities.

We note that in the five years leading up to the GFC, everything in the world went up.

The deep value was in currency for a change. Coming into 2007, there was euphoria across the board, including emerging markets!

Nasty, and there was no escaping the carnage (unless you were hiding in cash).

Which brings us to the current situation. It’s almost like a repeat of the 1995-2000 setup, but with one exception.

Small caps across the board have barely budged over the last five years, rather than just value oriented small caps. It’s the same with emerging markets and commodities.

By staying invested in stuff that is out of favour (few folks have made money in over the last five years), it is highly unlikely we will lose money on a five-year view.

But there is more to investing than the “angle of a chart.” Fundamental considerations have to be taken into account as well. Which brings me to…

Value vs Growth: Valuations Matter

An interesting article from the FT confirms what we have been thinking. Namely, that the premium being paid to growth stocks is madness (although it doesn’t exactly take a rocket scientist to figure that one out).

The ratio of the price to book value of the cheapest 30 percent stocks of the world stock market with the most expensive 30 percent.

Why We Focus on Macro and Sectors

A quote from Stanley Druckenmiller:

I was at a money manager roundtable dinner where everyone was talking about “my stock this” and “my stock that”. Their attitude was that it doesn’t matter what is going to happen in the world because their favourite stock is generating free cash flow, buying back shares, and doing XYX.

People always forget that 50% of a stock’s move is the overall market, 30% is the industry group, and then maybe 20% is the extra alpha from stock picking. And stock picking is full of macro bets. When an equity guy is playing airlines, he’s making an embedded macro call on oil.

We would say that a stock’s price movement is more like 50% associated with the sector it is in and 30% the market.

Anyway, I guess it comes down to a question of time frame. The big point is that more energy should be focused on analyzing the macro factors affecting a sector rather than the stock itself.

Emerging Markets, Commodities, and Producers: Toxic Waste?

Looking down from a 30,000 foot view, it isn’t hard to spot where value is likely to reside and how out of favour emerging markets, commodities, and commodity producers are compared to the S&P 500.

Emerging markets are more out of favour today than at the height of the LTCM crisis/Russian default of 1998.

It certainly seems like we live in a world of endless and cheap abundance of physical resources. Or could it be said that investors are fixated with dominating people’s headspace rather than physical stuff?

Almost as out of favour as they were during the height of the corona crisis in March 2020, where investors were preparing for the end of the world as we knew it.

Six years of sideways trading. That looks like a long-term bottom formation.

Now, ask yourself — where would I rather be positioned for the next 10 years? In commodities and related equities, emerging markets, and value focused stocks… or the S&P 500 (essentially, the Magnificent 7)?

US Shale Oil Production Stalling

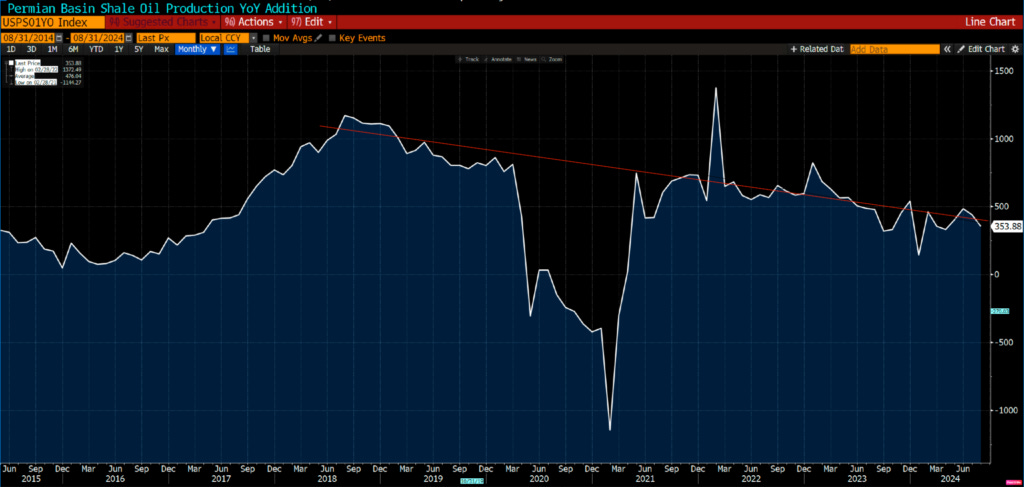

We feel like a broken record in saying that US shale oil production appears to be in trouble. But allow us to continue and outline our thinking with a few charts.

On the face of it, it seems like US shale oil production is doing just fine, having registered a record high this year.

However, if we dig beneath the surface, then we discover that the growth is accounted for more or less by the Permian basin. Other regions are not growing. Rather, they are struggling to maintain production

Instead of looking at the absolute levels, let’s look at production from an indexed perspective. Over the last 10 years, all the growth in US shale production has come from the Permian. It seems that production outside of the Permian peaked in 2019.

Ever since 2019, production ex-Permian has struggled. Why? We don’t know for sure, but perhaps it was due to the big increase in production form 2016 to 2019 with a focus on Tier 1 assets? But that’s only our best guess — hard to prove or disprove with any degree of objectivity.

And the Permian itself? That, too, seems like it is struggling. While production is continuing to grow, the rate of growth is declining rapidly and is dramatically less than 2019 levels.

We can see the drop in momentum using a log chart instead of an absolute style chart.

One can also get an idea of the decline in growth rate by looking at production from a year-over-year addition perspective.

We used our imagination and drew an eyeball regression line from 2018 until now taking out the effect of the corona scam crisis.

Are we “out of order” in saying that y-o-y growth in Permian oil production will be “zero” some 18 months from now (end of 2025)?

The cracks in the system are widening, and the next phase is already in motion.

While most will be caught off guard, those paying attention have a chance to position themselves before the real chaos begins.

What happens when debt service overtakes military spending? What comes next for capital controls? More importantly—how do you protect yourself? Keep reading.