Blockchains & Bunkers

Bitcoin! Is it a hedge, a trap…or the only way out of fiat chaos? Let’s take a closer look.

“In times of uncertainty, people seek freedom. Sometimes they find Bitcoin.”

If you've made it this far into 2025 without bumping into Bitcoin headlines, we’d like to know your secret. Because right now, the world’s most misunderstood asset is back in the ring…and it’s not pulling punches.

From $645 in 2016 to over $117,000 today, Bitcoin’s price chart looks less like a financial instrument and more like a stress test for rational thought.

And yet, here we are, watching institutional giants like BlackRock gobble up coins via ETFs, while social media timelines morph into non-stop pump fests.

So what’s really going on here?

Let’s dive into Bitcoin’s 2025 resurgence, why it matters, and how it fits into a disciplined, long-term investor’s arsenal. This isn’t a moonboy’s fantasy or a permabear’s nightmare…it’s a sober analysis of the world’s most controversial hedge.

The $100K Question

Let’s be honest…Bitcoin’s surge back into six-digit territory has left plenty of investors wide-eyed, including those who’ve long written it off as digital tulips. It’s not just the price action. It’s why it’s happening.

Start with the basics: macroeconomic instability.

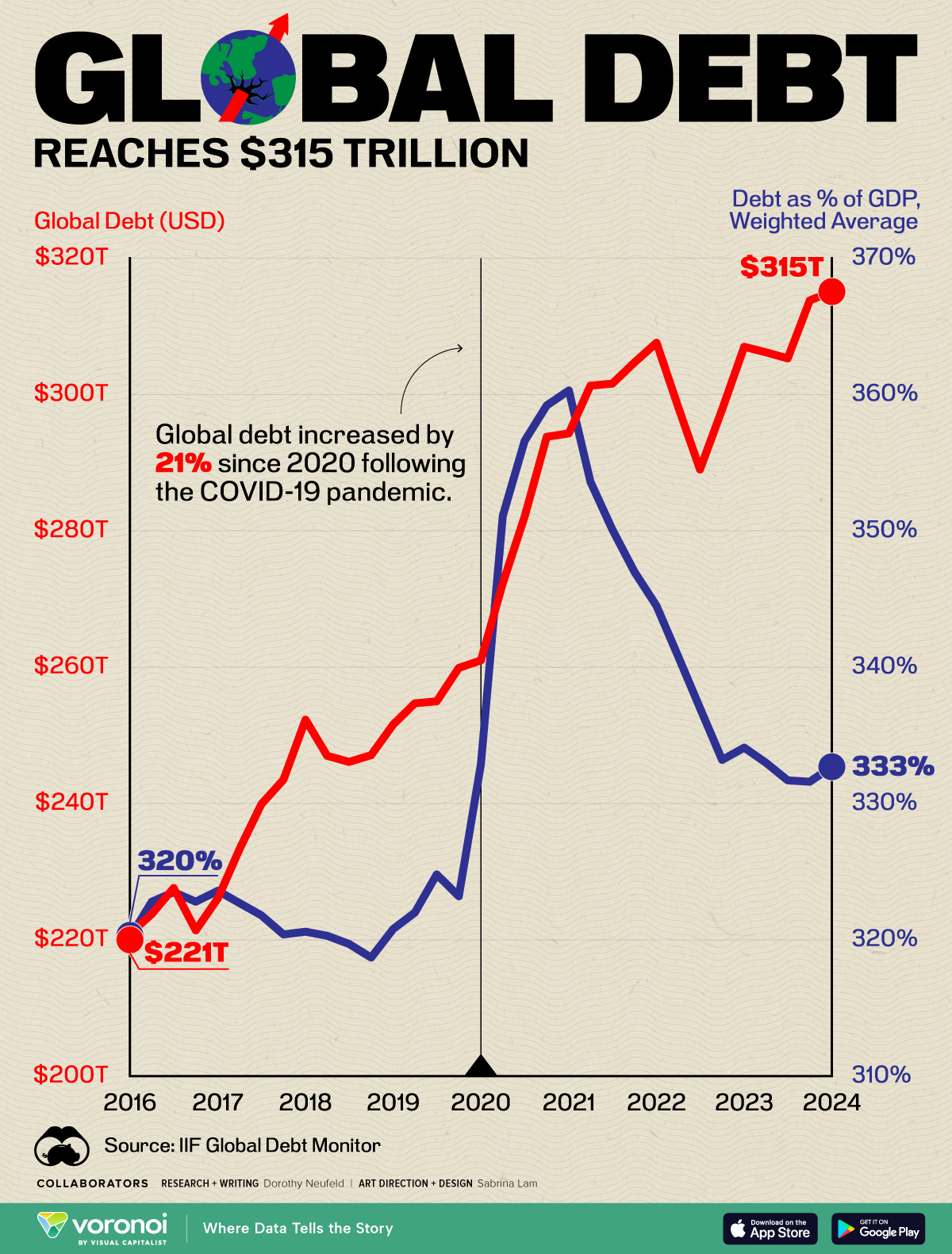

The IMF now pegs global debt at $315 trillion. That’s not a typo. It’s three hundred and fifteen trillion reasons why rational people might want to park a few dollars somewhere inflation and central banks can’t reach.

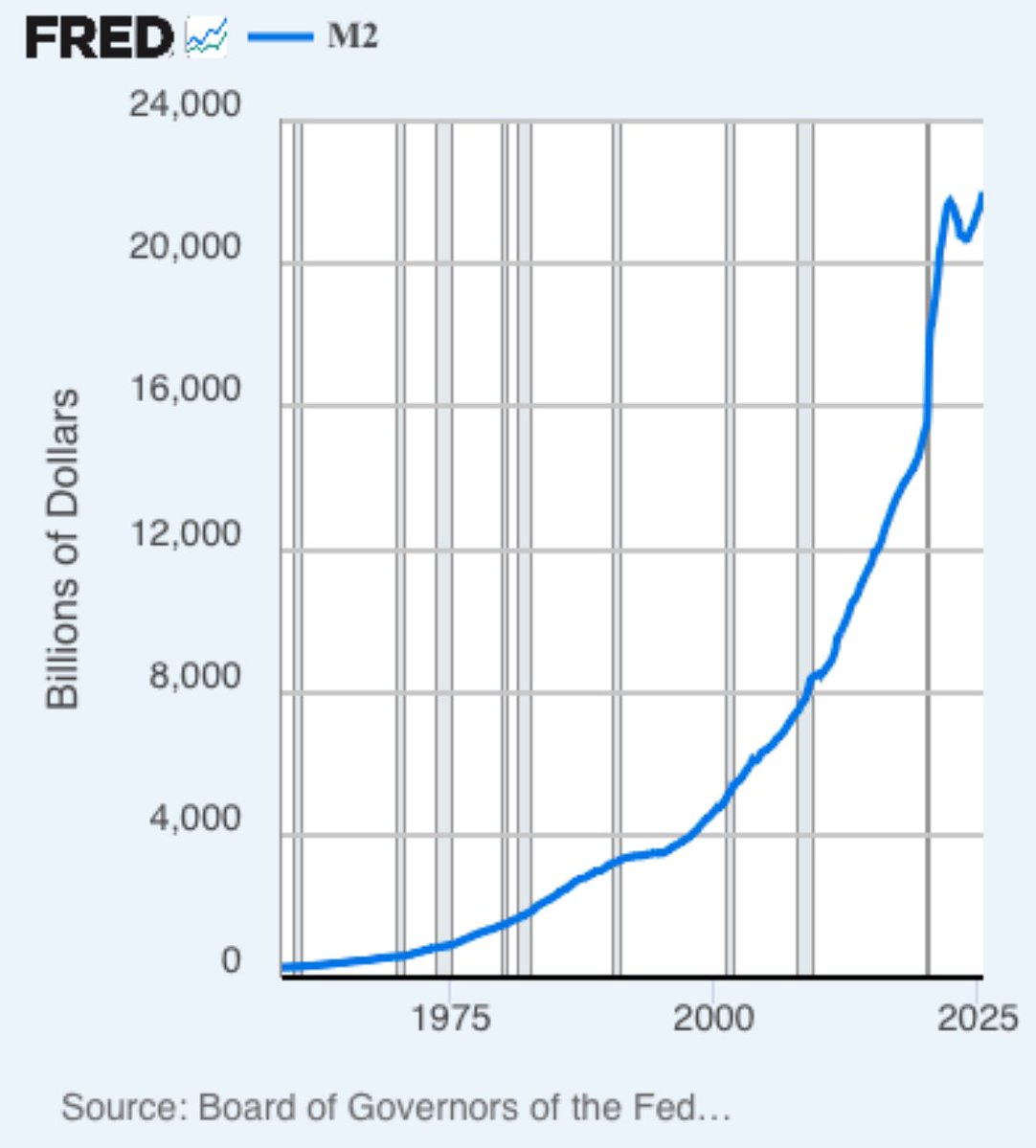

The dollar’s purchasing power? Slipping. Real yields? Elusive. Central banks? Playing musical chairs with credibility.

Enter Bitcoin: borderless, decentralized, and capped at 21 million coins. Whether you think it’s sound money or just a speculative mania, the market’s vote in 2025 is clear.

But it’s not just retail traders pushing buttons on Coinbase. This time, the suits are here.

When Wall Street Moves In

BlackRock’s iShares Bitcoin Trust…ticker: IBIT…is now flush with billions. Fidelity’s not far behind. The gatekeepers of TradFi have rolled out the red carpet for crypto, packaging Bitcoin into ETFs like it’s just another blue chip.

On the one hand, it signals legitimacy.

On the other, it introduces a paradox: a decentralized asset now sits in the vaults of the most centralized players on Earth. This makes for a rather awkward cocktail of freedom and counterparty risk.

And for those who still think Bitcoin is the Wild West? Think again. The SEC might have blessed the ETFs, but regulators aren’t done poking around the crypto campfire.

The IRS already treats Bitcoin as property, meaning your gains are taxed just like your beach house…capital gains, 15–20%, depending on your bracket.

Which brings us to something more fundamental.

The Halving That Keeps on Giving

Every four years, Bitcoin rewrites its own supply code. The 2024 halving sliced miner rewards in half…again…tightening new supply just as demand spiked. This isn’t guesswork. History shows Bitcoin tends to moon a year or so after these events.

2012 halving? Massive bull run.

2016? Same story.

2020? You know the drill.

2024? You’re watching it unfold.

Bitcoin’s supply schedule is arguably more predictable than the Fed’s dot plots. And that’s saying something.

FOMO vs Fundamentals

Of course, not all rockets go to the moon. Bitcoin’s 2025 rally is also being fueled by something far more combustible: retail euphoria.

Scan social media and you’ll see retail piling in, eyes glazed with TikTok TA and laser-eyed avatars. The fear of missing out is strong, and yes, that often precedes corrections.

But don’t conflate noise with nonsense.

Even if retail momentum cools, the structural story remains. Bitcoin isn’t about flipping lambos…it’s about opting out of fiat dysfunction.

And that’s a concept with staying power.

The Hedge That Doesn’t Ask Permission

Here’s where things get interesting.

For long-term investors, Bitcoin offers something equities and bonds can’t: non-correlation.

Historically, Bitcoin’s correlation with the S&P 500 hovers around 0.2 to 0.3. In a world where everything moves together, that’s a welcome outlier.

More importantly, Bitcoin offers self-custody.

Unlike your brokerage account, Bitcoin doesn’t need a middleman. Your keys, your coins. Cold wallets like Ledger and Trezor give you direct control…no counterparty, no paperwork, no gatekeeper.

Try that with your IRA.

But Wait…It Gets Risky

Of course, it’s not all orange pills and freedom memes.

Bitcoin remains volatile. In 2022, it dropped 65%. This isn’t a T-bill. It’s a digital asset that can swing 20–30% in a matter of days. That’s a stomach test most portfolios aren’t built to pass.

Then there’s regulation. Governments around the globe are sharpening their pencils.

The SEC, the IRS, and their global equivalents are all circling the crypto wagon.

One wrong legislative move and liquidity could evaporate faster than you can say “Mt. Gox.”

And don’t even get started on security. Lose your private key? That Bitcoin is gone.

Hardware wallets help, but they aren’t idiot-proof. And if you think hackers sleep, you’re in for a rude awakening.

So what’s an investor to do?

Portfolio Fit: Threading the Needle

Bitcoin’s volatility makes it a tough fit for income seekers or risk-averse retirees.

But for those with a long-term horizon and a tolerance for chop, the math starts to tilt in its favor.

A small allocation…say 1–5%…won’t sink your ship, but it could punch above its weight if Bitcoin continues its trajectory. Even a 10% allocation isn’t out of the question for high-conviction holders. But overexposure? That’s not strategy, it’s speculation.

In other words, it’s a hedge, not a Hail Mary.

Still with us?

How to Buy Without Getting Burned

You’ve got two paths: own the asset directly or go the ETF route.

Direct Ownership:

Use exchanges like Coinbase or Kraken to buy small amounts.

Transfer to a cold wallet…hardware like Ledger Nano S is popular.

Track transactions using tools like CoinTracker to stay tax-compliant.

ETF Route:

With the Blackrock, Fidelity, and other pointy shoes getting involved with crypto lately, it’s never been more critical to own Bitcoin directly (if you’re a recent member interested to learn more, we published an entire series of crypto guides and video tutorials over the years that cover that topic).

However, if you have no choice but to buy an ETF, here’s what you can do:

BlackRock’s IBIT or Fidelity’s FBTC offer exposure through traditional brokers.

You lose some decentralization but gain convenience.

Be mindful of expense ratios (~0.25%) and, again, counterparty risk.

Either way, start small. Build your confidence. This isn’t a sprint…it’s a marathon run through a minefield.

Why Bitcoin, Why Now?

Because the systems that underpin traditional finance are cracking at the seams. Because governments are printing like it’s a contest. Because the IMF doesn’t ring alarm bells when global debt hits $315 trillion…they just update the PDF.

Bitcoin offers a release valve. A sovereign escape hatch. A digital bunker in a world of paper promises.

And while it may never replace the dollar, it doesn’t need to.

It just needs to survive.

Discipline, Not Dogma

At Capitalist Exploits, we don’t cheerlead. We weigh. Measure. Analyze.

Bitcoin is not in our equity-focused Insider portfolio today, but we’ve been early before…2016 at $645, exit in 2021 at $54,000. An 83x return speaks for itself.

This isn’t a crusade. It’s a question of optionality. And in a world short on trust, assets that don’t require permission have a strange way of sticking around.

So… is Bitcoin a must-have hedge?

Maybe. But only if you can stomach the chaos and see through the noise.

Because in the end, it’s not about whether Bitcoin is perfect.

It’s about whether the alternative still works.

Join the Insider Community

At Capitalist Exploits, we actually recommended Bitcoin in Insider way back in 2016, when it was “just” $645 and then got out of the trade in April 2021 at $54,000 and a change (for a 83x gain).

Do we have any regrets about not getting back in, and missing out on another run? Not really. And here’s why…

In Insider, our focus is exclusively on publicly-traded equities.

But with all the monetary and fiscal insanity we’ve witnessed over the past couple of years, it’s become obvious that Bitcoin is a unique hedge…along the lines of physical gold.

Our team scours the globe for asymmetric opportunities…markets and assets ignored by the masses but poised for outsized returns.

Whether it’s Greece, Argentina, or the next hidden gem, we provide actionable insights to help you build wealth over the long term.

To get started, subscribe to our free Insider articles on Substack for weekly market analysis, investment ideas, and updates on trends like Greece’s rally.

For deeper dives, including our full portfolio recommendations and real-time trade alerts, join the Insider service at capexinsider.com.

Our premium members get access to our proprietary research, risk management strategies, and a community of like-minded investors.

Don’t miss the next Greece.

Subscribe to the Insider Newsletter at substack.capitalistexploits.at/subscribe or unlock the full Insider experience at capexinsider.com.

Your portfolio deserves an edge…let us help you find it.