A Strange Pattern

A strange pattern has emerged. Price is up, but shares in issue have dropped significantly. What does this mean and how can you benefit?

The Illusion of Choice

Let’s play a game.

Imagine two stocks. Both are up ~70% over the past 18 months.

One has CNBC anchors foaming at the mouth, TikTok influencers screaming “to the moon,” and every retail investor with a Robinhood account elbowing their way in.

The other? It’s quietly doubled while being ghosted by both Wall Street and Main Street.

Same gains. Vastly different vibes.

Now, what if I told you these two stocks represent entire categories of the market?

One is worshipped like a tech god, the other treated like an exiled leper.

Both are signaling something.

And if you care about not getting steamrolled when the music stops, it’s worth understanding what.

Let’s start with “the gods”...

The Glorious Cult of the Mag 7

Welcome to the church of the Magnificent 7: Nvidia (NVDA), Microsoft (MSFT), Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), Meta (META), and Tesla (TSLA). Tech’s golden calves.

These aren’t just stocks. They’re the story. They are the S&P 500. Together, they make up about 30% of the index.

Nvidia and Microsoft alone are ~7% each. Apple’s sitting just below that.

If the S&P were a boat, these guys are the engine, the mast, the hull…and probably the guy yelling “full speed ahead.”

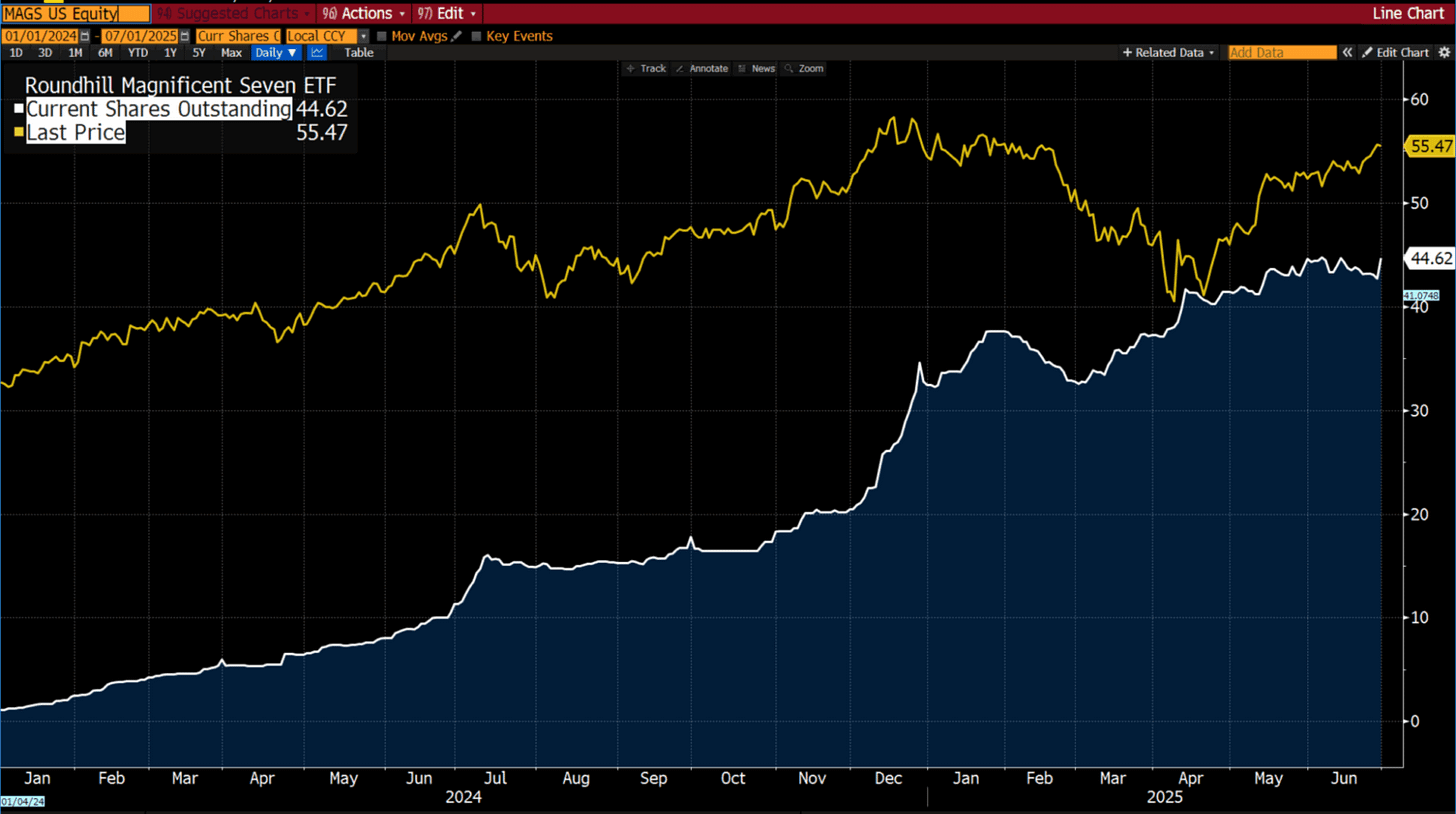

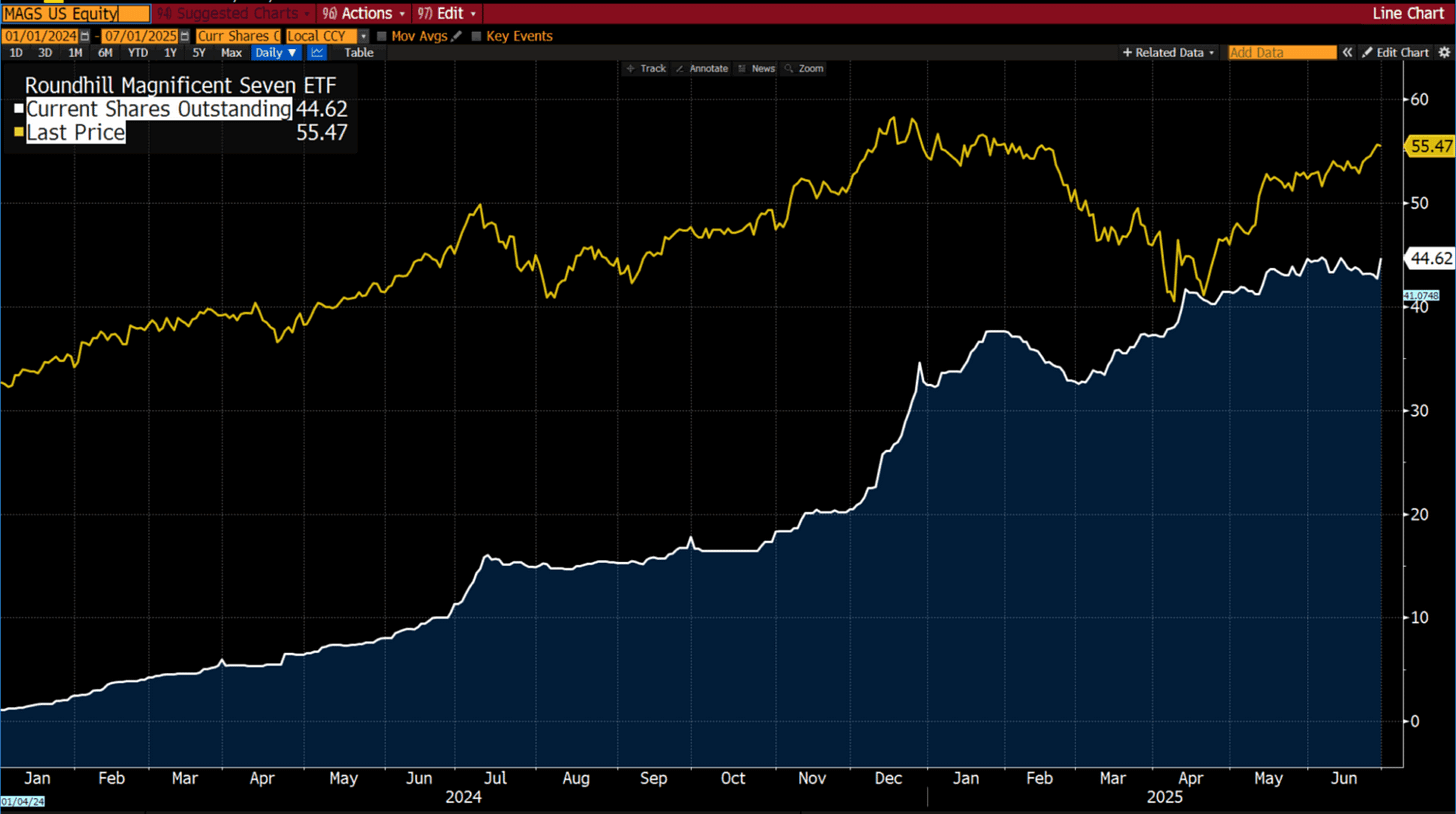

So it’s no surprise that investors are piling into the MAGS like it’s a lifeboat made of pure gold. Price is up. Shares outstanding are surging. Everyone wants a piece.

But that’s also the problem.

The Fever of FOMO

It’s July 2025, and the markets are still basking in the afterglow of their latest AI-fueled sugar high.

But the P/E ratios are beginning to whisper warnings. Nvidia? Try north of 70.

Microsoft and Apple? Trading like they'll never have a down quarter again.

And this isn’t a startup frenzy…we’re talking about trillion-dollar titans priced like teenagers with dreams and no debt.

Here’s the rub: what do Nvidia, Apple, Microsoft, and Amazon all rely on?

Semiconductors. Most of them? Made in Taiwan.

One geopolitical cough between China and Taiwan and the whole AI dream turns into a nightmare. Supply chains freeze. Margins implode. Stock prices plummet.

Also, remember interest rates? Those things the Fed plays with when inflation won’t behave?

High-flying tech stocks with bloated valuations are like Icarus…fly too close to rising rates, and those wax wings melt fast.

And when the ETF holding them (MAGS) is seeing surging demand on top of surging prices, you’ve got all the makings of a crowded theater…just waiting for someone to yell “fire.”

The Miners in the Shadows

Now let’s shift our gaze to a sector that’s been equally strong… but eerily quiet.

Gold miners.

You’d think with gold flirting near all-time highs, miners would be the talk of every financial podcast.

After all, miners are a leveraged bet on gold. A 10% move in bullion can mean a 20–30% jump in mining stocks.

And they’ve delivered.

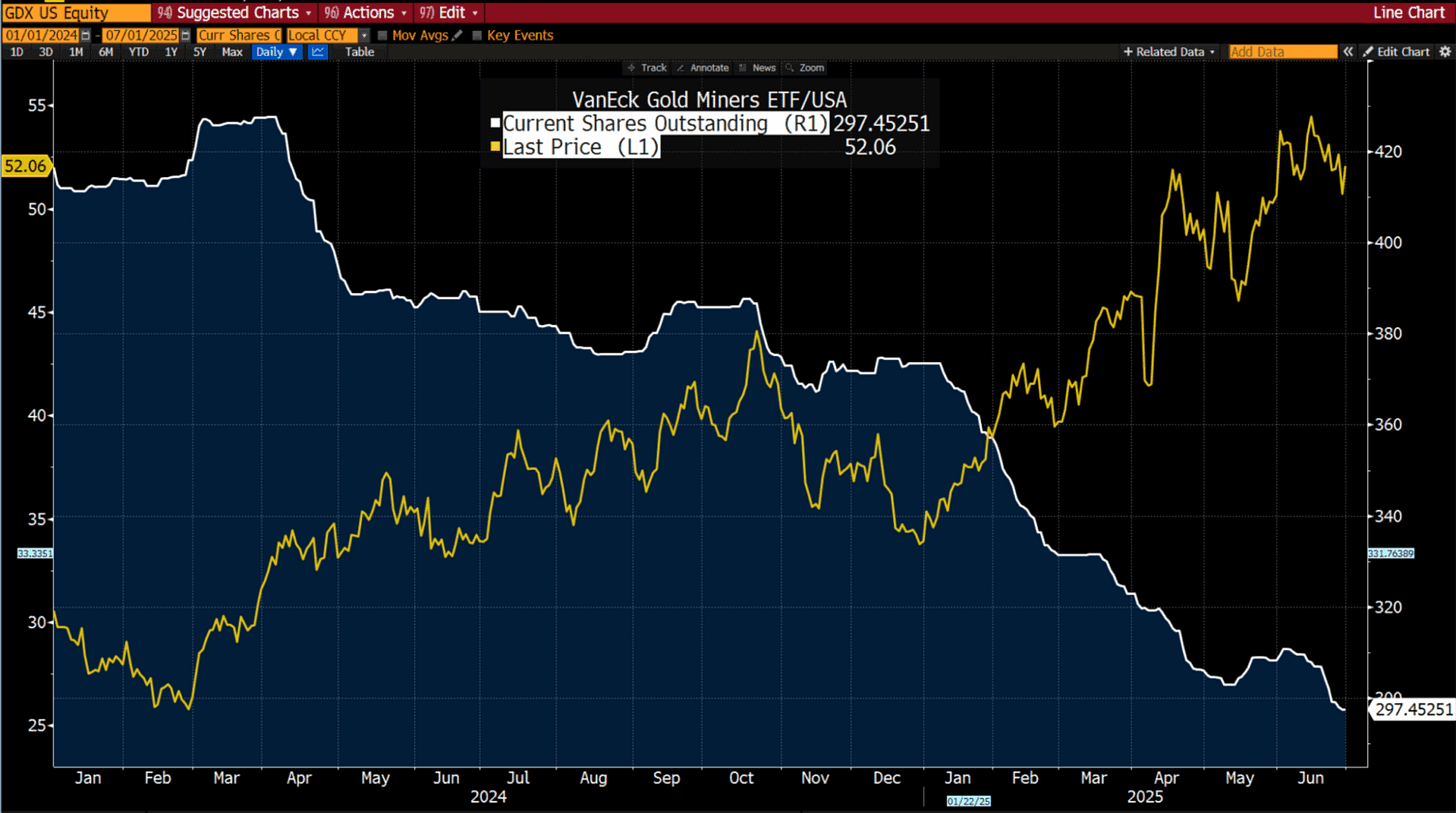

Just like the Mag 7, gold miners (tracked by the VanEck Gold Miners ETF, GDX) are up ~70% since early 2024.

But unlike tech, no one’s watching.

In fact, something downright bizarre is happening.

The Anomaly: Shares Outstanding Collapse

Let’s talk ETF mechanics. When demand rises, shares outstanding go up. Simple.

So, what do you expect when an ETF like GDX sees a 70% price surge?

More demand. More shares. Right?

Wrong.

GDX’s shares outstanding have… dropped.

That’s not just unusual…it’s weird. When SPDR Gold Trust (GLD) goes up, shares go up.

When MAG7 flies, so do its shares.

But GDX? Price up, shares down. Investors are bailing…or just refusing to show up.

It’s like a rock concert where the band is crushing it but the stadium’s empty.

Something’s out of sync. And in this case, that something might be your opportunity.

The Crowd Has a Blind Spot

Why the disconnect?

Narrative.

Tech’s got AI. It’s got robots that write poems, chips that simulate consciousness, and billionaires making promises no one can keep. It’s sexy. It’s now.

Gold miners? They dig stuff out of the ground. It’s dusty. It’s slow. It reminds people of old men with shovels and grizzled CEOs in flannel.

But while the Mag 7 is a tightrope walk over a pit of leverage, miners are the boring, stable bridge you didn’t know you needed.

And boring is beautiful.

The Edge of Asymmetry

Let’s be clear: we’re not arguing that gold miners are a guaranteed win. Nothing is.

But here’s what we are saying: they’re cheap. They’re cash-flow machines.

Many trade at single-digit P/E ratios, spitting off dividends while most tech stocks are priced for perfection in an imperfect world.

Gold demand is robust, driven by central banks hoarding the stuff, governments debasing currencies, and geopolitical tinderboxes refusing to be extinguished.

In that world, owning the guys pulling gold out of the earth seems... sensible.

Meanwhile, the Mag 7’s risk profile is stretching like a rubber band in a sauna.

One bad earnings print, one semi-conductor threat, or one central bank surprise, and we could see some serious air come out of this bubble.

Signal vs. Noise

The real signal in this market isn’t in price…it’s in participation.

The Mag 7’s price is up and the crowd is stampeding in.

The gold miners’ price is also up… but the crowd is heading the other way.

This suggests to us that investing in gold miners is far from being popular or a crowded trade.

In a rational world, that wouldn’t happen. But this isn’t a rational world…it’s a marketplace of narrative-addicted gamblers.

Which means that while everyone’s chasing momentum, you’ve got a rare shot at buying quality when nobody’s looking.

That’s the edge.

A Word of Strategy

Let’s not get cute here. We’re not saying mortgage the house and load up on miners.

We’re saying this: if you’ve got a diversified portfolio, it might make sense to allocate 1-2% to the VanEck Vectors Gold Miners ETF (GDX) or a basket of high-quality miners.

This isn’t about FOMO. It’s about prudence. It’s about asymmetric bets. It’s about putting some capital into a sector that’s already performing but hasn’t been blessed by the gods of hype.

The Mag 7 may keep flying. Or they may not. But if they stumble, the crowd will be too packed to get out.

Gold miners? You might just have the whole exit row to yourself.

The Market’s Dirty Little Secret

Here’s what they don’t tell you: being early isn’t always wrong. Sometimes, it’s the whole game.

When a sector is rising and nobody cares, that is your window. Because when they do care, it’s usually too late.

So ask yourself: do you want to be in the trade everyone is already in, hoping you’re not the last to the party?

Or do you want to be the one leaving just as the limo pulls up?

⭐️ Subscribe to our insider newsletter for professional-grade breakdowns on asymmetric opportunities like this.

We unpack markets, portfolios, and capital rotations others miss. If you’re serious about playing this game like a pro, not a tourist, come behind the paywall.