Global Monetary Shift In Progress

A global monetary shift is taking place and it's sending strong signals...Here's what we know and how to front run the catastrophe.

Capitalist Exploits

June 11,2025

“The end of an era rarely sends a press release. But it always sends a bill.” – Anonymous

If you want to know when the music stops, don’t watch the dancers…watch the guy pulling the plug on the jukebox.

We’re standing at the edge of a monetary and energy regime shift so massive, it’ll make the Nixon Shock look like a polite tap on the shoulder.

And as history repeatedly shows, when paper melts and systems wobble, the winners aren’t the ones holding the most debt-backed digits on a screen…they’re the ones holding stuff.

Real stuff. Dirty stuff. Commodity stuff.

If you can smell it, mine it, drill it, or light it on fire, you’re probably onto something.

This isn't about market timing. It's about survival.

The last time these conditions lined up, commodities went 10x, currencies collapsed, and “safe” portfolios imploded.

The steamroller is already moving…and this time, the Fed won’t stop it.

Let’s open the playbook.

The Big Reset: When Monetary Regimes Die

In every major shift in modern financial history…from the weakening of the gold standard in the 1930s to the currency crashes of the 1990s…one pattern repeats: commodities go from pariah to prophet.

Today smells eerily familiar.

A period of significantly low interest rates, financialization on steroids, and a central bank-fueled carry trade have hollowed out the productive core of the economy.

But beneath that froth lies a brewing plan: what some speculate could become the “Mar-a-Lago Accords.” It’s not official, but it might as well be.

Rumored mechanisms? Tariffs. Currency pegs. Debt swaps involving non-marketable, zero-coupon bonds with 100-year maturities.

Imagine slapping a 90% haircut on your sovereign obligations and still getting invited back to the global dinner table.

And before you scream “impossible!”…just remember, we’ve done it before.

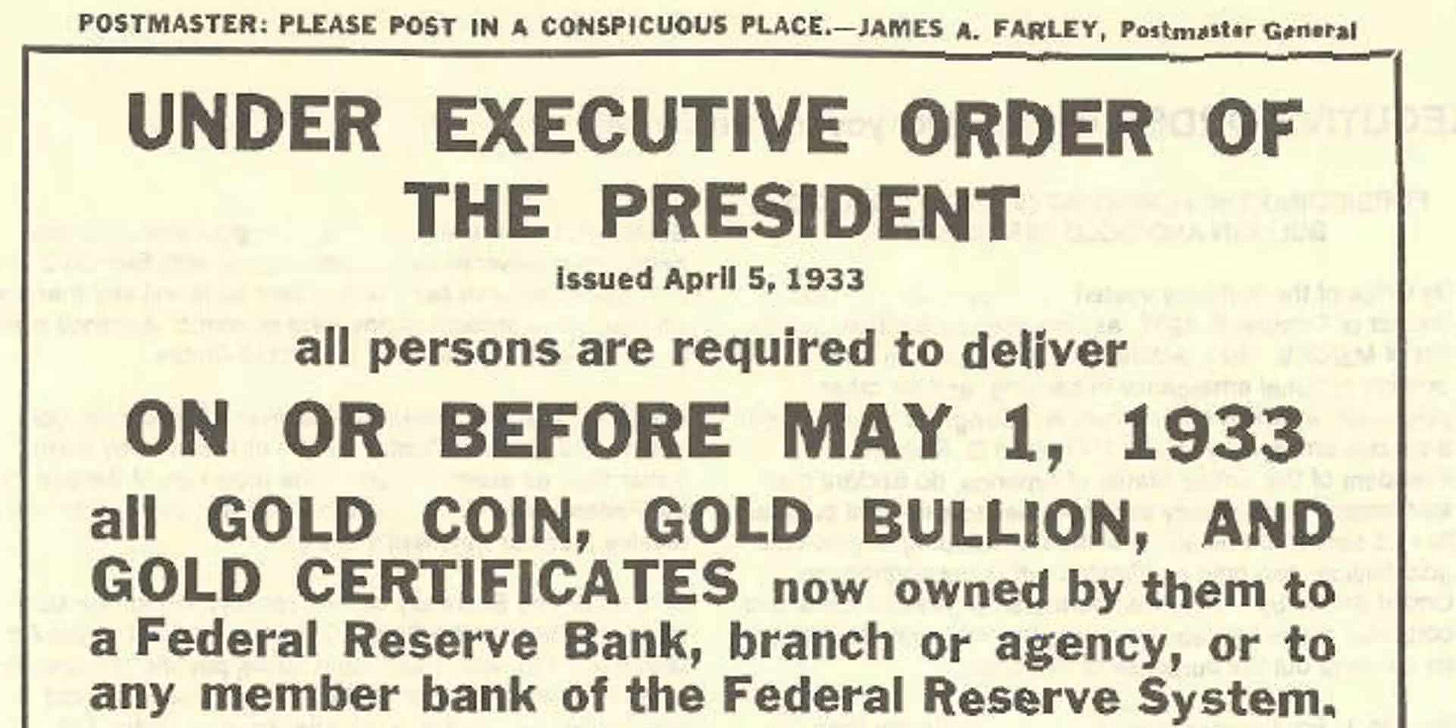

In the early 1930s, the classical gold standard began to collapse, with the U.S. suspending domestic gold convertibility in 1933 [Federal Reserve History].

A significant step occurred in 1968 when the Gold Reserve Act’s requirement for 25% gold backing for Federal Reserve notes was repealed.

This was part of the Gold Reserve Requirement Elimination Act, signed on March 18, 1968 [Gold Cover].

Three years later, in 1971, Nixon suspended the dollar’s convertibility into gold, and gold rose from $35 to $850 per ounce by 1980, a roughly 24x increase [Nixon Shock].

Then came 1997, with Asia’s currency pegs and their self-inflicted crises, which…surprise…also marked the end of another commodity bear cycle.

History rhymes. The players change, but the script is the same…and it’s pointing toward a violent repricing of everything tied to fiat illusions.

What’s unfolding isn’t monetary theory…it’s monetary theater, playing out in real time with real consequences.

And just like any performance, the final act begins when the applause dies and the crowd starts looking for the exits.

You sensing the rhythm yet?

A Dead Carry Trade and a One-Way Street to Nowhere

Every good Ponzi needs a story.

The carry trade’s was simple: borrow in cheap currencies like the yen, park it in Aussie bonds or U.S. tech, and profit on the spread while the volatility gods slept [Yen Carry Trade].

But when everyone’s doing the same thing, and volatility gets too cheap to insure, the whole machine becomes one massive short-volatility bet.

The trade works…until it doesn’t.

When it breaks, it breaks fast. Think long-term capital management but bigger, dumber, and with more passive ETFs involved.

We’ve reached that point.

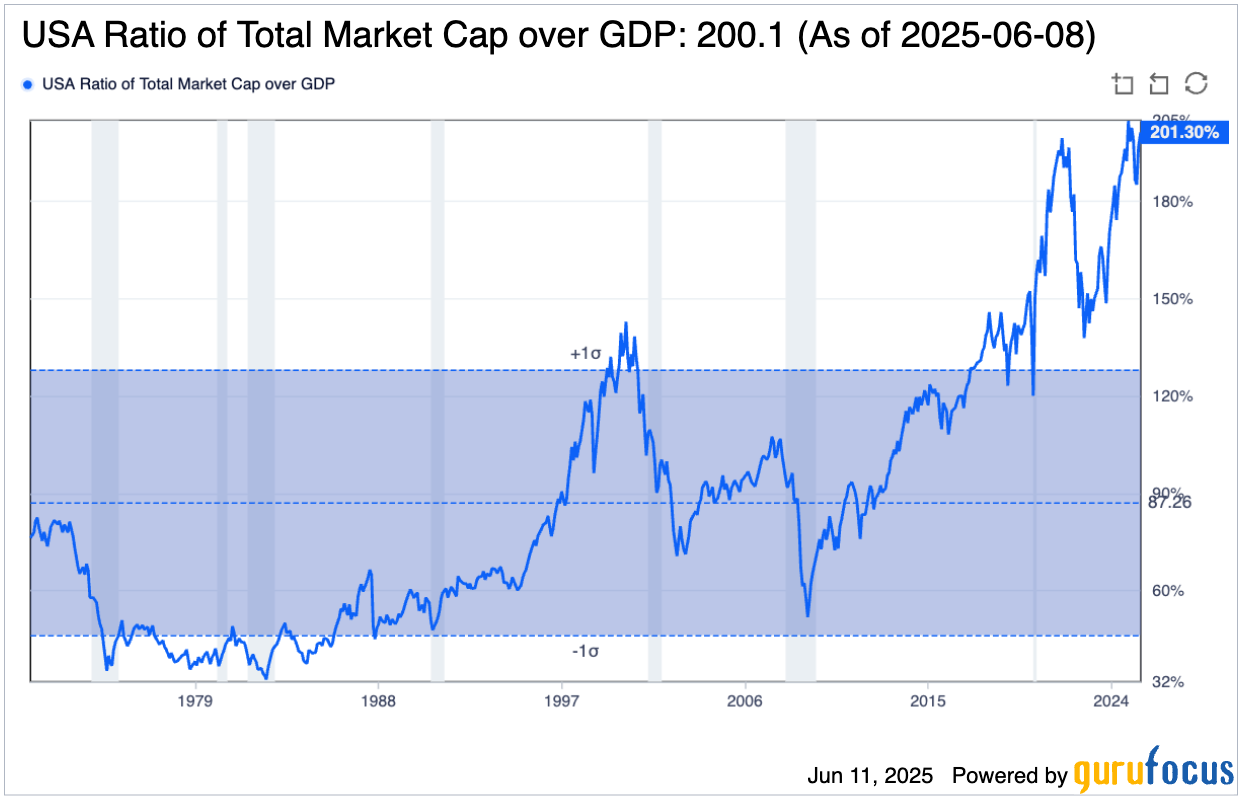

U.S. equity market cap has risen to approximately 200.7% of GDP, per gurufocus.

For reference, it was around 150% at the dot-com peak in 2000 and 105% before the 2008 meltdown [World Bank; Federal Reserve Economic Data].

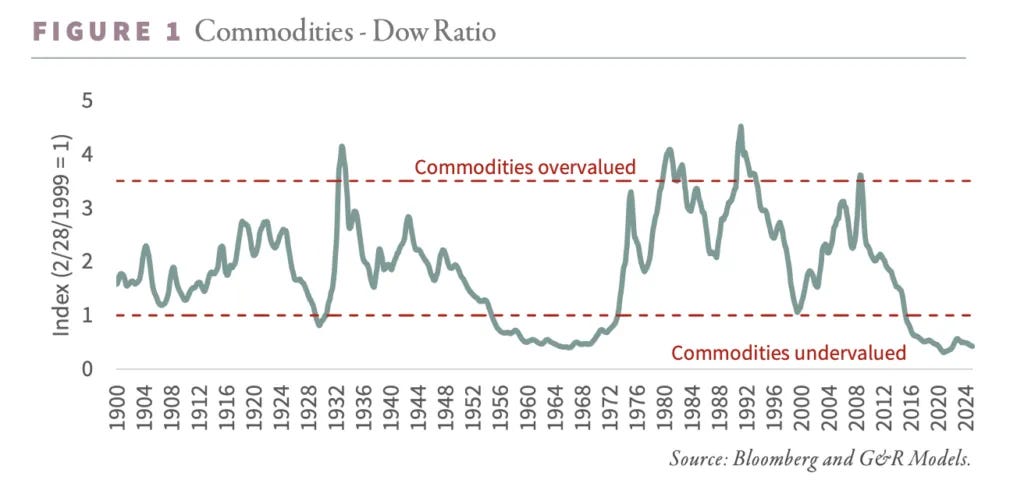

Meanwhile, commodities are trading at valuations relative to stocks not seen since the Great Depression. If this isn’t a coiled spring, nothing is.

Oh, and value investing? Considered dead in a carry-dominated world. Just ask your local tech bro who’s now a “macro expert” on TikTok.

Every chart says “blow-off top.” Every data point screams fragility. But the mainstream narrative keeps dancing to yesterday’s tune.

But as the curtain lifts on the next act, we’re not just looking at fragile trades…we’re staring at a physical world long ignored by paper speculators.

The kind that doesn’t just reprice… it revolts.

Let’s start by exploring the geological truth about shale, and why the U.S. energy boom may already be over…

Shale’s Last Breath

Peak oil was a meme. Until it wasn’t.

Let’s talk geology…not ESG fantasies or political wish-casting.

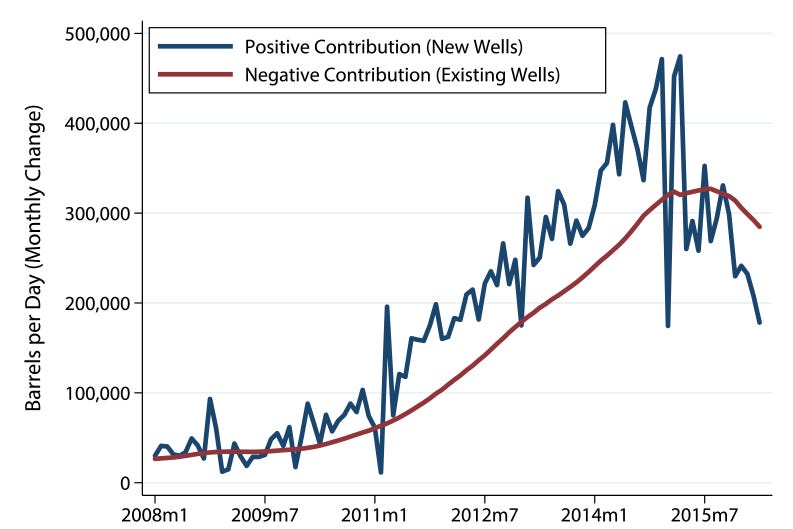

U.S. shale isn’t running out. It’s peaking. Subtle difference, massive implications. The best wells are already drilled. What remains is costlier, less productive, and increasingly uneconomic, even at decent oil prices.

The depletion paradox is brutal: production peaks not when you run out, but when the next well can't offset the last one’s decline.

The EIA forecasts US oil production to peak at 14 million barrels per day by 2027. After this peak, they expect a steady decrease. [gisreportsonline.com].

And this isn’t about policy. It’s about physics. You can’t legislate molecules into the ground.

Decline curves don’t negotiate, and geology doesn’t care about quarterly guidance.

If you think oil’s future is sobering, wait until you see what’s lurking behind the facade of America’s “clean energy” advantage.

Natural Gas: The Silent Crisis

Meanwhile, natural gas is faking its strength.

U.S. dry natural gas production set a record of 103.6 Bcf/d in 2023, but remained relatively flat in 2024.

Although demand from sources like data centers and LNG exports is increasing, low natural gas prices in 2024 contributed to reduced drilling activity in some regions like the Haynesville.

The EIA forecasts higher natural gas prices in 2025 and 2026.

The U.S. wants to be the Saudi Arabia of LNG. But you can’t export what you haven’t drilled.

Forget climate narratives. This is about geology, infrastructure, and capital discipline.

And if winter gets even a little colder, or exports ramp up just a bit faster than expected, we’re staring at a price spike that’ll punch straight through the narrative ceiling.

The infrastructure gap is widening.

And while the market argues over narratives, something far more ancient is stirring…an asset that’s moved quietly through every monetary regime change for 5,000 years.

Gold: The Canary Has Flown

Gold prices have experienced significant upward momentum, reaching new record highs throughout 2024 and in early 2025.

Driven by factors such as central bank demand, geopolitical uncertainty, and investor sentiment, gold prices have seen significant upward momentum, reaching new record highs throughout 2024 and in early 2025.

The LBMA Gold Price, a key benchmark, averaged $2,860/oz in Q1 2025, a 38% increase year-over-year.

Recent price action from June 11, 2025, shows the spot price at $3,350.70 USD per ounce.

The World Gold Council reports that gold prices continue to hover around $3300/oz and anticipates continued growth in 2025.

Every major monetary reset involved a dollar devaluation relative to gold: 69% in 1933 after Roosevelt’s devaluation, an increase from $35 to $850 per ounce (24x) in the 1970s after Nixon’s 1971 gold window closure, and a rise from $282 in 1999 to $1,900 by 2011 [lettersandscience.ucdavis.edu].

And this latest move? It’s happening with central banks as the main buyers.

BRICS nations…burned by the dollar’s weaponization after Russia’s reserves were frozen…are diversifying.

Western investors are waking up too, but so far they’re doing it through miner ETFs like GDX and GDXJ.

Translation: this move isn’t over.

What makes this different isn’t the price action…it’s the silence.

When an asset that’s been ridiculed for a decade starts to rise without retail, without media, without FOMO… you’re no longer in a market. You’re in a message.

The Great Repricing Has Begun

If you think you’re diversified, look again.

In 2022, the 60/40 portfolio failed spectacularly.

In 2025, nearly every major index…Russell 2000, S&P 500, Nasdaq, Nikkei, DAX…has moved in lockstep. Correlated assets in a carry-driven world aren’t diversification. They’re a liability.

The moment volatility returns, those beautifully constructed portfolios crumble like a Value at Risk model at Lehman Brothers.

Commodities, by contrast, are the last uncorrelated asset class standing. And they’re still dirt cheap.'

In a market addicted to sameness, dislocation becomes the only real hedge. And the best opportunities? They’re hiding where the crowd refuses to look.

Offshore Oil, Copper, Uranium: The Forgotten Assets

Want asymmetric upside?

Offshore oil and gas assets are trading at distressed valuations. Copper is one AI boom away from structural shortages.

Uranium…underinvested, geopolitically sensitive, and essential for base load power…remains a rounding error in most portfolios.

This isn’t a bet on narrative. It’s a bet on physics, scarcity, and the failure of fantasy.

And while the herd chases headlines, the architects of the new regime are already drafting the rules…some in public, most behind closed doors, and all of them with a single objective: reclaim control.

Invest in the same things we are. Join thousands of Insider members, low member-churn, model portfolio’s, Q&As, newsletter, and a 30-day (no questions asked) money back guarantee.

Enter the Mar-a-Lago Matrix

Back to the rumored accords.

A global deal involving tariffs, currency pegs, and debt swaps isn’t about altruism. It’s about power. Specifically, U.S. power. And that means reasserting dollar dominance at the expense of over-leveraged global players caught mid-carry.

China can try to promote the yuan all it wants. But with a closed capital account, they’re cornered.

Open the gates, and the capital flees. Keep them shut, and the currency remains irrelevant.

Meanwhile, the U.S. still controls global trade lanes, settlement networks, and yes…the printer.

Which means: when the reset comes, it won’t be evenly distributed. It will be engineered.

What emerges from this won’t be evenly distributed, rational, or fair.

It will be violent, directional, and absolute. And when the dust settles, only those who’ve realigned early will recognize the landscape.

Adapt or Get Flattened

This isn’t a prediction.

It’s a diagnosis.

We’re at the end of a 40-year cycle of falling rates, rising debt, and fictitious wealth.

The carry trade is a dead man walking.

Shale is wheezing its last high-output gasp.

And commodities…real, scarce, tangible…are quietly gathering steam.

Gold has already sniffed it out. Oil and gas won’t be far behind. Copper and uranium are next.

You can pretend this is temporary. Or you can read the room.

Because the steamroller is coming…and you can either be on it, or under it.

🔴 Want more analysis like this? Join our insider Newsletter for deep dives on the global reset, commodity market insights, and portfolio positioning from professionals who saw 2020 coming.

Our 5-part series on asymmetric investing is available free to new subscribers.

Capitalist Exploits

June 11,2025

Spot on. What are your thoughts on bitcoin and it's potential role in this new monetary accord? For the record, I'm long.

Ok, but why copper? Copper usually correlates with economic activity and the situation you describe does not look like an economic boom.