Hong Kong Small Caps?

"Hello, is there anybody out there?" Hong Kong and China have been completely overlooked by international investors as a destination for value...

During our “global adventures to find value,” smaller cap stocks in Hong Kong keep on popping up on our radar screens. Hong Kong and China have been completely overlooked by international investors as a destination for value.

This is hardly surprising given all the banter about China invading Taiwan, the Chinese military build up, ongoing China-US trade relations and Trump threatening absurd tariffs on them, yada yada yada.

No surprise then that folks are a little gun shy given the sanctions on Russian securities back in 2022.

Here’s the thing, though. These risks are already priced into the market. I would say they’ve over exaggerated because — and not to diverge from the main topic here — China has already won this war.

Why? Because you can’t go to war with the country that owns the supply chains and critical components for your own military.

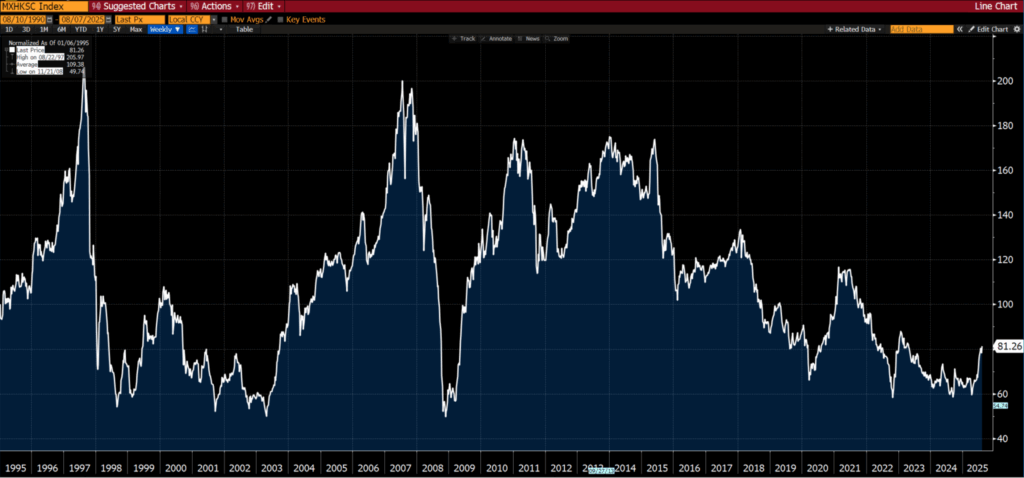

In any event, at the start of the year Hong Kong small caps were trading at the same levels as the GFC, at the end of the “dot-com” bear market in early 2003, and at the very worst of the LTCM (Russian default) crisis of 1998. I vividly recall these events.

No one wanted to touch emerging markets (Hong Kong was a great proxy for emerging markets) with a 40-foot barge pole, let alone small cap stocks in emerging markets.

But nothing exists in isolation. We need to look at how a market has behaved relative to others.

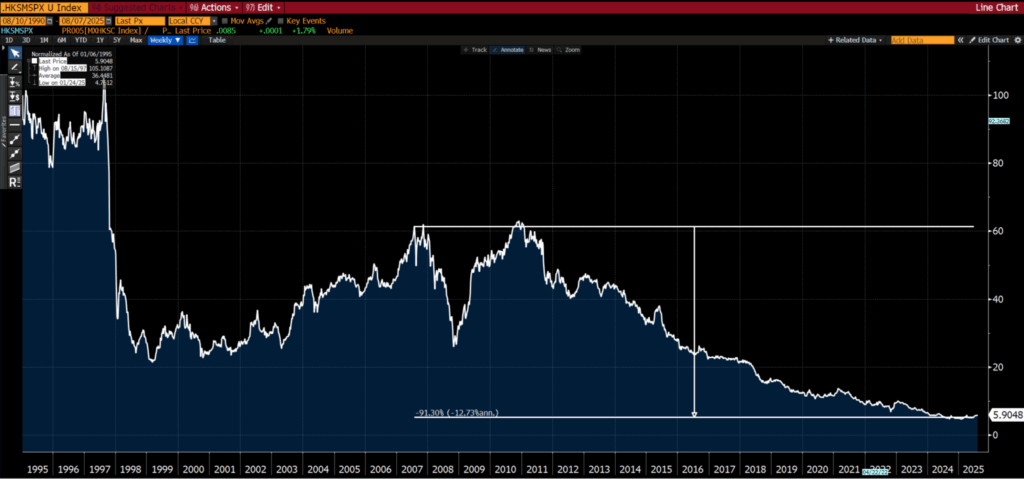

From the mid-1990s, Hong Kong small caps are down some 95% relative to the S&P 500, some 90% since 2010, and 75% from the late 1990s.

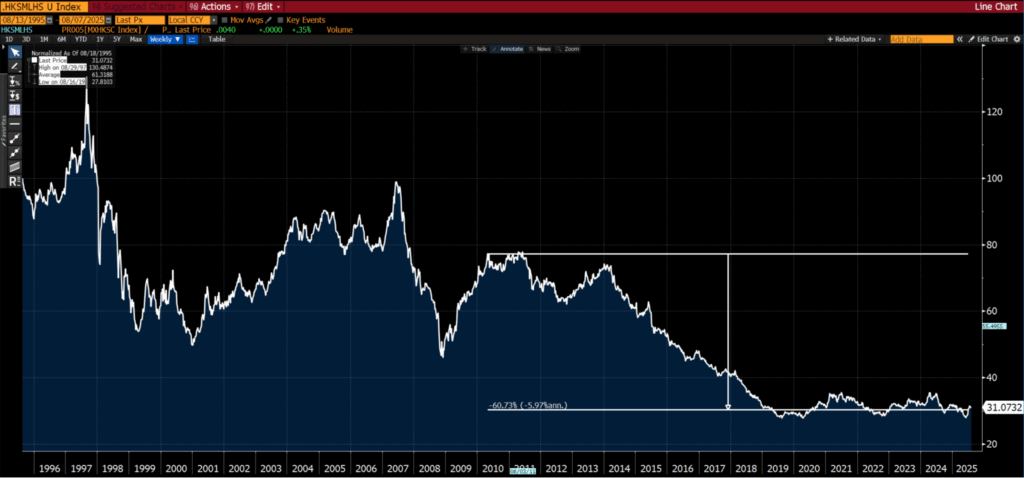

Since 2010, small caps in Hong Kong are down some 60% relative to large caps and down 40% since the worst of 2008.

Now, let’s look at Hong Kong from a valuation perspective.

They sit on a forward P/E of about 13x and a dividend yield of some 5%.

It doesn’t take a highly paid stock analyst in a pinstripe suit with shiny teeth to figure out that if you take the time to go digging, it wouldn’t be difficult to find many stocks below a P/E of 10x or with a dividend yield above 8%.

Now, here is the catch — there are no small cap Hong Kong ETFs left. There were a few but they have all been liquidated. That in itself is a wonderful contrary sign.

The point of all this is, if you are looking for value, take a closer look at the Hong Kong stock market and in particular smaller cap issues.